Alex Wong

Just Some Quick Facts

The main topic for today is “clean energy” and Berkshire Hathaway (NYSE:BRK.B)(NYSE:BRK.A). There’s something hidden in plain sight that I believe many investors do not fully grasp. It could change your thoughts about Buffett for better or worse. We’ll see.

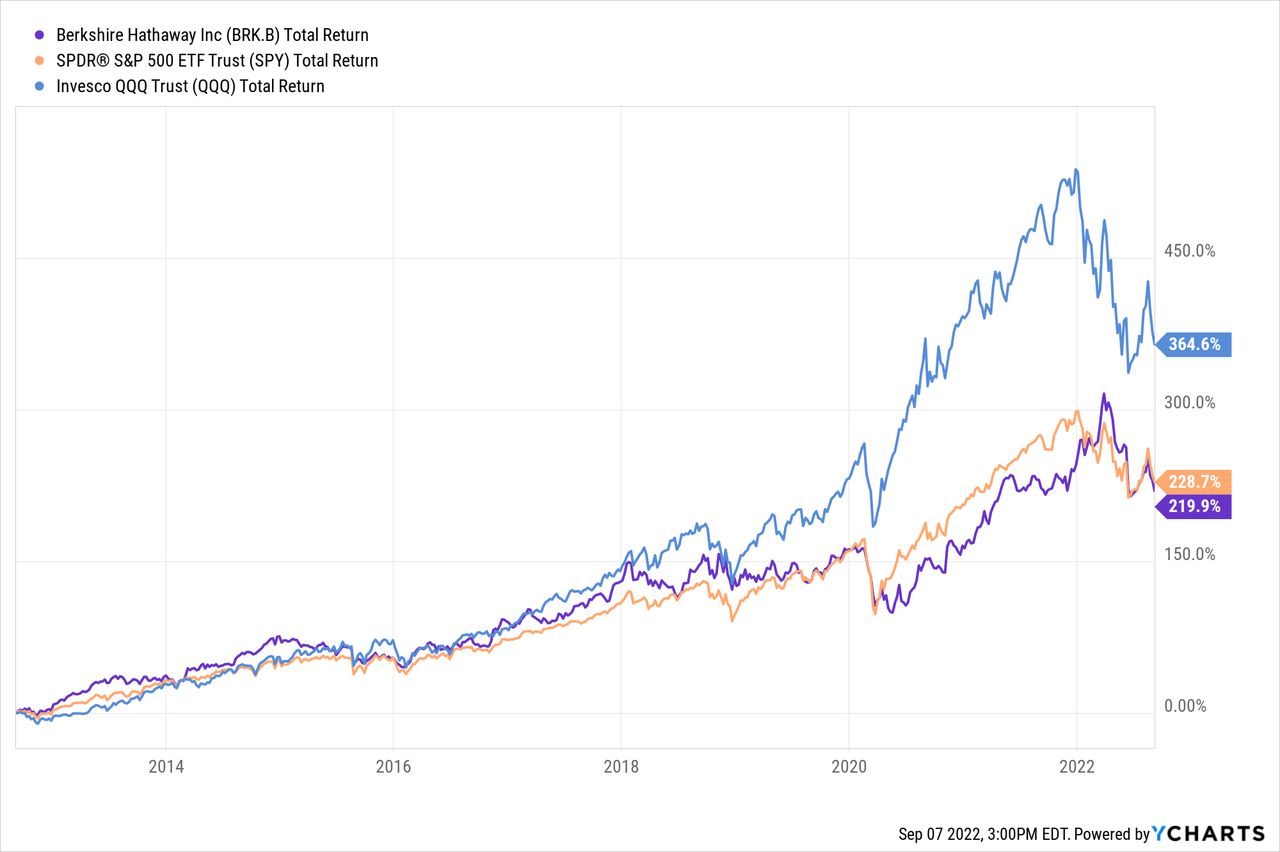

Before we look into the open secret, let’s review how Berkshire has held up during these chaotic times. I’ll keep it simple, putting up Berkshire against the market, specifically the S&P 500 (SPY) and the Nasdaq (QQQ).

That’s over 10 years, of course. The technology heavy QQQ has done better than both Berkshire and SPY. Not too surprising, even with Big Tech getting smashed hard in 2022. Roughly speaking, Berkshire has tracked SPY. Zooming in a bit for greater clarity:

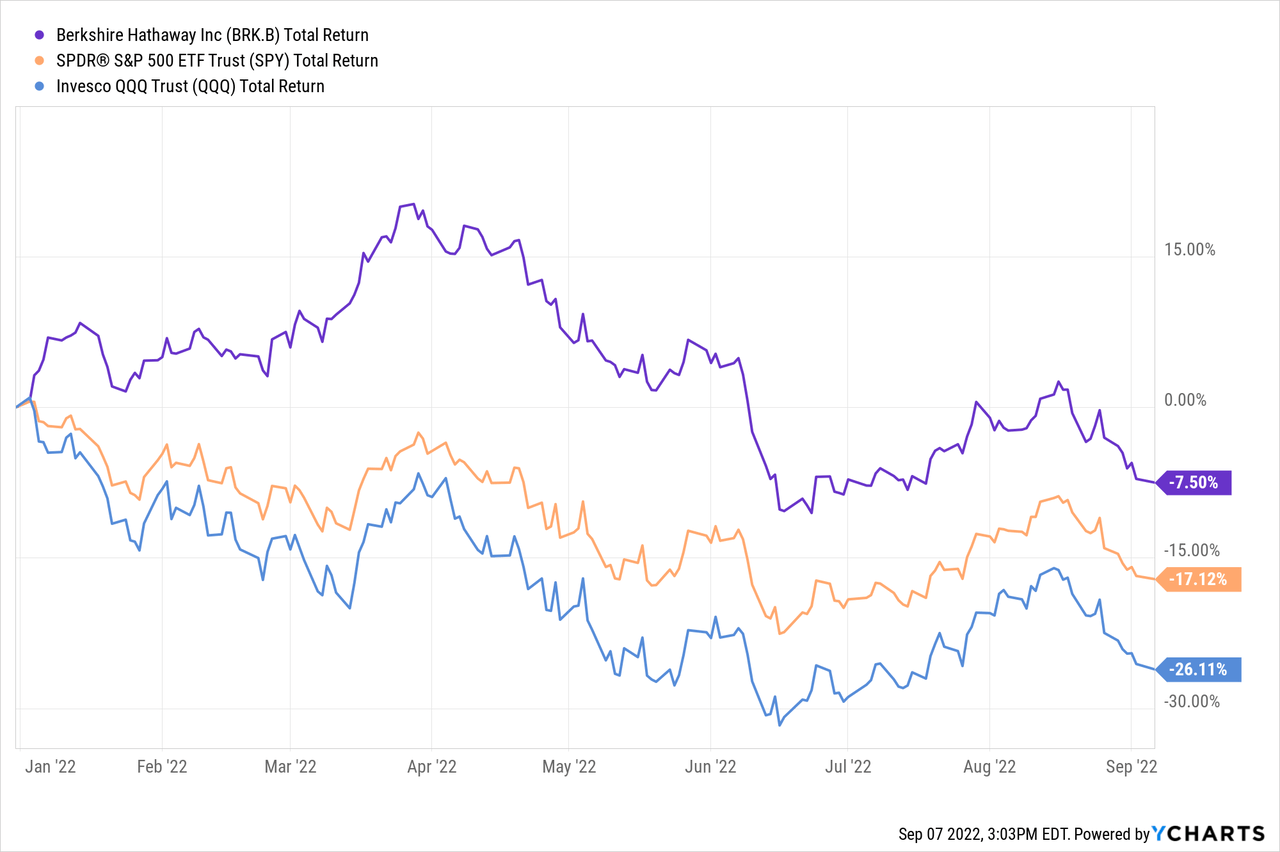

As you probably know, Berkshire has beaten both SPY and QQQ in 2022. That’s not incredible since Berkshire is still down 7.50% thus far. But, on a comparative basis, we’re ahead by a significant amount. Losing less doesn’t feel great but it’s a fact you’re winning when you’re bleeding less.

So, that’s some fast background on price action. Now we’ll turn to something much more interesting. And, depending on your perspective and your overall disposition, we have a nasty drag on the business or hope for a better future. I suppose for some people, it will be both at the same time.

Berkshire Hathaway Energy

Recently, I’ve been spending time looking at Berkshire’s annual reports. From time to time, I put in the reading time, and I think about what’s really going on inside Buffett’s business. Really, since I’m a shareholder, I’m reading about our business and my mind starts buzzing.

Here are several quotes that caught my attention, from the 2020 annual report, starting with this one:

Our second and third most valuable assets – it’s pretty much a toss-up at this point – are Berkshire’s 100% ownership of BNSF, America’s largest railroad measured by freight volume, and our 5.4% ownership of Apple. And in the fourth spot is our 91% ownership of Berkshire Hathaway Energy (“BHE”). What we have here is a very unusual utility business, whose annual earnings have grown from $122 million to $3.4 billion during our 21 years of ownership.

If you’re wondering about the 91% ownership of BHE, keep in mind that Berkshire bought 91% from Walter Scott. At the time of purchase, Scott owned 8% and Greg Abel (Berkshire Vice Chairman) owned 1%.

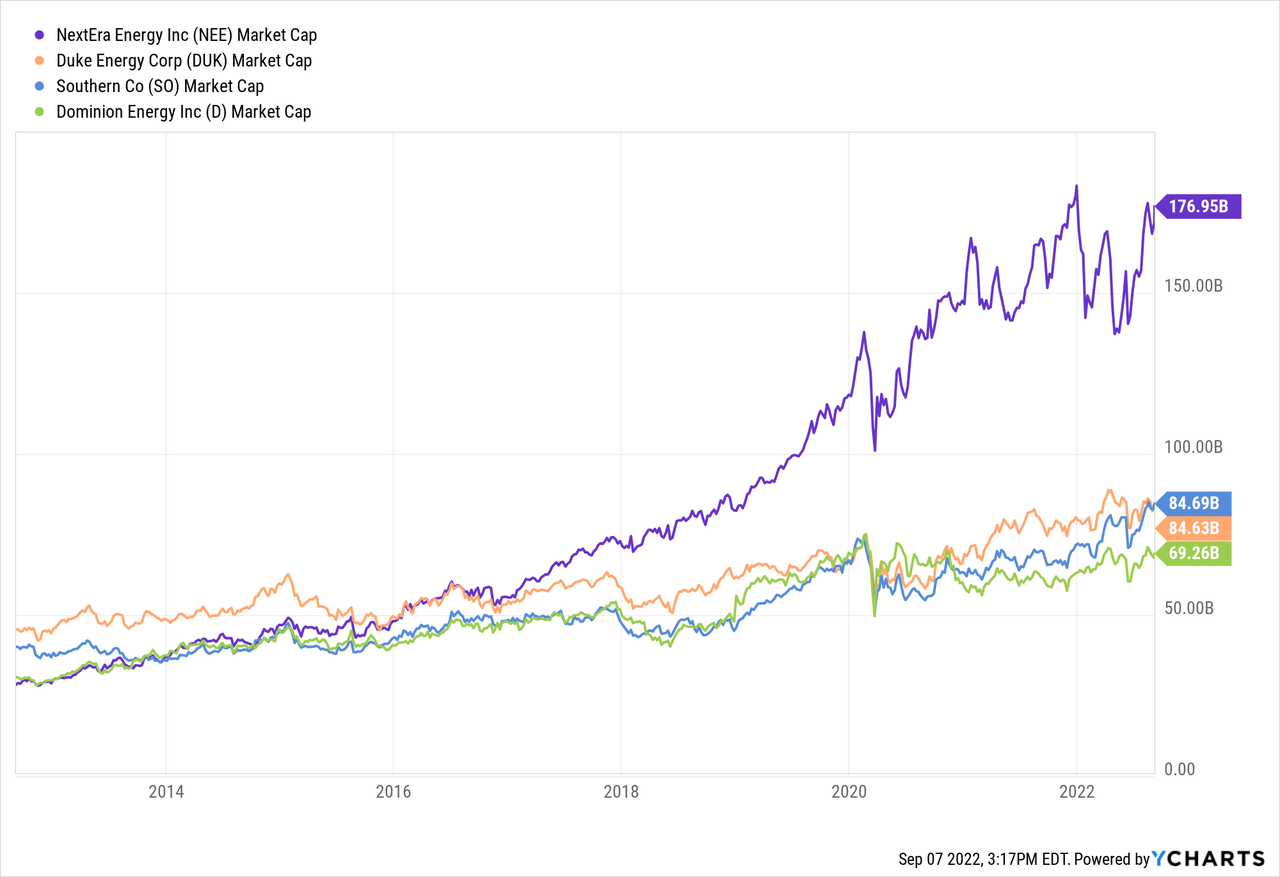

And, as a point of great interest, you can see just how big BHE has grown. If traded on its own, at the time of purchase, it would have been the fifth largest publicly traded utility. For perspective, but leaving off Berkshire:

Next, I think it’s interesting that Buffett combines BHE and BNSF together. In large part, this is because they are both capital intensive. This is essential to understand. We’ll come back to this several times. And, for perspective on this dynamic duo:

In 2011, Berkshire’s first full year of BNSF ownership, the two companies had combined earnings of $4.2 billion. In 2020, a tough year for many businesses, the pair earned $8.3 billion.

BNSF and BHE will require major capital expenditures for decades to come. The good news is that both are likely to deliver appropriate returns on the incremental investment. [Emphasis: Author]

But, here’s where the alarm bell starts to ring:

BHE, unlike BNSF, pays no dividends on its common stock, a highly-unusual practice in the electric-utility industry. That Spartan policy has been the case throughout our 21 years of ownership. Unlike railroads, our country’s electric utilities need a massive makeover in which the ultimate costs will be staggering. The effort will absorb all of BHE’s earnings for decades to come. We welcome the challenge and believe the added investment will be appropriately rewarded.

Let me tell you about one of BHE’s endeavors – its $18 billion commitment to rework and expand a substantial portion of the outdated grid that now transmits electricity throughout the West. BHE began this project in 2006 and expects it to be completed by 2030 – yes, 2030.

Now, to be absolutely clear, Buffett tells us in the 2020 annual report that BNSF has paid Berkshire a staggering $41.8 billion in total. Buffett bought the remaining 77% of BNSF shares it didn’t own for $100 each in early November 2009. In any case, that investment has been wonderful for shareholders, even after the heavy ongoing capital expenditures. There’s a wonderful return on investment in the here and now.

Shifting a bit, notice where Buffett puts the emphasis on BHE in contrast:

BHE’s record of societal accomplishment is as remarkable as its financial performance. The company had no wind or solar generation in 2000. It was then regarded simply as a relatively new and minor participant in the huge electric utility industry. Subsequently, under David Sokol’s and Greg Abel’s leadership, BHE has become a utility powerhouse (no groaning, please) and a leading force in wind, solar and transmission throughout much of the United States. [Emphasis: Author]

There is no real focus placed on the financial benefits of BHE. At least not in any kind of immediate timeframe. In fact, there are repeated mentions of how painful it’s going to be going forward. And, it’s not because BHE is losing money. BHE earned a record $4 billion in 2021. Instead, it’s because of BHE’s massive investments.

Going back to the 2020 annual report, we see this on page 14:

Let me tell you about one of BHE’s endeavors – its $18 billion commitment to rework and expand a substantial portion of the outdated grid that now transmits electricity throughout the West. BHE began this project in 2006 and expects it to be completed by 2030 – yes, 2030.

Look at what’s pouring back into BHE. It’s a whopping $18 billion. And, look at the timeline here. Completion is out another eight years. This is why Berkshire isn’t enjoying dividends – like BNSF – but instead, it’s why money is being drained. Or, as others would say, it’s how money is being invested.

How to Reconcile Mr. Green’s Approach

You’ll notice that I said “drained” and “invested” above. The key idea here is that depending on your perspective, Berkshire is inappropriately allowing current cash flows to be drained (i.e., wasting money on green energy), or it’s playing a long-term game (i.e., investing in a green future).

If you’re looking for actual dividends, then it’s likely you’ll continue to be disappointed with Berkshire and Buffett. That probably can’t go on forever, but never say never. And, while we know Buffett loves collecting dividends, and cash from wholly owned businesses, he’s obviously very willing to reinvest back into very long bets.

With BNSF, we get immediate cash coming back to the mothership for Buffett to deploy. But, with BHE, shareholders are going to have to suck it up for at least five more years, perhaps even a decade.

In some ways, I see something of a “near perfect combination” of two capital intensive businesses. Right now, BNSF is a powerful cash cow. At the same time, BHE is a huge investment in the future. The money isn’t being burned or totally wasted. After all, the BHE infrastructure upgrade increases the value of the business, and therefore Berkshire. It’s really just that shareholders are going to have to be tremendously patient about the payback. We’ll see.

Wrap Up

I left out one huge advantage of the dynamic duo, twin turbo set up that I described with BNSF and BHE. We know that BNSF is pouring out cash. And, we know that BHE is not. What I failed to mention is that Buffett is also able to surf the clean energy wave. Buffett can say he’s green, to a degree.

But, there’s a bit of a dark side here. It’s not all rainbows and butterflies. Buffett made the following comment in 2014 per U.S. News & World Report:

“I will do anything that is basically covered by the law to reduce Berkshire’s tax rate,” Buffet told an audience in Omaha, Nebraska recently. “For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.” [Emphasis: Author]

In any case, I don’t think Berkshire is making any dumb investments. As a shareholder, it really comes down to our faith in the business. And, being in rough agreement with Buffett’s choices, and the choices made by all of leadership, at all levels. The timelines matter too, of course.

All in all, I’m optimistic about Berkshire Hathaway’s future. While there are many complexities, there are also many opportunities. Some of those opportunities are in the “here and now” such as BNSF dividends. Other opportunities are going to land in a decade, or more, in the future. As a conglomerate, that’s exactly what I expect with Berkshire.

Right now, for me personally, Berkshire is a Hold. But, this isn’t a place to be selling. Not by a longshot. If I didn’t have any Berkshire at all, I’d be very comfortable starting a position at the current prices. It’s not a screaming buy, but that’s fine. In any event, putting it all together, let’s call it a Hold for now.

Be the first to comment