jetcityimage/iStock Editorial via Getty Images

AstraZeneca (NASDAQ:AZN) is a powerhouse of pharmaceutical development with strong oncology, rare diseases, and biopharmaceutical segments. They grow organically but have also engaged in acquisitions, such as the $39 billion takeover of Alexion last year. They have developed a strong pipeline and are conservatively managed for long-term and enduring growth. However, as I explain, the current valuation makes me hesitate and I am therefore recommending a hold on buying shares unless we see a decline. I love the company, but my risk aversion makes me uncomfortable with the potential here for a fall in price.

Reasons to like the company

There are three main reasons that I like this company. First, they have a good pipeline moving forward. Second, their diversification provides a measure of assurance and stability. Third, they may provide an effective inflation hedge because of the nature of the industry.

In my opinion, many long-term investors will benefit from having at least a portion of their portfolio invested in healthcare and pharmaceutical stocks. Depending on the nature of the portfolio, broad-based indices using an ETF may be appropriate or it may be wise to select several strong candidates, like AZN, that will provide long-term growth potential.

A strong pipeline provides assurances moving forward

The company has maintained a strong pipeline in recent years through its own developments and acquisitions. They have a number of new molecular entities over their three key segments that should provide strong growth through the next several years and continue to provide opportunities beyond 2025.

While there is a good mix of drugs at various levels of development, there remains a small but real chance of some of these hitting serious problems and failing to be approved or taking longer for the approval process.

When investing directly in pharmaceutical companies, the pipeline and approval is something that needs careful consideration, as it may weigh on the expected earnings growth where delays in approval may push out the development of expected revenue streams.

Strong revenue growth and diversification provide stability

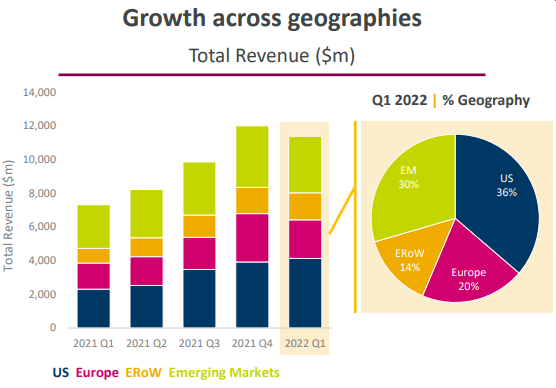

The company has a good geographic diversification, which I appreciate, as shown in Figure 1. The spread shows a continued strong presence in the emerging markets, providing many portfolios with a broader exposure and providing some measure of stability.

Figure 1. Geographic diversification of revenue (AstraZeneca Q1 2022 Results (p. 6))

As an international investor, I appreciate a good mix of geographic diversification. In my experience, it provides a good hedge against risks and tends to dampen or reduce the damage of any particular incident. As a consequence, the mix of revenue shown in Figure 1 provides a powerful foundation for long-term stability. In particular, the diversification away from the EU and USA, with about a third of revenue from the emerging markets, suggests that while there is outsize exposure to the EU and USA this is buffered by the balance from revenue from other sources.

Of course, this also brings with it currency exchange rate risks. Given the broad diversification here, much of the fluctuations that I expect to see would counterbalance against other currency movements in the portfolio and so I would not expect to see many adverse issues here.

The inflation-hedging role of pharmaceutical firms

Looking at past data, Mark Hulbert says healthcare is the leading sector to hedge against inflation, and “No other industry group comes close.”

Mark Hulbert notes that this is because the “demand for health care is relatively immune from inflationary pressures. Except for the most elective of procedures you’re not likely to turn down medical care because of increasing price.”

Stated in another way, the investments in drug development have already taken place and the pharma firms are then relying on their intellectual property and its value that holds in the future. This means that when “they have graduated from the ‘sowing’ phase, and move into the ‘reaping’ phase, their hard costs are mostly locked in (the cost of a drug is mostly in developing it; once it goes to market, it typically costs pennies to manufacture). Typically drugs have twenty years of patent exclusivity when they can charge whatever the market will bear.”

In essence – people will keep buying drugs even with increasing prices and the cost of developing this property was fixed in pre-inflation dollars. This is a favorable position for AZN. It assures me that as we move forward even if inflation persists, the earnings for AZN (and other comparable firms) will hold up reasonably well. Their costs are fixed while they can increase revenue.

The problem of delays with approval does not entirely disappear with inflation – delays in the approval process are still going to be painful for AZN and the investors.

Reflecting on Q1 and looking forward to Q2

There are several elements that I will be keeping an eye on as we move into the Q2 reports. There has been a settlement of a long-standing issue with AZN’s drug, Ultomiris, that will cause a large Q2 payout: “Both parties have now agreed to withdraw their complaints as a result of the settlement, which includes no other payments – including royalties – other than the single lump sum to be paid in the second quarter.”

The recent settlement regarding Ultomiris is important. While it is expensive, with AZN taking the hit in Q2, this should clear the road ahead for the firm to benefit from strong sales (for example, the drug recorded sales of $391 million in Q4 of 2021 and then sales of $419 million in Q1 of 2022).

In addition, the rising inflationary environment will present an increase in costs for drug development and trials. Given the strong revenue and credit worthiness of AZN, this is not likely to be a major issue. However, it is an element that I will continue to monitor. I expect that any adverse reports here will not be overly detrimental and may, therefore, simply take the shine off the expected earnings growth and dampen the EPS estimates a little but not substantively enough to move the needle on this investment opportunity.

Risks

There are many standard risks that we expect in this industry. For example, there are ongoing regulatory risks and the FDA may not approve some drugs in the pipeline.

The risks relating to intellectual property and patents are also present, particularly where they make acquisitions. The risk is particularly pertinent given the recent settlement with Chugai Pharma as noted earlier.

They balance these risks to a large degree with the strong and robust growth the firm experiences. If there were emerging risks that became known, the AZN stock price would take a tumble and it would produce an attractive entry point.

A major risk for AZN is how their drugs will come off patent in the near future (such as the 2025 to 2030 period) while others in the pipeline may not be approved on time to replace them in the portfolio. Ultimately, then, I consider there to be a higher risk in the assumption of longer-term growth due to the certain loss of protection measured against the (probable) chance of new drugs being approved to enter the market.

Valuation

This company has a history of strong performance. Their current situation shows a well-stocked pipeline that should enable them to continue their successes in the future. Consequentially, we might provide this firm with some measure of premium. If so, the question may be how much premium and how does this influence the price we may pay? If we provide an allowance for too much premium, there becomes too much downside risk if the market sells off and this company is carried with it.

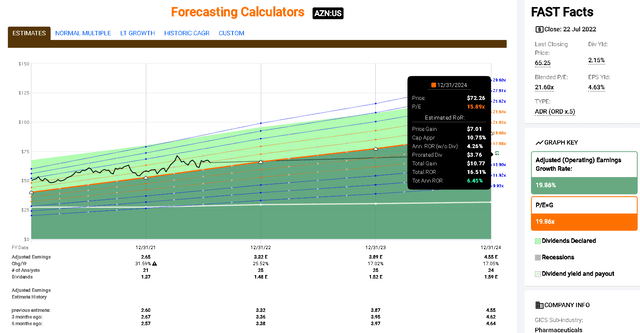

At present, there are strong analyst expectations for strong EPS growth of approximately 15-20% pa for the coming five years. Examining Figure 2, we can see that the analyst estimates have been relatively stable for AZN. For example, we can see that analysts have revised the 2024 estimates downwards, but they have not fundamentally changed; they remain indicative of strong future growth.

The current PE is over 20x and this seems richly valued. As noted, this is a firm with a lot to like. However, it also represents some risks. If there is some contraction in the PE ratio and the market stops providing it with such a rich premium that results in a decrease in premium to 16x, we are likely to see meager gains, such as low single-digit returns by the end of 2024 (Figure 2). In this case, despite the strong growth in earnings, the fact that we are buying at a high price means that we have not captured the earnings growth.

Figure 2. AZN’s near-term earnings forecasts based on analyst estimates. (Graph and analyst estimates – Copyright © 2022, F.A.S.T. Graphs)

Another good question is how successfully do the analysts estimate future earnings? From 2009 to 2021, I would say the one-year estimates are good (beating 1/3 of the time and hitting the rest of the time); the two-year estimates were a little off for the 2014 year but otherwise good. (Source: FactSet analyst estimates.)

Using a two-stage model and EPS of 1.89 with a 0-5 year EPS growth of 20% (discounting the analysts’ expectation of earnings growth next year and holding this EPS at an optimistic level) with a longer-term (5-10 year) expected growth of 15%, with the 0-10 year expected growth of dividends of 5% (again, generous, given the current dividend yield), a terminal PE of 15x, and a target rate of return or 12% gives me a buy now below the $55.96. At this price, I would be more confident in reducing my near-term downside risks and benefiting from the projected growth of earnings that AZN should experience in the coming years.

Dividends

AZN pays dividends, but not at a particularly high rate, as noted. They have held the dividends constant for several years, but there is the expectation that AZN will increase them in the coming years. At the current yield of about 3%, this is hardly anything for a dividend-focused investor to write home about and it certainly does not make for a compelling case for investment.

Thesis

Given the continued concern with inflation rates, this is an attractive sector. AZN maintains a strong and diversified pipeline with a strong global presence. There are risks, but they are manageable and should not impact the long-term success of the company. As a result, I consider this an attractive company if we can purchase shares at the right prices. As I suggest in the valuation section, there is little margin of safety here, giving some potential for near-term price decreases. But the short- and long-term analyst estimates are positive and provide assurance of future growth.

For these reasons, I consider the company a hold because of the current rich valuation. If the price declines into the mid-50s and hits my buy now below $55.96, then I will look at AZN with more interest and will probably start to build a position in this exceptional company. In the meantime, it is wise to wait for the prices to lower so that an entry point can be made at a price where we can more completely capture and benefit from the future growth of the company.

Be the first to comment