emrah_oztas/E+ via Getty Images

How Much Did Apple Benefit From Stimulus?

In 2021, CEO after CEO gave glowing conference calls about how demand for their products & services was booming. Analysts in turn took these reports to feed into their models about how much companies were likely to earn in the future, which then aggregated into the S&P 500 earnings estimates widely used by institutional investors to gauge market valuations. This approach works well in normal times, but 2021 was not a normal time. Massive amounts of stimulus were paid for by the US government printing money, with the country running the largest peacetime budget deficits in history to not only replace household income but to increase income above equilibrium levels for short-term political gains. After an admittedly unsustainable spending path was chosen by both major political parties over the last 5 years, America is now faced with the specter of living off of what it earns, or at the very least running dramatically smaller budget deficits. This circular logic of feeding earnings estimates into future models without accounting for the unwinding of massive stimulus creates a glitch in analyst earnings models going forward that almost no one will see coming.

The key question here is whether analysts are missing the forest for the trees. Perhaps not all of the amazing demand that companies saw in 2021 was because Corporate America produces such awesome products, but because the government printed tons of money and handed it out to consumers due to the pandemic. The gridlock in the Senate blocks new stimulus and roaring inflation numbers illustrate what we knew all along. Printing money doesn’t create wealth–it only redistributes it.

I’d argue Apple Inc. (NASDAQ:AAPL) was positioned to be the #1 beneficiary of the lockdowns and stimulus that happened since the pandemic for several key reasons.

- The pandemic shifted spending away from services like live entertainment, restaurants, and travel and towards goods like electronics and cars (increased demand).

- Apple has an excellent supply chain and market power, which allowed them to outcompete other companies for a limited supply of semiconductors. (stable supply).

- Stimulus checks directly gave consumers spendable cash. iPhones were in supply and could be purchased without consumers having to pony up additional money of their own. These checks totaled $8,000 per median family of 4 when accounting for December 2020 and March 2021 relief checks. In addition, the enhanced child tax credit would have given this same family another $4,500 for 2021, for a total of $12,500 in extra income in roughly a 12 month period of time (increased demand).

The vast majority of households worked during the pandemic, so this money is all on top of normal earnings from employment. The student loan pause, QE, the foreclosure moratorium, the eviction moratorium, etc. all had a synergistic effect to fire up the economy, and as such, growth and inflation were higher in the US than in our peer countries.

But the key point here–these policies were all temporary, but analyst earnings estimates mostly all imply that corporate profits will exceed 2021 levels forever and grow at an above-average pace from there. This is a crazy contradiction because the policies that drove these massive earnings have since been removed. In addition, higher prices for food and gas are putting the squeeze on consumers, especially those outside of the US with less disposable income to spare. The March CPI inflation release on April 12 will be closely watched, as will be the Fed’s response to it.

Is Apple an inflation hedge? It probably won’t be going forward, but it effectively worked as one from 2020 to now due to the unique circumstances surrounding the pandemic. These factors reversing won’t be Apple’s fault per se, but we shouldn’t give their business too much credit for demand caused by temporary stimulus policy either. Apple’s policy of avoiding giving forward guidance since the pandemic is a double-edged sword in this regard as it is likely to increase the volatility of the stock.

Apple was a huge beneficiary of the pandemic, and its earnings roughly doubled compared with its pre-pandemic numbers. This is not sustainable, and the history of Apple shows that its earnings are cyclical. This is why you’re seeing a report from Bloomberg that Apple is cutting iPhone production. Demand was temporarily high, and it will revert to the mean. This is a problem for the S&P 500 at large but is an especially big problem for consumer-facing companies like Apple.

This will not be solved by renting people iPhones for a higher price. Some analysts got very excited by the idea that consumers would like to pay even more to Apple rather than buy iPhones every few years, but just like in the auto industry, leasing is not a magic trick to dramatically increase profit margins.

Is Apple Stock Overvalued?

In light of the sustainability concerns I have about their earnings, I believe Apple is significantly overvalued. I expect Apple to earn less this year than they did last year because consumers will have less disposable income and they already upgraded their iPhones en masse. In my article in December, I estimated that Apple would earn somewhere between $4.50 and $5.00 for 2022, and I think this number is probably still about right, with a possible further slowdown from there.

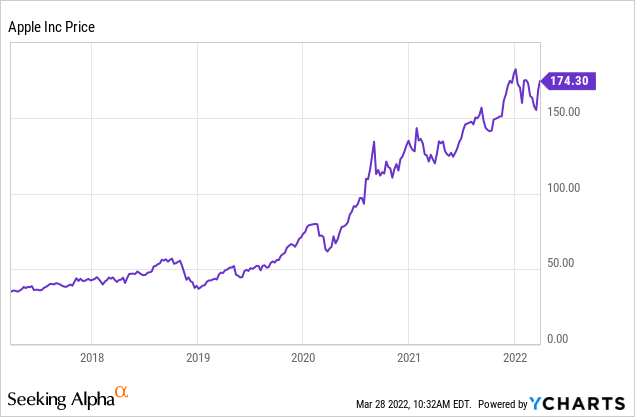

Make no mistake, Apple is a good business, and its services segment means the stock deserves a meaningfully higher valuation than it carried during the early 2010s. But reality checking Apple’s earnings and multiple get you a much lower share valuation than the shares go for on the open market. As of my writing this, Apple trades for roughly $175, up nearly 17% in the last 10 days. This probably isn’t a short squeeze (Apple isn’t heavily shorted), but I would not chase this. Maybe a gamma squeeze? Hope springs eternal, and retail traders seem to be piling back into GameStop (GME) and other meme stocks like AMC Entertainment (AMC) as well, despite dismal earnings.

Apple is a popular blue-chip stock, and history shows that stocks like these tend to have to struggle to find their way after expectations get so high that they’re impossible to beat. At some point, the network effects that make tech companies get more and more valuable start to be overwhelmed by the regulatory pressure they face, as in the United States vs. Microsoft case from the late 1990s. This is also a lesson that Amazon (AMZN) shareholders should take to heart.

Also, what the heck happened to the metaverse? The constant drumbeat of media coverage around the metaverse seems to have slowed to a trickle, or maybe the PR dollars being used to pump it have slowed. Earlier, wild estimates of future sales such as metaverse profits and the Apple car were used to justify Apple’s increasing valuation relative to profits, but I’m not hearing as much about that lately. Now, people don’t seem to be justifying anything, and rather simply trading on momentum until it turns.

Apple Stock 2022 Forecast

Stocks seem to be defying the changes in fiscal and monetary policy so far. As far as monetary policy goes, I see why traders would be skeptical that the Fed will do what it says it will do, although I disagree with them. But to expect massive transfer payments going forward and add them on top of employment income and implicitly bake them into expectations for consumer spending is not realistic.

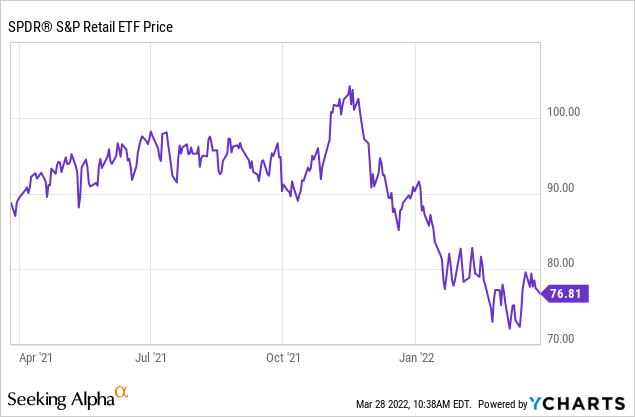

This is why consumer stocks like retailers are now in free fall. This is most likely not noise trading, as hedge funds are able to buy alternative data such as credit card data and satellite data to predict retail sales.

Apple has the largest market cap of any company in the world and is heavily influenced by ETF and mutual fund flows, so long/short smart money funds trading on alternative data are not likely to move the stock yet. But if Apple’s earnings miss like I think they will miss, then we could see a sharp revaluation of the stock.

I reiterate my fair value estimate for Apple of roughly $100 and expect the stock to trade down after earnings to start to shrink the gap between value and price. If you’re willing to hold 10+ years, I think you’ll come out okay in Apple even if you pay up. But based on the actual business, your long-run stock returns will likely be in the 4-6% per year range, not the 30%+ that Apple has returned lately.

Bottom Line

This earnings season is the first earnings season without the $250-300 per-child-per-month tax credit, and the 2021 relief checks are 3 months further removed. Consumer confidence has been battered by higher prices for food, fuel, and essential goods (and now by higher interest rates). When you throw the eventual need to restart student loans on top of this as the next shoe to drop, it’s clear that consumer-facing stocks are not where you want to be with valuations still significantly higher than pre-pandemic. Expect a lot of volatility for the broad market and a re-test of the March lows in the S&P 500 and NASDAQ. For those in AAPL, I’d expect the same–for the stock to retest the $150 level and probably start to trade in a range at or below it.

Be the first to comment