petrovv/iStock via Getty Images

Investment Thesis

Shell plc (NYSE:SHEL) is one of our well-monitored energy stocks, given its exciting diversification to renewable energies. Its goal of operating 500K EV charging ports globally by 2025 is not lofty, since the company is already operating approximately 46K gas stations with 90K charging ports already installed as of June 2022. Its acquisition of ubitricity will also allow consumers to charge their vehicles from 50K on-street EV charge posts in the UK by 2025, on top of its Greenlots acquisition in the US. SHEL went on to launch a global pilot in January 2022 by converting one of its existing sites in London to cater solely to an ultra-rapid EV charging hub, complete with a cafe and supermarket.

Combined with its ambitious partnership with NIO (NIO) for EV charging and battery swap stations in China ( the largest world market for EVs ), the company is indeed highly committed to remaining relevant in a rapidly transforming industry. The global EV market is expected to grow tremendously from $246.7B in 2020 to $1.31T by 2028, at a CAGR of 24.3%, with many automakers such as Tesla (TSLA), General Motors (GM), and Ford (F) reporting massive backorders worth billions over the next year. Impressive indeed, given the rising inflation and hyper-inflated price tags.

As a result, it is not surprising that these forward-looking growth strategies will mark SHEL’s aggressive transition to a well-balanced energy company. It would be able to tap into both the conventional oil/gas industry worth $10.37T by 2026 and the breakthrough EV charging market worth $111.9B by 2028, over the coming century.

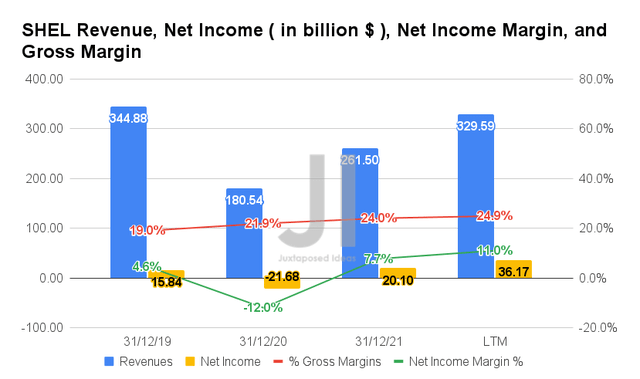

SHEL Continues To Grow Its Profitability As Oil/Gas Prices Soar

In the last twelve months (LTM), SHEL reported revenues of $329.59B and gross margins of 24.9%, representing a remarkable increase of 26.03% and 0.9 percentage points YoY, respectively. The sustained oil/gas prices have directly contributed to its improved profitability, with net incomes of $36.17B and net income margins of 11%. It indicated an increase of 79.95% and 3.3 percentage points YoY, respectively. Otherwise, an immense growth of 228.34% and 6.4 percentage points from FY2019 levels, respectively.

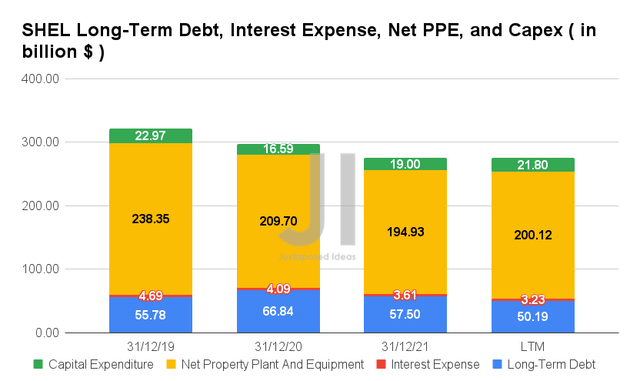

In the LTM, SHEL also reported an excellent reduction in its long-term debts to $50.19B and interest expenses to $3.23B, representing a massive moderation of -12.71% and -10.52% YoY, respectively. In the meantime, the company continued to invest in its future capabilities with net PPE assets of $200.12B in the LTM and up to $27B of capital expenditure planned for FY2022, indicating an increase of 2.66% and 42.1% YoY, respectively.

Investors should note that these investments would eventually be top and bottom lines accretive through the end of this decade, with a particular focus on its rapid green energy transformation in the US and the EU, significantly accelerated by the Russian oil crisis.

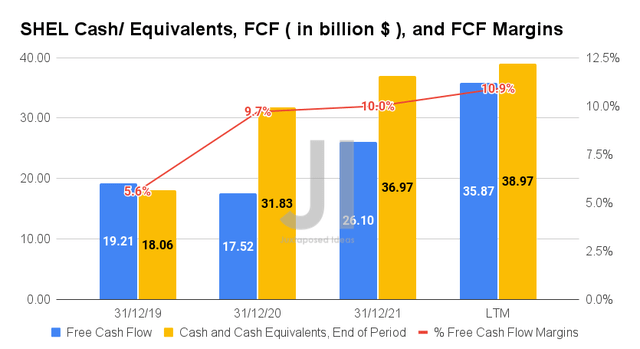

Therefore, given the current insatiable demand and record-high oil/gas prices, it is not surprising that SHEL reported an exemplary Free Cash Flow (FCF) generation of $35.87B and an FCF margin of 10.9% in the LTM. It represented an increase of 37.43% and 0.9 percentage points YoY, respectively. Otherwise, a tremendous growth of 86.72% and 94.64% from pre-pandemic levels in FY2019, respectively.

Naturally, SHEL reported a more than impressive war chest of cash and equivalents of $38.97B on its balance sheet in FQ2’22, negating its massive liabilities of $83.74B to a comfortable net debt of $46.4B. Furthermore, the company has deftly reduced its net debt/ EBITDA ratio from 1.57x in FQ2’19 and 3.45x in FQ4’20, to 0.47x by the latest quarter, indicating a herculean reduction of -86.37% within the past six quarters.

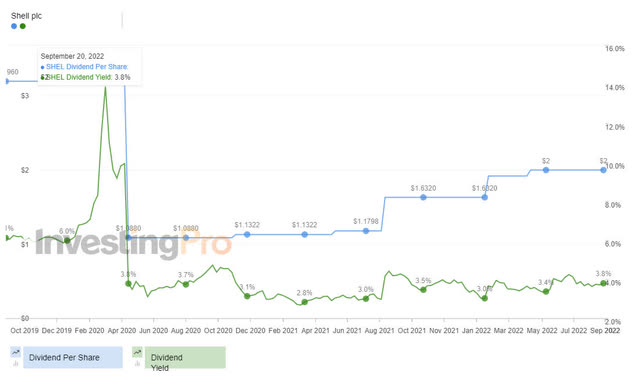

SHEL 3Y Dividend Payout & Yield

Stellar indeed, since SHEL has also proved to be an excellent dividend stock thus far, with dividend payouts of $2 and dividend yields of 3.81%. These are comparable with other dividend aristocrats, such as Exxon Mobil Corporation (XOM) at 3.78% and Chevron Corporation (CVX) at 3.63%. Long-term investors must also note the excellent increases in its payouts over the past two years at 69.52%, compared to XOM’s at 7.31% and CVX’s at 19.32% for the same period of time.

Given the upcoming winter and tight energy supply, we expect another stellar cash flow generation for the next few quarters, further accelerating its deleveraging with a potential dividend hike in H2’22. Combined with $12.04B of share repurchases in the LTM, it is no surprise that much value has been returned to SHEL investors indeed.

Mr. Market May Upgrade SHEL’s FY2023 Performance Depending On The Coming Winter

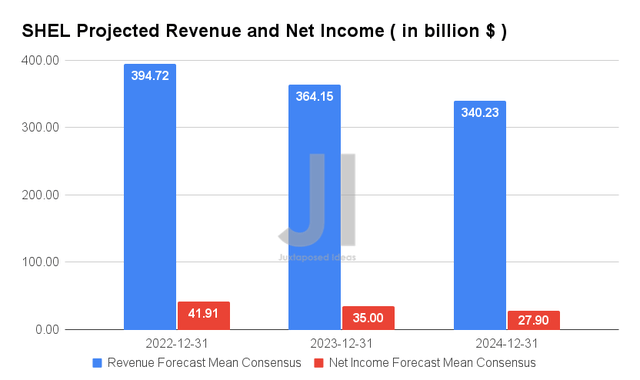

Over the next three years, SHEL is expected to report a drastic normalization of revenue growth back to FY2019 levels, while remaining highly profitable. By FY2024, consensus estimates that the company will report improved net income margins of 8.2%, compared to 4.6% in FY2019 and 7.7% in FY2021. Thereby, underscoring speculatively elevated oil/gas prices then, with notable contributions from its aggressive energy transitions.

For FY2022, SHEL is expected to report revenues of $394.72B and net incomes of $41.91B, representing a tremendous increase of 50.94% and 208.5% YoY, respectively. For its upcoming call, analysts will be closely watching its FQ3’22 performance, with projected revenues of $50.86B and EPS of $2.94, representing a YoY decline of -15.29% but a massive growth of 277.35%, respectively. It remains to be seen how SHEL will perform then, given its mixed record for the past year.

Over the next few quarters, we doubt that the situation in Ukraine/ Russia will be alleviated, sustaining elevated oil/gas prices due to the limited supply ahead. As of 19 September 2022, the prices of WTI crude oil are at $85.65 per barrel, down 28.62% from its peak prices of $120s in June 2022, though still at a premium of 55.7% from FY2019 levels of $55s. The Fed’s efforts would only tamp down on the rising inflation through 2023, though unlikely to kill global energy demand, given the nascency of renewable energy options and phasing out of nuclear energy in the EU since 2006.

Combined with the massive demand from the coming winter months and the zero reliance on Russian oil/gas moving forward, we expect to see an upwards rerating of SHEL’s FY2023 revenue and net income growth, possibly by 5%, nearing FY2022 projections. We shall see, since these would also temporarily boost its stock valuations.

So, Is SHEL Stock A Buy, Sell, or Hold?

SHEL 5Y EV/Revenue and P/E Valuations

SHEL is currently trading at an EV/NTM Revenue of 0.62x and NTM P/E of 4.73x, lower than its 5Y mean of 0.87x and 9.15x, respectively. The stock is also trading at $52.49, down -14.89% from its 52 weeks high of $61.68, though at a premium of 16.90% from its 52 weeks low of $44.90. Consensus estimates remain bullish about SHEL’s prospects, given their price target of $68.33 and a 30.18% upside from current prices.

SHEL 5Y Stock Price

Nonetheless, it is evident that despite the sustained stock rally and record-high oil/gas prices thus far, SHEL is still trading below its pre-pandemic levels. The stock has been facing multiple headwinds in recovery, partly attributed to Australia’s strike, Russia’s Sakhalin-2 LNG losses, and perceived management issues leading to the departure of its CEO. As a result, the stock continues to underperform with a 5Y Total Price Return of 10.7% and a 10Y Return of 21.6%, compared with XOM’s 50.7%/55.3% and CVX’s 68.2%/101.5%, respectively.

In the meantime, since the Feds are set to introduce a 75 basis point hike on 20 and 21 September, we may likely see another moderate retracement over the next few days. If not worse, as there is a 15% speculative chance of a 100 basis points hike instead. Whichever it is, the stock market will see another short-term decline, giving opportunistic investors with excellent near-bottom entry points to this stellar stock. We are confident that SHEL will weather its next century resiliently with its green transformation strategies, as it had in the past century with conventional oil and gas.

Therefore, we rate SHEL stock as a Buy in the low to mid $20s. Do not miss this chance again.

Be the first to comment