Ian Waldie/Getty Images News

Article Thesis

BHP Group Limited (NYSE:BHP) (OTCPK:BHPLF) is a leading mining company that has had a great fiscal 2022. The company is highly profitable, benefits from high commodity prices, and shares its cash flows with its owners who are getting a dividend yield of more than 10% at current prices. Commodity prices will continue to experience swings in the future, but BHP is well-positioned to benefit from growing demand due to rising infrastructure spending and increasing green economy investments.

Did BHP Beat Earnings?

BHP Group Limited’s fiscal year ends in the summer months, which is why the company has just announced its fiscal 2022 results. In short, that year was the best one in BHP’s history.

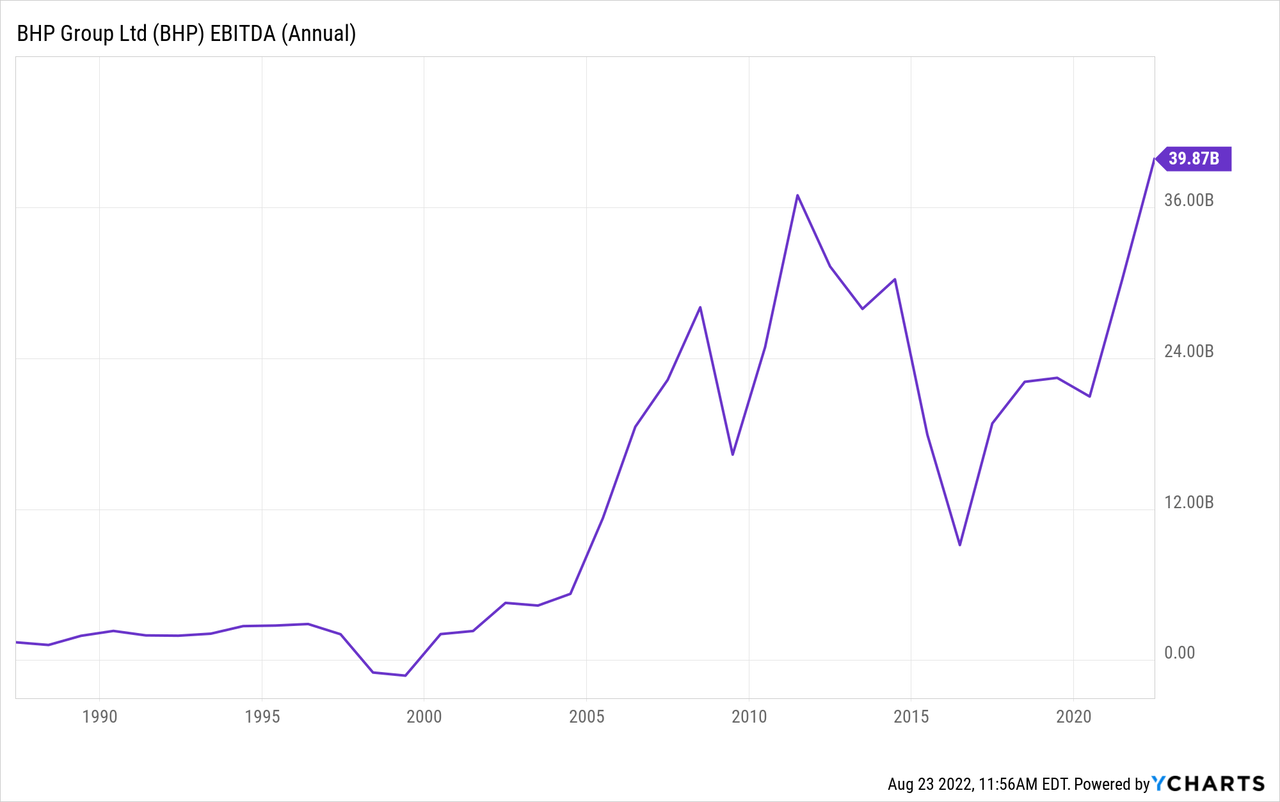

The company, which is primarily active in iron ores but has exposure to other commodities on top of that, reported an adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of $41 billion. That was the highest-ever in its history, even outpacing the results from past supercycles such as the one prior to the Great Recession:

Note that YCharts uses unadjusted EBITDA, which is why the number is marginally lower than the adjusted EBITDA of $40.6 billion that BHP reports for the fiscal year that has just ended.

This makes for an EBITDA margin of 65%, which is outstanding, of course. This shows the strong cost controls that BHP employs, as the company was able to generate highly attractive margins during the period, despite headwinds such as rising diesel prices that put some pressure on its input costs.

Adjusted net profit came in a little ahead of $21 billion, which pencils out to $8.42 per US share (ticker: BHP), or $4.21 per Australian share, as two of those are equal to one US share (ticker: BHPLF). Since BHP is trading for less than $60 right now, that makes for an earnings multiple of less than 7.0 based on the profits that BHP generated last year. There is, of course, no guarantee that profits will remain this high going forward. In fact, most analysts expect somewhat lower profits this year, i.e. fiscal 2023, but it seems highly likely that profitability will remain high even if 2023 won’t be a record year, as prices and demand for commodities remain very healthy.

Sharing The Wealth With Its Owners

BHP Group operates with a very clean balance sheet. At the end of the year, BHP had a net debt position of $0.3 billion — relative to the company’s massive size and profits, that basically renders BHP debt-free, as net debt is equal to less than 0.01x EBITDA over the last year. Last year, BHP reduced its net debt by $4 billion, despite making massive payments to shareholders.

Over that period, the company returned $17.9 billion to its owners via dividends, while paying another $2.5 billion to non-controlling interests, primarily related to its Escondida copper mining JV.

For fiscal 2022, BHP has announced total dividends of $6.50 per US share, which makes for a dividend yield of 11% based on current prices. A little less than half of that was paid for H1, while a little more than half of that, $3.50, will be paid in September. The ex-div date is September 1, thus everyone buying before that will receive around 6% of the current share price in the form of dividends a couple of weeks from now.

Profits are forecasted to be lower this year, relative to the record 2022. But since BHP is now basically net debt free, it could return a larger portion of its free cash flows via dividends. The $4 billion in net debt reduction from 2022 will likely not be repeated this year, I believe, as strengthening an already very strong balance sheet further does not make too much sense. While BHP has paid out around 70% of its free cash flows via dividends last year, that ratio could be higher this year. Capital expenditures, for both maintenance of its mines and for new growth projects such as the giant Jansen potash project in Canada, are already accounted for when we look at BHP’s free cash flow number. Its free cash flows can thus be used for dividends, debt reduction, buybacks, or M&A. But since debt reduction from the current level does not make too much sense, and since BHP does not seem to be a big fan of buybacks, an even more pronounced focus might be put on dividends.

Thus, with earnings likely declining this year, the dividend might still remain pretty strong, as BHP will put less of its free cash flows towards debt reduction. The actual size of the dividend depends greatly on what commodity prices will look like over the next 10 months, thus making it impossible to forecast where exactly BHP’s dividend payments for 2023 will end up.

Is BHP A Good Investment Long-Term?

Mining companies are oftentimes seen as “old industry”-type businesses. But the products they produce are essential for our world and modern societies. Everything from housing to infrastructure, from ports and airports to EVs and electrical grids, and even windmills and solar farms require the materials that BHP and its peers produce. Steel, copper, nickel, etc. are needed for these and other assets that are required for modern societies, and that are also required to power the green transition that many politicians are so interested in.

At the same time, many countries around the world are experiencing economic growth that makes their consumers wealthier, which leads to huge demand growth for housing, infrastructure, vehicles, and so on in China, India, and many more fast-growing countries.

The demand outlook for the commodities that BHP produces is thus pretty good in the long run, although macro issues such as lockdowns in China can lead to temporary demand suppression.

At the same time, exploration and supply growth is limited. ESG mandates, environmental regulations, etc., limit the potential for new mining projects, which is why the supply-demand outlook over the coming years looks relatively favorable for BHP and its peers. This bodes well for commodity prices in the long run, which is also why some analysts believe that the world is entering a new commodities supercycle that will drive up prices for everything from iron ore to crude oil during the 2020s. To me, it seems very likely that BHP’s profitability will be healthy in the coming years. A major commodity price pullback over a longer period of time is possible, but I don’t see a good reason why that would happen. Limited supply growth and a healthy demand picture make it more likely that commodity prices will remain firm going forward, although there will always be some temporary ups and downs.

Is BHP Stock A Buy, Sell, Or Hold?

BHP Group’s stock price experiences large swings to the upside and the downside. Over the last year, BHP has risen from as low as $50 to as much as $80. Then it dropped back to less than $50, and now it has risen to a little less than $60, up more than 20% from the lows seen in July — just a month ago. These big ups and downs can make BHP a good trading vehicle, as it is not rare for BHP to move by 20%+ in a couple of months. For someone pursuing this strategy, July was a great time to buy, whereas BHP might be of less interest now, following the steep recovery over the last month.

That’s not everyone’s investment style, of course. For a buy-and-hold investor, BHP seems like a reasonably good buy at current prices. BHP is trading at an enterprise value to EBITDA multiple of just 4.5 based on current estimates for fiscal 2023, where an earnings decline versus 2022 is already accounted for. An EV/EBITDA ratio of less than 5.0 is pretty cheap, especially for a leading company with industry tailwinds over the next couple of years. High dividends over the next year can be expected, which includes the 6% half-year payment that will be made in September.

Overall, I do think that BHP is a reasonably strong investment at current prices, although investors that want to optimize their entry points may want to wait for a potential pullback.

Be the first to comment