hapabapa/iStock Editorial via Getty Images

The EVgo (NASDAQ:EVGO) stock is amongst one of the biggest gainers in both its sector and the broader market this year. Second to charging peer Allego (NYSE: ALLG), which benefited from a steep upward valuation re-rate following completion of its reverse SPAC merger with Spartan Acquisition III in mid-March, the EVgo stock also outperformed with first quarter gains of close to 30% (+89% peak to trough), while key benchmark indexes like the Nasdaq 100 and S&P 500 continued to reel from the aftermath of surging market volatility with losses of 10% and 6%, respectively, over the same period.

Buoyed by consecutive months of positive progress on EVgo’s network build-out, including new partnerships with retailers and reputable auto OEMs, the stock has been rallying since late January. Momentum persisted into the final week of March after the company reported results that beat consensus estimates. Although EVgo’s near-term growth guidance may have been set on the softer side as a result of weaker-than-expected electric vehicle (“EV”) sales in the U.S. due to ongoing chip supply shortages and new threats to supply chains from the Russia-Ukraine conflict, it remains in very early innings of a “major secular transformation” as American EV adoption approaches an inflection point.

The company’s guidance issued for the current year in terms of network demand and stall installation growth is still strong, nonetheless. Paired with its increasing portfolio of complementary software service offerings, EVgo is poised to benefit from a positive mix of sales that will continue to drive margin expansion towards profits within the foreseeable future, as demand for charging infrastructure increase with growing EV adoption.

Despite its month-to-date losses (-2.5%) under this week’s risk-off market environment on renewed fears of a potential economic slowdown resulting from aggressive monetary policy tightening to tame inflation, the EVgo stock continues to outperform the market and its peers – including Allego which has lost more than 11% of its value this month. Considering EVgo’s significant growth headroom still on the horizon, the stock remains an attractive long-term investment pick, with recent broad-based market volatility-driven pullbacks being a reasonable buy opportunity.

Did EVgo Beat Earnings?

EVgo reported both a sales and earnings beat for the fourth quarter last year. The charging network generated full year revenues of $22.2 million, beating the higher range of its previous guidance ($20 million to $22 million) as well as consensus estimate ($21 million). Both charging and ancillary software services revenues jumped by more than 80% in 2021, underscoring increased usage of EVgo’s solutions alongside rising EV adoption.

Network throughput jumped 68% from 15.7 gWh in 2020 to 26.4 gWh in 2021, beating the higher range of its previous guidance as well (24 gWh to 26 gWh), which is consistent with EVgo’s ongoing build-out of charging stalls across U.S. urban areas as well as sustained customer growth on rising EV adoption. The company closed the year with close to 1,700 operating direct current fast charging (“DCFC”) stalls, up from about 1,550 fully operating stalls in the second quarter. Customer accounts also grew from 231,000 to more than 340,000 during the year, underscoring the rapid increase in network demand following the integration of charging management app PlugShare as a result of its acquisition of Recargo, as well as the signing of various preferred charging provider agreements with reputable OEMs.

With network throughput growth closely aligned with the combination of EV adoption rates and EVgo’s business expansion efforts, the company is expecting throughput to double this year (50 gWh to 60 gWh), with estimated total sales of $48 million to $55 million (compared to $54 million outlined in its pre-merger investor presentation). The reported guidance is consistent with estimated U.S. EV sales increase of 40%, while EVgo’s charging stall development pipeline is expected to top 3,100 by the end of the year. Considering EVgo’s current portfolio of charging partners accounting for “over 40% of U.S. light-duty vehicle sales”, and the launch of its new “eXtend” partnership program, the company is well-poised for another sales beat this year.

What is EVgo’s Long-Term Outlook?

As discussed in detail in our initial coverage on the stock, EVgo is a DCFC-focused charging infrastructure owner and operator, focused on servicing retail and fleet owners across “high-traffic metropolitan areas”. In the first half of the year, the network recorded average spending of $8.20 per charge, which corroborates that the majority of EVgo’s current clientele are “convenience charging” and taking advantage of the strategic placement of EVgo’s charging infrastructure as anticipated. More than 130 million Americans currently “live within a 10-mile drive of an EVgo fast charger”. Based on EVgo’s core operating strategy of providing fast charging solutions to retail EV owners that do not have access to their own at-home charging and fleet operators, the company is well-positioned for growing demand ahead of rapidly accelerating EV adoption. The country will require at least $39 billion in charging infrastructure investments by the end of the decade to support its emissions reductions and electrification goals. In LA alone, where EVgo is already operating at positive cash flow margins, more than 97,000 public charging stations will be required by the end of the decade to electrify the entire city’s vehicle fleet, which is a part of its plans to become the first carbon-free U.S. city.

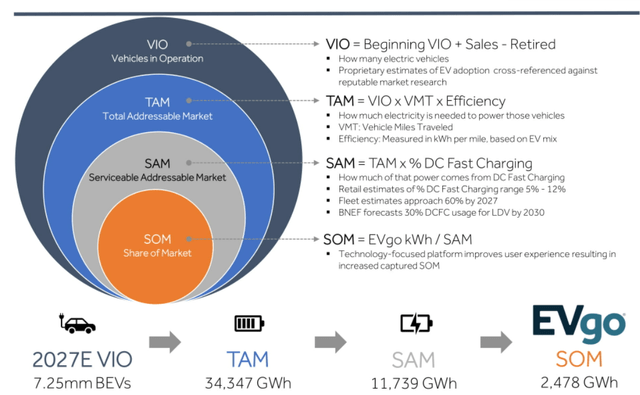

Based on EVgo’s investor presentation from last year, the company had projected a total addressable market (“TAM”) of 34,347 gWh by 2027 based on estimated 7.25 million EVs on American roads over the forecast period. The serviceable addressable market (“SAM”), which represents the share of TAM attributable to DCFC demand, was estimated at about 34% at the time of the investor presentation. Because of its operational focus servicing dense, urban areas, EVgo had identified a 21% market share of the SAM by 2027.

Projected EVgo Market Share (EVgo 2021 Investor Presentation)

However, considering the rapid rate of EV adoption over the past year, buoyed by favourable government policy support, significant improvements to battery technology that have increased compatibility with DCFC solutions, and a massive investment pipeline of more than $300 billion into the U.S. EV economy over the forecast period, total demand for DCFC underscores a higher SAM for EVgo than ever before. Recognizing the increased need for fast charging solutions and an opportunity to further market penetration, EVgo has expanded its operational strategy beyond urban areas into interstate corridors and other lower-traffic areas through a new partnership program, eXtend.

Through eXtend, EVgo expands beyond its flagship business model of owning and operating all of its charging hardware assets, as well as accompanying software services. EVgo is now partnering with commercial customers to extend its network to the “growing corridor charging market”. As part of the eXtend program, EVgo’s charging partners will retail charging hardware and asset ownership, while EVgo will provide its expertise in network planning, site design and installation, operating and maintenance with guaranteed performance standards, as well as complementary software products and solutions. The strategy bypasses the “underwriting hurdles for asset ownership” under EVgo’s corporate strategy. EVgo eXtend allows the network to participate in growing DCFC opportunities outside of its core metropolitan market and secure additional recurring revenues, while reducing the risks of operating in less developed markets by minimizing balance sheet exposure.

In addition to eXtend, EVgo is also on a positive track in capitalizing on demand arising from the continued expansion of its charging partnerships. In addition to previously disclosed partnerships with reputable OEMS, fleet operators and retail site hosts like GM, Nissan, Walmart, Uber, and Lyft, EVgo has grown its partnership roster with the following additions over the past few months:

- Uber: As discussed in our previous coverage on EVgo, the charging network already counts Uber as one of its major charging partners. During the fourth quarter, EVgo was able to expand this partnership by enhancing discounts and benefits for Uber drivers through the “EVgo Discount Program”. Recognizing the opportunity stemming from high DCFC network utilization and demand from rideshare fleet drivers that travel 40,000 miles to 50,000 miles per year on average, compared to regular commuters who travel 11,000 miles per year on average, the new and improved joint discount program will extend EVgo’s brand exposure, while also increasing visibility into its long-term recurring revenues. The expanded partnership also effectively propels the flywheel effect of EV adoption and DCFC utilization – by enabling convenient and affordable access to DCFC solutions, EVgo plays a critical role in encouraging further EV adoption, which inadvertently, fuels greater demand for its charging solution over the longer-term. And considering Uber’s goal of becoming a “zero-emission platform by 2030 in the U.S.”, the expansion of the EVgo-Uber discount program only underscores greater cross-selling opportunities over the longer-term for EVgo’s other charging solutions offered (e.g. fleet management services, eXtend, etc.), driving greater fundamental growth ahead.

- Toyota: Toyota has named EVgo as its preferred charging network ahead of the automaker’s upcoming release of its flagship, fully electric bZ4X SUV. Toyota bZ4X owners will receive one year of unlimited free charging at all EVgo DCFC stations across 35 states in the U.S. The partnership marks a critical addition to EVgo’s customer portfolio, considering Toyota’s status as the best-selling U.S. brand for the second year, topping close competitor GM, which is also a key strategic partner to EVgo’s continued development. Toyota’s two-year win of the “U.S. sales crown” was buoyed by increasing consumer demand for “hybrids and EVs amid soaring gas prices”, underpinning EVgo’s massive growth outlook ahead of a bullish demand environment for DCFC solutions over the longer-term. As Toyota aims at electrifying 70% of its fleet by the end of the decade, EVgo’s provision of charging solutions to the bZ4X marks the beginning of a greatly expandable opportunity.

- Subaru: In addition to Toyota, Subaru has also selected EVgo as its preferred charging solutions provider ahead of the upcoming launch of its first, fully electric Solterra SUV later this year. The new partnership continues to highlight EVgo’s increasing prominence in the provision of accessible and reliable vehicle fast charging solutions across the U.S., as the switch from ICE-vehicles to EVs picks up in momentum.

- Meijer: EVgo’s partnership forged with major brick-and-mortar retailer Meijer last year will play a crucial role in accelerating the network’s expansion to the Midwestern market. The first EVgo DCFC stations as part of the partnership began operations earlier this year. As part of the agreement, EVgo will “manage the installation and ongoing operation and maintenance” of DCFC stations across more than 250 Meijer supercenters located within Michigan, Ohio, Indiana, Kentucky, Illinois and Wisconsin. The partnership also paves way for continued expansion of EVgo’s newest eXtend program. Positive progress in the expansion of its partnership with Meijer, as well as other existing retailer charging partners, will continue to serve as validation for potential future customer relationships in the lower-traffic corridor markets that EVgo seeks to penetrate through eXtend.

- JPMorgan Chase: Chase bank has commissioned EVgo to install DCFC stations across 50 of its retail branches across major states like California, Indiana, Illinois, New York, Oregon and Pennsylvania beginning this summer. All stations are expected to begin operations by the end of summer 2023. The partnership stems from Chase bank’s ESG initiative to “expand on-site solar power to approximately 400 additional branches by the end of 2022” and “reduce greenhouse gas emissions from its [operational footprint] by 40% by 2030”. The chargers installed for Chase bank are expected to account for up to 9.4 gWh of throughput on EVgo’s network on an annual basis (~16% to 19% of guided 2022 network throughput), supplying 100% renewable energy for 30 million EV miles and eliminating 12,000 metric tons of CO2 emissions from the environment each year. The latest addition to EVgo’s list of charging partnerships underscores a perfect opportunity for further expansion – lacking availability of charging infrastructure remains the “biggest hurdle to EV adoption” in the U.S., and enabling convenient access to fast charging through “everyday settings of life” like the local bank will be key to EVgo’s long-term success.

In addition to maximizing market penetration through continued expansion of charging partnerships, EVgo’s commitment to providing seamless integration of various supporting software services also increases momentum of the flywheel effect between EV adoption and fast charging demand. EVgo’s current charging partners account for almost 40% of the U.S. car market. And by setting itself up as an all-in-one, one-stop-shop charging service provider in the new era of electrification, EVgo is bound to extend its charging partnerships and further extend its market share gains over the longer-term.

Is the EVgo Stock Priced at a Fair Valuation?

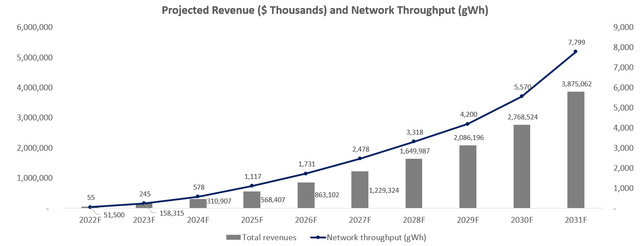

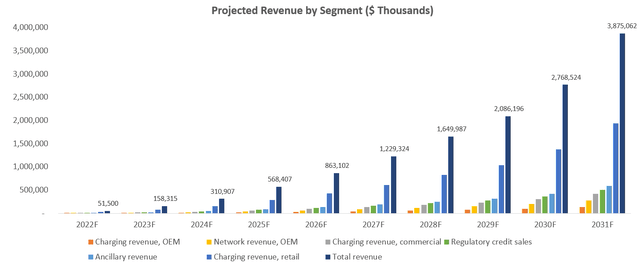

Adjusting our previous forecast to reflect EVgo’s actual fourth quarter performance, 2022 growth guidance, as well as the near-term industry headwinds on EV adoption rates stemming from protracted supply chain constraints, we are expecting EVgo to achieve sales of $51.5 million in the current year, with further expansion towards $863.1 million by 2026 and $3.9 billion by 2031.

EVgo Projected Revenues (Author)

EVgo_-_Forecasted_Financial_Information.pdf

The 2022 revenue forecast is consistent with EVgo’s stall connection pipeline expansion, as well as estimated U.S. EV sales growth for the current year. Over the longer-term, the sales growth assumptions applied considers EVgo’s estimated network throughput and market share as a result of continued acceleration in U.S. EV sales growth, as well as the build-out of EVgo DCFC stalls across the country. Specifically, market currently expects U.S. EV uptake rate to expand at a 10-year compounded annual growth rate (“CAGR”) of more than 35%, while EVgo is pressing towards a DCFC stall build-out CAGR of more than 40% over the forecast period in order to address accelerating demand for fast charging solutions ahead of rapid electrification of the American transportation sector. Charging revenues are expected to remain the core driver of annual topline growth, while ancillary revenues resulting from the provision of accompanying software services, as well as revenues generated from the regulatory credit sales, will continue to represent less than 30% of the total sales mix.

EVgo Projected Revenues (Author)

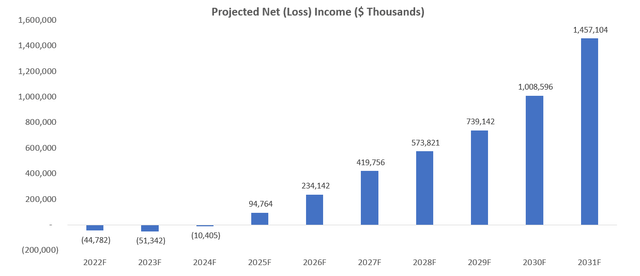

Paired with EVgo’s cost structure as previously discussed, the company is expected to incur narrowing losses from -$44.8 million in the current year to $10.4 million by 2024. Profit realization is expected to begin in 2025, buoyed by U.S. adoption rates that are expected to hit more than 3% country-wide by then. This is consistent with management’s expectations for positive EBITDA and cash flow margins at an EV adoption rate of 2.5%, as highlighted by its current performance in San Francisco where cash flow margins are at a stellar 43.3% based on a city-wide EV adoption rate of 3.1%. Continued margin expansion will also be supported by the continued roll-out of higher-margin, less capital-intensive revenues generated from adjacent service sales (e.g. fleet management services), as well as eXtend network sales.

EVgo Income Projections (Author) EVgo Financial Projections (Author)

Drawing on the above fundamental forecast, our base case 12-month price target for the EVgo stock is about $17. This represents upside potential of 37% based on the last traded share price of $12.48 on April 8th.

EVgo Valuation Analysis (Author)

We have derived the 12-month price target by performing a discounted cash flow (“DCF”) analysis over a five-year discrete period in conjunction with the forecasted financial information analyzed in earlier sections. The valuation analysis assumes a 13.8x exit multiple, which compares to a peer range of 11.27x to 16.37x. A WACC of 9.7% is also applied to discount the cash flow streams, which takes into consideration the company and broader sector’s cost structure and risk profile, especially under current market volatility which has triggered contracting valuation multiples across the board.

EVgo Valuation Analysis (Author)

Is EVgo Stock a Buy, Sell or Hold?

The EVgo stock remains a strong long-term investment ahead of massive growth opportunities arising from accelerated EV adoption across the U.S. American EV adoption is fast-approaching an inflection point – defined as 10% of annual new passenger vehicle sales.

EVs are becoming an increasingly popular choice, especially amongst fleet operators, thanks to their lower total ownership costs compared to legacy ICE vehicles. It takes only “high tens of thousands of miles to break even” for EV fleets, compared to more than 100,000 miles for ICE fleets considering lower fuel and maintenance costs, a benefit that has been further accentuated by today’s soaring prices at the pump. The conversion of legacy ICE fleets to electric makes strong tailwinds for DCFC stall operators, especially EVgo which operates a network powered by 100% renewable energy and compatible with all types of connectors. Even consumers are becoming increasingly excited around EVs considering better ownership economics, especially with improvements to battery technologies, increasing model options, as well as rising availability of public charging infrastructure in recent years.

With EV adoption closely correlated to the long-term success of EVgo, as corroborated by generous cash flow margins in EV-dense metropolitan areas like San Francisco and LA, the charging infrastructure and accompanying services operator is well-positioned for promising upsides ahead.

Author’s Note: Thank you for reading my analysis. Please note that I am in the process of planning a subscription service with Seeking Alpha’s Marketplace. The service will allow you to follow my model portfolio, interact with me directly, and participate in chat rooms with other subscribers. I’ll be launching in the near future with a legacy discount for early subscribers and I’ll be sharing more details as we ramp up to launch in the coming months.

Be the first to comment