Pasticcio/iStock via Getty Images

Studying abroad in Barcelona a few years back, there was a bar popular with American and British students called Dow Jones. At the bar, the price of drinks rose and fell like the stock market. When prices were high, you were better off sitting tight. When prices crashed, it was time to buy. Of course, at Dow Jones, most everyone got drunk and wandered off at the end of the night empty-handed. Lo and behold, the pandemic came out of nowhere a few years later, and $5+ trillion in stimulus and QE turned the global market for stocks and housing into the Dow Jones bar. To this point, Apple Inc. (NASDAQ:AAPL) reports earnings Thursday of this week after skyrocketing in price during the pandemic. As the most popular stock among retail investors, Apple’s business success in its Q3 fiscal quarter earnings will be an important litmus test for whether the pandemic bull market was for real or was only a temporary high driven by government borrowing and fiscal stimulus. Up until late fall, Apple looked invincible, but investors are starting to question the status quo rather than accept it at face value.

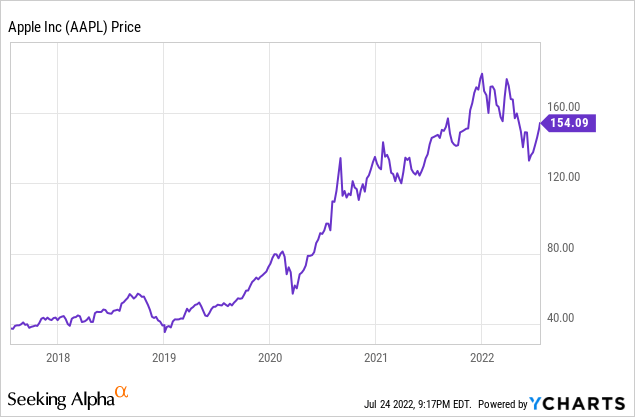

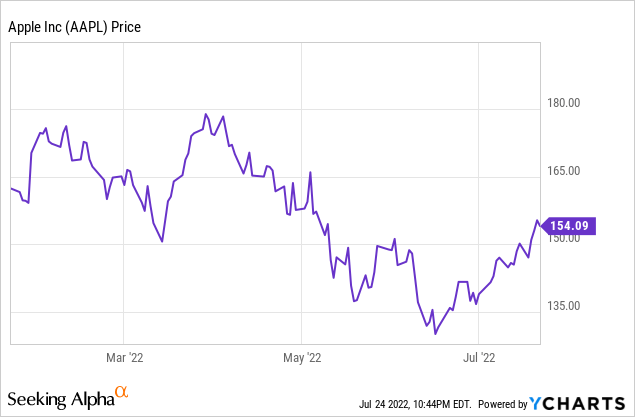

As of my writing this, AAPL has spun up to $154, making this the third sharp rally in the last six months. But every time this has happened, the stock has sold off right back to where it came from and made a new low.

Let’s look at the fundamentals.

Is Apple Doing Well Financially?

Yes, but is the current pace sustainable?

Apple did extraordinarily well financially during the pandemic. Consumers were stuck at home and got hefty amounts of stimulus, funneling spending towards goods, especially tech. Apple did very well to manage the supply chain and was able to keep its products in stock far better than its competitors could.

But now, as consumer spending shifts from goods back to services like travel, dining out, and live entertainment, it’s an open question whether this pace will continue. For example, the used-car market is still heavily out of whack, and consumers not wanting to deal with the supply chain and continued issues like chip shortages seem happy to direct spending towards areas less impacted.

Apple’s success is one of the most thematic stories of the pandemic. A $1400 stimulus check would buy an upgraded iPhone and a few meals out, and that’s exactly what many consumers seemed to do in 2021 as AAPL’s earnings nearly doubled from pre-pandemic levels. But the history of AAPL will tell you that it’s a cyclical stock, and earnings are more than capable of falling. Apple is doing well financially, but the assumptions being made about the company’s future growth by retail investors are not realistic and were likely driven by a massive rush of stimulus in 2021, rather than long-term, sustainable business fundamentals. Bulls want Apple’s growth to be secular, while the bears’ argument is that like many other pandemic winners, Apple’s growth trajectory was simply pulled forward by the pandemic, not permanently increased.

Does AAPL’s Valuation Make Sense?

Not really.

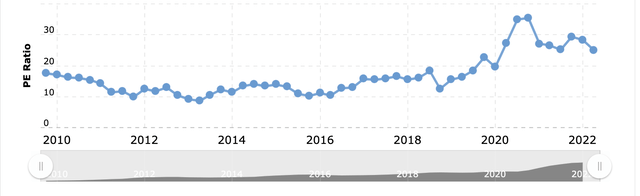

A basic test when analyzing a stock that has gone up a lot over the past few years is to see if the change in price has been primarily driven by earnings (business success), or if the multiple investors are willing to pay has expanded (speculation). Sometimes stocks can change the narrative and find new ways to grow, and end up deserving a higher multiple. More commonly, investors and sell-side analysts fall in love with stocks and end up overpaying.

AAPL’s multiple went from about 10x seven years ago to over 30x during the pandemic! This means the stock price increases have dramatically outrun their business success. Analysts make the argument that AAPL changed everything by building services revenue, but I think this is way overdone.

AAPL PE Ratio Over Time (MacroTrends)

But when you dig into the story of services-you realize that the growth in services is going to be seriously constrained by antitrust issues going forward. Google is now paying Apple a little less than $20 billion per year to be the default search engine in Safari. By my count, that’s nearly 20% of AAPL’s net income from one client, which just so happens to be another massive tech company less than a 20 minutes drive away!

Monetizing the services platform sounds great on quarterly conference calls. But do the US or EU governments agree that the App Store monopoly or these types of arrangements with competitors are okay to have in a democracy? They generally don’t, and antitrust cases will be a mounting drain on Apple’s resources to defend. There’s an index called the Herfindahl-Hirschman Index (HHI) that provides clues. Governments use the HHI to determine when to launch antitrust lawsuits against companies, and studies show that this index is useful in multiple ways at predicting when companies will underperform. It’s used both to gauge anticompetitive incentives in the marketplace and alternately, to gauge index concentration in the S&P 500 (SPY). What does this mean?

- High HHI predicts low future returns for Big Tech.

- HHI for tech, in general, has risen dramatically over the past 10 years.

- Antitrust action is bad for future stock returns.

Apple’s services business is a great profit center, but it’s not something that is going to double every 3-4 years going forward. Their revenue from services could easily stagnate as the enforcement environment for antitrust heats up.

Will Apple Beat Earnings?

For the quarter? Probably. But going forward, the picture is much murkier.

Apple is expected to report $1.15 in quarterly earnings on Thursday. Like almost all tech companies, this number is somewhat sandbagged, so AAPL should report a “beat” of at least 2-3 cents. But the more interesting question is what will happen 6-12 months down the road. Apple so far has declined to give earnings guidance since the pandemic. I believe this is a serious mistake given that it removes transparency from the marketplace and is causing retail investors to chase mania and hype.

Wall Street analysts expect 9% earnings growth for FY 2022, 6% for 2023, and 4% for 2024. Given that AAPL is trading for 25x earnings at the moment, this isn’t giving you much of a margin of safety. There are so many disconnects with Apple stock, but this is one of the larger ones. The great thing about Apple was as much as the company had gone up over time, the stock was relatively cheap. This all changed in the summer/fall of 2019 and accelerated into the pandemic when AAPL stock quadrupled. Earnings increased 2x, but for the stock to go up over 4x makes a prima facie case that some real business success got whipped up into hype.

What Is Apple’s Long-Term Outlook?

AAPL will likely be fine in the long run. But if you’re buying the stock now, I believe you’re overpaying. Earnings are at a cyclical peak and are likely to decline, and when this happens, the multiple is going to need to come back closer to its historical range.

This isn’t an exact science, but a 20% decrease in earnings to $5 or so and a 20% decrease in the PE multiple to around 20x implies a price target for AAPL of around $100. The pendulum tends to swing the other way on the downside, and I wouldn’t be surprised to see this stock at $80 if the hype fades away (note that AAPL would be nicely undervalued at that price). If you have a very long timeframe, I think you’ll make money in AAPL. But the current price doesn’t make much sense. You’re looking at a total return of perhaps 5-6% annually by buying at today’s price, less than the market at large and far less than you could make if you were willing to take time and dig into the financials of the companies you invest in.

Is AAPL A Buy, Sell, Or Hold?

I believe AAPL is a sell here.

This is a uniquely wild week for stocks. We have the Fed meeting at 2:00 PM Eastern on Wednesday, and it’s coming before an onslaught of Big Tech earnings, including Microsoft (MSFT), Amazon (AMZN), and of course, Apple.

I’ve covered this several times before, but 2021 was the best year ever for corporate profits in the US, smashing 2019’s record by roughly 30%. So far, Wall Street is operating under the assumption that corporate profits will be permanently higher than they were pre-pandemic. However, unless you believe government money printing is a cheat code to prosperity, this almost certainly is not true. This week could very well be when the easy-street perception is truly shattered for stocks.

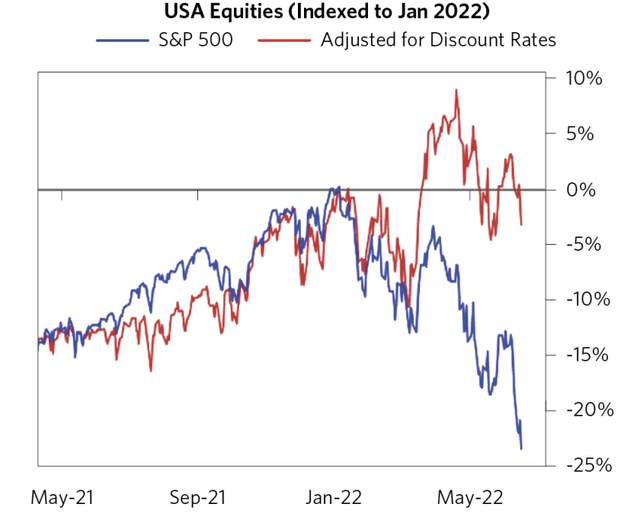

So far, the entire move down in stocks has come from market participants lowering the multiples on stocks, rather than analysts marking down earnings estimates. If the current crop of Big Tech companies ends up showing that their earnings are cyclical in the end and they can’t grow EPS at double-digit compound annual rates going forward, there is a serious shoe to drop in the market. Look at the gap here between discount rates and earnings from Bridgewater from a few weeks ago-something has to give.

Fed Vs. Earnings (Bridgewater)

The market is uniquely vulnerable this week because the Fed is going to hike rates another 75 basis points or more, and then Big Tech companies report earnings. If the Fed comes out much more hawkish than expected and Big Tech comes out afterward on Wednesday and Thursday and whiffs on earnings, it’s checkmate for the current rally in stocks. It’s not certain that this will happen, but rarely is there such a clear path to stocks being routed like this in such a short period of time.

Bottom Line

Nothing is certain in the stock market, but Apple’s stock has increasingly come unhinged from its business, not much different than how the price of drinks did at the Dow Jones bar years ago in Spain. Apple is far from the only company to have this happen during the past couple of years, but the popularity of the stock makes Apple one of the more thematic examples of this trend. Apple’s last two quarters haven’t been great, and I think the stock is quite vulnerable here. Don’t buy this stock, and sell some if you own it. I get that Apple shareholders have done extremely well over the years, but the choice is clear. Diversify some money out of Apple, pay some capital gains taxes, and put the money to work anywhere else in areas where valuations are more in line with fundamentals.

Be the first to comment