metamorworks/iStock via Getty Images

MercadoLibre Q4 Earnings Analysis

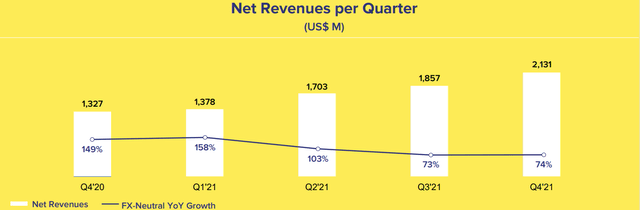

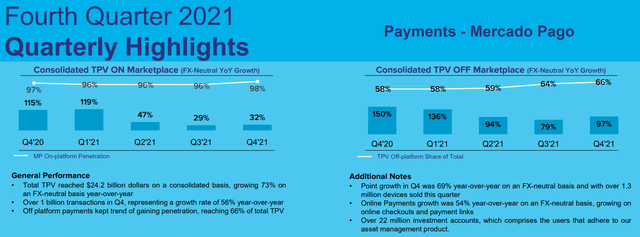

In Q4 2021, MercadoLibre (NASDAQ:MELI) continued its tradition of beating analyst expectations with quarterly revenues hitting a new record – $2.1B (up ~74% y/y FX-Neutral). After undergoing revenue growth deceleration over the last two quarters, MELI registered slight re-acceleration in Q4 2021 on the back of the strength in its fintech business, but more on that later.

MELI Q4 2021 Earnings Presentation

MELI Q4 2021 Earnings Press Release

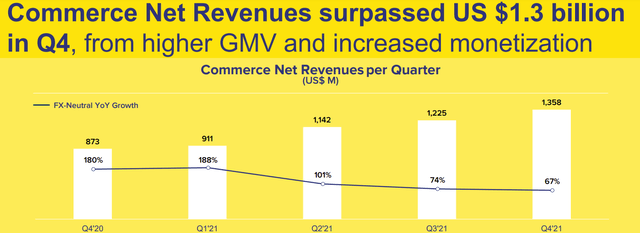

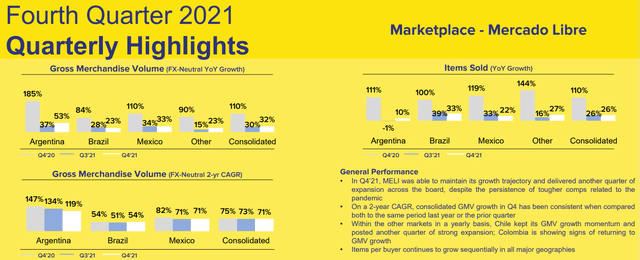

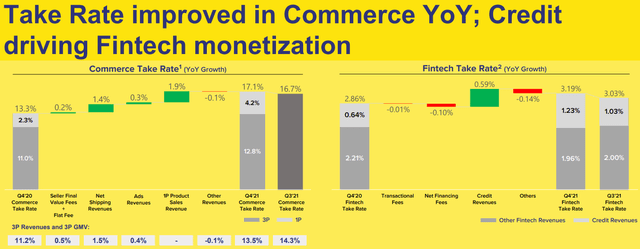

On the back of higher GMV (32% y/y growth) and increased monetization (commerce take rate increased to 17.1%), MELI’s Q4 commerce net revenues rose to $1.36B (y/y growth of 67%).

MELI Q4 2021 Earnings Presentation

MELI Q4 2021 Earnings Presentation

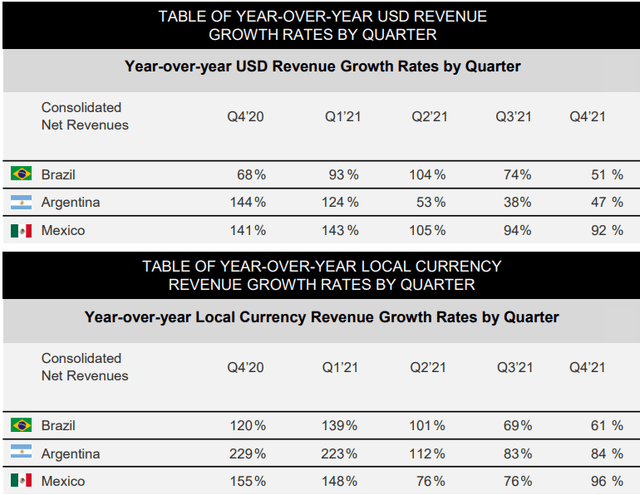

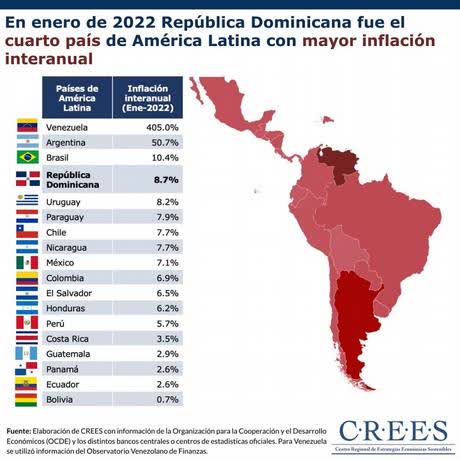

The GMV and Items Sold figures show that MercadoLibre’s commerce revenue is being boosted by high inflation in Latin American countries. While inflation could be a boost to revenues in the near term, it could lead to demand destruction if it runs out of control.

Blaze Trends

So far, MercadoLibre has outpaced inflation in its primary markets, and I think it can continue to do so in coming quarters. However, the macroeconomic conditions are getting tougher for MELI, and this could dampen growth in commerce revenues. Now, let’s look at MELI’s fintech business.

Here’s what we said after MELI’s Q3 report –

In my mind, MercadoLibre is more of a fintech company than an e-commerce company. Our investment thesis is more or less predicated on the success of Mercado Pago, and we have talked about this at length in previous notes. For those looking for a refresher, review the following note could be useful:

And MercadoLibre’s Q4 report further substantiates this stance, with fintech revenue growth outpacing e-commerce revenue growth. It is also important to remember that MELI’s fintech business will end up having much higher margins than its commerce business.

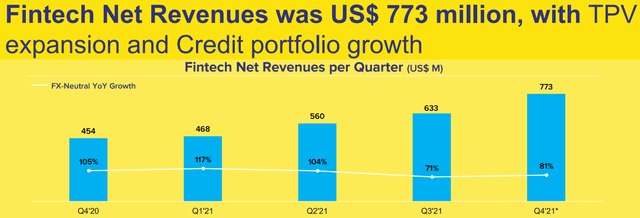

MELI Q4 2021 Earnings Presentation

In Q4, MELI’s fintech revenues climbed to ~$773M (up ~$81% y/y (FX-neutral), marking a re-acceleration in MELI’s fintech businesses, namely, Mercado Pago and Mercado Credito. Let’s look into these numbers more closely.

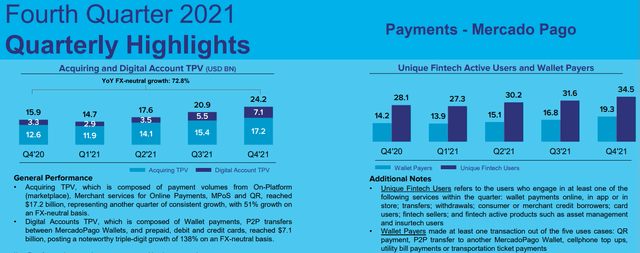

As you can see below, MELI’s Total Payment Volume [TPV] grew 72.8% y/y (FX-neutral basis) to come in at ~$24.2B, of which $7.1B came from Digital Accounts (classified in the image below). Even in the post-pandemic era, the use of Mercado Pago’s Wallet continues to expand, with the company adding ~3M new active users and wallet payers in Q4 2021.

MELI Q4 2021 Earnings Presentation

MELI Q4 2021 Earnings Presentation

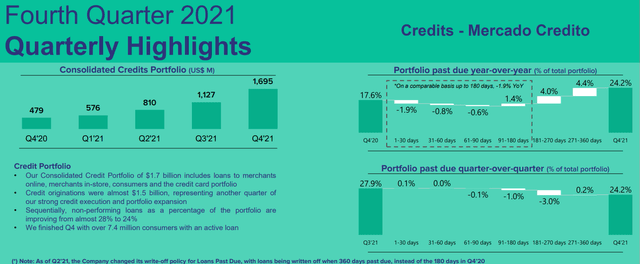

After StoneCo’s (STNE) blowup, investors (including me) are mighty nervous about the possibility of greater systemic risk in the lending markets in Latin America (especially Brazil). Furthermore, Argentina is suffering from ultra-high inflation (~47% y/y in 2021), which increases the risk to Mercado’s loan book. In Q3, nearly 27.9% ($314M) of Mercado Credito’s loan portfolio of ~$1.1B was delinquent, which was an improvement over Q2 2021.

In Q4, Mercado Credito’s loan portfolio expanded to $1.7B, and delinquencies rose to $410M (~24.2% of total loan book). Although the delinquency data is showing signs of improvement and Mercado Credito’s AI/ML capabilities are likely improving with more data, MercadoLibre could fail to recover these loans if there’s a recession following these inflationary episodes (in Latin American countries). MercadoLibre has ~$3.5B of cash on its balance sheet, and it is highly free cash flow positive, which means it could probably survive any potential loan write-offs. Also, consumer loans make up most of MELI’s loan portfolio, so I think the delinquencies and defaults will remain contained. However, the credit risk here is real, and it cannot be ignored.

MELI Q4 2021 Earnings Presentation

We will continue to monitor Mercado Credito’s performance over the coming quarters, and I would like to see delinquencies go below 10% in the long run. For now, let’s turn our attention to take rates and margins.

As you can see below, MercadoLibre is increasing monetization across its businesses. In Q4 2021, MELI’s commerce take rate rose to 17.1% (+40 bps y/y), and its fintech take rate rose to 3.19% (+16 bps y/y).

According to MELI’s Q4 2021 press release –

Our Fintech take rates over the total payment volume have been pressured by increases in interest rates, mainly in Brazil. This spread compression effect on take rate is about 10 basis points year-over-year. We recently announced a new pricing structure for our financing fees, starting in 2022, to contemplate new interest rate levels and begin offsetting these pressured financing revenues and the subsequent impact to profitability.

On the other hand, we had a strong year-over-year improvement in take rates over gross merchandise volume in our commerce business, as well as a higher penetration of first-party sales, both of which are boosting our commerce revenues across all key geographies.

Even more relevant than these two offsetting monetization trends, is the increasingly positive impact on take rate coming from the Credit business. Credit revenues reached almost $300 million during the fourth quarter alone, triple the value of the previous year.

MELI Q4 2021 Earnings Presentation

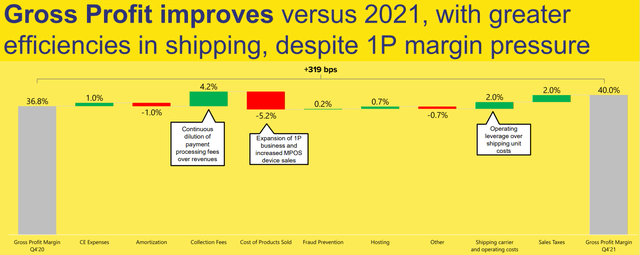

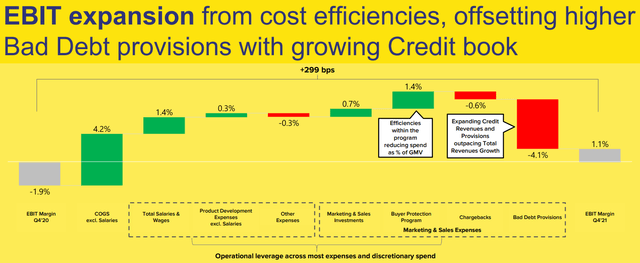

Despite the adverse effects of the pandemic, MELI’s margins continue to trend higher. In Q4 2021, MELI’s gross margins expanded to 40.0% (from 36.8% last year) while EBIT margin went up to 1.1% (from -1.9% in Q4 2020) despite a sizeable impact of bad debt (originated as a result of rapid expansion of Credito).

MELI Q4 2021 Earnings Presentation

MELI Q4 2021 Earnings Presentation

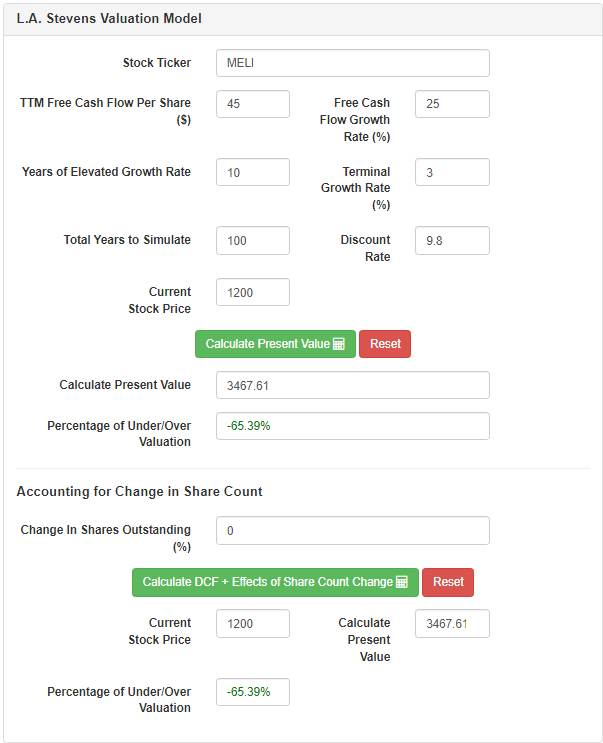

Now, let’s review the fair value and expected returns for MELI.

Fair Value And Expected Returns

Assumptions:

|

Forward 12-month revenue [A] |

$10 billion |

|

Potential Free Cash Flow Margin (long term) [B] |

25% |

|

Average diluted shares outstanding [C] |

~55 million |

|

Free cash flow per share (normalized for long term FCF margin) [ D = (A * B) / C ] |

$45 |

|

Free cash flow per share growth rate |

25% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

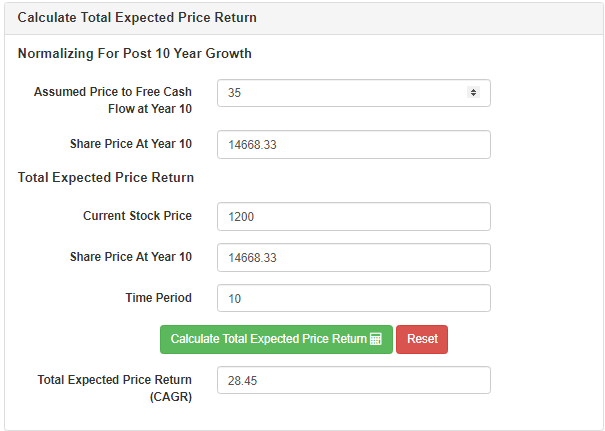

L.A. Stevens Valuation Model

L.A. Stevens Valuation Model

Concluding Thoughts

Amid a problematic macroeconomic backdrop (high inflation & slowing growth in Latin America), MercadoLibre’s business is scaling new heights, and the leadership team is executing flawlessly. Both commerce and fintech businesses are experiencing hypergrowth, and MELI is already profitable.

MELI Q4 2021 Earnings Presentation

Considering its massive TAM, MELI is likely to keep growing for many more years to come. While I continue to have some (credit-underwriting quality) concerns around Credito’s rapidly-expanding loan book, I am content with the Q4 numbers that showed a marginal reduction in delinquencies. Here’s what I said after MELI’s Q3 report, and I have the same take today –

The expansion of the credit portfolio brings added risk to this investment; however, MercadoLibre is highly free cash flow positive, and the loans are not concentrated among merchants. We will be closely monitoring the performance of MELI’s credit portfolio over the coming quarters, especially after what’s gone on at StoneCo, but there’s no need to panic at this point in time.

Overall, MercadoLibre is a high-quality business that’s trading at a heavy discount to its fair value. I understand that Latin American countries (especially MELI’s primary markets – Argentina and Brazil) are experiencing tremendous inflation, and some of the strength in MELI’s numbers is attributable to price inflation. However, I feel we are being compensated fairly for the risk inherent to this investment. Hence, I continue to rate MELI a buy.

Key Takeaway: I rate MercadoLibre a buy at $1,200.

Thank you for reading, and happy investing. Please feel free to share any thoughts, questions, or concerns that you may have in the comments section below.

Be the first to comment