Justin Sullivan

Investment thesis

Dell Technologies Inc. (NYSE:DELL) is a major player in the computing hardware market. It has been able to consistently grow its market share across many key segments. But shares are currently priced at a very cheap valuation. I think that the primary cause is the recent weakness in the PC market. However, I believe the company’s revenue is more sustainable than its competitors.

Preliminary market share results show the strongest declines in consumer computer shipments. Dell’s primary focus has been on commercial PC products, which are seeing stronger demand. I’m bullish on the company’s shares at their current valuation.

Dell’s strong financial outlook

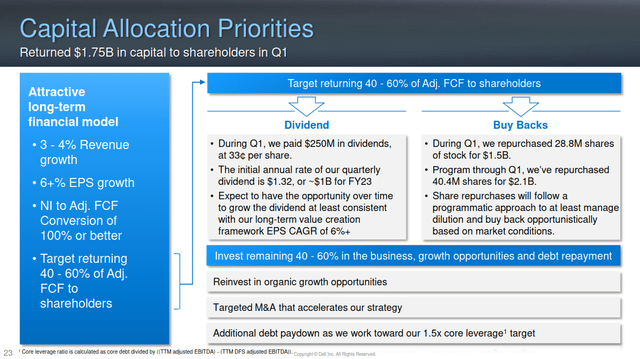

After their last quarter, Dell in May released a strong financial outlook. The company beat consensus estimates on both their top and bottom lines. Management then raised their guidance to 6% revenue growth and 12% profit growth for the full year. This is on top of the company’s long-term outlook of 3 to 4% revenue growth and over 6% profit growth. Dell’s next earnings report is scheduled for August 25.

Dell Q1 2023 Performance Review

In Q1, Dell had double-digit revenue growth across both of its operating segments. One of these segments is its Client Solutions Group, which sells branded hardware and peripherals. The other is its Infrastructure Solutions Group. It primarily sells storage, server, and networking products. These segments have both consistently grown revenue and market share each year.

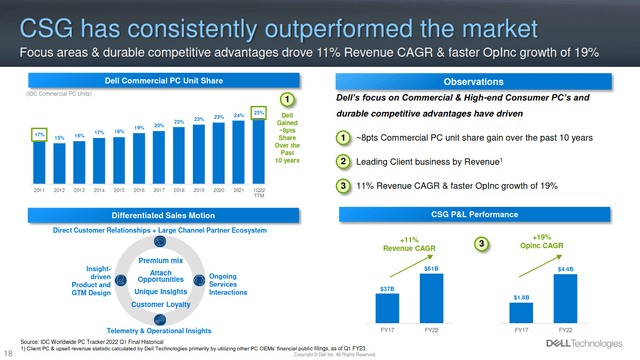

Client Solutions Group

Dell’s PC segment is their best-known division, and it drives about 60% of their revenues each year. The segment has shown solid revenue and market share growth over the last decade. Profitability has been very strong, compounding at 19% per year since 2017. More recently, the company has shown a strong ability to offset inflation. The segment increased its margins yearly throughout the pandemic.

Dell Q1 2023 Performance Review

The segment has been very strong over the past year, growing by 27% year over year. But Dell expects their CSG segment’s growth to moderate over the rest of the year. Since late last year, the company has reported that demand for clients is slowing. This industry is cyclical, but Dell has shown the ability to consistently grow its market share regardless. I believe the company can improve its position even during a dip in demand. This increases the company’s long-term value.

Infrastructure Solutions Group

The ISG segment makes up about 30% to 40% of Dell’s revenues. The segment is also responsible for about half of the company’s operating profit. I believe this division is more resilient to adverse economic conditions. On their latest earnings call, management said that IT demand is remaining healthy:

Looking ahead, we are seeing a rotation in IT spending from CSG to ISG. Despite economic uncertainty, digital transformation and automation efforts are being used to solve the pressing challenges at the moment as technology and business strategies emerge, benefiting our infrastructure business. We expect ISG growth for the full fiscal year.

Profit from this segment was up 39% year-over-year last quarter. I think the infrastructure solutions group is important to consider when analyzing the company. ISG earnings diversify Dell’s revenue streams away from the more cyclical client business. They should help offset potential weakness in the company’s branded hardware businesses.

Navigating a spending pullback

The largest risk this investment faces is the possibility of a recession. There are fears that the current environment will cause a major slowdown in consumer electronics. We’re already seeing a sharp decline in PC shipments. Many PC manufacturer stocks have pulled back as a result of these fears.

But Dell’s PC sales mix is well positioned for this decline. The highest declines are projected in the low price and consumer segments. Chromebooks are especially weak, with sales dropping by more than half. But less than 14% of the company’s revenue is exposed to the consumer PC market. Dell sells the vast majority of its PCs to commercial clients. According to the company’s latest earnings call, these segments aren’t seeing much of a decline.

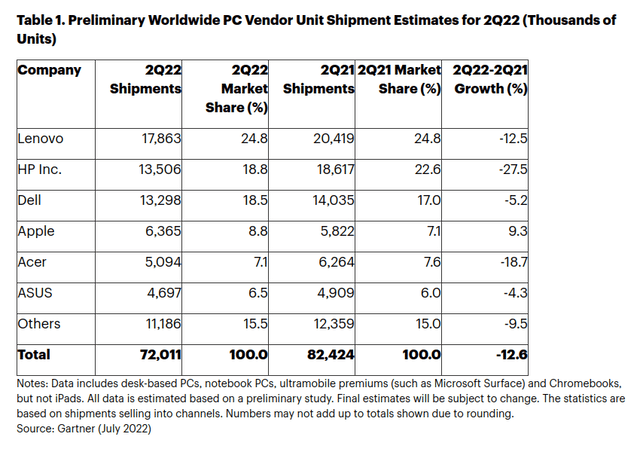

Preliminary data suggests these trends have continued into the second quarter. Gartner (IT) recently released their second quarter market research showing a 12.6% decline in PC shipments.

Dell has outperformed the market with shipments, declining less than half as much as the total market. The company increased its market share by one percentage point during the second quarter.

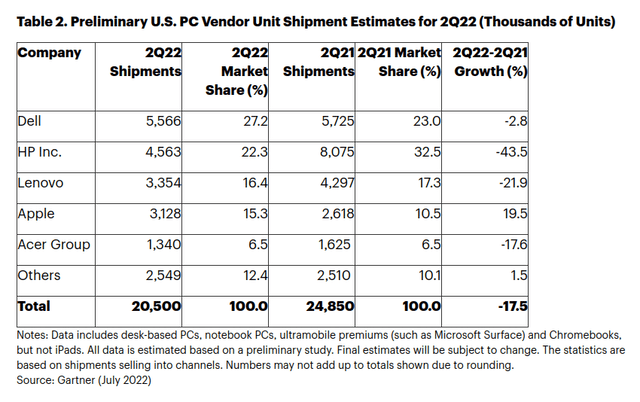

Data specific to the U.S. further confirms this trend. Dell maintained its number one spot in Q2, posting a minor decline of less than 3%. Lenovo (OTCPK:LNVGY) and HP (HPQ) both fell, by 20% and 40%, respectively.

I believe the PC market will continue to be weak for some time. But Dell is positioned to generate strong revenue and grow its market share anyway. While this decline is a headwind for the company, I think the market is overreacting.

Too cheap to ignore

Dell’s stock is trading at an extremely cheap valuation. The company is trading at a forward P/E ratio of 8. Accounting for debt, shares have an EV/EBITDA ratio of 5. This is within the range of what I’d be willing to pay for a company with flat or slightly declining growth. For Dell, these outcomes are the bear case.

Dell’s balance sheet isn’t as good. The company has a lot of debt compared to its equity. As of its most recent report, Dell had about $27 billion in debt and about $20 billion in net debt. However, a lot of this debt is related to Dell’s financing segment. The company considers this debt non-core.

The company’s debt position has been trending in the right direction for the past few years. At the end of the 2019 fiscal year, their balance sheet had $39.3 billion in core debt. As of the last quarter, core debt had been reduced to $16.5 billion.

Analyzing this in terms of leverage ratios, Dell’s net core debt/FCF was over 5.5 times in fiscal 2019. Last quarter, net core debt was only 1.3 times last year’s free cash flow. I think this is a lot healthier. It will allow the company to distribute more of their profits to shareholders in the long term.

Final verdict

I believe Dell will be able to grow its market share and increase its profitability even if the PC market pulls back. The company is paying down debt and has committed to returning free cash flow to shareholders.

The primary risks seem to be limited growth, supply chain issues, and weakness in the PC market. I feel that Dell is well positioned to navigate these headwinds. Pessimism is already priced into the stock, and I see limited downside at the current valuation.

Be the first to comment