Luis Alvarez/DigitalVision via Getty Images

With more than 6.6 million members, Peloton Interactive, Inc. (NASDAQ:PTON) is the largest fitness platform in the world. The stock’s price has dropped by 87% to $22 per share from its record high in December 2020. Now, it is the time to buy the future.

The only thing that has been considered in most analysis is the pandemic. Many investors are bearish on PTON as the company reported a net loss in its last quarter financial report. However, analyzing the company’s financial results with more precision and considering the future of online training, I am bullish on PTON.

PTON 2Q FY 2022 financial results

In its 2Q 2022 shareholder letter, Peloton reported a net loss of $439.4 million, or $(1.39) per diluted share, compared with a 2Q 2021 net profit of $63.6 million, or 22 cents per diluted share. Peloton’s net income for the first half of the fiscal year 2021 was $132.2 million, or 46 cents per share. However, in the first half of the fiscal year 2022, Peloton reported a net loss of $(809.9) million, or $(2.64) per share.

Yes, the company’s profit turned into a loss. But, you should know that PTON’s 2Q 2022 total revenue increased by 7% YOY to $1133.9 million. PTON’s 2Q 2022 subscription revenue jumped by 73% to $337.5 million, from $194.7 million in 2Q 2021. Peloton devoted a large part of its 2Q 2022 revenue to marketing, and R&D. PTON’s 2Q 2022 sales and marketing expenses increased by 97% YOY to $349.6 million. Also, its 2Q 2022 R&D expenses increased by 111% YOY to $100 million.

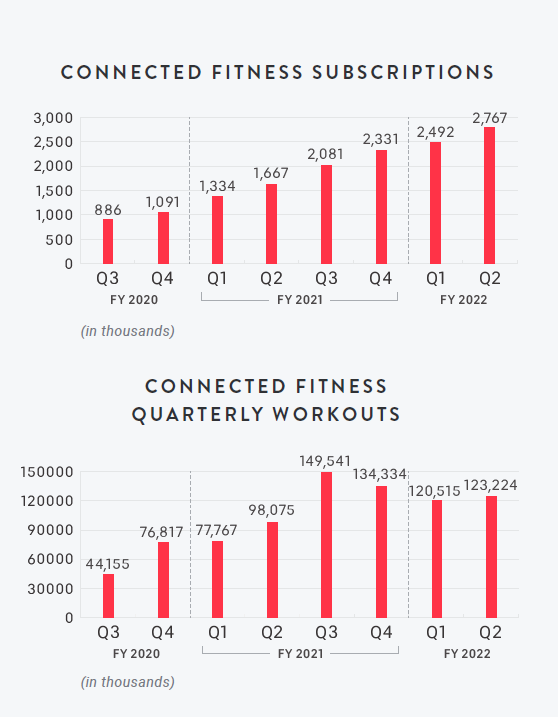

What was the result of these higher marketing and R&D expenses? In the second quarter of FY 2021, Peloton’s ending connected fitness subscriptions were 1.67 million. This number increased by 66% to 2.77 million in 2Q FY 2022. PTON’s 2Q 2022 total workouts increased by 26% YoY to 123.2 million. As a result, the company’s 2Q FY 2022 paid digital subscription grew by 38% to 862 thousand, and its total members grew to over 6.6 million.

John Foley, the founder, declared the objective of the company is to move toward sustainable growth and consistent profitability. “As we look to execute on the next phase of our company’s transformation, we are clear-eyed that it will not occur overnight and that our progress may not be linear,” Foley commented.

For its 3Q FY 2022 guidance, the company expects 2.93 million ending connected fitness subscriptions, $950 million to $1 billion total revenue, gross profit of 23%, and $(140) million to $(125) million adjusted EBITDA. Also, the company updated its 2022 guidance. PTON expects 3 million ending connected fitness subscriptions, $3.7 billion to $3.8 billion total revenue, gross profit of 28%, and $(675) million to $(625) million adjusted EBITDA.

Online workout outlook: See the trends

According to the Worldwide Survey of Fitness Trends for 2022, online live and on-demand exercise classes have come to stay for the rest of our lives. In 2021, online training was the number 1 trend. In the 2022 survey, online training ranked 9th among fitness trends. Ranking 1st in 2021 was due to the pandemic. Also, dropping to 9th place was due to the emergence of the world from the isolation imposed by COVID-19. But compared to 2020, when still we were at the first stages of the pandemic, online training ranked 26th among fitness trends. After the vaccination started, demand for online training retreated. However, compared to the pre-pandemic era, demand for online training is strong.

Also, according to GoodFirms, the at-home fitness regime is the top fitness trend in 2022. The survey was conducted between 15 January 2022 to 24 January 2022 (long after the vaccination started). The results of GoodFirms’ survey imply that even after the pandemic finishes, lots of people want to work out at home. Why? People responded that online training is more convenient and more affordable. Online training works around people’s schedules, making them balance work, family life, and the time and energy they need to go to the gym. According to GoodFirms’ survey, 65.9% of the respondents say that pandemic has appended their fitness regime.

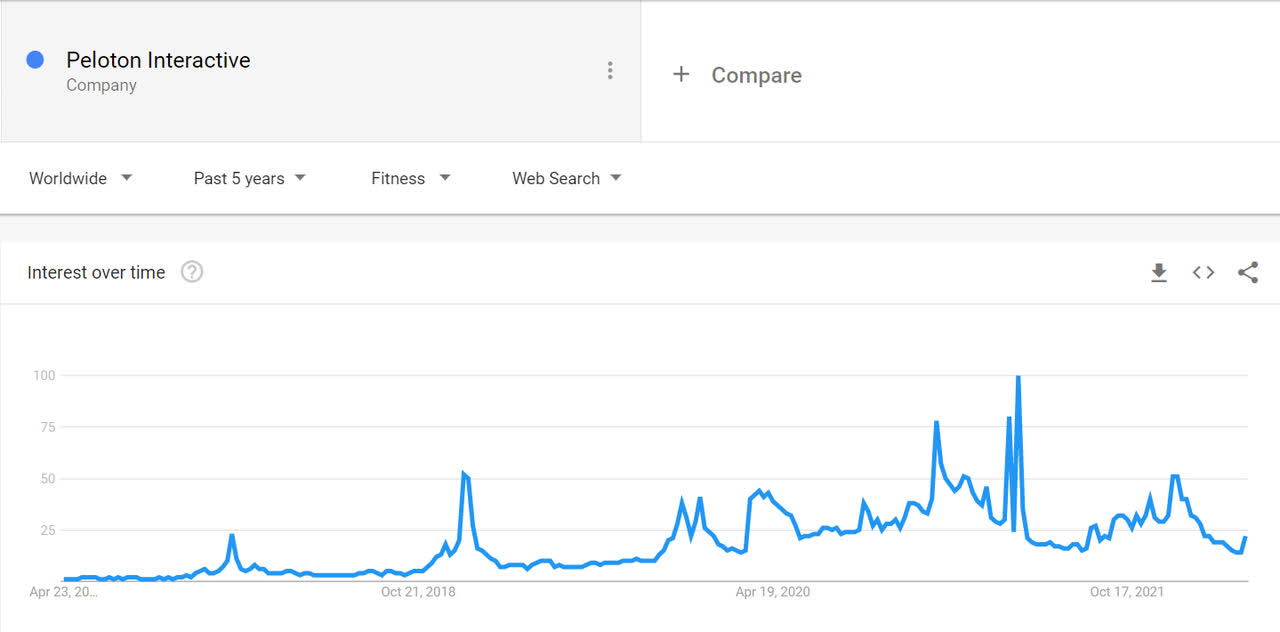

According to ReportLinker, the global online/virtual fitness market is expected to increase by 42% to $16.15 billion, from $11.39 billion in 2021. ReportLinker expects the market value to reach $79.87 billion in 2026. ReportLinker believes despite recovering from COVID-19, a new normal left. Figure 1 shows that based on Google Trends data, on average, people’s interest in Peloton is higher than its pre-pandemic levels.

Figure 1 – Peloton Interactive and Google Trends data

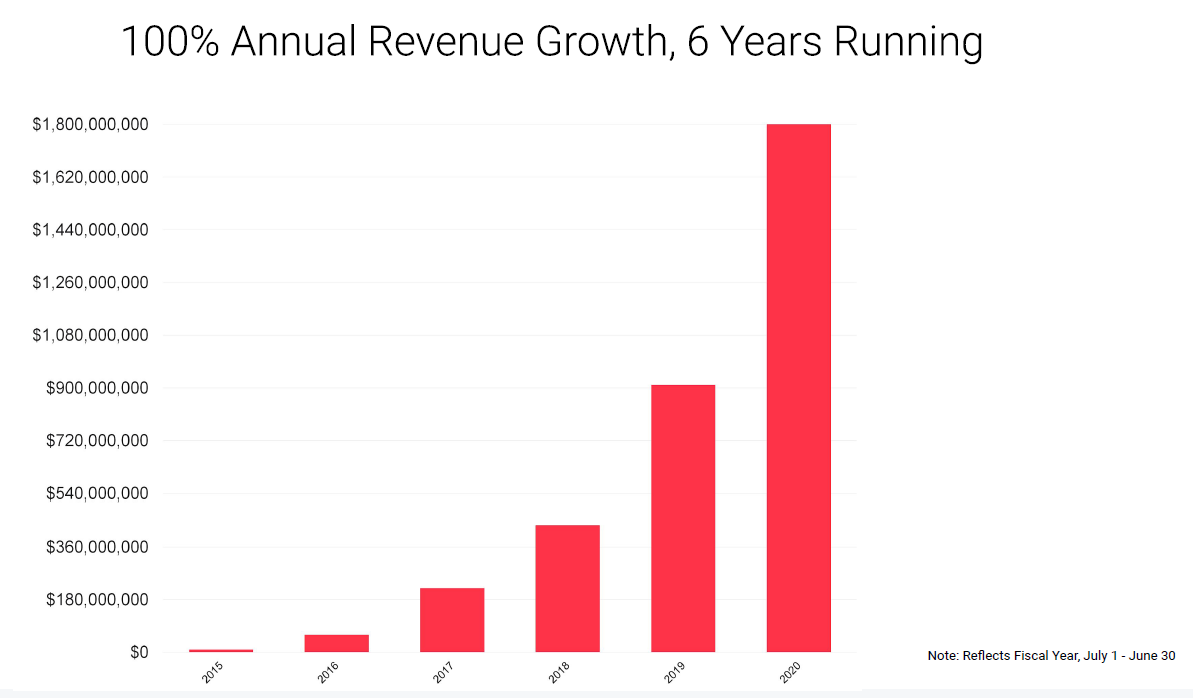

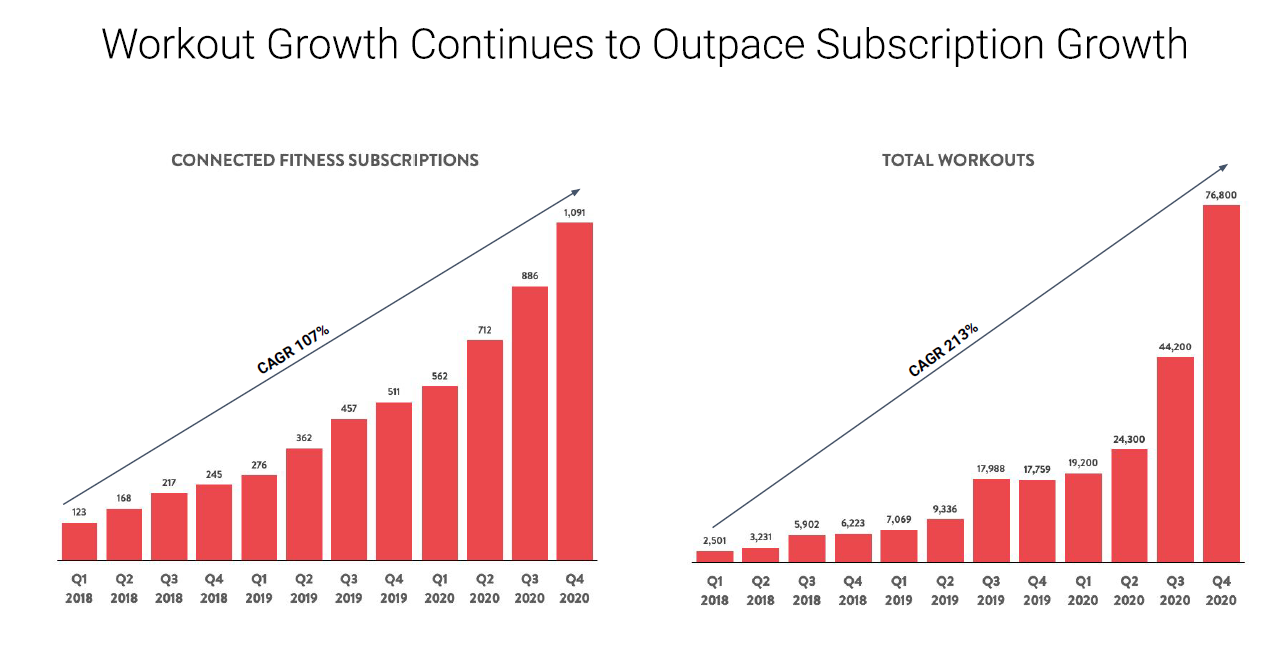

Figure 2 shows PTON’s revenue from 2015 to 2020. The jump in the company’s revenue in 2020 was due to the pandemic. But what can explain the revenue increase between 2015 to 2019? Moreover, Figure 3 shows PTON’s connected fitness subscriptions and total workouts from 1Q 2018 to 4Q 2020.

Again, we know that the pandemic was the reason behind the increase in connected fitness subscriptions and total workouts in 3Q 2020 and 4Q 2020 is the pandemic. But what about the increase from 1Q 2018 to 2Q 2020?

The answer is digitalization. In a world where virtual reality, augmented reality, and metaverses spread, the future for Peloton is bright. We cannot ignore the significant effect of the pandemic on PTON’s revenue and net income. However, the pandemic just acted like a catalyst. It turned online training into a normal at a faster pace than we expected. Figure 5 shows that the connected fitness subscriptions and connected fitness workout from 4Q 2020 to 2Q 2022 have increased significantly.

Figure 2 – PTON’s annual revenues

PTON’s last presentation

Figure 3 – PTON’s connected fitness subscriptions and total workouts from 1Q 2018 to 4Q 2020

PTON last presentation

Figure 4 – PTON’s connected fitness subscriptions and total workouts from 3Q 2020 to 2Q 2022

PTON 2Q 2022 shareholder letter

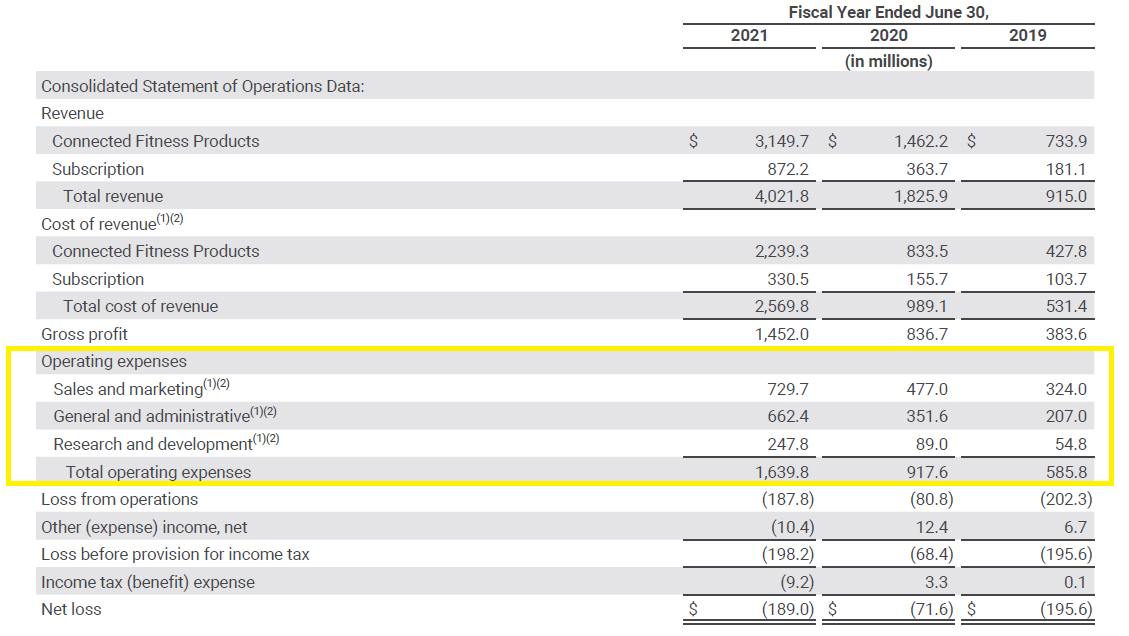

Figure 5 shows that from FY 2019 to FY 201, Peloton’s R&D expenses increased by 352% to $247.8 million. In the same period, PTON’s total revenue increased by 340%. Thus, the growth rate of PTON’s R&D expenses was even higher that its total revenue growth rate. PTON reported a full year 2021 net loss of $189 million. Without expending $247.8 million on R&D, Peloton would have reported a profit in FY 2021. Thus, PTON’s net loss of $189 million in FY 2021, is not a sign of bad performance; however, it is the sing of investing in the future.

Figure 5 – PTON’s operating expenses

PTON 2021 annual report

Performance

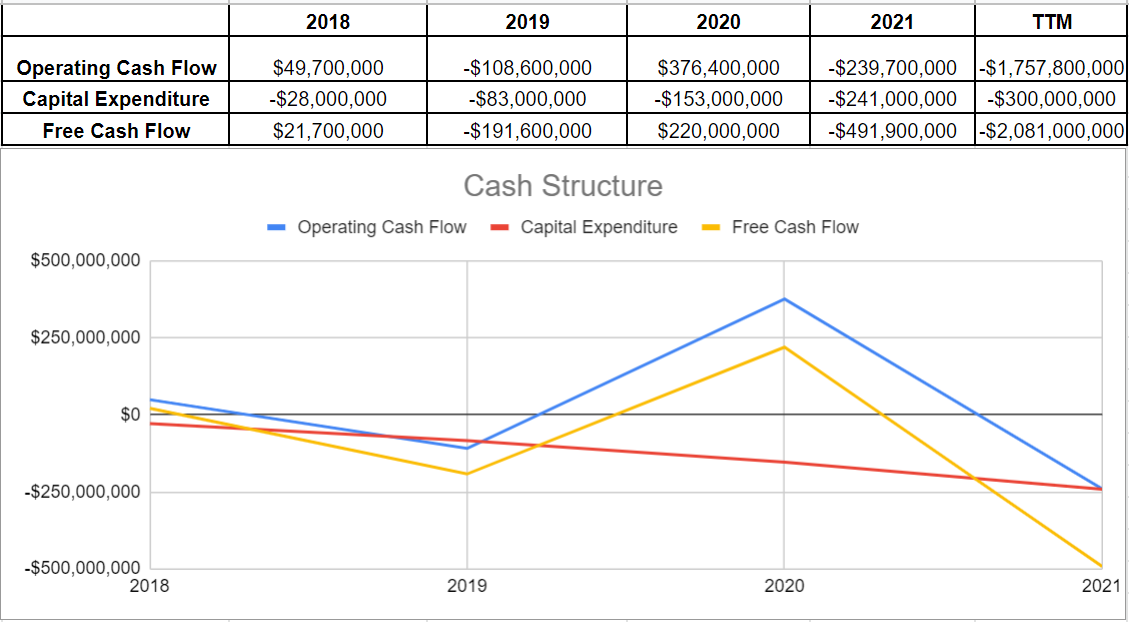

The company’s operating cash flow increased from $(108.6) million in 2019 to $376.4 million in 2020 following the lockdown. It subsequently dropped back to $(239.7) million by the end of 2021. Meanwhile, PTON’s capital expenditure saw a massive increase from $153 million in 2020 to $241 million in 2021, up 57%. Ultimately, the company’s free cash flow declined from $220 million in 2020 to $(491.9) million in 2021 (see Figure 6).

Figure 6 – PTON’s cash structure

Author

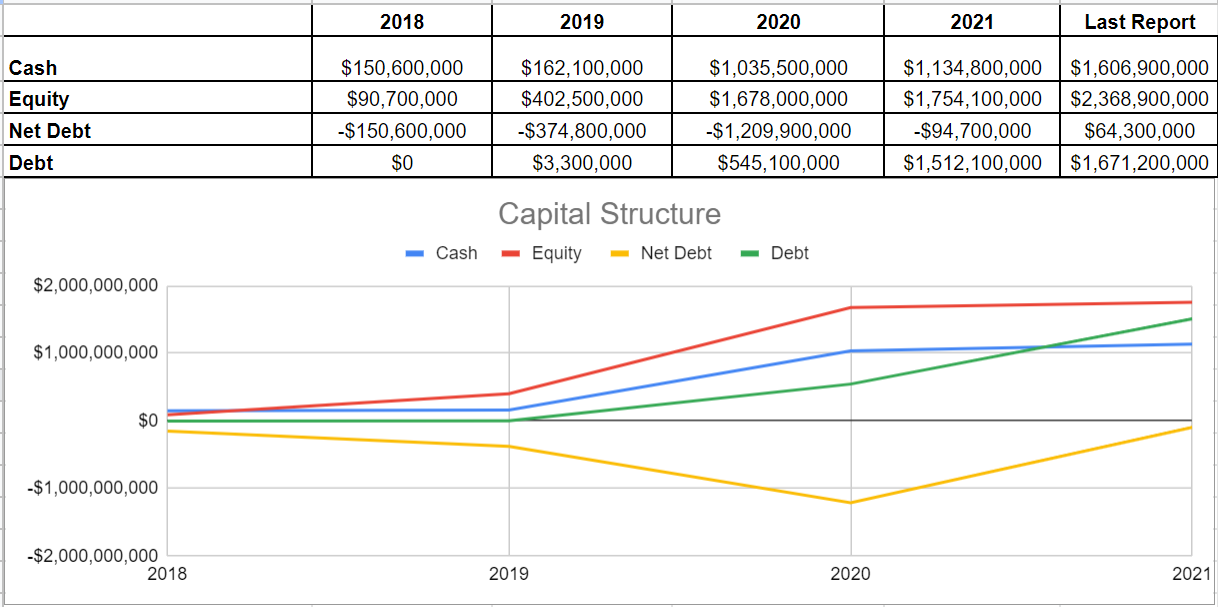

The company’s capital structure shows that PTON’s equity level surged to $2.36 billion in 2Q 2022, from $1.75 million in 4Q 2021, up 98%. PTON’s cash generation has increased by over 41% to $1.6 billion. Meanwhile, the company’s debt sat at $1.67 billion, compared to $1.51 billion in 4Q 2021. All of these lead to a better leverage condition (see Figure 7).

Figure 7 – PTON’s capital structure (from 2018 to 2021, data belong to the fourth quarter of each fiscal year)

Author

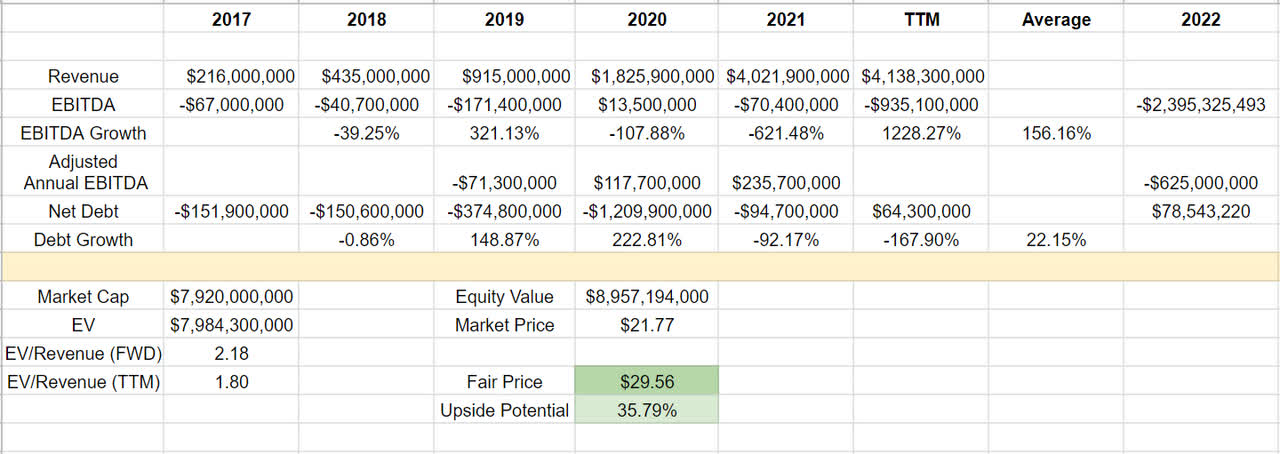

Valuation

To estimate PTON’s fair value, I investigated its EBITDA growth during the last years. The company’s EBITDA growth was disappointing during these years. Peloton’s annual adjusted EBITDA grew by 100%, from $117.7 million in 2020 to $235.7 million in 2021. However, the company expects an FY 2022 adjusted EBITDA of $(625) million to $(675) million. PTON has a negative EV/EBITDA (TTM), which is not useful in the stock valuation. I use the forward EV/revenue ratio to evaluate the stock (see Table 1). According to my calculations (based on the real-market data), PTON is worth $29 per share. In a word, the stock is a Buy.

Table 1 – PTON stock valuation

Risks

According to Barrons, Peloton plans to increase the price of its core subscription and decrease the price of its bikes and treadmills. The increase in the price of PTON’s core subscription may hurt the trust of its customers. A decrease in the price of bikes and treadmills may lead to the argument that the company is losing customers.

As the company is in a volatile condition and the main financial results of the company are not in favor of it, this kind of news may affect the stock’s price negatively. Also, the company is not the only online training service provider. If other sports company (the big ones with huge free cash flows) increase their investment in online training, the market share of Peloton will be at risk.

Summary

The future for Peloton Interactive is bright. The pandemic acted like a catalyst, turning online training into a normal at a faster pace than we expected. After the recent drop in PTON’s price, it is time to buy the dip. I am bullish on the stock.

Be the first to comment