Carl Court

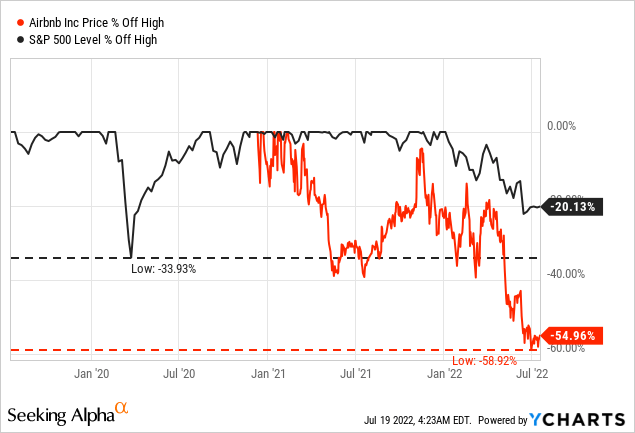

In the past few quarters, I covered Airbnb, Inc. (NASDAQ:ABNB) twice – one time in February 2021, when the stock was trading for $211 and the second time in October 2021, when the stock was trading for $160. In both cases I was rather skeptical as to whether Airbnb was a good investment (in my first article, I even rated the stock as sell) – and in both cases the current stock price was the main issue. In both articles, I assumed that an intrinsic value should be somewhere between $90 and $100 for Airbnb, and now that the stock is trading below $100, we should take another look at the company (and the stock).

In the following article, I will take a closer look at the company and the stock and try to answer the question if the stock is finally a buy. And once again, we will start by looking at the last quarterly results, which were quite impressive. ABNB is expected to report second quarter earnings on August 2, 2022.

Quarterly Results

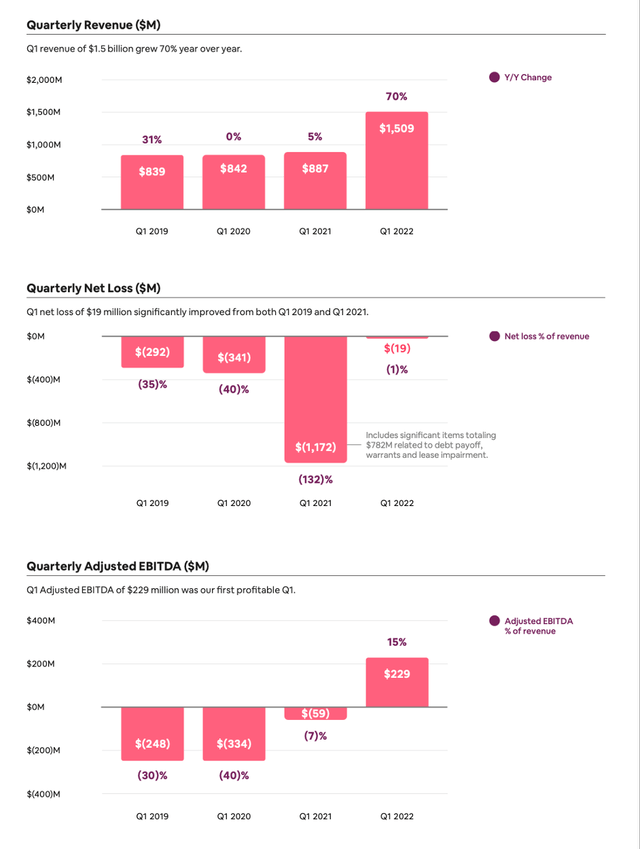

In the first quarter of fiscal 2022, Airbnb reported revenues of $1,509 million. Compared to $887 million in revenue in the same quarter last year, this resulted in 70.1% year-over-year growth. And although Airbnb had been profitable in previous quarters, the company had once again to report an operating loss in Q1/22. However, the operating loss was only $5 million, and it improved compared to an operating loss of $447 million in the same quarter last year.

And the picture is similar for the bottom line: Airbnb reported a loss of $0.03 per share in Q1/22, but managed to improve the numbers compared to a loss per diluted share of $1.95 in Q1/21. But similar to my last article about Marriott International (MAR), we must also point out for Airbnb that we are comparing the results to a pretty horrible quarter, and it is quite easy for a company to report high relative growth rates in such a case.

Airbnb Q1/22 Shareholder Letter

When looking at some more business metrics, we see further improvements. The nights and experiences booked increased from 64.4 million in the first quarter of fiscal 2021 to 102.1 million in Q1/22. And gross booking value increased from $10,290 million in Q1/21 to $17,165 million in Q1/22 – an increase of 66.8% YoY. And while the increased gross booking value mostly stemmed from increased nights and experiences booked, the gross booking value per night and experience booked also increased 5.2% YoY to $168.07. And when comparing that metrics to the same quarter in 2019 (pre-pandemic level), it increased even 37%.

Growth

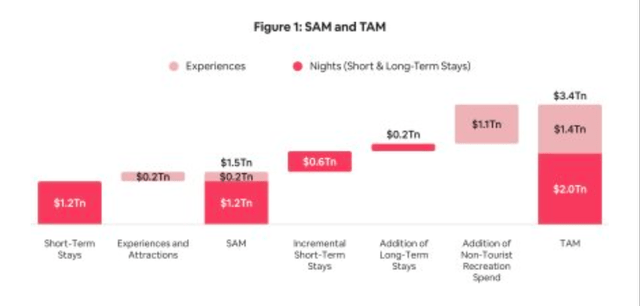

It is probably not surprising to hear that a business like Airbnb is depending on high growth rates as the stock would be extremely overvalued otherwise. And as I already outlined in previous articles, Airbnb has huge growth potential – at least in theory.

We can start by looking at the total addressable market (“TAM”), but we should not make the mistake and assume that a huge addressable total market automatically results in huge growth rates for the companies operating in that market (it is actually quite annoying when start-ups project extremely high revenue just because they are entering a gigantic market).

However, there are several hints indicating that Airbnb could continue to grow with a high pace in the years to come. For starters, Airbnb is profiting from several underlying trends which will be beneficial for all companies operating in the industry and does not require Airbnb to take market shares. Airbnb will profit from the trend towards people working remotely as well as the rising gig economy. In both cases, people might want to work away from home and might actually stay at exotic destinations to work from there.

This is becoming obvious when looking at Airbnb’s long-term stays (which are defined as 28 days or more). Long-term stays continue to be the fastest growing category by trip length and more than doubled compared to the first quarter of fiscal 2019. Long-term stays account now for 21% of gross nights booked and 48% of gross nights booked were from stays of at least seven nights in Q1/22.

Airbnb is probably the second biggest company in the sector with a market share around 25%, and only competitor Booking Holdings (BKNG) is ahead with a market share of 35%. And at this point, we can assume that Airbnb will continue to take market shares, but we should not assume that Airbnb will reach a similar dominance like Google (above 90% market share) and should therefore not expect unlimited growth potential.

And of course, it was possible in the past that companies were suddenly able to take huge market shares in an industry that was before dominated by several small players – Meta Platforms (META) and Alphabet (GOOG) (GOOGL) might be two examples that suddenly were able to take huge market shares in the advertising market. And this could also be possible for Airbnb in a similar way. But we should also be careful not to get carried away by huge growth expectations that might just be unrealistic.

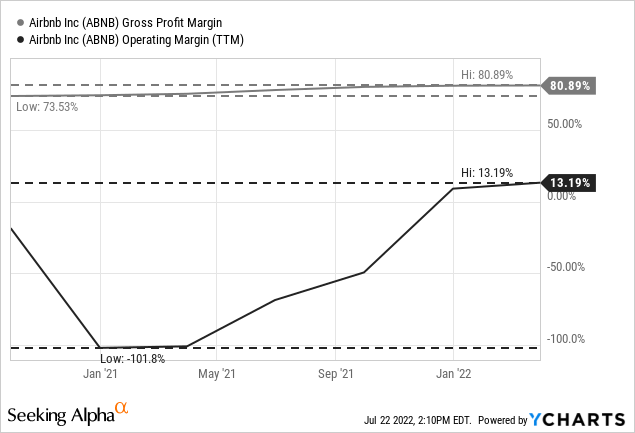

Aside from growing its revenue, Airbnb can also grow its bottom line by becoming more and more profitable. So far, Airbnb is usually profitable in the third quarter (when it is generating its highest quarterly revenue in any fiscal year). And Airbnb being a business that is scalable with fixed costs that don’t increase – no matter if 10 or 10,000 places are listed – should be able to improve its margins in the years to come. Especially operating margin could be higher. Booking Holdings for example has an EBITDA margin close to 30% right now and Airbnb could reach similar levels.

COVID-19 and Competition

And Airbnb has not only growth potential in the years to come but is also facing several risks. In my last article about Marriott International, I already mentioned COVID-19 as a still existing risk. And Airbnb also must see COVID-19 as a challenge, as we don’t know what will happen in the fall and winter. We can assume that lockdowns won’t be a major issue anymore, but travel might decline again.

Additionally, competition might be an issue for Airbnb in the years to come. If Airbnb’s fees are too high for example (and they seem rather high), people might switch to a competitor that might offer lower fees. However, strong network effects that should not be underestimated in case of Airbnb might prevent people from switching. Hosts will remain on Airbnb as they know most guest are also on Airbnb and are searching for lodging on Airbnb – and for guests the same is true. In my first article, I describe the wide economic moat:

And Airbnb’s competitive advantage is mostly stemming from network effects. The network effect as a competitive advantage arises, when the value of the product or service increases with every new user – and not only for the existing user, but also for the new user. And network-based businesses either tend to create monopolies or we see only a few companies remaining in an industry. The reason for this limitation to only a few companies is very simple: When the value of a product or service increases with the number of people using it, the most valuable product or service will be the one the most people are using. And as we are seeing a vicious circle with new users being attracted to the biggest network making the network even bigger and attracting even more new users, the biggest networks tend to win and sometime even form a monopoly. Smaller networks are squeezed out by the dominant networks. This effect is often referred to as the Matthews Effect and has been described by the sociologist Robert K. Merton. Although first noticed and described in citation networks in science, there are many other examples where the big get bigger and not so much the quality of a product or service is deciding which product/service new users choose, but only the former success of a company (or individual) is important. Scientists get cited because they have been cited a lot in the past, people use Airbnb because others are using it and have used it in the past.

Recession

Another risk we have to mention is a looming recession. The entire leisure industry is not really recession-proof, and we can find already several news articles talking about recession fears and stocks declining. And aside from knowing how competitors and peers performed in the past, we don’t really know how Airbnb will perform during a recession. The last recession was atypical and leisure stocks suffered especially due to the lockdowns and travel restrictions and during the Great Financial Crisis, Airbnb was a really young company (just a few months old) and I don’t think we can use the data from back then to draw conclusions for the potential next recession.

Nevertheless, it is interesting what CEO Brian Chesky had to say about a potential recession and the performance during the Great Financial Crisis (as the topic was debated during the last earnings call):

Airbnb, we launched on August 11, 2008. So you’ll remember what the world was like in August 2008. And we really got going January, February, March of 2009, in the depths of the Great Recession. And the reason that Airbnb initially grew was that people were having trouble paying their rent, having trouble keeping their homes, and people turn to Airbnb to list their homes. And what we generally see is in recessions, people change their behavior. And they change their behavior based on kind of price considerations. And so will generally expect in a recession, if that were to happen, is that probably more people would turn to hosting. That would be number one. So that we would expect, and number two, travelers would probably become more budget conscious. And that would probably have a benefit to Airbnb as well. Now, the downside, of course, the recession is often times fewer people travel. But again, I think we’re a pretty resistant business, whether it’s economy’s good or bad, we’re pretty adaptable model. So that’s what I would expect in the supply side, that’s the more difficult to the economy is, the more people are going to need supplemental income. And a lot, a handful of them will turn to hosting.

I honestly don’t know how Airbnb will perform during a recession. We must assume that revenue growth will slow down for Airbnb, and it is also a possibility that revenue will decline. An average price of $170 per night seems rather high, and in case of a recession that number might decline and lead to lower revenue for Airbnb. And this is also undermining Chesky’s argument that people will switch to more affordable choices in case of a recession: in case of a recession and less disposable income, $170 per night might also seem expensive.

And I also don’t know if the comparison to Airbnb’s first few months of existence is appropriate. Of course, it is great sign that Airbnb survived that time, but I don’t know if the growth rates from back then (which are also unknown to me) are a good indicator for the next recession.

Balance Sheet

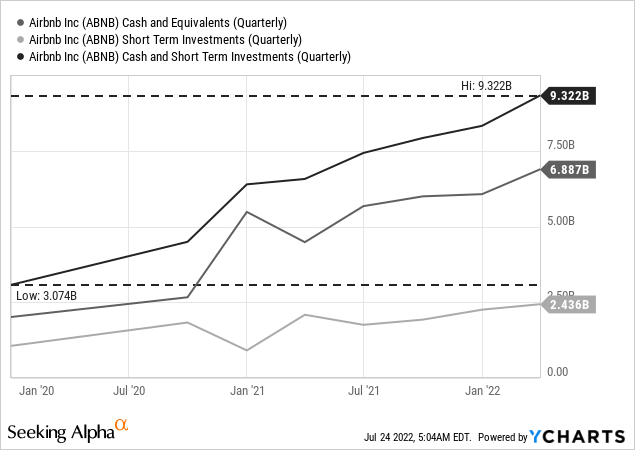

And, although we should not ignore the risks of a recession and the negative impact it might have on Airbnb’s business, it is good to know that Airbnb has a great balance sheet (especially for a rather young business) and the balance sheet even improved in the last few quarters. On March 31, 2022, the company had $6,887 million in cash and cash equivalents as well as $2,436 million in marketable securities on its balance sheet. Hence, these liquid assets make up for almost 55% of the company’s total assets (which were $17,068 million).

Of course, we also should mention $1,983 million in long-term debt on the balance sheet, but with about five times that amount in extremely liquid assets, it is not worth mentioning. When comparing the total debt to the stockholder’s equity of $4,737 million, we get an acceptable D/E ratio of 0.42.

Intrinsic Value Calculation

In the end, an investment decision comes down to the question if the current stock price for Airbnb seems fair. I already mentioned above that I considered $90 to $100 being a fair price in the past. And as the business improved in the meantime, a higher intrinsic value might be justified for Airbnb. When calculating an intrinsic value by using a discount cash flow calculation, we can take the trailing free cash flow of the last four quarters (which was $2,878 million) as basis.

But despite Airbnb having extremely low capital expenditures (in the last four quarters, Airbnb only had to spend $25 million in CapEx), I don’t think the free cash flow is realistic and sustainable. I can imagine about 30% to 35% of revenue ending up as free cash flow (but right now it would be 44%). And we should also not forget that free cash flow is much higher than net income right now.

For our calculation, let’s assume 30% of revenue will end up as free cash flow ($1,984 million). And let’s also assume free cash flow not growing in fiscal 2023 due to a recession. For fiscal 2024 we assume 20% growth again and estimate growth to slow to only 6% till perpetuity over the next ten years. When taking 635 million outstanding shares and a 10% discount rate, we get an intrinsic value of $116.09 for Airbnb.

We mentioned above that Airbnb has a great balance sheet with a lot of cash and we should include net cash into our calculation and add the amount to the intrinsic value. A net cash of $7,340 million is resulting in $11.56 in additional cash per share, which would lead to an intrinsic value of $127.65.

Conclusion

Despite the risk of a looming recession, Airbnb could be slightly undervalued at this point and might be a cautious buy. I myself won’t purchase any shares at this point as I expect share prices to drop further in the coming quarters as recession fears and a negative sentiment could push the stock down lower. But from a fundamental point of view, the stock seems to be at least fairly valued.

Be the first to comment