jurgenfr/iStock via Getty Images

Company description

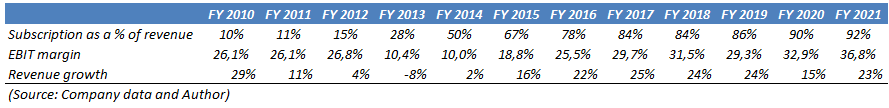

Adobe Inc. (NASDAQ:ADBE) is a software developer active in content creation, document management and digital marketing applications. The company has been one of the first to transition to a subscription model in 2013 and >90% of revenue come from subscriptions.

The group operates under three business segments: Digital Media (73% of revenue), Digital Experience (25% of revenue) and Publishing (2% of revenue).

The latter is irrelevant as it accounts for only a tiny fraction of total revenue and contains mainly legacy products such as eLearning solutions, technical document publishing or web conferencing platforms. This segment also includes Adobe Advertising Cloud.

Digital media encompasses two sub-segments: Creative Cloud (60% of total revenue) and Document Cloud (13% of total revenue). Creative Cloud is composed of iconic software used to create and manage photos and video content such as Photoshop, Illustrator, InDesign, Premiere Pro, Dreamweaver and many others. Some of these products have been around for decades. For instance, Photoshop is the industry-leading image editing software since its launch in 1989. Such a feat is the result of operational excellence, strong innovation and constant product improvement. Document Cloud encompasses solutions for the creation, visualization, management and signature of digital documents such as the Acrobat family of products. Digital media is the highest margin business with gross margin reaching 96% as the company faced limited competition and has limited marketing expenses (high portion of direct sales are generated through Adobe.com).

Digital Experience regroups marketing, advertising, e-commerce and analytic solutions on one integrated platform. These solutions enable corporations to manage their marketing campaigns from email delivery campaigns, ad buying or measuring the success of a marketing campaign. This business is somehow complementary to the digital media business. The latter creates content while the former uses that content for marketing purposes. The business segment has a lower level of profitability (66% gross margin) than the digital media business because of a more difficult competitive landscape and a higher need for marketing resources (sale representatives and marketing budget). Nevertheless, this level of profitability is already decent and should improve as the business scales.

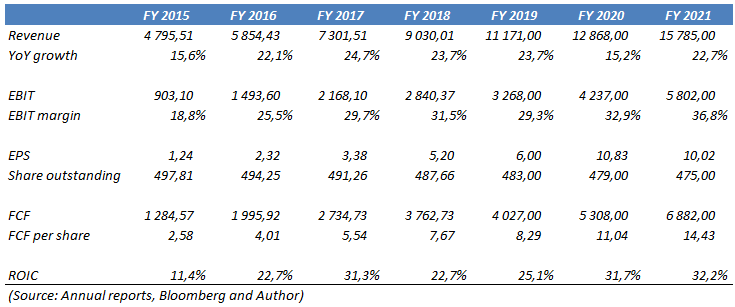

ADBE stock key metrics

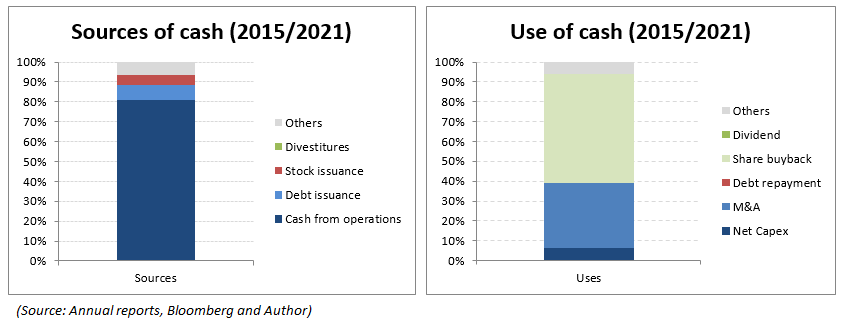

Adobe’s financial numbers are very impressive. Revenue grew at a 22% CAGR over the period 2015/2021 while operating margins improved from 18.8% to 36.8% thanks to the business model transformation. As a result, EPS and FCF per share grew at a 42% and 33% CAGR over the same period, respectively. On the negative side, the number of shares outstanding has only modestly declined at a -1% CAGR despite that 55% of its source of cash on average is allocated to share buyback activities. Finally, the ROIC improved and averaged an excellent 25% over that period.

Annual reports, Bloomberg and Author Annual reports, Bloomberg and Author

A strong business model

Firstly, Adobe enjoys significant barriers to entry. Indeed, Adobe’s creative solutions are so widespread among photographers, video editors, illustrators… that students and new professionals have to learn about how to use it. The increasing number of users forces universities to train their students on Adobe’s applications, further incentivizing corporations to install it (creating a network effect). Besides, the different applications are so integrated in the daily life of creative professionals that switching to a competitive offering is highly unlikely as employees and corporate will become inefficient, and it will require a lot of training time to master a new tool. Acrobat and its famous PDF file format further strengthen the high switching costs. Indeed, given that PDF is one of the first file format to be developed (introduced in 1992), it enjoys a very large installed base of users, which is a strong barrier to overcome for a potential competitor.

Adobe has also successfully transitioned from a license-based to a subscription-based model, which improves revenue visibility, eliminates piracy (less loss of revenue), transforms the elevated upfront-cost required to install a software to a stream of accessible monthly payments and reduces the number of versions to maintain (lower maintenance costs).

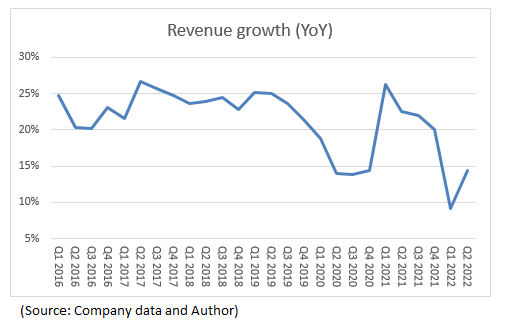

Company data and Author

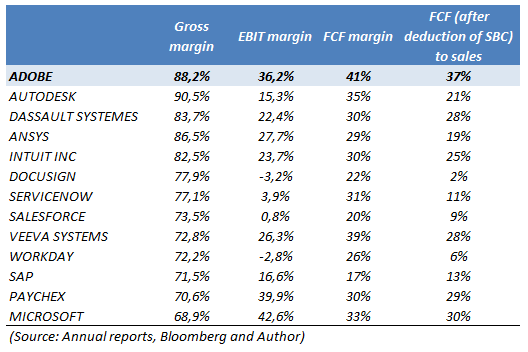

Adobe is a highly profitable and cash-generative business. Gross and EBIT margins are amongst the highest in the industry. From our understanding, margins are higher than peers for two reasons: 1) sales from digital media (creative and document software) are mainly derived from its website Adobe.com (limit the Salesforce (CRM) need) and 2) a strong focus on cost rationalization (especially during acquisitions).

Annual reports, Bloomberg and Author

Adobe is also highly cash generative because it is an asset-light and scalable business. Indeed, the capex to sales ratio is in-between 2% and 3% and selling new subscriptions or solutions to new clients does not require additional investments. Besides, working capital is negative as customers pay upfront an annual subscription (deferred revenue is a current liability).

Why did Adobe stock drop below $400?

Adobe’s stock price had an incredible run over the last few years. The annual total shareholder return was 28% and 20% over the last ten and five years, respectively. However, the share price has collapsed since December 2021 when the stock was trading at around $700. It currently trades at around $372.

Firstly, the stock suffered from a contraction in valuation multiple resulting from the surge in interest rates. Indeed, FCF yield increases from 2%-2.5% to almost 4%. From a P/E perspective, the ratio declined from >45x to 25x nowadays. In addition, revenue growth has decelerated from 20%-25% to 10%-15% in recent quarters. At the same time, the company lowered its 2022 guidance due to the war in Ukraine (discontinuation of the business in Russia) and negative FX impacts. Adobe now expects $17.65B in revenue and $9.95 in earnings per share ($17.9B in revenue and an EPS of $10.25 previously).

Annual reports and Author

Finally, investors are worried about increasing competition because of new players such Canva. However, we believe that disrupting Adobe is a daunting task at best, especially after the launch of Creative Cloud Express, a 100% web and mobile free solution, which limits the competition from freemium players such as Canva.

Growth opportunities

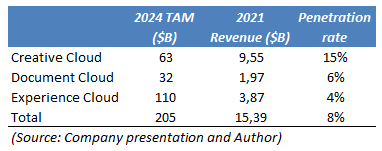

Adobe was able to grow revenue at >20% per annum over the last few years. Going forward, Adobe has significant room to grow as its penetration rate is still low. Indeed, the company considers a 2024 TAM of $205B split as follows: $63B for Creative Cloud, $32B for Document Cloud and $110B for Experience Cloud.

Company presentation and Author

The Creative Cloud benefits from the increasing content consumption which is notably driven by the digitalization of the world, the rise in e-commerce, the development of digital marketing and the proliferation of social networks. Besides, Adobe should continue to upsell existing products to its client base by increasing the number of functionalities (e.g.: mobile applications) and by selling more applications (e.g.: bundled offering). In addition, the dominant position of Adobe combined with a lack of competition and its importance in the day-to-day operations to content creators enable Adobe to raise prices, especially considering that the company keeps investing into new functionalities over time.

The Documents Cloud business is poised to benefit from the paper to digital evolution. Home-working has been a clear trend accelerator, increasing the use of online documents. The company is also in a good position to upsell premium services such as mobile and e-signature. Mobility is also a net positive as people desire to access their documents from anywhere at any time.

Experience Cloud benefits from the growth in e-commerce and the increasing need for data analytics. Besides, Adobe has the opportunity to cross-sell Experience Cloud solutions to its Creative Cloud customers as many of them are a natural fit.1

Valuation

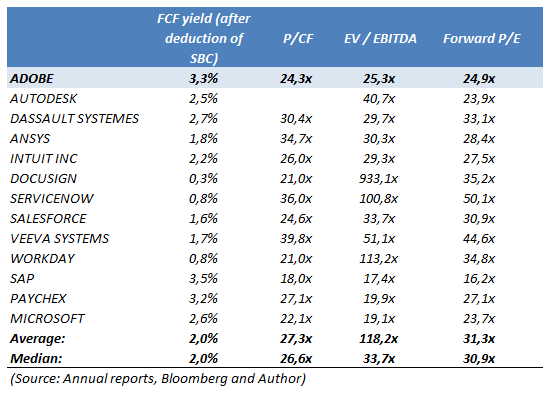

Adobe does not look cheap which is normal for a high-quality compounder. Nevertheless, valuation multiples have rarely been so inexpensive from a historical perspective. On a relative basis, Adobe seems to be trading at a discount to peers despite having stronger cash generation and more or less a similar growth profile.

Company presentation, Bloomberg and Author

Is Adobe stock a buy, sell or hold?

Adobe enjoys an attractive business model, which offers revenue visibility, industry-leading profitability and strong cash generation. Besides, the company has a strong balance sheet (net cash position) and is run by an excellent management team that has built a strong operational track-record over time. Valuation does not look highly compelling, but the combination of reasonable valuations and strong growth profile (double-digit EPS growth) seems to be offering a decent buying opportunity.

Be the first to comment