Sundry Photography

The airline sector took a massive hit in the early days of the Covid-19 pandemic as governments imposed strict mobility restrictions to curb the spread of the virus. Delta Air Lines, Inc. (NYSE:DAL) stock, after hitting a pandemic low of below $20, recovered to over $50 in April 2021, only to lose ground yet again with the emergence of new Covid variants, macroeconomic challenges, geopolitical tensions, and the negative sentiment toward stocks in general. DAL stock is down 21% this year but Q2 earnings helped DAL gain some momentum after initially losing ground due to the earnings miss. In this analysis, I will discuss where Delta Air Lines is headed amid challenging operating conditions.

Did Delta Beat Earnings?

Delta Air Lines announced second quarter results earlier this month that came in below the consensus estimate due to higher fuel costs and labor shortages. Delta reported adjusted earnings per share of $1.44 against expectations for $1.72. Although summer travel demand was high, airlines struggled to manage operations due to a pilot and ground staff shortage, which has left many airlines unable to meet flight schedules. In the June quarter, the company reported $13.8 billion in revenue, up 10% from the same quarter in 2019 with demand for domestic corporate travel recovering to 80% of pre-Covid levels. International corporate sales increased by 30 points to 65% of 2019 levels. Cargo revenue was $272 million in Q2, up 46% from pre-pandemic levels and MRO revenue was $178 million, which comes to around 85% of 2019 levels.

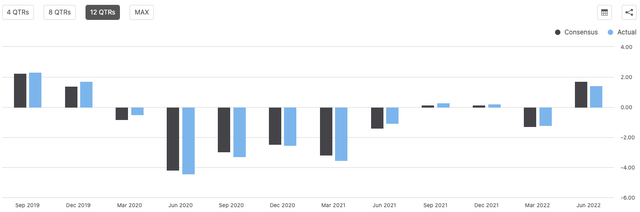

As illustrated below, Delta Air Lines has not been consistent with beating Wall Street estimates for earnings in the last 12 quarters. At Leads From Gurus, we believe there is a strong correlation between long-term stock price gains and consistent earnings beats, and Delta fails to check this box.

Exhibit 1: Earnings surprise history

Carriers struggled to ramp up capacity as the new variants of Covid-19 continued to put pressure on the travel industry, leaving them ill-equipped to deal with a surge in summer travel demand, resulting in higher operational costs. The management of Delta acknowledged making major mistakes, such as scheduling too many flights, which resulted in widespread flight cancellations. For context, Delta had to cancel 3.5% of its scheduled flights last month. Because of these cancellations, operating costs were much higher than expected. Delta’s costs for each seat flown a mile, excluding fuel, increased by a staggering 22% compared to 2019 levels in Q2.

The increase in fuel prices is proving to be the biggest challenge for airlines today in addition to employee shortages. Delta’s average fuel expenses increased to $3.82 per gallon in Q2, up 37% from the first quarter, when it had anticipated paying between $3.20 and $3.35 per gallon. Delta, however, benefited from higher fuel prices as it is the only airline with its own oil refinery and sold $1.5 billion in oil to third parties, up from just $40 million in the second quarter of 2019.

What to Expect After Delta’s Earnings?

Despite falling short of analyst expectations, Delta’s operating revenue recovered to around 99% of 2019 levels in Q2, and its capacity restored to around 82% of pre-pandemic levels. The company also reported its first double-digit operating margin since 2019, indicating the recovery is well and truly gaining traction. Delta remains focused on expanding its capacity to meet financial goals.

Delta CEO Ed Bastian, commenting on this strategy, said:

This quarter’s operational performance has not been up to our industry-leading standards, and restoring operational excellence is our top priority. Steps we’ve taken include the strategic direction to hold capacity at the June month level for the remainder of this year as well as additional investments to restore operational integrity, including earlier boarding procedures and operational buffers.

Because of training backlogs for new hires, the company intends to maintain third-quarter capacity between 83-85% of 2019 levels. Although Delta has hired over 95% of the staff required to fully restore capacity, the carrier has a large number of untrained employees which is proving to be a major challenge, not surprisingly. During the pandemic, large airlines reduced their workforce by offering early retirement and voluntary layoffs, and they have been trying to hire more people in recent quarters amid the recovery of travel demand. This has tilted the odds in favor of potential candidates who are now in a better position to demand higher salaries knowing many airlines are competing for the same talent. In May, Delta increased the base pay for many workers by 4%, and it claims that premium pay and overtime for its staff will exceed $700 million this year, which is a 50% increase over 2019. Amid already challenging operating conditions, this massive increase in labor costs will be a drag on the company’s operating margins in the next couple of quarters.

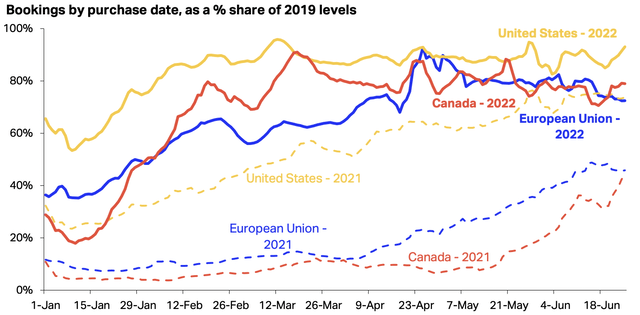

Last quarter was certainly intense, beginning with airline delays, baggage losses, cancellations, and staff shortages. The Russia-Ukraine war-related volatility in oil prices and the possibility of a further rise in fuel prices have complicated the outlook for the airline sector. However, carriers have consistently increased their revenue expectations for the current quarter because of robust travel demand for both leisure and corporate travel. Delta not only returned to profitability but also saw adjusted revenue increase from 2019 levels for the first time since the pandemic began. From a demand perspective, the U.S. is leading the charge among developed countries.

Exhibit 2: Bookings by purchase date as a percentage share of 2019 levels

The company also reported that the third quarter started with an average month-to-date completion factor of 99.2% and 84% of flights arriving within 14 minutes of the scheduled arrival time.

While staff shortages remain an industry-wide issue, Delta announced on July 22 that it is partnering with Wheels Up, one of the world’s largest private charter companies, to accelerate pilot training and full-time employment. Pilots in its college program would be able to log training hours with Wheels Up. Because most pilots-in-training must log 1,500 hours of flight time to be eligible for hire, this collaboration will help alleviate the national pilot shortage.

Additionally, Delta announced the purchase of 100 Boeing 737 Max 10 aircraft, its largest order in more than a decade. Delivery is set to begin in 2025. This would upgrade Delta’s fleet of narrow-body aircraft as the carrier looks to capitalize on the travel rebound. According to management, the Max aircraft will be 20-30% more fuel-efficient than the jetliners they will replace.

In the aftermath of Q2 earnings, there is reason to believe that Delta will face ongoing margin pressures in the coming quarters but from a long-term perspective, the company seems to be moving in the right direction to restore its profitability.

Is Delta Air Lines a Good Long-Term Investment?

Travel demand is expected to remain high, resulting in higher revenue for the airline industry. With this expectation, Delta Air Lines anticipates a 1% to 5% increase in third-quarter revenue compared to 2019 levels. Delta’s fleet strategy distinguishes it from the competition. Delta has replaced many of its aircraft with fuel-efficient Airbus models, which are expected to burn roughly 20-30% less fuel. This could contribute significantly to increased operating income in the future. Amid the current inflationary environment, the company has improved its operational efficiency commendably by strategically managing costs.

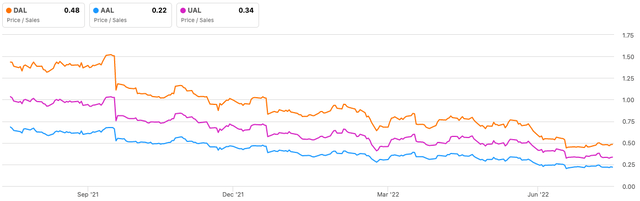

What we can see from the Q2 earnings of Delta and its closest peers is that the rise in oil prices has drastically altered the earnings picture for airlines. The overall revenue for American Airlines (AAL) increased by around 12% over the same quarter in 2019, while unit costs increased by 45% due to uncontrolled macroeconomic factors. Because of these cost challenges and pressure on margins, all three major carriers – American, Delta, and United – have seen their P/S ratios fall in recent months.

Exhibit 3: P/S ratio of major U.S. airline companies

Delta is valued at a premium over both American and United from a P/S perspective, and this is understandable given that Delta returned to profitability before its closest peers and seems better positioned compared to its peers to see long-term margin improvements.

U.S. airlines may encounter additional challenges if passengers decide to cut back on travel spending due to the highest level of inflation seen in four decades, which could result in further value contraction for all airline companies.

Rising oil prices and continued pressure from the pandemic have led to a contraction in Delta’s P/E ratios this year. The Bureau of Labor Statistics reports that air travel prices dropped in June compared to the previous month. According to data from Hopper, the average cost of domestic travel in May was $310, up approximately 16% from the same period in 2019, while the average cost of an international flight in May was $827, up 26% from 2019. Given the high demand for travel and staff shortages, it is unlikely that ticket prices will fall sharply in the coming quarters, and this will help Delta mitigate some of the negative impacts on its operating margins.

Despite operating at reduced capacity, major airlines have nearly recovered operational efficiency to pre-crisis levels. Delta may be able to meet its goal of reaching pre-pandemic capacity by the summer of 2023, as demand for corporate and international travel recovers with airports eliminating pandemic-related travel requirements. While the current uncertainty may be daunting, there seems to be value in Delta stock today.

With operating improvements and cost efficiencies expected in the next five years along with consistent demand for air travel, Delta Air Lines stock seems a good pick today for long-term-oriented investors although shares are likely to remain volatile for the remainder of this year.

Takeaway

Delta Air Lines posted mixed results for the second quarter of 2022 but certain granular financial performance metrics suggest the company is moving in the right direction. Despite short-term challenges, Delta seems well-positioned to grow in the long run while achieving operational efficiencies at the same time. Delta stock, therefore, seems attractively priced today.

Be the first to comment