SDI Productions

Elevator Pitch

I have a Hold investment rating assigned to Conagra Brands, Inc.’s (NYSE:CAG) shares.

Conagra’s Q4 FY 2022 (YE May 31) earnings beat was driven by lower taxes and income contribution from a joint venture, rather than better-than-expected revenue and operating profit. Moreover, CAG’s fiscal 2023 bottom line guidance also disappointed the market. But CAG isn’t a Sell, as price elasticity is still relatively low which allows it to raise prices, and the company operates in segments where private label penetration rates are lower as compared to industry averages. Therefore, I rate CAG as a Hold, instead of a Sell.

What Were Conagra’s Expected Earnings?

Conagra was expected to generate a non-GAAP adjusted earnings per share or EPS of $0.63 for the fourth quarter of fiscal 2022, according to a July 13, 2022, Seeking Alpha News article which previewed its Q4 financial results.

Did Conagra Brands Beat Earnings?

Conagra Brands did deliver an earnings beat for Q4 FY 2022, but the market’s response to CAG’s recent financial results release was negative.

Based on its Q4 FY 2022 financial results press release, CAG’s adjusted EPS grew by +20% YoY to $0.65 in the most recent quarter, which was +3% higher than the Wall Street’s consensus earnings estimate.

But Conagra’s stock price fell by -7% from $35.74 as of July 13, 2022, to $33.15 as of July 14, 2022, after the company reported its fourth-quarter earnings before trading hours on July 14. CAG’s shares remained weak in the subsequent trading days, and closed at $33.18 as of July 21, 2022.

In the subsequent two sections of this article, I perform a review of Conagra’s key Q4 FY 2022 financial metrics and its FY 2023 guidance, which will help to explain why CAG’s shares didn’t go up despite achieving an EPS beat for the recent quarter.

CAG Stock Key Metrics

CAG’s key metrics for the fourth quarter of fiscal 2022 suggests that the company’s earnings beat wasn’t driven by its core business operations.

Conagra’s top line increased by +6% YoY to $2,910 million in Q4 FY 2022, but this was -0.6% lower than the sell-side’s consensus sales forecast. Notably, CAG had delivered revenue beats in the past eight quarters prior to Q4 FY 2022. A sell-side analyst from Barclays (BCS), Andrew Lazar, had noted at CAG’s Q4 FY 2022 earnings call that Conagra’s “volume (-6.4%) was down a bit more” as compared to “other food companies, all of whom have had as much pricing or more than Conagra.”

In other words, CAG’s volume has declined to a large extent than what was expected in response to price hikes to counter inflation, and this led to CAG’s slight top line miss. But CAG did emphasize at the Q4 FY 2022 investor briefing that “price elasticity has remained below historical levels.” This gives Conagra the capacity to pass on cost increases in the form of hikes in the foreseeable future.

Separately, both Conagra’s gross profit margin and operating profit margin for Q4 FY 2022 fell short of market expectations. CAG’s non-GAAP adjusted gross profit margin contracted by -1.47 percentage points to 24.9% in the most recent quarter. According to data sourced from S&P Capital IQ, the market was expecting a much higher Q4 gross margin of 25.7% for Conagra. Similarly, CAG’s Q4 FY 2022 adjusted operating margin of 15.0% was -0.4 percentage points lower as compared to the sell-side’s consensus operating margin projection of 15.4%.

Although CAG’s profitability didn’t meet the market’s expectations, the company was still able to deliver an earnings beat in Q4 FY 2022, thanks to a lower-than-expected tax rate and higher-than-expected income contribution from its joint venture, Ardent Mills. In other words, this wasn’t the high-quality EPS beat (one driven by better-than-expected revenue growth and profitability) that investors were expecting. This is a key reason for Conagra’s poor share price performance following its quarterly results release.

What To Expect After Earnings

The expectations for Conagra’s future financial performance post-Q4 FY 2022 earnings announcement aren’t great.

CAG guided for a +1%-5% growth in its core adjusted EPS for fiscal 2023, as per its Q4 FY 2022 results presentation, and this translates into a mid-point FY 2023 EPS guidance of $2.43. In contrast, the Wall Street analysts were anticipating that Conagra’s bottom line will expand by +8% to $2.54 in the current fiscal year.

There are two key factors contributing to Conagra’s below-expectations FY 2023 earnings guidance.

One factor is that the company’s joint venture, Ardent Mills won’t perform as well in fiscal 2023 as it did in fiscal 2022. In its Q4 FY 2022 results presentation, CAG noted that Ardent Mills “provided strong results during an inflationary period” in FY 2022, but guided that Ardent Mills will deliver “lower expected results (in FY 2023) than FY22.”

Another factor is that CAG expects the company’s interest costs to be around $410 million in FY 2023, which is about +11% higher than prior consensus expectations as per S&P Capital IQ. This is likely attributable to expectations of higher interest expenses in a rising rate environment.

I evaluate CAG as a long-term investment candidate in the next section.

Is CAG A Good Investment Long-Term?

Putting the relatively low-quality Q4 FY 2022 EPS beat and disappointing FY 2023 earnings growth guidance aside, CAG is a good investment for the long term.

The key is that private labels should not pose a substantial threat to Conagra in the long run.

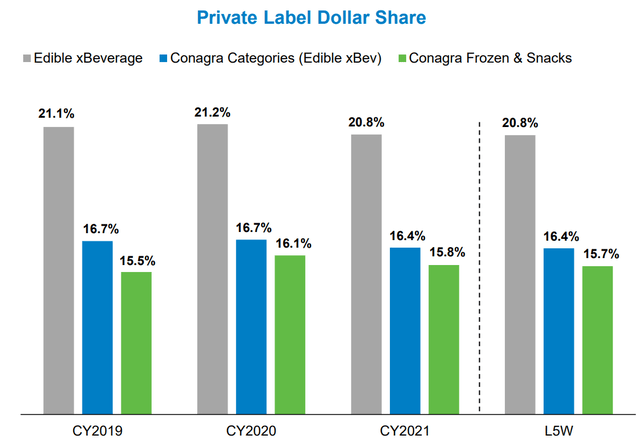

Private Label Penetration Rates In Key Product Categories For CAG And The Industry At Large

CAG’s Q3 FY 2022 Results Presentation

As per the chart above, private label penetration is lower in the product categories that Conagra competes in, as compared to the industry average. More significantly, Conagra has a “value-for-money” positioning which should make it more resilient in the face of private label competition. A 2019 Deloitte research report titled “The Consumer Products Bifurcation” highlighted that Conagra has kept “price points that would speak to the value consumer”, while launching new products to capitalize on “health-consciousness and new food and ingredient trends.”

Notably, CAG also stressed at the recent quarterly investor briefing that “we have not seen notable migration toward private label in the heavily branded categories in which we compete.” In other words, even as the economy weakens and private labels gain favor with consumers, Conagra is still holding up well, which is an indicator of the company’s resilience in the long term.

Is CAG Stock A Buy, Sell, Or Hold?

CAG stock is a Hold. Conagra isn’t a Buy as its Q4 FY 2022 core profitability and its FY 2023 outlook fell short of expectations. But CAG isn’t a Sell, as it is very likely to be resilient in the face of private label competition in the long term. As such, I think CAG is deserving of a Hold investment rating.

Be the first to comment