Sundry Photography

CrowdStrike Q2 earnings results

CrowdStrike (NASDAQ:CRWD) released fiscal Q2 2023 earnings on August 30th, and the results beat estimates for non-GAAP earnings-per-share (EPS) and revenue. Revenue was more than 3% higher than predicted, and management raised fiscal year guidance and reiterated a 30% free cash flow margin.

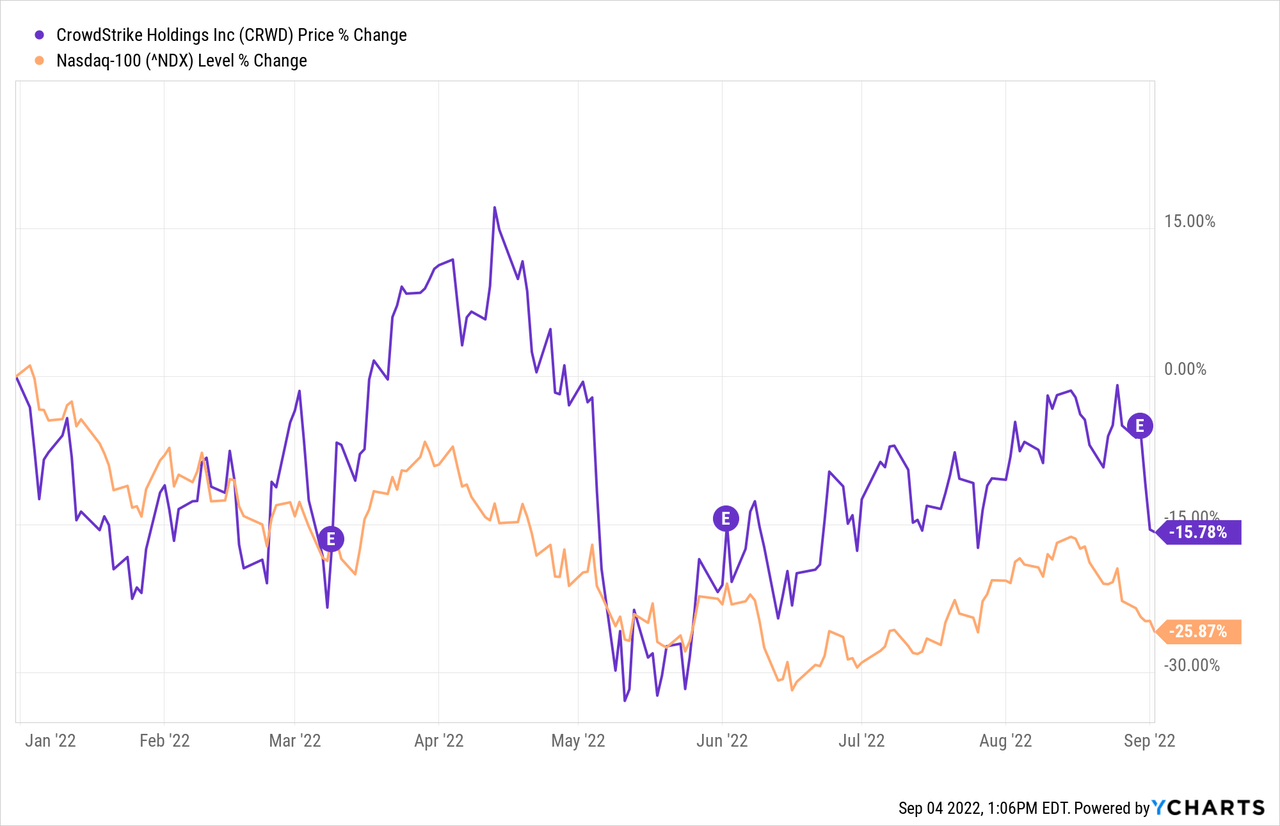

I dub the results “predictably impressive.” Despite a record-setting quarter, it wasn’t particularly flashy, and the stock fell more than 10%. Year-to-date (YTD), the stock is off over 15%, although slightly outperforming the S&P 500 and trouncing the Nasdaq.

Beating the market is of little solace when it still means losing money. On the other hand, I invest for the long haul, so a market drop is as much an opportunity as an annoyance.

The big question is: what do the earnings tell us about CrowdStrike’s long-term prospects?

How did CrowdStrike perform on key metrics?

I covered several vital performance measurements and made some educated predictions in an earnings preview article, including:

- Subscription customers

- Dollar-based net retention rates (DBNR)

- Free cash flow (FCF)

- Annual recurring revenue (ARR)

Let’s roll through these, talk about differentiation, and where the stock could go from here.

Subscription customer, DBNR, and differentiation

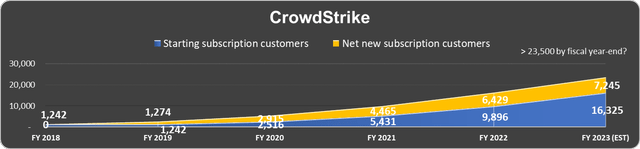

CrowdStrike continued its record-setting by adding 1,741 new subscription customers in the quarter, outpacing last quarter’s gain of 1,620 by 7.5% sequentially and growing the customer base 51% over the prior year.

This was right near the middle of the range I discussed in the earnings preview article linked above. CrowdStrike could push its subscription customer base over 23,500 this fiscal year if this pace continues. The incredible rise is shown below.

Data source: CrowdStrike. Chart and FY23 estimate by author.

As the numbers get bigger, the percentage growth rate will continue to drop, but absolute growth in customers is still accelerating.

The adoption of additional modules is even more important to the future, which leads to high DBNR and enmeshes customers into CrowdStrike’s Falcon ecosystem. It’s a simple but crucial concept. The more modules a customer adopts, the more they spend with CrowdStrike each year, and the less likely they will switch to a competing product.

The Falcon platform being customizable and comprehensive differentiates CrowdStrike from competitors. Executives are looking to consolidate cybersecurity operations, which plays into CrowdStrike’s success. This is evidenced by increased module adoption and growing DBNR:

Q2 subscription customers with five or more, six or more, and seven or more modules were 59%, 36%, and 20%, respectively. This represents a 70%, 84%, and 105% year-over-year increase in these respective module adoption cohorts. As customers adopt more modules, Falcon is increasingly embedded in their operations and workflows, which we believe leads to higher retention rates and even more opportunities for future expansion.

DBNR, a measure of the company’s sales growth from existing customers, exceeded the company’s benchmark and improved slightly over the past three quarters, coming in at 124%.

Government wins were impressive in Q2 as well.

Free cash flow and annual recurring revenue

Free cash flow hit $135.8 million in Q2, bringing the total to $293 million for the first half of the fiscal year. This is an improvement over FY22 by over $100 million so far. This number is significantly assisted by a healthy dose of stock-based compensation (SBC). The weighted average diluted shares outstanding were 3% higher in Q2 this year than last year. This isn’t likely to slow anytime soon, and it is something investors should be aware of when deciding if CrowdStrike stock is a good fit for their portfolio.

Another reason SBC will probably continue to grow is because CrowdStrike is increasing its headcount. CrowdStrike is hiring while many companies are scaling back or beginning layoffs. This is a terrific sign of management’s confidence that demand for Falcon will stay strong.

We are also executing our 2023 hiring plan and are pleased to report that we added a record number of net new hires for the second consecutive quarter. Bringing on and retaining top talent is a cornerstone to supporting our product road map, future growth, and market share gains in new markets. We believe the investments we are making today will lead to sustained growth over the long term…

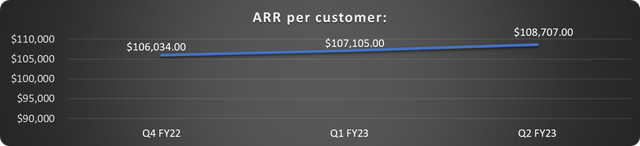

CrowdStrike’s ARR hit $2.14 billion on $535 million in Q2 sales. Again the percentage growth rate is slowing as the numbers increase, although still 59% year-over-year. But total ARR added in the quarter hit another record.

Extrapolating out CrowdStrike’s ARR per customer shows a modest increase over the past several quarters:

Data source: CrowdStrike. Calculation and chart by author.

Humio, Fusion, and a potential acquisition

CrowdStrike bought Humio for under $400 million last year, and the investment seems to be paying off. The company doesn’t report quarterly sales exclusively from Humio, but management stated that Humio sales set a record and total emerging products revenue grew 129% year-over-year to $219 million.

Falcon Fusion is CrowdStrike’s offering to streamline, automate, and modernize security operation center (SOC) operations. Fusion adoption is expected to drive the retention rates discussed above, and 35% of customers are using the platform after the first year.

There are rumors that CrowdStrike is looking to acquire another fledgling security company; however, this did not come up on the conference call. The reports may not be credible or could be premature. On the other hand, a significant acquisition would make sense, given the industry consolidation and competition’s recent moves. We will have to stay tuned.

Is CrowdStrike stock a buy?

One of the most challenging things is to value high-growth stocks while they are not making GAAP profits. This is even more difficult when the market is topsy-turvy and there are broad economic question marks. But this is the norm, not the exception.

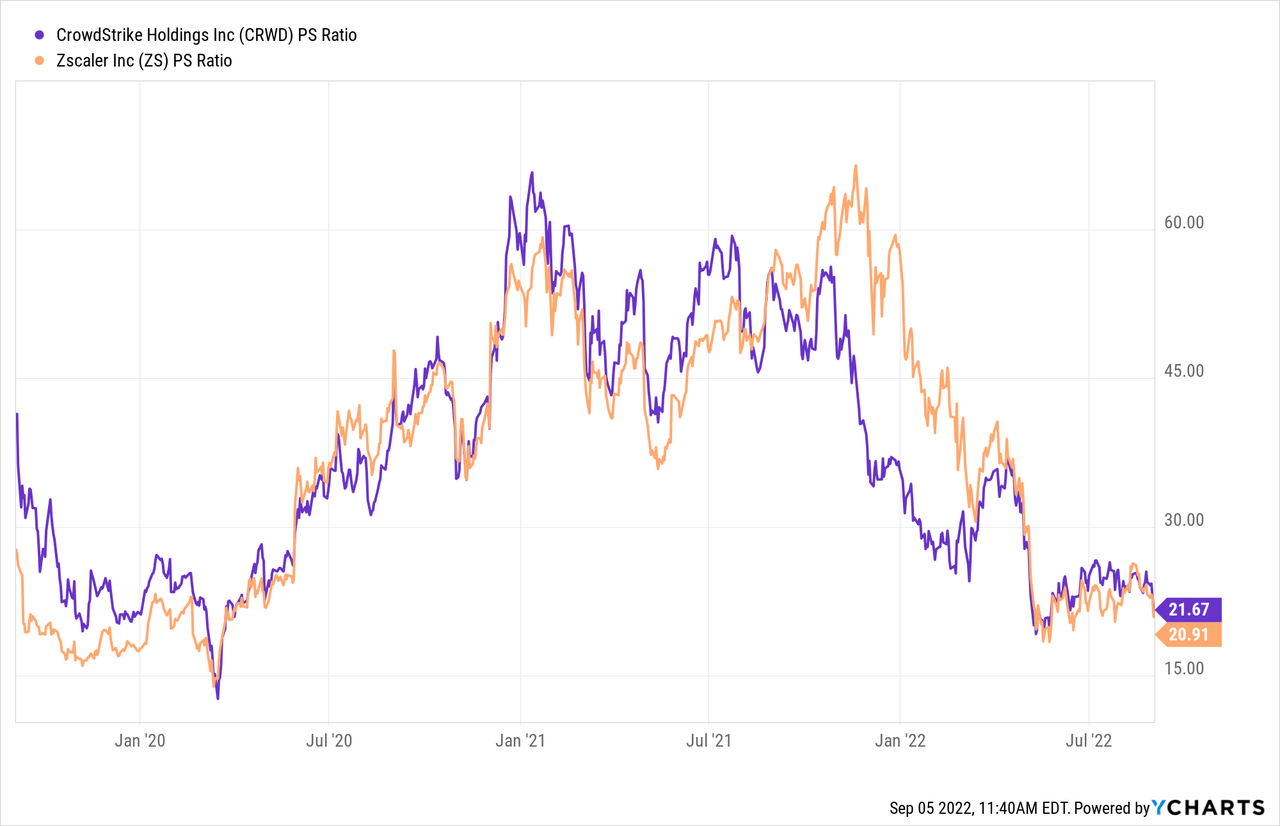

CrowdStrike’s best comparable is probably fellow cybersecurity growth name Zscaler (ZS). The companies have similar growth rates, gross margins, industry, and addressable markets. They trade in a similar price-to-sales (P/S) range, as shown below.

The problem with the comparison is that if the market continues to shun growth stocks, they will likely drop in unison. On the other hand, the ratios are now in their pre-pandemic range, and both companies continue to post impressive results.

Investors should determine their risk tolerance and consider accumulating shares over time to take advantage of price dips. The short-term could be rocky; however, CrowdStrike remains a long-term high-conviction pick for me.

Be the first to comment