Wachiwit

Investment Thesis

Apple Inc.’s (NASDAQ:AAPL) sales have been growing over the last few quarters as it continues to launch innovative products and new services. This growth is reflected in the company’s gross margin as well, which has improved over the last few quarters. However, the June quarter of the company is expected to be impacted by Covid-related disruptions in China, foreign exchange translation, industry-wide silicon shortages, and the shutdown of businesses in Russia. The sales are expected to be impacted in the range of $4 bn to $8 bn due to the Covid-related disruption and silicon shortages. Looking forward, the lockdown in China has started easing and the related headwinds are expected to fade in the coming quarters. In the long term, AAPL should benefit from the launch of its new products such as Macbooks and iPads with M2 chips and user-friendly updates. AAPL’s larger installed base should drive the services revenue as the company introduces new services for its users. The company also plans to introduce the Apple car by 2025 and AR/VR headsets by 2023, which could be incremental to the company’s revenue.

AAPL Stock Key Metrics

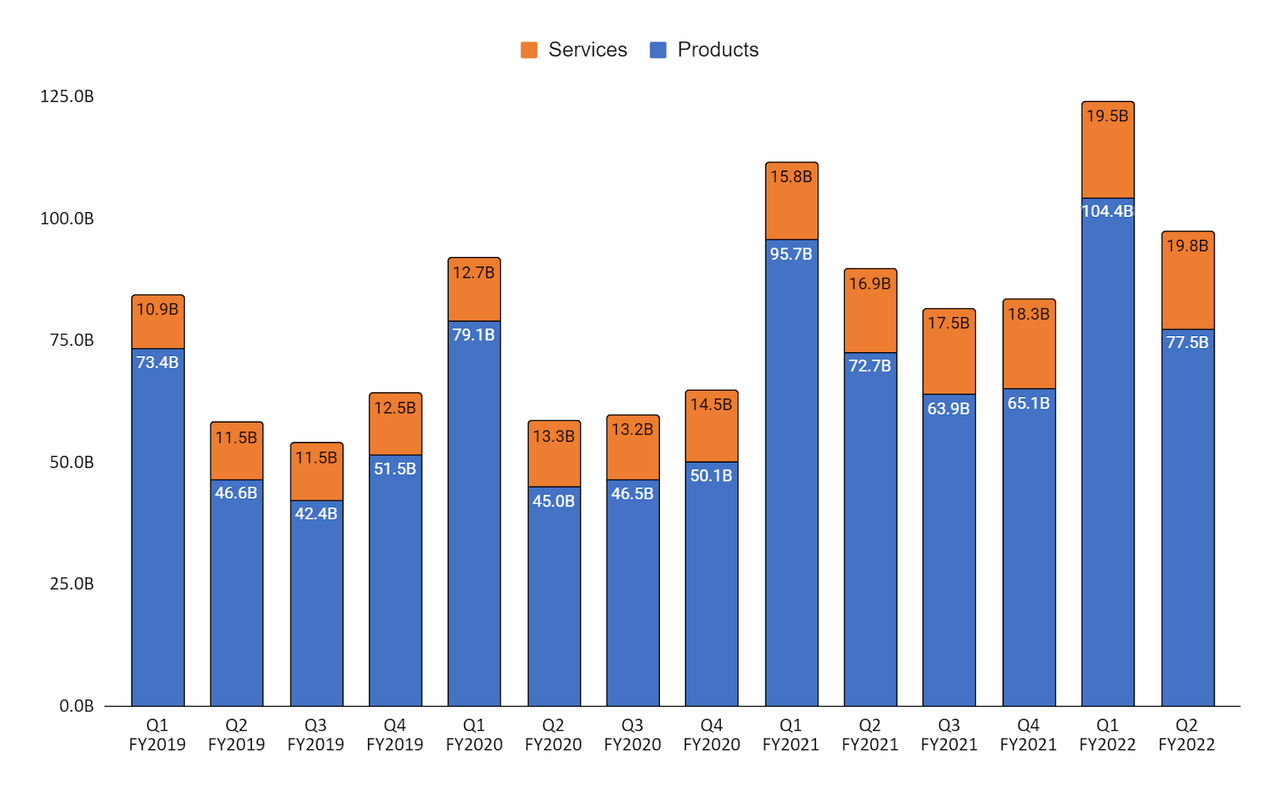

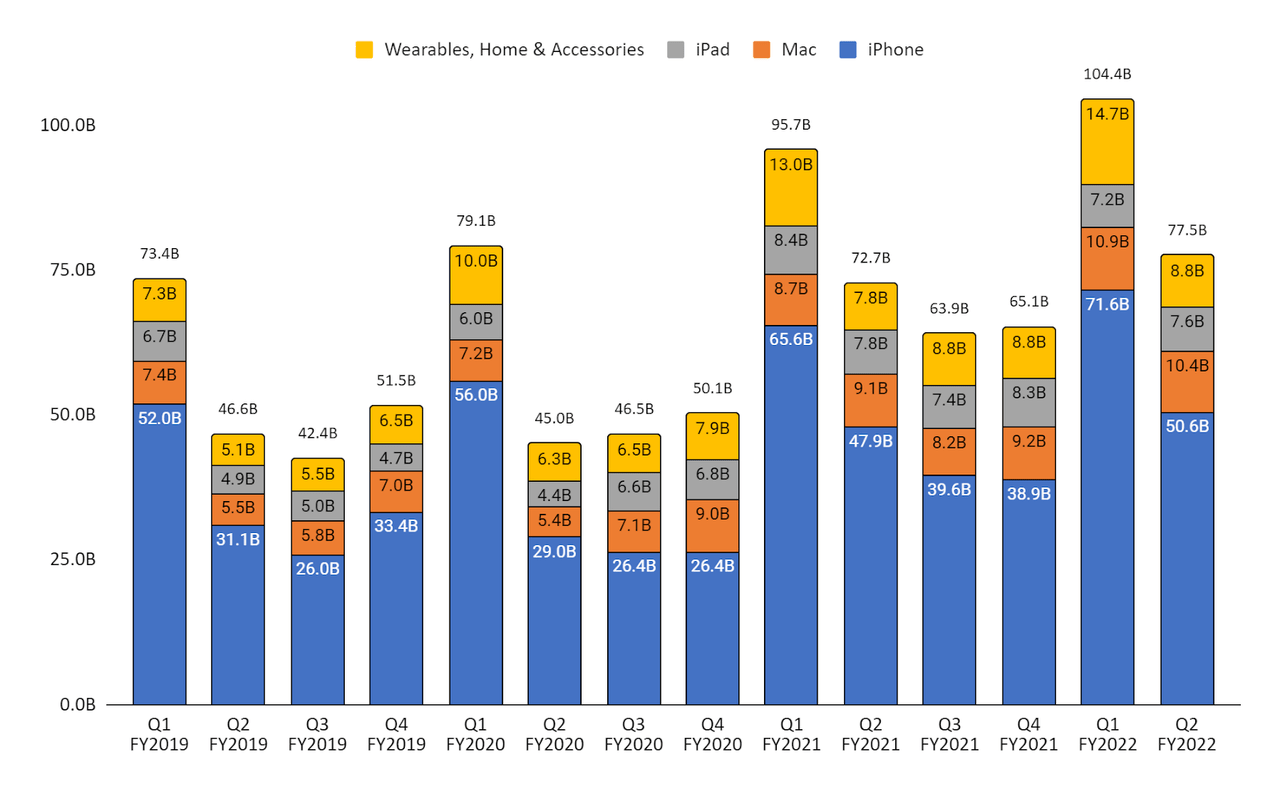

Apple derives its revenues from both products and services. While services accounted for ~20% of revenues in the last reported quarter, the gross margin for the services business is almost double that of products. So, growth in the services business is going to be a significant driver of the company’s margins looking forward. The products’ revenue includes the sales generated by the iPhone, iPad, Mac, and Wearables, Home & Accessories, whereas the service revenue includes the revenue generated from advertising and its services such as Apple Care, Cloud services, and offering digital content through its subscription-based services such as Apple Music, Apple Arcade, Apple TV+, Apple Fitness+, and Apple News+. The first quarter for products has always been outstanding, as the company launches most of its new products (especially iPhones) between September and October. In the last three years, the Wearables, Home & Accessories sub-segment have seen good growth. The sales of Macs were at their highest level too, as the company is continuously investing and driving innovation in its Apple silicon processors. Almost 50% of the customers purchasing Macs were new to the product during the March quarter. The transition of Apple from Intel (INTC) to Apple silicon processors is benefiting the company’s Mac sales. The iPad sales of the company are being affected due to the supply chain constraints, but the demand for iPads has increased over the last few quarters for education, entertainment, and creativity purposes.

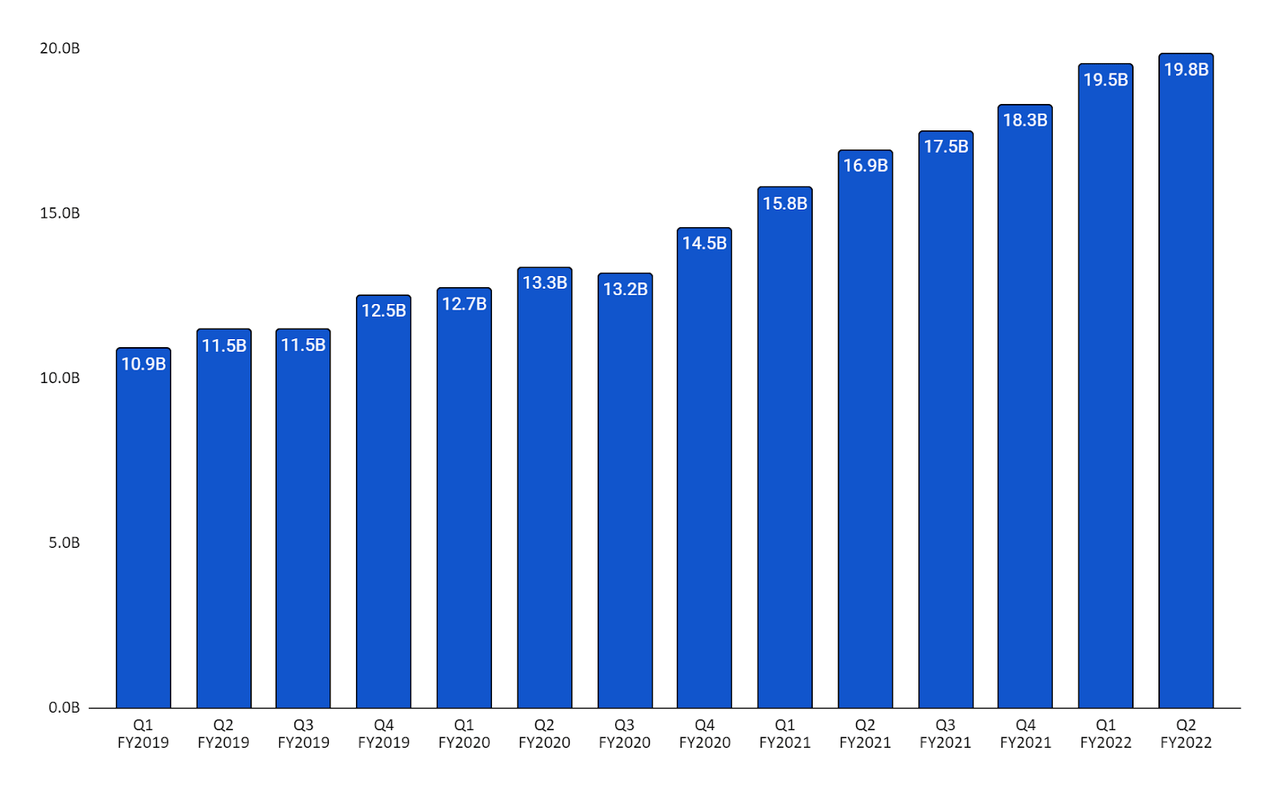

The revenue generated from the Services segment has almost doubled from Q1 FY19 to Q2 FY22, primarily due to Apple’s growth in its installed base of active devices. The company is also working towards improving its services and growing its customer base in the service segment by launching new services such as Tap to Pay.

Apple’s Products and Services revenue (Company data, GS Analytics Research)

Apple’s Product revenue disaggregation (Company data, GS Analytics Research)

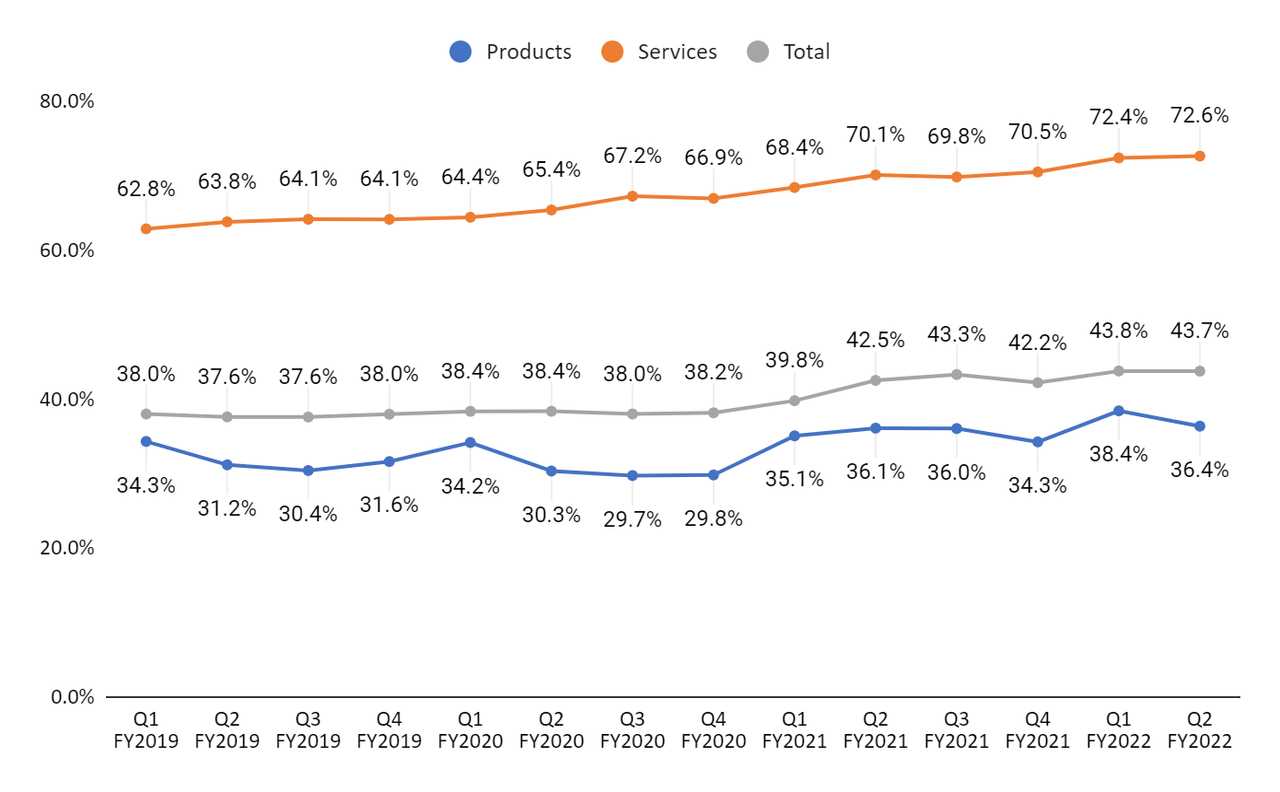

Apple’s gross margin (Company data, GS Analytics Research)

AAPL’s gross margin has been improving Y/Y over the last few quarters, especially due to the growth in the services side of the business. The Product margin was impacted during the Covid period but has improved since then. In the last reported quarter, the Product margin declined 200 bps sequentially due to the seasonality of the business, unfavorable currency translation, and an inflationary environment. As a result overall margins also saw a slight decline sequentially. Looking forward, June quarter product sales and margins are likely to be impacted by supply chain disruption but in the long term, the company should resume its growth trajectory as these disruptions ease.

Is Apple Stock Worth Investing In?

After the recent decline of AAPL from its all-time high of $182.94, the stock looks attractive to buy at the current levels. I think the near-term headwinds might impact the sales growth and profitability of the company, but as they subside, the company has good potential to grow in the long run. The year-over-year revenue growth of the company in the June quarter, i.e., Q3 FY22, should be impacted due to the lockdowns that were implemented in China in March 2022. The Covid-related disruption did not affect the company’s March quarter significantly as it already had decent inventory levels, but we might see its impact in the June quarter due to supply chain constraints and a decline in demand in China.

The Covid-related disruption and the industry-wide silicon shortage are expected to hamper the June quarter’s revenue of the company by $4 bn to $8 bn. Apple outsources most of its products from China and generates almost 20% of its revenue from the Greater China region.

Due to geopolitical tensions between Russia and Ukraine, the company paused its sales in Russia in March, which partially affected Q2 FY22 and is expected to impact the June quarter by almost 150 basis points in the Y/Y growth rate. Additionally, changes in the foreign exchange rate should also impact Apple’s revenue as almost 60% of the total revenue comes from international business. Over the last few months, the dollar has strengthened compared to other currencies. This is expected to impact the growth rate in Q3 FY22 by 300 basis points.

The lockdowns in China started getting lifted from April end and almost all the affected factories of Apple in China have restarted. So, I believe the conditions should improve over the next few quarters. In the long term, Apple should be able to grow its business through product innovations and growth in its services business.

In recent years, the company shifted from using Intel processors to using in-house manufactured Apple silicon processors in its devices, such as the Mac and iPad. Since the launch of Apple Silicon chips in its products, Apple has seen strong demand for its Mac and iPad products over the last few quarters. In June 2022, Apple announced new products, services, and updates at WWDC22. The company unveiled the 13-inch MacBook Pro and MacBook Air, both of which run on the brand-new M2 chips. The new M2 chips are the next generation of Apple silicon that is designed specifically for Macs. The M2 chip takes the breakthrough performance of the M1 chip to the next level, enhancing the user experience. The company’s M1-powered devices have already seen success, and I believe as the M2-powered devices roll into the market, Apple’s sales should benefit as the demand for faster-performance devices is high. The demand for performance-driven devices has grown in tandem with the global shift toward technology and the expansion of the gaming and content creation sectors.

Apple also unveiled its newest operating system, iOS 16, at the WWDC22 event. Recently, in July 2022, the company released the public beta version of its iOS 16 software update. The iOS 16 update offers users to personalize their lock screen by customizing font styles, adding widgets, and creating multiple lock screens. Users can also manage how their notifications appear on the lock screen and follow any ongoing activity through Live Activities right from the lock screen without cluttering the lock screen with notifications. The update will also provide users to edit their sent messages, use SharePlay via messages, update the dictation feature, new map features, and better integration with Siri.

The company has been able to grow its installed base over a period of time, which should benefit its service business. The company has almost doubled its services revenue over the past three years. Apple is also planning to introduce Tap to Pay on the iPhone later this year, where businesses can accept contactless payments in a simple and secure way. The company has also introduced subscription-based services for small businesses to manage their Apple products and services. Further, the upcoming “Buy Now Pay Later” (BNPL) feature within its Apple Pay service will allow users to buy products from stores that support Apple Pay in four installments with zero fees and interest. To complement this feature, the company is also introducing an order tracking feature, so that users can track their orders. I believe as the company brings new services to its users, it should be able to grow its service revenue at a good rate in the long run. Since Services gross margins are almost double that of products for Apple, it will help improve the overall margin of the company.

Apple’s service segment revenue growth (Company data, GS Analytics Research)

In addition to its traditional markets, AAPL is also venturing into new businesses like Autonomous vehicles, and AR/VR headsets which if successful could drive further avenues of growth. While management has not given much guidance on it, Apple’s autonomous vehicles should be launched by 2025. The company is hiring the necessary veterans and engineers for this project to be successful. AAPL has already been spotted testing its vehicle in California by some Auto and Technology journalists. Apple has been partnering and working with other auto companies to develop its self-driving vehicle. Over the last few years, the company has also been focusing on developing AR/VR headsets, which are expected to hit the market next year, according to Apple analyst Ming-Chi Kuo and Bloomberg’s Mark Gurman. This product should compete with Meta’s (META) Oculus Quest, which is already present in the market. I believe Apple has good growth prospects with its existing product updates, services growth and potential new launches. Hence, I believe it is worth investing in for long-term investors.

What Is Apple’s Target Price?

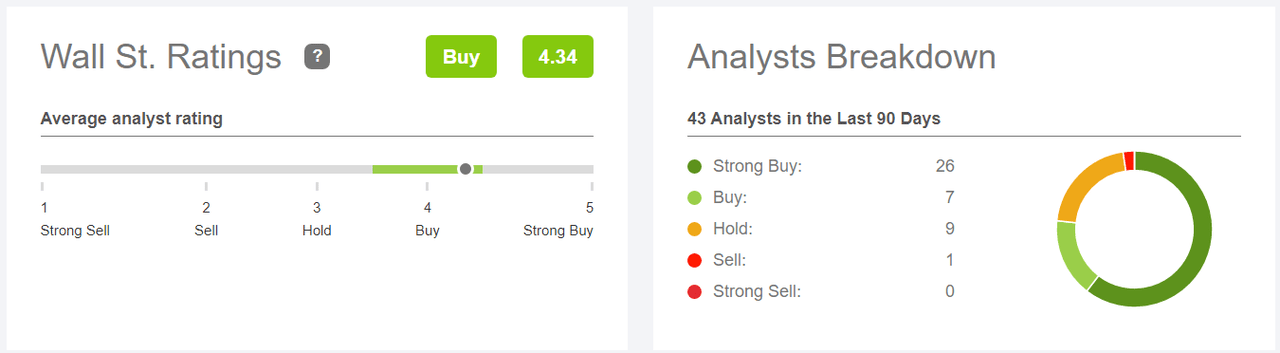

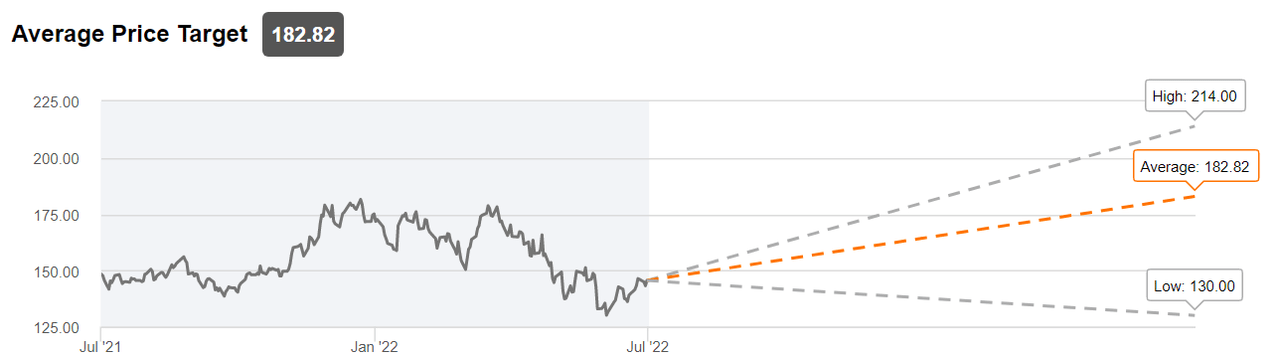

If we look at Wall Street ratings, most of the analysts are bullish on the stock. Out of 43 analysts covering the stock, 33 have buy or strong buy ratings, nine have hold ratings and only one has a sell rating. The average target price for the stock is $182.82 which implies over 25% upside from the current levels.

AAPL Wall Street Ratings (Seeking Alpha)

AAPL Average Target Price (Seeking Alpha)

Is Apple Stock A Fair Value?

Apple is currently trading at 23.72x FY22 (ending September 2022) and 22.34x (ending September 2023) earnings. While these valuations are roughly in line to a slight premium versus the company’s five-year average forward multiple of 22.18x, I believe the market is not capturing some of the potential acceleration in the company’s revenues and earnings growth prospects and the stock offers good upside at the current levels.

I believe the company’s business is poised to accelerate with its M-series chips offering much better performance compared to its previously used Intel chips which should improve the satisfaction of loyal Apple customers as well as bring in new customers, especially the high-end gamers, content creators, and others looking for better performance.

Further, the company’s success in growing its services business bodes really well for AAPL. Firstly, the services business has really high gross margins. So, an increased mix towards the services business will help the overall margins of the company. Secondly, the service business should have much less cyclicality and uncertainty compared to new product launches. So, it improves the quality of the overall business and imparts some defensiveness to sales and earnings. This should limit the downside during a slowdown and help the company maintain a high P/E multiple. Finally, services create further customer stickiness for Apple as those liking Apple’s services are likely to buy Apple products again when they upgrade or use Apple’s other product offerings.

In addition, there can be a further upside if the company gains any success with its new launches like the Apple car or VR/AR headsets.

Is AAPL Stock A Buy, Sell, or Hold?

I believe Apple is a good buy after the recent correction. While there are near-term concerns like supply chain constraints, rising interest rates, and a potential macro slowdown, the company’s long-term growth story is too compelling to ignore. The new and faster M-series chips which can increase product adaption, growing services revenues helping sales as well as margin mix, as well as optionality from potential success of new products (Apple Car, AR/VR headsets) make risk-return favorable. Hence, I have a buy rating on the stock.

Be the first to comment