Teamjackson

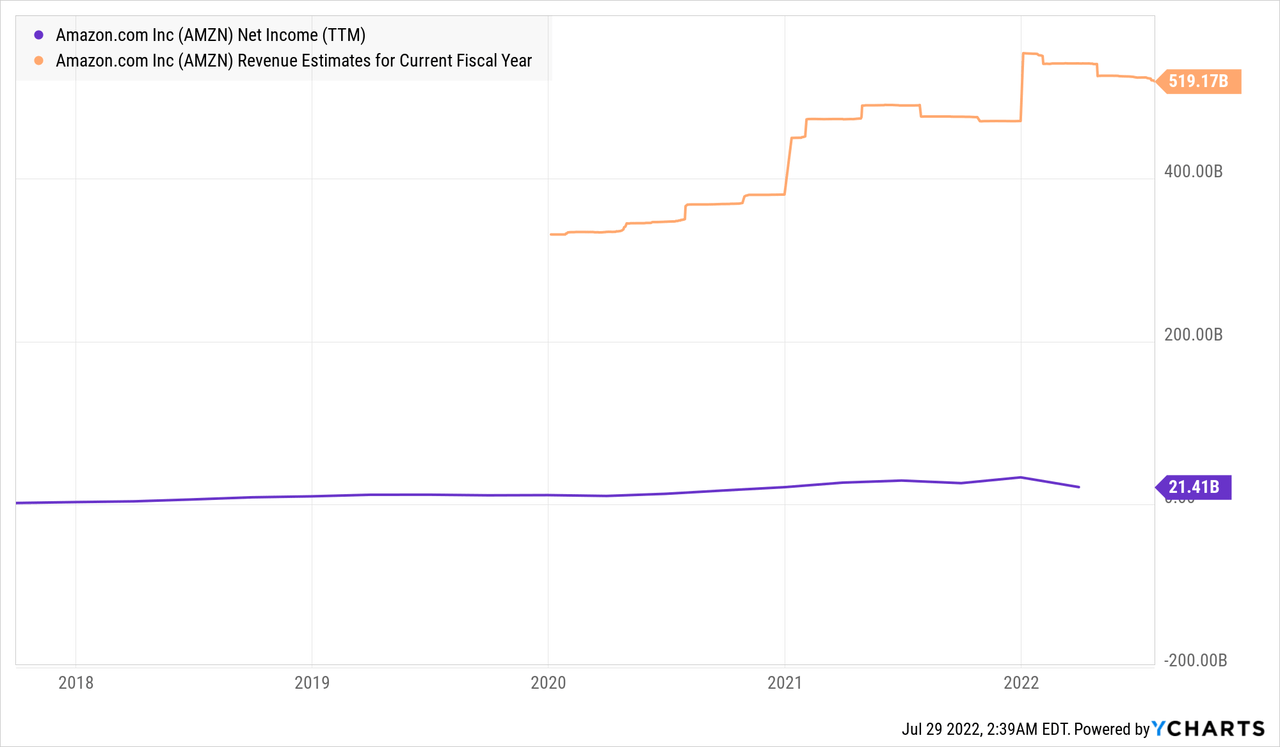

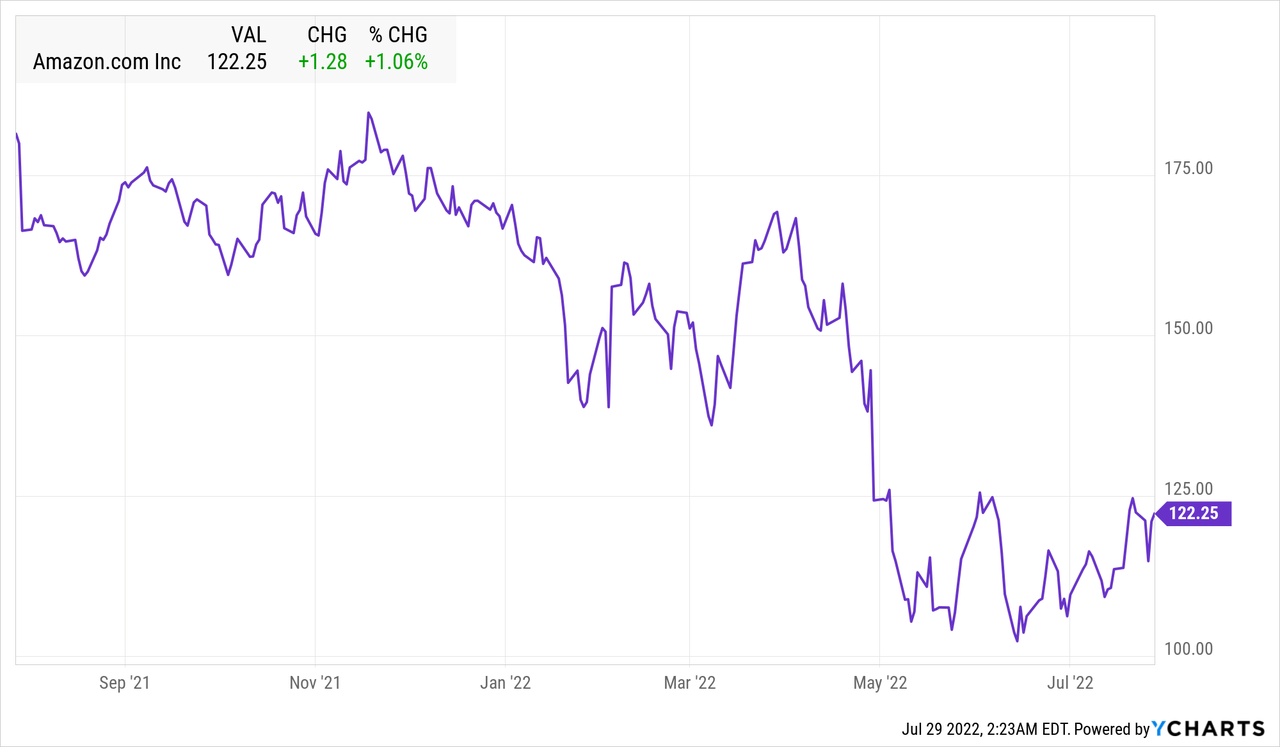

Amazon.com, Inc. (NASDAQ:AMZN) recently announced its financial results for the second quarter of 2022. Despite racking up a huge net loss of $2 billion, the company actually beat revenue expectations on strong AWS growth, and the stock popped by ~14% in aftermarket and premarket trading. The stock is still undervalued intrinsically and relative to historic multiples, so let’s dive into the business model, financials, and valuation for the juicy details.

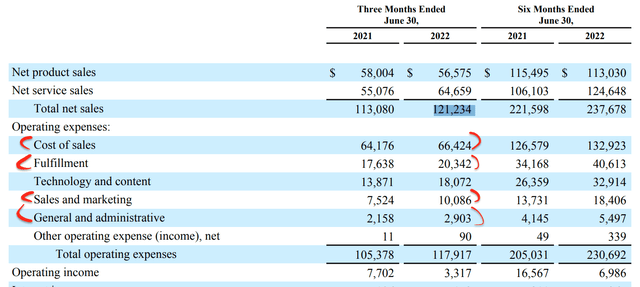

Revenue Up, Profits Down

Let’s look at what Amazon announced in its financials for the second quarter of 2022. Revenue grew by a steady 7% year-over-year to $121.2 billion, smashing analyst estimates by $2 billion. Now, although 7% growth is a far cry from the rapid 27% growth rate generated in the year 2020/2021, that was during a lockdown of physical retail, and thus ecommerce boomed. If we zoom out, we see that despite the headlines, Amazon’s revenue is actually up 36% over a two-year period, while the stock price is down 1% over that same period. In addition, “unfavorable” foreign exchange headwinds from a strong dollar have impacted revenue by a whopping $3.6 billion. Thus, sales increased 10% on a constant currency basis. Amazon is particularly prone to the foreign exchange-rate impact, as ~25% of its sales are from international regions. This would likely be a great number with AWS sales included, but that segment is not broken down by region.

Operating Income was $3.3 billion in the second quarter, which was down an eye-watering 57% from the $7.7 billion in Q2,22. This was driven by higher-than-normal fulfilment costs, which increased by nearly one third to $20.4 billion. This may seem terrible again, but it’s good to remember that the primary driver of this is inflation in transport costs and supply chain disruptions. These are temporary headwinds, as oil prices tend to be cyclical over time and Amazon is rolling out EV delivery trucks with partner Rivian (RIVN).

It was also interesting to see Amazon aggressively increase its Sales and Marketing spend by over 34% to $10 billion. The company aims to aggressively capture more market share in the cloud industry, while simultaneously rolling out more products. For example, the company launched Alexa integrations with new vehicle models such as the Chevy Equinox and Lucid Air. With the integration, drivers can use Alexa to do everything from playing music to finding parking spots and even starting the engine. The platform is already available with leading manufacturers such as Audi (OTC:AUDVF), BMW (OTCPK:BMWYY), Ford (F), Volkswagen (OTCPK:VWAGY, OTCPK:VWAPY, OTCPK:VLKAF) and many more. This evolves Amazon into being a Software as a service (“SaaS”) provider, which is a great strategy for long-term margin improvement.

The company also increased Technology and Content expenses by 30% to $18 billion. This includes investments into Prime content such as five new Amazon Original series, in addition to scoring the exclusive launch of the new Lord of the Rings movie. Amazon continues to “Invent and Simplify” on all fronts and rolled out 12 new Amazon Fresh stores with the “Amazon Dash Cart.” This AI powered shopping cart uses computer vision to identify which foods shoppers pick up and put in the trolley. This empower shoppers to then easily exit the store and skip the checkout line.

Alexa also showcased new features at the re:MARS conference, which included integration with Astro, the smart household robot. The robotics industry was worth $41.7 billion in 2021, and is estimated to grow at a rapid 11.8% CAGR reaching over $81 billion by 2028. Thus, this good be a strong future driver for the company.

More Losses?

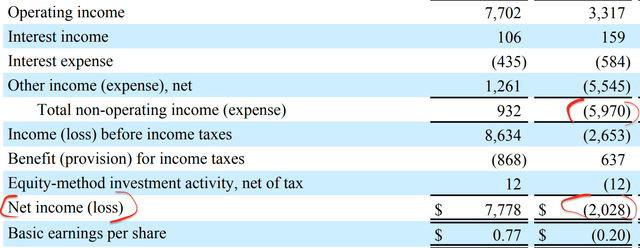

Back to the bloodbath. Amazon’s Net Loss expanded to $2 billion, down from $7.8 billion in Net income posted in the equivalent quarter last year. These results may seem atrocious at first glance, but keep in mind this loss was driven strongly by a $3.9 billion write down on Amazon’s investment into electric vehicle (“EV”) maker Rivian, whose share price has declined by 73% since its IPO. This is a “pre-tax” valuation loss and really can be seen as a paper balance sheet adjustment. This isn’t great, but it isn’t exactly real dollars which have been burned.

Amazon stock losses (Income statement (2021 – Left Column), (2022 – Right Column) )

Operating Cash flow also decreased by an eye watering 40%, to $35.6 billion for the trailing 12 months. Free Cash Flow (“FCF”) decreased to an outflow of $24.5 billion.

AWS is the Crown Jewel

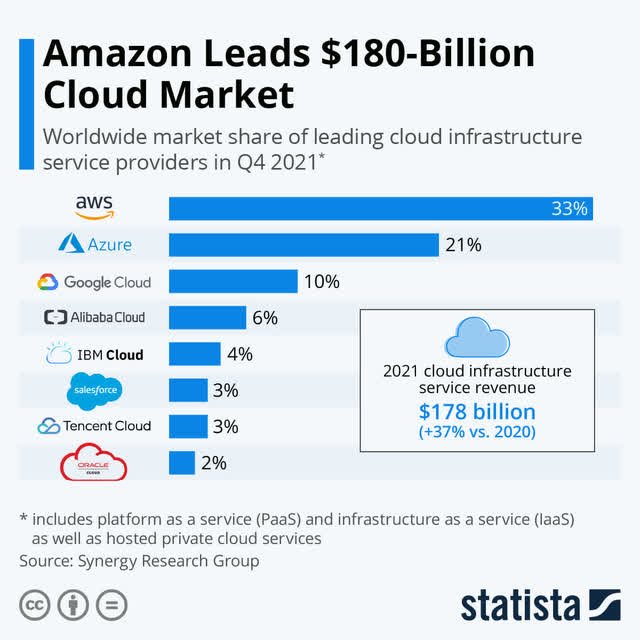

Amazon Web Services (AWS) is the number one cloud infrastructure provider, by market share, above Microsoft (MSFT) Azure and Google (GOOG, GOOGL) Cloud. The company had a first-mover advantage, as it was founded in 2006, two years earlier than Azure and Google Cloud, both founded in 2008. AWS operated in stealth mode for a long time, before surfacing like a whale and dominating the cloud market. Enterprises are discovering that in order to be more flexible and agile in this unpredictable world, it makes sense to outsource their computing power and even software applications to AWS. This trend of “Digital Transformation” accelerated over the pandemic, and thus the cloud industry has boomed.

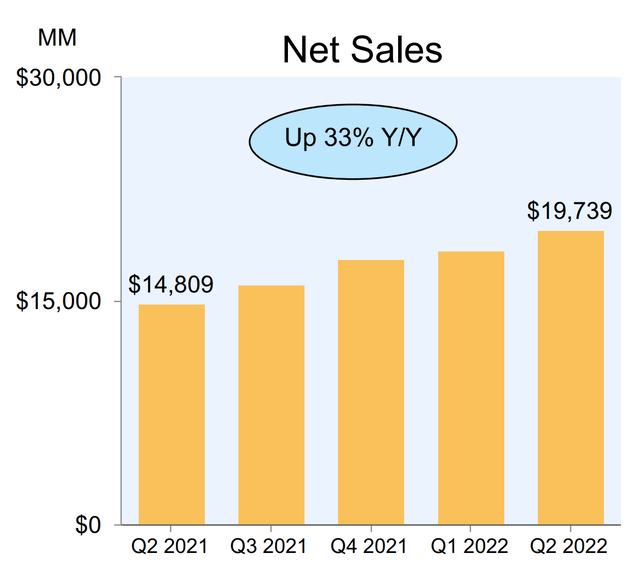

In the second quarter of 2022, AWS continued to show strong momentum with Net Sales increasing by a blistering 33% to $19.74 billion, up from $14.8 billion in the equivalent quarter last year. Operating Income also boomed by 36% year-over-year to $5.7 billion for AWS. The cloud segment made up 15% of Amazons revenue in trailing 12 months and is the true profit driver.

Approximately 80% of Fortune 500 companies, use AWS to host their IT infrastructure. Recent wins for AWS include Delta Air Lines (DAL) and British Telecom (OTCPK:BTGOF), which is the UK’s largest telecommunications company.

Advanced Valuation

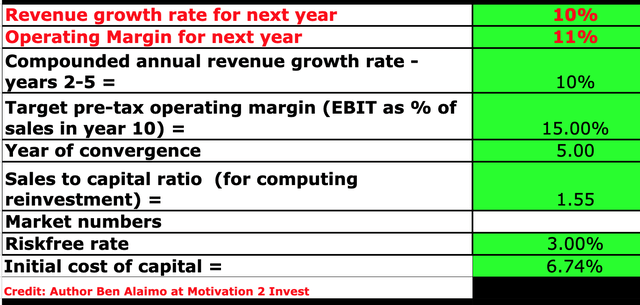

In order to value Amazon, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth for next year and 10% for the next 2 to 5 years. This is conservative given management is forecasting between 13% and 17% revenue growth for the third quarter of 2022. However, I think it’s always best to be conservative with a valuation and in this case it doesn’t change the rating (Buy/Sell/Hold) which you will see later on.

Amazon Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

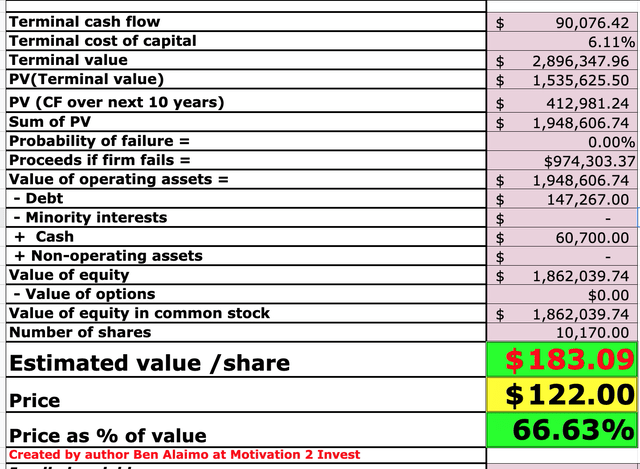

I have forecasted margins to expand to a healthy 15% over the next 5 years. I expect this increase due to the continued growth of the high margin AWS business, which is operating at a healthy 29% margin in the trailing 12 months. In addition, I forecast fuel cost inflation to cool in the upcoming years. To increase the accuracy of the valuation, I have included factors such as Amazon’s $60.7 billion cash balance, it’s debt and R&D expenses.

Amazon Stock Valuation (created by author Ben at Motivation 2 Invest)

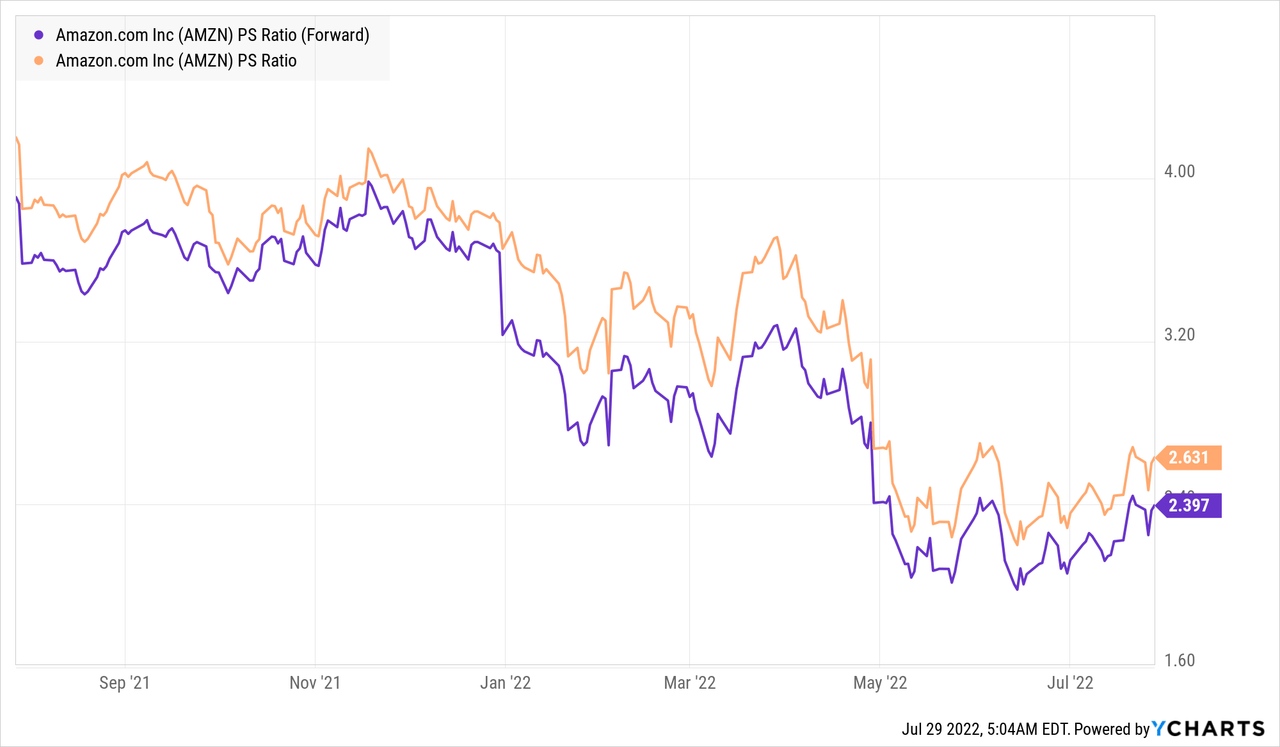

Given these factors, I get a fair value of $183/share, the stock is currently trading at $122/share and thus is ~44% undervalued. In addition, Amazon is trading at a forward Price to Sales Ratio = 2.37, which is 29% cheaper than the five-year average.

Competitive Advantages

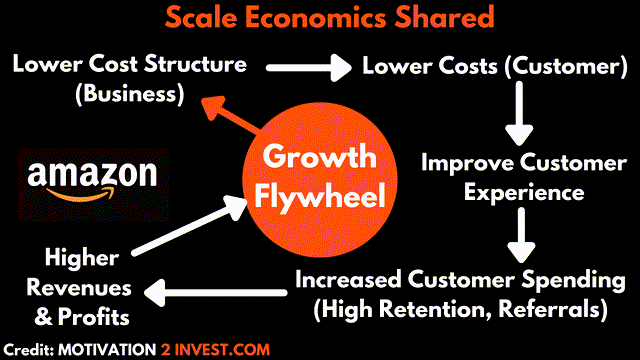

Amazon has many competitive advantages, from its vertically integrated logistics network, to its AI and Cloud technology, network effects from Amazon Prime, and even its culture and brand. However, the most interesting competitive advantage is its “Scale Economics Shared” philosophy. This involves the company passing on its cost savings to customers as it scales.

We see this in all aspects of Amazon’s business. A common example, is Amazon Prime, which keeps stacking the benefits for users (from free delivery to music, video, e-books and more). Recently, new Prime members even receive access to free Grubhub delivery for one year. AWS also operates with a similar philosophy of scaling operations and then passing cost savings onto users. I created the “Growth Flywheel” graph below in my previous post about the successful Investing Manager Nick Sleep, who at one point had approximately 40% of his fund in Amazon stock.

Scaled Economics Shared (created by author Ben at Motivation 2 Invest)

Risks

Macroeconomic Headwinds

In the words of Warren Buffett, “Inflation Swindles Everybody.” Not even Amazon can escape the rising input costs and uncertain consumer demand. The high inflation environment and a possible recession is expected to eat away at Amazon’s profits in the short term. However, the cloud provider AWS should be more insulated from these issues and is set to continue with strong growth.

Jeff Bezos has Left

A key part of my investment strategy is to invest into Founder-led companies. In this case, Founder Jeff Bezos stepped down as CEO in 2021 and is now the executive chairman. The new CEO is Andrew Jassy, a veteran of Amazon who has been with the company since 1997 and was the head of AWS for a substantial period. However, now the company is going through challenging times. Jassy will be tested to see if he has the skills and commitment to run the entire company effectively.

Final Thoughts

Amazon is a tremendous company which dominates both ecommerce and the Cloud. The company’s unique culture and “Customer Obsession” has led to massive success over the years. In the past year, the company (along with many others) is facing macro-economic pressures which are increasing input costs and decimating margins. However, the stock is undervalued intrinsically, and thus this volatility could be an opportunity for the long-term investor.

Be the first to comment