JHVEPhoto/iStock Editorial via Getty Images

Elevator Pitch

Abbott Laboratories (NYSE:ABT) is a Sell before upcoming earnings. The company is likely to deliver an earnings miss when it releases its Q2 2022 results this week. To make things worse, Abbott’s current valuations are demanding, which suggests a potential derating of its valuation multiples going forward.

ABT Stock Key Metrics

ABT’s key metrics are the company’s most recent Q1 2022 financial results and its post-earnings announcement stock price performance.

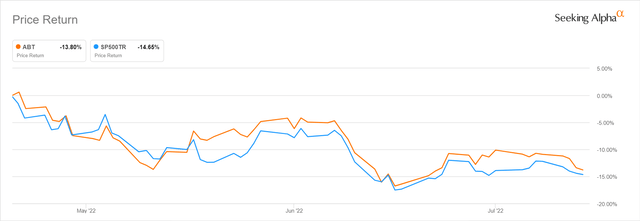

After Abbott reported its first-quarter results on April 20, 2022 before the market opened, the performance of the company’s shares have largely tracked that of the broader market. As per the chart below, ABT’s stock price declined by -13.8% following its Q1 2022 earnings release. During the same period, the S&P 500 was down by -14.7%.

ABT’s Post-Q1 Results Share Price Performance

In my opinion, Abbott’s share price performance in the past three months is a reflection of the market’s view of the stock. Investors are encouraged by ABT’s better-than-expected Q1 2022 financial performance, but they are also concerned whether the company’s upcoming Q2 2022 results will be below expectations.

As per its Q1 2022 financial results press release, Abbott’s revenue increased by +13.8% YoY from $10.5 billion in the first quarter of 2021 to $11.9 billion in the most recent quarter. Adjusted for the effects of foreign exchange, ABT’s organic revenue would have grown by an even higher +17.5% YoY in Q1 2022. Furthermore, Abbott’s first-quarter top line was +8% higher than the sell-side analysts’ consensus revenue projection of $11.0 billion. ABT’s non-GAAP adjusted diluted earnings per share or EPS expanded by +31.1% YoY from $1.32 in Q1 2021 to $1.73 in Q1 2022, which was +18% better than the market’s expectations of a first-quarter EPS of $1.46.

However, Abbott’s strong growth in its top line and bottom line for the first quarter of 2022 doesn’t seem to be sustainable for the rest of the year.

Revenue relating to the COVID-19 pandemic such as the sale of testing products amounted to $3.3 billion in Q1 2022, and this revenue stream accounted for 28% of ABT’s top line in the most recent quarter. Assuming that pandemic-related sales were excluded, Abbott’s Q1 2022 adjusted revenue growth would have been much lower at +3.9% YoY (or +7.7% in organic growth terms adjusted for foreign exchange).

More importantly, Abbott is only guiding for $4.5 billion of pandemic-related revenue for full-year FY 2022 as indicated in its Q1 2022 earnings media release. This implies that ABT expects to only recognize another $1.2 billion in COVID-related sales for the remaining three quarters of fiscal 2022, which points to a substantial slowdown in the sales of testing products for the rest of the year. This doesn’t come as a surprise, as ABT’s Q1 testing revenue was mainly driven by a new wave of COVID-19 cases related to the Omicron variant. As such, it is reasonable to assume that Abbott’s excellent first-quarter performance won’t be repeated in subsequent quarters.

When Does Abbott Laboratories Report Earnings?

Abbott Laboratories is reporting the company’s Q2 2022 earnings on July 20, 2022 prior to trading hours, as per its announcement issued at the end of last month.

What To Expect From Earnings

I expect Abbott’s Q2 2022 financial results to come in below market expectations.

In an earlier section of this article, I touched on the expected decline in contribution from COVID-related revenue like the sale of testing products in Q2 2022 and 2H 2022. Besides this, there are three other negative factors that will weigh on ABT’s second-quarter earnings.

Firstly, Abbott highlighted at its Q1 2022 earnings call that it has revised its ex-COVID (excluding testing product sales) revenue growth guidance for FY 2022 downwards from “high single digits” to “mid- to high single digits”, considering the impact of “a voluntary recall in February of certain infant formula products manufactured at one of our U.S. facilities.”

Secondly, the continued strengthening of the US dollar will hurt ABT’s headline revenue in the second quarter of 2022. As per S&P Capital IQ data, Abbott derived approximately 62% of its total sales in non-US or foreign markets in FY 2021.

Thirdly, inflationary cost pressures will be a headwind for ABT. Abbott revealed at its first-quarter results briefing that the company “incorporated an additional $200 million in gross margin impact” relating to higher costs for “logistics and commodities.”

More importantly, I don’t think that the market’s consensus numbers have factored in all the negatives that will be a drag on ABT’s bottom line in Q2. Abbott’s consensus Q2 2022 EPS forecast has largely remained unchanged for the past three months. In addition, Wall Street seems to be split on the financial outlook for ABT, with seven analysts raising their earnings estimates and eight other analysts lowering their bottom line projections over the same period. In my view, this translates into a high probability of negative earnings surprises for Abbott when it announces earnings this week.

Is ABT Stock Overvalued?

ABT stock is overvalued.

Abbott is currently valued by the market at a consensus forward next twelve months’ normalized P/E multiple of 25.6 times, according to valuation data sourced from S&P Capital IQ. This represents a 21% premium as compared to ABT’s 10-year average forward P/E of 21.1 times.

ABT’s valuations are also expensive when one compares the stock’s current P/E multiple to the company’s future growth prospects, as highlighted in the next section of this article.

What Is Abbott’s Long-Term Forecast?

The Wall Street analysts forecast that Abbott will deliver revenue and normalized EPS CAGRs of +4.1% and +7.3%, respectively for the FY 2023-2026 period as per S&P Capital IQ. During the FY 2016-2019 period prior to the COVID-19 pandemic, ABT achieved a top line CAGR of +11.8% and a bottom line CAGR of +10.8%.

A high-single digit annualized earnings growth rate doesn’t provide support for Abbott to be trading at a forward P/E multiple in excess of 20 times. Moreover, Abbott is expected to generate slower revenue and bottom line growth in the next couple of years as compared to what it did in the past.

In conclusion, the long-term financial forecasts for ABT support my view that ABT’s shares are overvalued now.

Is ABT Stock A Buy, Sell, or Hold?

ABT stock is a Sell. Abbott should suffer from a valuation de-rating over time, as its Q2 2022 earnings come in below expectations and it experiences slower growth in the next few years.

Be the first to comment