Eoneren/E+ via Getty Images

Introduction

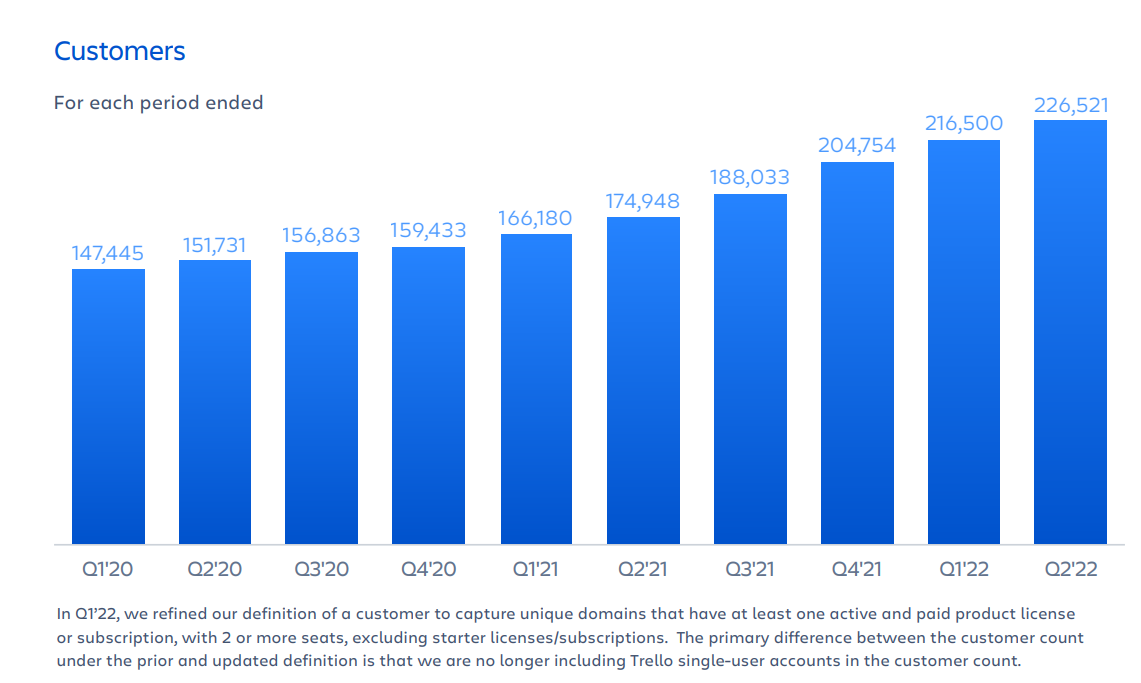

Atlassian Inc. (NASDAQ:TEAM), a tech stock with a market cap of ~$65bn is primarily noted for its prowess in building products that are used by tech professionals across 200 countries around the world. Rather than focus on building software for an enterprise as a whole, the priority here is to produce cross-functional tools that can help developers and non-developer teams collaborate better. The company has been around for over two decades now, and during this time, it has built up an active customer base of over 226,000 customers (TEAM’s long-term goal is to hit 500,000 customers). TEAM’s predominant sources of revenue generation are via subscriptions, maintenance work, and the sale of perpetual licenses.

Atlassian – What’s to like?

One of the most distinctive features of the Atlassian model is its sales model. Quite unlike a lot of their peers in this space, TEAM does not focus on building a traditional enterprise sales force to push its products to the CTO of various firms; we know that these types of sales models are rather common for vendors who are fishing for opportunities with large enterprise clients, but TEAM has quite a diversified client base with no single client accounting for more than 5% of sales and the bulk of its clients are all predominantly based in the sub $50k+ bracket.

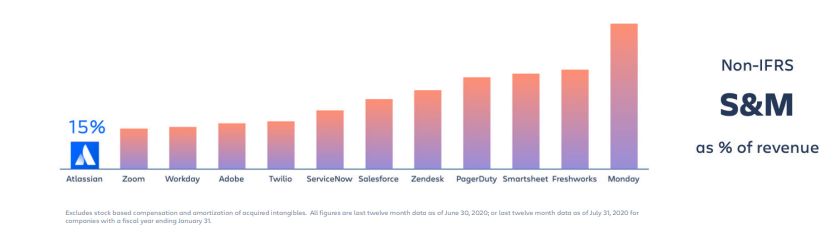

TEAM’s strategy is to rely on online marketing and targeted web-based content and then hope that these initial users can help ramp up scale via word-of-mouth marketing. On account of this, TEAM does not get bogged down by the sizeable upfront costs and long sales cycles that are typically associated with the direct sales model. In effect sales and marketing costs as a function of sales are well below the industry norm.

Investor Day Presentation

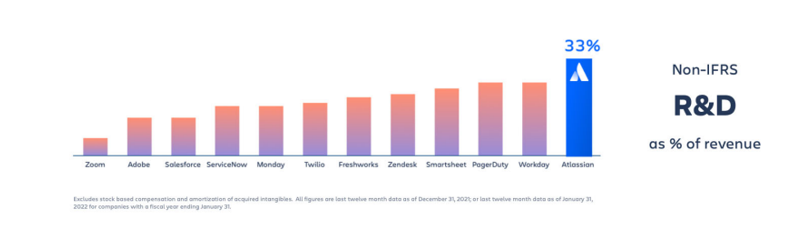

What this also means is that, unlike other enterprise software peers, TEAM has ample elbow room to devote funds -that would otherwise have gone for marketing-towards R&D activities.

Investor Day Presentation

This focus on R&D ensures a relentless conveyor belt of new products that technical and non-technical teams find very useful. What they save via sales and marketing can also be passed on to clients via competitive pricing and I believe this is one of the reasons that the company has been able to get its foot in the door with clients, across the board, as a lot of these products are priced in such a manner that they don’t require capital budget approval from the top hierarchy in an organization. Once TEAM is able to connect with the lower levels in an organization, we then see a cascading velocity effect via word-of-mouth, which helps the company accumulate clients at a rapid pace. Note how the quantum of clients has surged from around 147K during Q1-20, to over 225K in just nine quarters.

Q2 earnings report

The other interesting aspect of the TEAM story is its ongoing pivot away from on-premises offerings to cloud. This would represent a more efficient route to enabling greater cross-selling of products as well as upselling different variations, thereby enabling more levers for the sales base and the future growth potential. From a capability angle, TEAM’s existing clients are incentivized to move to cloud as they get enhanced and exclusive capabilities such as telemetry, automation, etc., something that wouldn’t be available if they maintained the status-quo (regardless, by 2024, Atlassian will stop all maintenance and support for the on-premise offerings). Financially as well, there are incentives for existing server and data center clients who could get discounts ranging from 20-40% if they sign up for Atlassian’s cloud services.

It’s fair to say that the innovation and variability offered on TEAM’s cloud have nudged quite a few existing data center clients to migrate, as the company mentioned that one-third of their cloud migrations came from existing data center customers. Besides, existing customers also consider that the company was able to bring in 10,000 new customers in Q2, and 98% of these new additions signed up for cloud services. All in all, do consider that Atlassian expects cloud-based revenue to grow by an impressive 50% over the next two years (10% of this growth will be driven by migrations).

What are some of the risks that investors should be aware of?

Ongoing outages are not ideal for the company’s cloud transition ambitions

As covered in the previous section, Atlassian has great ambitions to become a cloud-oriented company, but it remains to be seen how it can overcome the ongoing reputational damage that has beset the company on account of outage challenges related to its cloud services since the first week of this month. The issue was expected to be rectified in one week, but recent reports suggest that this will now likely linger till late April. Considering the word-of-mouth facet of Atlassian’s sales model, you do wonder if prospective clients or existing on-premise clients will sign up with a company that can’t seem to rectify its bugs promptly nor communicate effectively and keep its clients in the loop.

Growing risk of financial leverage and debt service challenges

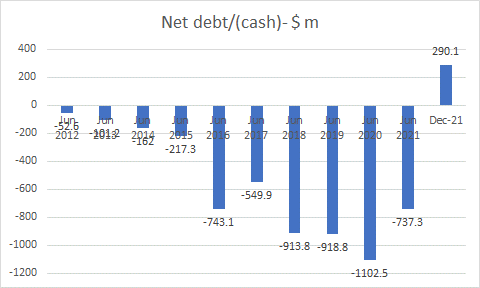

Traditionally Atlassian has done well to maintain a net cash position (the level of cash and liquid instruments has exceeded total debt) but in the December quarter, we saw the cash position decline by 20% sequentially, to $986m, even as the debt levels have more than doubled from $605m to $1329m. In effect, for the first time in years, Atlassian is faced with a net debt position.

Seeking Alpha

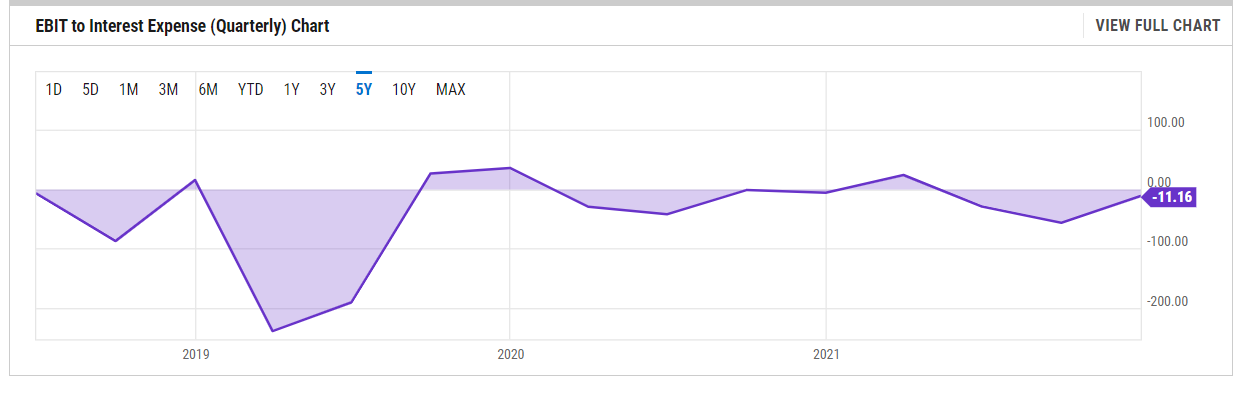

Growing indebtedness does not necessarily have to be an issue if the firm is generating ample operating income but that isn’t the case with Atlassian. As you can see from the image below, the EBIT performance has been rather patchy and paltry and not adequate enough to comfortably cover the interest bill.

YCharts

Expensive valuations

Atlassian’s stock has never quite been a cheap stock to own (a forward EV/EBIT of 111.5x whilst the sector median is just 15.8x), and investors ought to decide if they want to shed out an astronomical multiple for a company that is likely to witness margin contraction in June ’23 (EBIT margins are poised to drop to mid-teens level on a non-IFRS basis). YCharts consensus estimates point to a June 2023 EPS figure of $1.66 this would imply an enormously high forward P/E of 159x, still above the long-term average of 150x, and well above the historical low of 101.6x.

Are there any events surrounding Atlassian that investors should be watching?

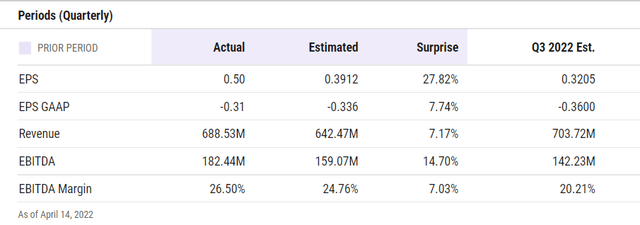

Atlassian will announce its Q3 results on the 28th of April and I don’t think investors should be bracing themselves for a particularly outstanding quarter. Firstly, you’re looking at a rather difficult base effect, particularly as there was a surge in purchases in Q3 last year ahead of some pricing increases. Basically, group revenue growth in Q3-21 was 38%. YCharts Q3 consensus estimates point to a revenue figure of $704m, this would imply revenue growth of 24%, slower than the Q2 revenue growth of 37%.

Then the company is also in the midst of ramping up its headcount and deepening its investments to support its cloud migrations (for instance, higher cloud hosting costs) and this will no doubt put further pressure on the cost base. This could see the non-IFRS operating margin decline from levels of 26% in Q2-21 to 17-18% in Q3-21. GAAP-based Net loss per share guidance in Q3 points to a range of -0.31 to -0.33, although interestingly, consensus is expecting a lower number of -0.36 so there’s potential for upside surprises as well.

YCharts

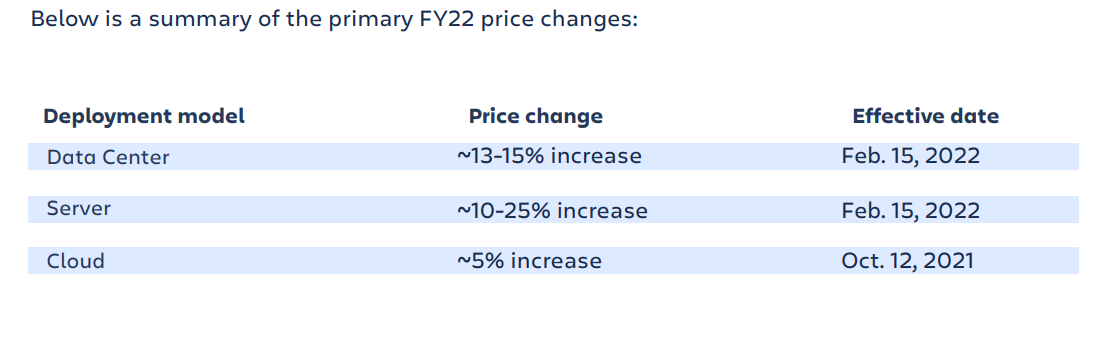

Separately, note that the company announced some pronounced pricing increases to the tune of 10-15% in data center and server-related offerings from mid-February and I’d be curious to see how this was accepted by the market. Did the company see a surge in purchases in January and early February ahead of the price increases? Did this fall off significantly after the price increase, or was it a gradual slowdown? I bring this up because Atlassian is widely perceived to be a budget pricing player in the market and I’m curious to see how the user base perceives the company’s offerings in light of these recent price increases.

Q2 Shareholder letter

Closing thoughts- Is TEAM Stock A Buy, Sell, or Hold?

Finally, we examine the technical conditions of TEAM’s stock. Firstly, I’m keen to see how the stock is positioned relative to its peers in the US Tech space, as represented by the iShares US Technology ETF (IYW). Note that this ratio has been trending up in the shape of a wedge pattern and is currently close to the lower boundary of the wedge (rather than the upper boundary), implying decent risk-reward at this juncture.

Stockcharts

Trading View

We then move to the standalone chart of Atlassian’s stock. What we can see is that after spending some time building a base in H1-21, the stock broke out of its ascending broadening wedge pattern in July-2021. Unfortunately, the entire breakout was sold into and the stock has now fallen back into the old wedge pattern after correcting by ~45% from its lifetime highs. If you’re looking to buy the stock, I reckon the more preferable entry point would be somewhere around the $240 levels as that zone had served as a congestion area in the first half of 2021 (before the breakout) and it could help the stock form a base there after six straight months where the monthly closing price has been lower than the opening price (note that the stock had quickly rebounded from those levels in March as well). For now, I rate TEAM a HOLD.

Be the first to comment