Michael Vi/iStock Editorial via Getty Images

1) General

ironSource (NYSE:IS) is a software business that offers mobile app developers a suite of software products to help them expand, engage, and monetize their user base. The tagline on their website is “turning apps into scalable businesses.” ironSource is a “picks-and-shovels” play on the growth of both mobile gaming and digital apps. The business was founded in 2010 by a team of seven Israeli entrepreneurs who all remain actively involved in senior management positions. It is headquartered in Tel Aviv, Israel.

ironSource benefits from a number of secular growth trends. This includes the shift from desktop to mobile advertising, growth in mobile gaming, and expansion of the app economy. According to eMarketer, the average adult in the US spends more than four hours per day on their mobile phone. More than 80% of this time is spent on mobile apps, such as gaming or social media apps. As mobile phone usage continues to increase and more of the developed world becomes digitized, ironSource is well placed to leverage these structural trends.

Almost 90% of ironSource’s revenue comes from serving mobile game app developers, according to their recent Q4 earnings conference call. Global Industry Analysts suggests that this market is expected to continue to grow at double-digit rates for the next half-decade, providing a strong tailwind for ironSource to grow their customer and revenue base. ironSource boasts an impressive founder-led management team that, in stark contrast to most other public tech companies valued in the $1-5b market cap range, prioritizes profitable growth, with 35% adjusted EBITDA margins in 2021. Moreover, ironSource has world-leading net revenue retention rates, which averaged 158% over the past 10 quarters. With a fortress balance sheet and a reasonable valuation of 4.8x forward sales and 21.5x forward earnings, I believe ironSource should deliver at least a 15% internal rate of return (IRR) for investors through to 2026.

2) A SPAC (But Not Like The Others)

ironSource entered the public markets in June 2021 via a Special Purpose Acquisition Company (SPAC) merger with Thoma Bravo Advantage. Led by Orlando Bravo, Thoma Bravo is one of the leading software-focused PE firms in the US, with more than 270 software investments to date. In their SPAC presentation, Thoma Bravo disclosed an astonishing 51% gross IRR on realized software investments made under the supervision of this SPAC sponsorship team, providing a morsel of hope for ironSource shareholders bleeding red so far throughout 2022.

SPACs have sold off aggressively over the past 12 months as investors have rotated from unprofitable growth stocks in the tech sector (many of which are SPACs) towards more profitable businesses outside of the tech sector. And ironSource has not been immune to this carnage, with shares down more than 57% in the past six months and 42% in 2022 alone.

However, while investors seem to be indiscriminately selling down all SPACs, there are diamonds in the rough for curious investors. In particular, here are several differences between ironSource and other SPACs with similar price declines:

-

ironSource is profitable with 35% adjusted EBITDA and 11% net income margins in 2021;

-

ironSource has an established business model with clear product-market fit in the mobile gaming sector (net revenue expansion rate has exceeded 145% for the past 10 quarters);

-

ironSource has exceeded all financial projections since going public; and

-

Thoma Bravo is a credible SPAC sponsor with a demonstrated track-record of investment success in the software sector.

3) Product Offering

ironSource has two core products: (1) Sonic and (2) Aura.

Sonic

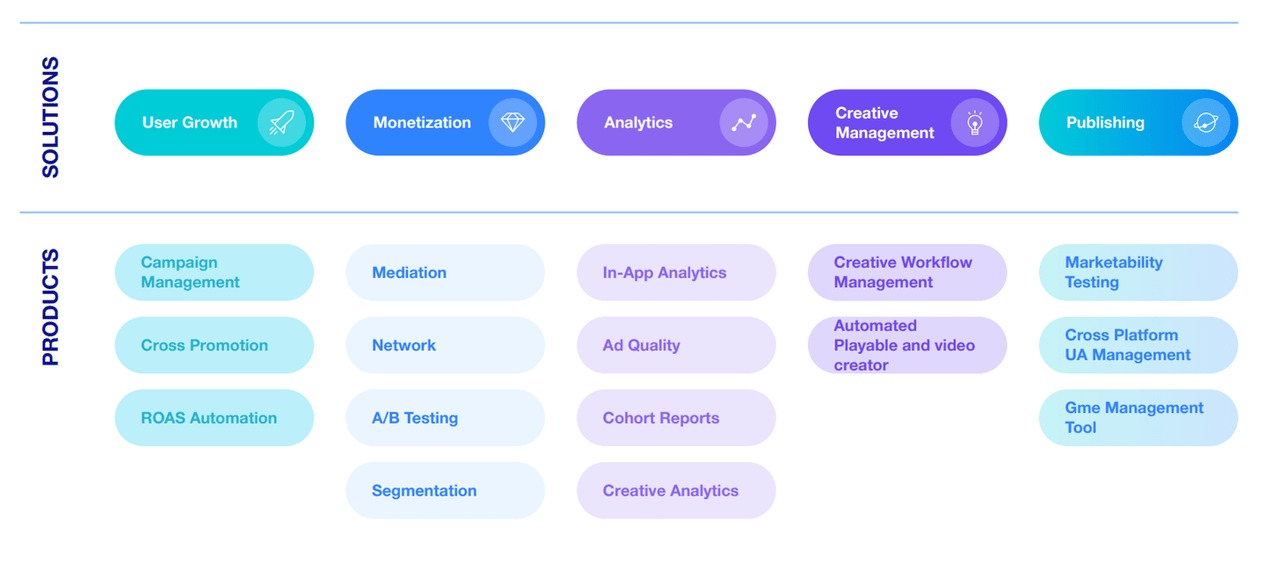

Sonic offers software products that help app developers turn their mobile game from a concept into a profitable business. Mobile game developers can use ironSource Sonic to:

-

Publish their game (Publishing);

-

Expand their user base through targeted digital marketing (User Growth);

-

Better monetize their user base through programmatic in-app advertising (Monetization); and

-

Evaluate and refine their user acquisition and monetization efforts (Analytics and Creative Management).

As of Q4 2021, Sonic accounted for 88% of ironSource’s revenue and had significant penetration in the US mobile game market, with 88% of the top 100 most downloaded games using at least one of their products. Established customers include Aristocrat Leisure Limited (OTCPK:ARLUF) and Activision Blizzard (NASDAQ:ATVI).

It is important to note that ironSource does not provide tools to help app developers create a mobile game. Mobile game developers have a choice of working with Unity Software (NYSE:U) or Epic Games to create their games. However, once a game has been built, ironSource helps app developers across the remainder of the app lifecycle, including user expansion and monetization.

Sonic Solution Suite (ironSource Q3 Investor Presentation)

Aura

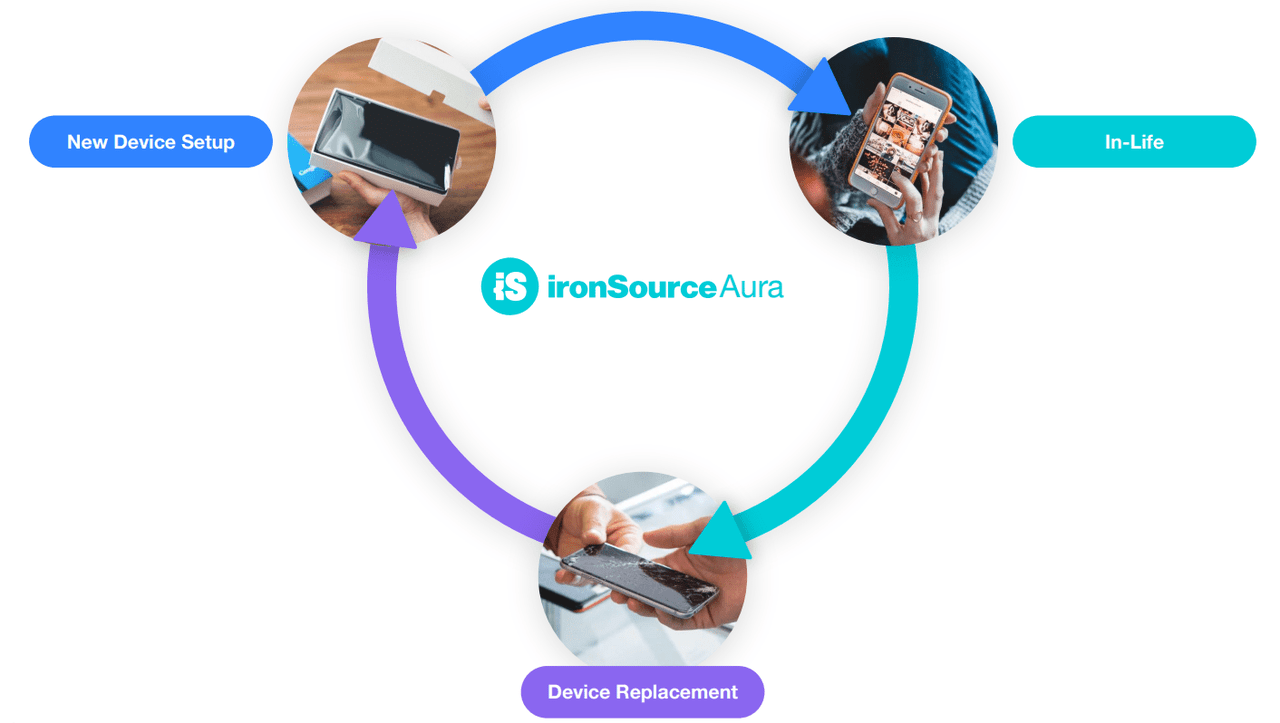

Aura helps telecom companies improve their customer experience through adding customer touchpoints across three stages:

-

Setting up a new device (i.e., after initial purchase of a mobile phone);

-

During normal use; and

-

When replacing the device.

Using ironSource Aura, telcos can leverage mobile apps to: (1) better communicate and engage with their customers, and (2) promote their own or other’s products and services, helping to generate incremental revenue. For example, a telco (e.g., Vodafone) using Aura could schedule personalized promotions to a customer when that customer is engaged with their mobile device, or send push notifications about renewing a mobile phone plan if that plan is nearing expiration. As of Q4 2021, Aura accounted for 12% of ironSource’s revenue. Customers include Samsung Electronics (OTC:SSNLF) (KRX:005930), T-Mobile US (NASAQ:TMUS), and Vodafone Group (LON:VOD).

Aura Product (ironSource Q3 Investor Presentation)

4) Business Model

ironSource generates revenue via a combination of:

-

Revenue share;

-

Usage-based; and

-

In-app monetization.

Each individual solution and product is monetized differently. However, most of Sonic’s revenue comes from revenue share agreements with their mobile game developers, which aligns the interests of ironSource with their customers. As a developer earns more mobile app revenue from using ironSource’s software solutions, ironSource receives a cut of that revenue. In other words, if ironSource does not add value for its customers, it receives little revenue. As such, we can use top-line metrics like revenue, as well as retention metrics, to appraise customer satisfaction.

Similar to most B2B software companies, ironSource has a ‘land-and-expand’ strategy with a focus on first signing initial partnerships with customers – often a single solution to get their foot in the door – and then increasing the amount of solutions that customer uses over time. As of Q4 2021, more than 70% of ironSource’s large customers used at least two products, demonstrating the success of this approach.

5) Financial & Operational Metrics

ironSource boasts an impressive financial profile with strong revenue growth, high adjusted EBITDA margins, and world-leading net revenue retention rates.

Revenue

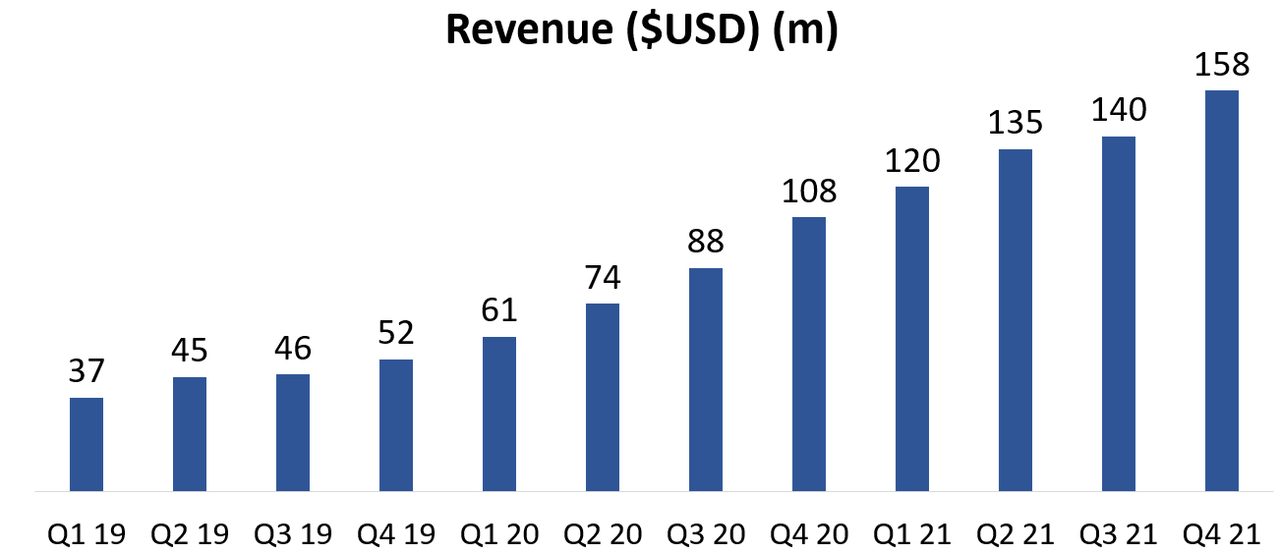

In 2021, ironSource reported $553m of revenue, which was up 67% from 2020. This represented a slight deceleration from the 83% revenue growth reported in 2020, although 2020 included extra COVID-related demand. Of note is that 99% of revenue growth in 2021 was organic.

Since Q1 2019, ironSource has grown revenues at a compound annual growth rate (CAGR) of 70%, with no sequential QOQ declines in revenue. This is impressive given that ironSource generates most of their revenue from revenue share agreements, which tend to be lumpier than fixed subscription fees.

Quarterly Revenue Chart (Author Generated from ironSource SEC Filings)

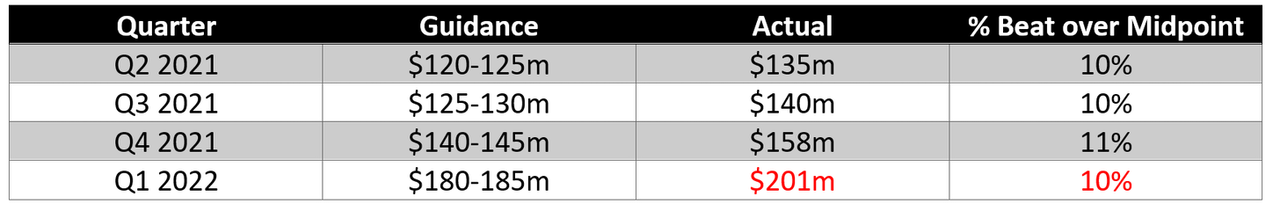

ironSource has demonstrated a consistent “beat-and-raise” approach to issuing guidance, having exceeded all revenue projections since going public by 10-11%. If we extrapolate this same trend to Q1 2022, we would expect revenue in Q1 2022 of $201m, representing 27% QOQ growth and 68% YOY growth. If ironSource instead meets the midpoint of their guidance, their Q1 2022 revenue would represent 16% QOQ growth and 52% YOY growth.

Forecast vs. Actual Revenue (Author Generated from ironSource SEC Filings)

ironSource also raised their 2021 revenue guidance each quarter following announcement of their SPAC deal with Thoma Bravo. See the below upgrades:

-

Pre-SPAC guidance: $455m revenue.

-

Updated guidance at Q1 2021 results: $480-490m revenue.

-

Updated guidance at Q2 2021 results: $510-520m revenue.

-

Updated guidance at Q3 2021 results: $535-540m revenue.

-

Actual 2021 revenue reported at Q4 2021 results: $553m revenue.

It is clear that ironSource has a management team that understands the game of Wall Street and sets guidance to deliver consistent “beat-and-raises.”

In 2022, ironSource is forecasting $790-820m revenue, which would represent 43-48% YOY growth from 2021. While growth appears to be decelerating based on this guidance, it is important to note that: (1) ironSource experienced a bump in demand in 2020/2021 as people were stuck at home with more spare time for mobile gaming; and (2) ironSource has a demonstrated track record of exceeding guidance, so I would not be surprised to see revenue growth exceed 50% in 2022.

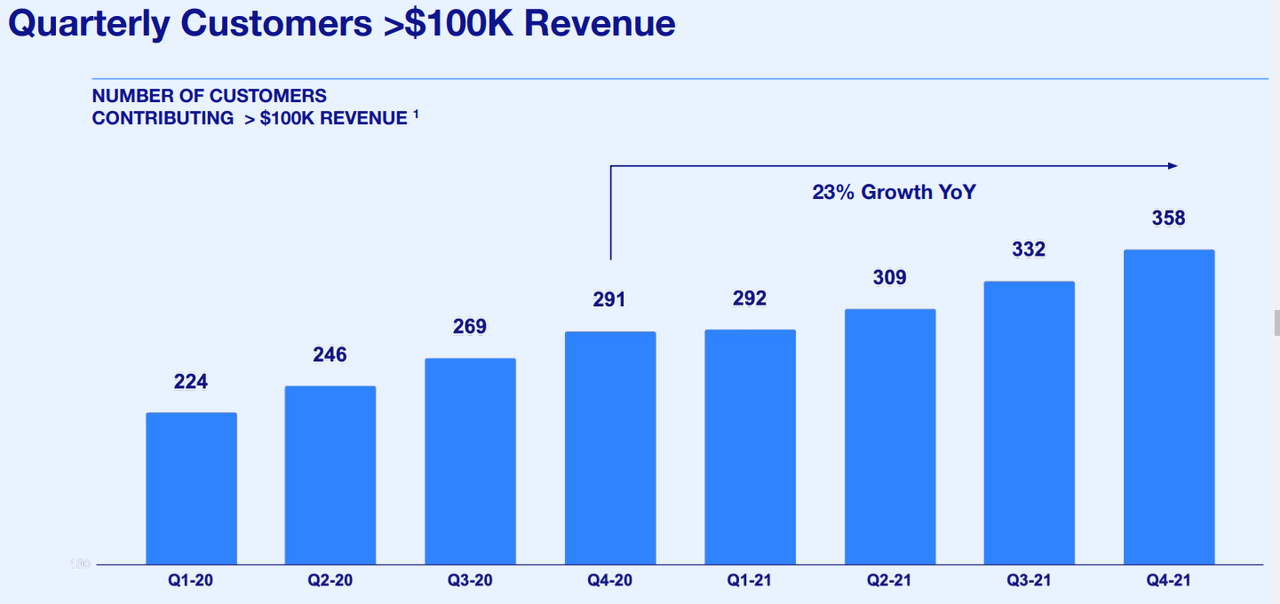

Number Of High-Spend Customers

As of Q4 2021, ironSource generates 95% of revenues from larger customers spending at least $100,000 on an annualized basis. Since Q1 2020, ironSource has reported consistent QOQ increases in the number of high-spend customers, helping to fuel revenue growth. Growth in high-spend customers from 224 (Q1 2020) to 358 (Q4 2021) represents a 31% CAGR. As a general rule, larger customers tend to be less prone to churning than smaller customers, owing to greater switching costs and lower risk of going out of business.

Large Customer Count (ironSource Q4 Investor Presentation)

Gross Margins

In 2021, ironSource reported gross margins of 83.8%, which expanded 120 bp from 82.6% in 2020. These gross margins are in line with other high-margin software companies and provides a strong foundation for operating leverage as the business scales.

Gross & Net Retention Rates

ironSource has world-leading retention rates, both on a gross and net basis. As of Q4 2021, ironSource’s gross retention rate was 98% (out of a maximum of 100%), indicating little churn and high customer satisfaction. This gross retention rate has also trended high over time from 96% in 2019 and 97% in 2020.

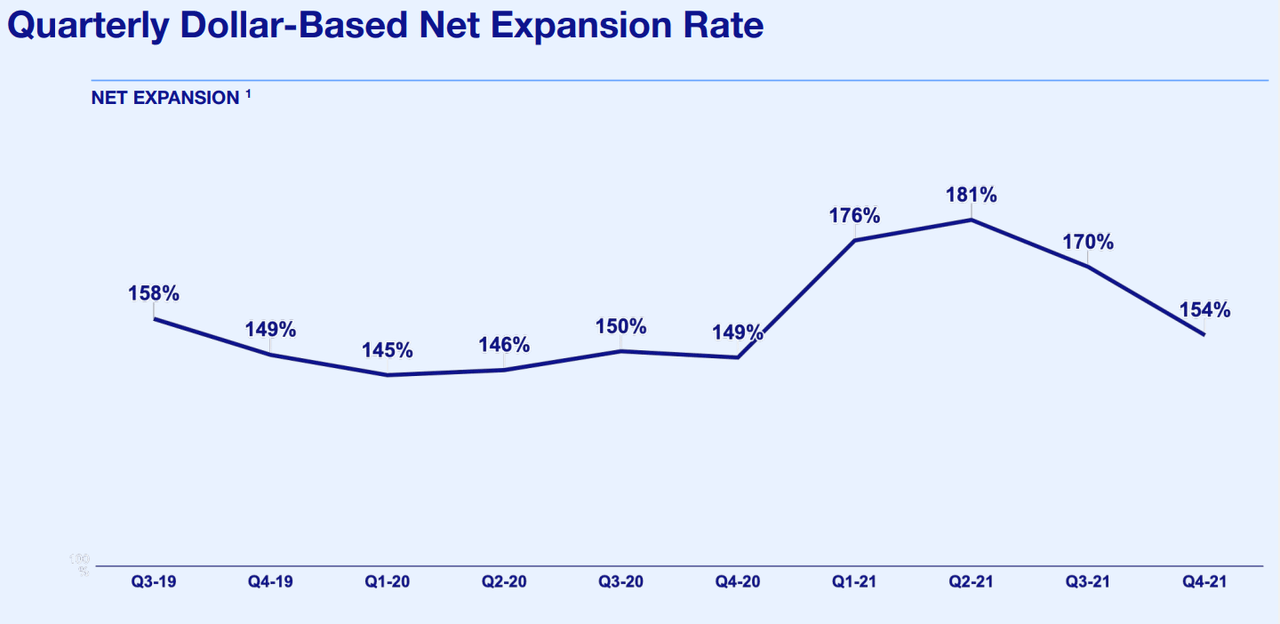

What is even more impressive about ironSource is their incredible net revenue expansion rate, which has exceeded 145% for the past 10 quarters. Throughout this period, ironSource’s net expansion rate has averaged 158%, which, to the author’s knowledge, is the second highest reported figure for a software business in the public markets behind Snowflake (NYSE:SNOW).

What this means is that ironSource’s existing customers – on average over the past 10 quarters – spent 58% more on ironSource with each successive year. In other words, if ironSource had not been able to acquire a new customer over the past 10 quarters, revenue would have still grown at a 58% CAGR.

Net Revenue Expansion Rate (ironSource Q4 Investor Presentation)

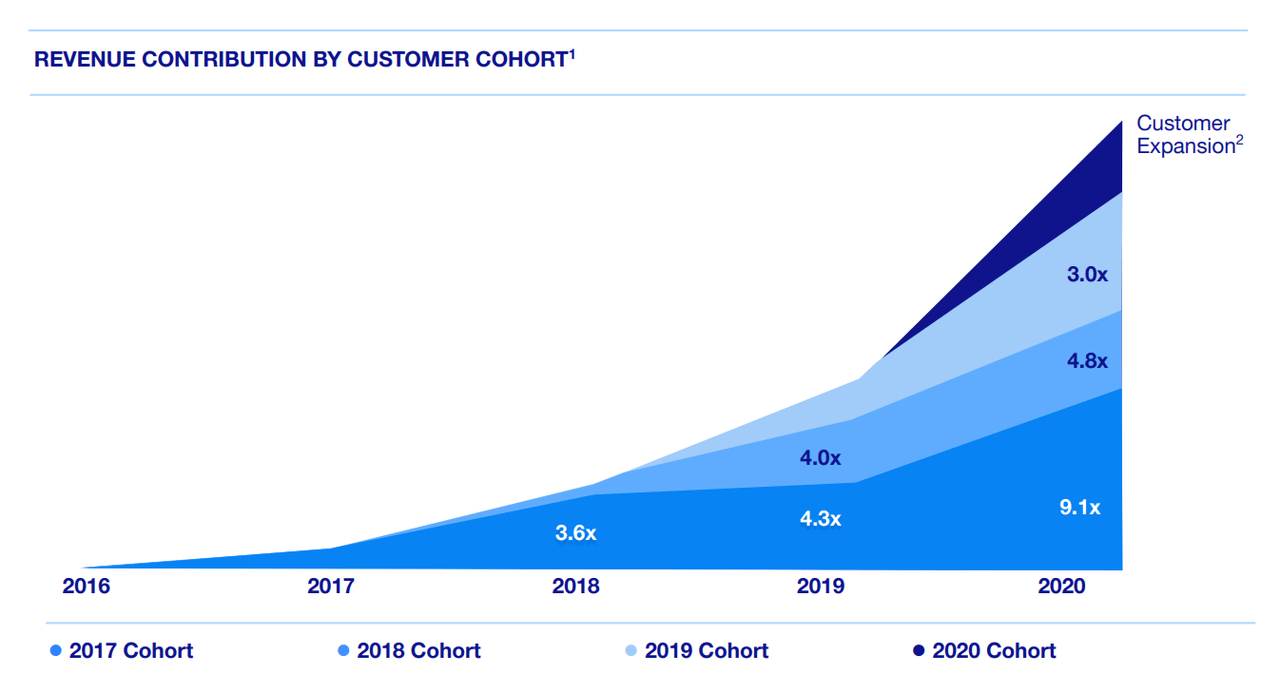

Data from ironSource’s recent presentations also indicates their strong cohort expansion over time, dating back to 2016. Once a customer is acquired, ironSource generates multiples of that customer’s spend over the first 12 months with each successive year. While ironSource does not disclose their LTV/CAC ratio, their impressive cohort expansion, high retention rates, and 35% adjusted EBITDA margins make me confident that unit economics are strong, supporting increasing marketing spend to acquire new customers.

Customer Cohort Expansion (ironSource Q3 Investor Presentation)

EBITDA & Net Income Margins

What first attracted me to ironSource was management’s focus on “profitable growth,” which lies in stark contrast to most tech companies which have entered the public markets in the past 24 months and continue to bleed cash with negative operating margins.

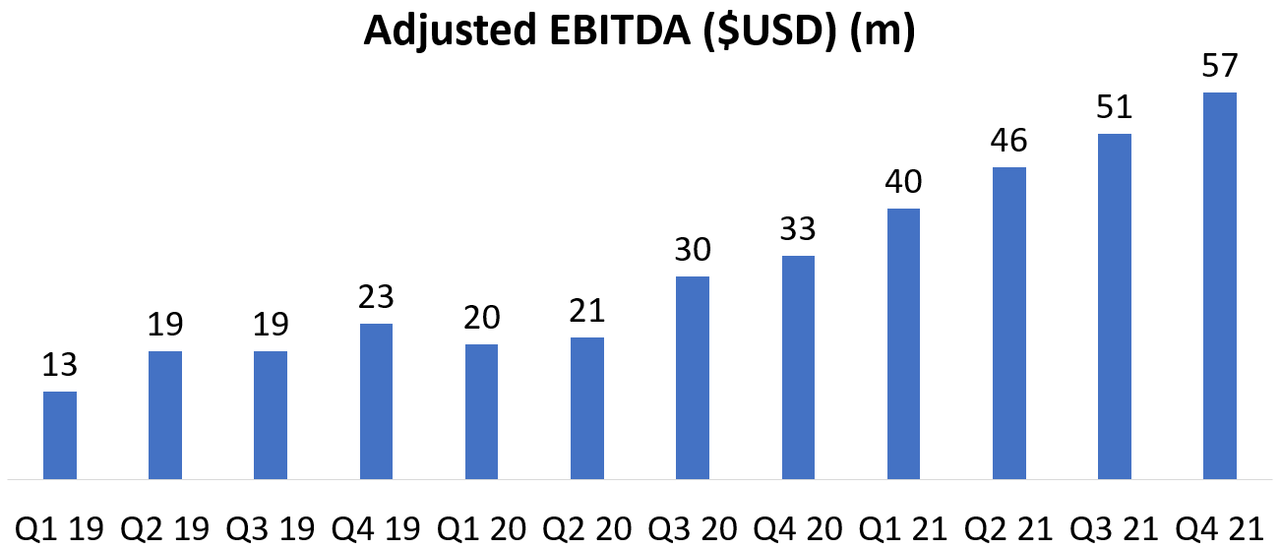

In 2021, ironSource reported adjusted EBITDA (excludes stock-based compensation and acquisition-related expenses) of $194m, which was up 87% from 2020. On a percentage basis, this represented a 35% adjusted EBITDA margin, which was up from 31% in 2020.

Since Q1 2019, adjusted EBITDA has grown at a 71% CAGR, just ahead of their 70% revenue CAGR over the same period.

Adjusted EBITDA Chart (Author Generated from ironSource SEC Filings)

ironSource is forecasting adjusted EBITDA margins to decline slightly to 31-34% in 2022 due to increased investments to build out their presence outside of mobile gaming.

In contrast to a large number of tech companies in the $1-5b market cap range, ironSource is also profitable on a GAAP net income basis, reporting net income margins of 11% in 2021 and 18% in 2020. ironSource incurred a large increase in SPAC-related costs and stock-based compensation in 2021, so I am not surprised nor concerned to see a decrease in net income margins from 2020 to 2021. ironSource is in their growth phase, so double-digit net income margins and 30% adjusted EBITDA margins demonstrate the scalability of their business model.

6) Competitive Landscape

ironSource’s core market is the US mobile gaming market which has grown at around a 20% CAGR over the past decade, so it is no surprise to see competition in the space. Below I’ve provided a brief description of three of ironSource’s main competitors.

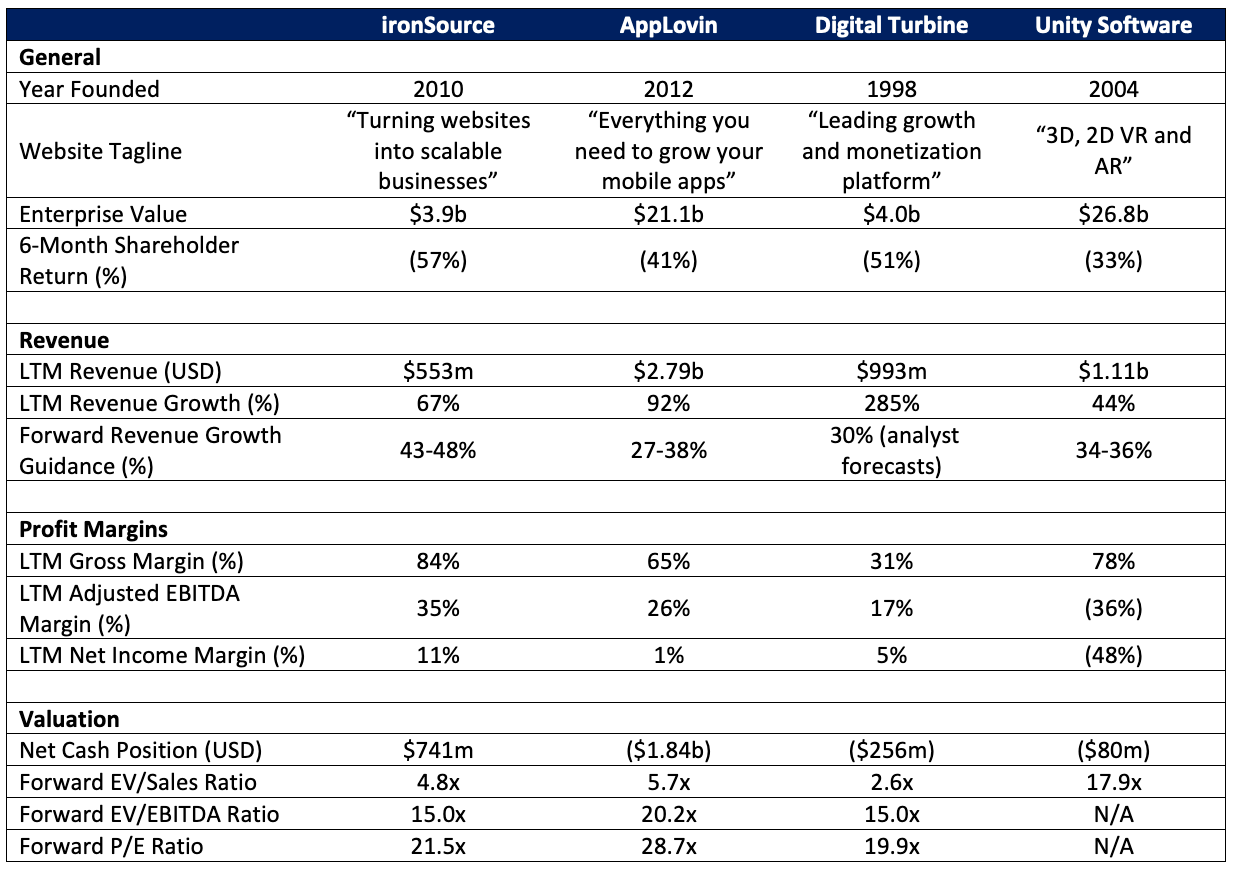

ironSource vs. Competitors (Author Generated on 10th April 2022 using Koyfin Data and SEC Filings)

Three companies that provide a similar range of services to ironSource are AppLovin Corporation (NASDAQ:APP), Digital Turbine (NASDAQ:APPS), and Unity Software (note: this applies to their “operate” segment). All companies provide software solutions to help app developers (both mobile game and non-game developers) increase app engagement, maximize revenue through targeted in-app advertising, and refine their marketing and content creation strategies.

What stands out in the above table is that ironSource is the smallest of the four businesses, both in terms of LTM revenue and enterprise value. Moreover, it has been the worst performer of the bunch over the past six months, with shares falling more than 57%. All companies have attractive revenue growth rates, with Digital Turbine a clear winner, although it must be noted that a large portion of this revenue growth has come via acquisitions, so growth rates should normalize over the coming 12 months. However, ironSource is projecting the highest revenue growth rate in 2022 as the growth rates of competitors normalize following large acquisitions.

When assessing profit margins, ironSource is a clear standout performer with the highest gross margins, adjusted EBITDA margins, and net income margins. What makes this more impressive is that ironSource has achieved such margins without the scale of their larger competitors, reflecting excellent product-market fit in the mobile gaming sector and an organizational culture that values “profitable growth.”

Of the four, ironSource is the only business with a net cash position and trades on the second lowest forward P/E multiple and the equal lowest forward EV/EBITDA multiple.

Digital Turbine trades on the lowest forward revenue multiple, which makes sense given their gross margins are much lower than peers. Despite a net revenue retention rate above 140% and high switching costs, Unity Software’s valuation appears rich at 18x forward revenue.

On a surface level, ironSource looks attractively priced relative to competitors, with the strongest 2022 revenue growth guidance, highest gross, adjusted EBITDA, and net income margins, a net cash position, and reasonable forward P/E and EV/EBITDA multiples.

7) Growth Expansion Plans

Game Publishing

ironSource Sonic offers publishing solutions for small, indie game studios lacking the budget of larger game studios. As mentioned in a recent shareholder update, since its inception in February 2020, ironSource’s publishing business has grown to become one of the largest mobile game publishers in the US, with more than 50 published games, of which more than 30 reached the top 10 most downloaded games in the US. This publishing solution helps to sign up smaller game studios who can then be cross-sold additional solutions, boosting net revenue expansion rate.

Expansion Into Other Verticals

ironSource is expanding into other, non-gaming mobile apps, such as e-commerce, social, and dating apps. These verticals are less monetised than mobile games, of which in-app advertising is standard practice. Two of ironSource’s recent acquisitions (Tapjoy and Bidalgo) support these expansion plans by offering similar software solutions to ironSource, but to a broader range of verticals. These acquisitions, announced in Q4 2021, expand ironSource’s TAM from $41b to $50b.

What I like about ironSource’s approach to acquisitions is that: (1) acquired businesses tend to be earnings accretive and (2) acquisitions are often funded using cash.

For example, Tapjoy was acquired for $400m in an all-cash deal and reported revenue in 2021 of $81m along with GAAP profits. In a world of increasing shareholder dilution among public unprofitable companies, it is a breath of fresh air to see a profitable business using excess cash (rather than a capital raise or convertible note) to fund acquisitions.

International Expansion

While most of ironSource’s revenue appears to be generated within the US, there is scope to serve other geographies as the developed world digitizes. ironSource is headquartered in Israel, which should increase brand recognition and traction within Europe, Middle East, and Asia (EMEA), compared to a more US-centric business. To date, there has been limited discussion in ironSource’s conference calls about plans for international expansion, but I expect this to become a greater strategic focus in 2022 and 2023.

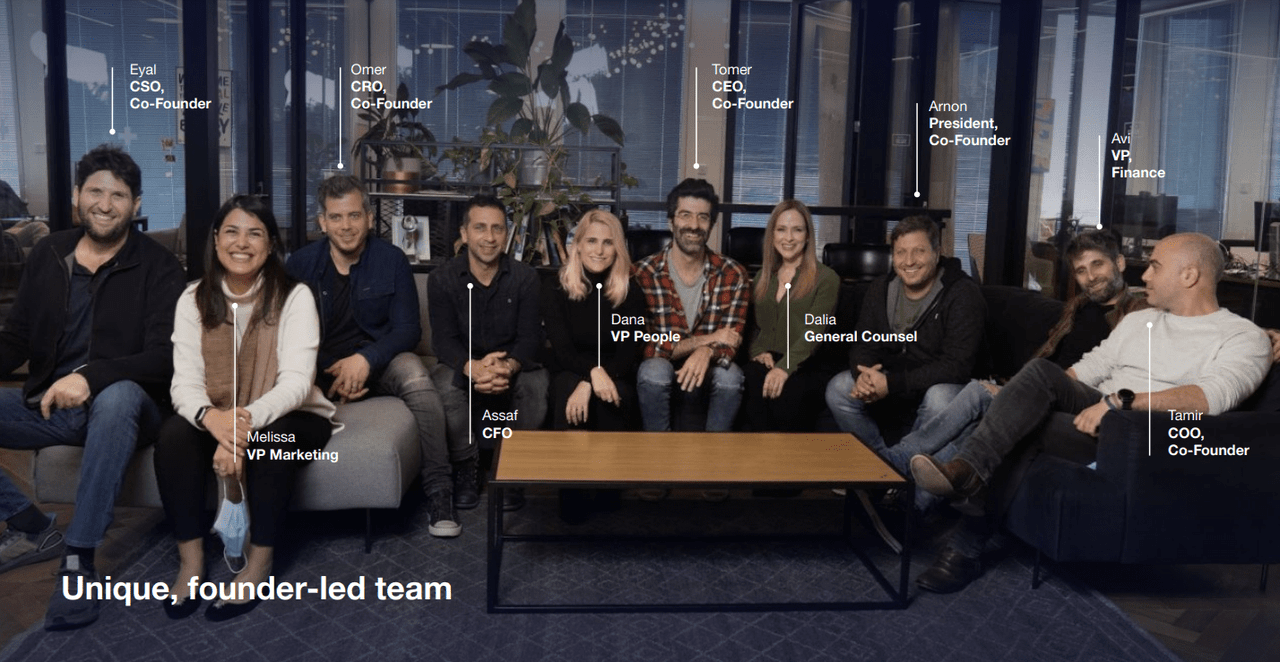

8) Management

ironSource boasts an impressive founder-led management team with notable inside ownership. Below I detail some of the core members of the senior management team.

CEO

Tomer Bar-Zeev is the Co-Founder and Chief Executive Officer (CEO) of ironSource. Prior to ironSource, he was the VP of Business Development at AtlasCT and Payoneer (NASDAQ:PAYO). He also has prior entrepreneurial experience as the Co-Founder of FoxTab, a web browser extension for Google Chrome, Firefox, and Internet Explorer designed to help users more efficiently organize their search tabs.

Tomer has an almost flawless 99% approval rating on Glassdoor from 129 ratings, and 90% of people would recommend working at ironSource to a friend.

According to TIKR, he owns 4.3% of outstanding shares (around $133m equity value), so has a vested interest in seeing ironSource shares recover to their SPAC merger price.

Glassdoor Reviews (Glassdoor)

Senior Management

One interesting aspect of ironSource’s organizational structure is that most of the senior management team are Co-Founders, who have remained with ironSource since their founding in 2010. This is a strong testament to a corporate culture that values staff retention and has been able to manage different personalities within such a large founding team.

-

Tomer Bar-Zeev – Co-Founder and CEO (owns 4.3% of outstanding shares).

-

Arnon Harish – Co-Founder, President, and Director (owns 1.7% of outstanding shares)

-

Omer Kaplan – Co-Founder and Chief Revenue Officer (share ownership unknown).

-

Tamir Carmi – Co-Founder and Chief Operating Officer (owns 1.6% of outstanding shares).

-

Eyal Milrad – Co-Founder and Chief Strategy Officer (owns 4.4% of outstanding shares).

The sole member of the C-suite team who was not a Co-Founder is Chief Financial Officer Assaf Ben Ami, who has been with ironSource for almost a decade.

The two Co-Founders who are not currently involved with the operations of ironSource’s business are Itay Milrad (Former Chief Technology Officer) and Roi Milrad (position unknown) who each own 4.4% of outstanding shares, representing an almost 9% combined ownership. Overall, insiders own at least 20% of shares outstanding, with no insider sales over the past 12 months.

Senior Management Team (ironSource Q2 Investor Presentation)

Orlando Bravo

Orlando Bravo is the Co-Founder and Managing Partner of Thoma Bravo, and also happens to be Puerto Rico’s richest person with a net worth greater than $6 billion. He was the lead sponsor for Thoma Bravo’s SPAC and is a board member of ironSource. Thoma Bravo has made over 270 software investments to date and I imagine Orlando would have been involved in at least several dozen of these, so seeing him commit to joining the board is a positive indicator of his long-term conviction in the business. Orlando owns 1.5% of shares.

9) Valuation

ironSource’s valuation appears compelling based on their financial metrics of 67% LTM revenue growth, 84% gross margins, and 35% adjusted EBITDA margins.

As of 10th April 2022, ironSource has a market cap of $4.66b and an enterprise value of $3.92b.

If we take the midpoint of ironSource’s 2022 guidance from Koyfin (keep in mind their trend throughout 2021 of smashing internal forecasts), ironSource trades on the following valuation multiples:

-

7.1x LTM revenue.

-

4.8x forward revenue.

-

5.7x forward gross profit (assuming gross margins remain unchanged in 2022).

-

15.0x forward adjusted EBITDA.

-

21.5x forward earnings (note: based on analyst estimates).

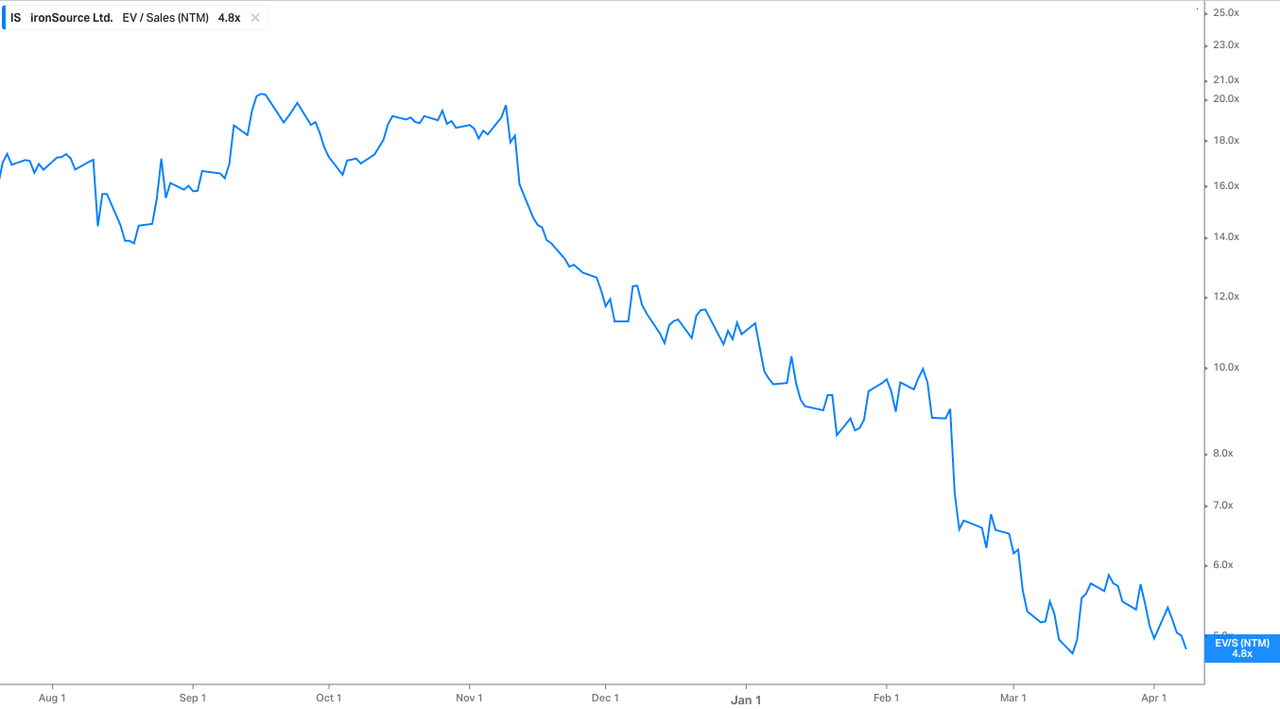

ironSource’s forward EV/sales multiple has contracted sharply since entering the public markets from a high of 20x as both the share price has fallen and 2022 revenue forecasts have been upgraded.

ironSource Forward EV/Sales Multiple (Koyfin Data)

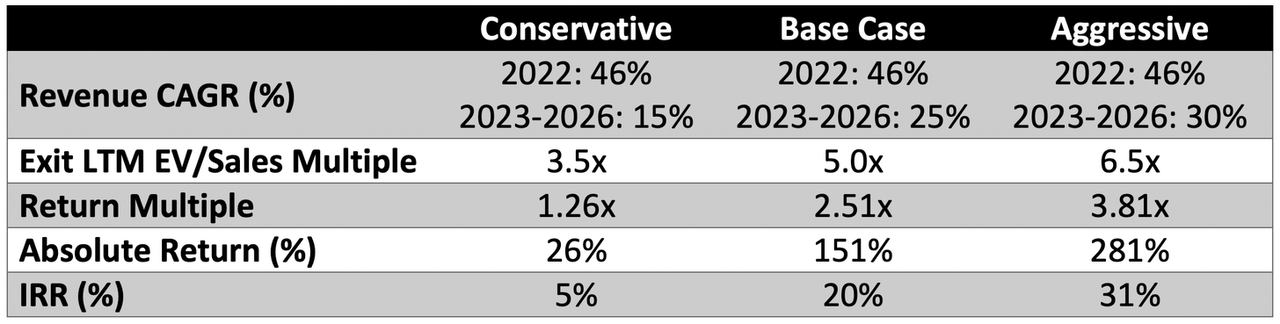

To estimate future returns based on “back of the envelope” calculations, I have compiled a table with the IRRs and return multiples for ironSource through to 2026 under conservative, base case, and aggressive scenarios. I have attempted to build margin for error into the model through assuming conservative exit multiples. I have estimated revenue growth rates using a combination of: (1) estimated growth rates for the US mobile gaming market through to 2026 (between 10-20% pa depending on the source); (2) ironSource’s historical growth rates, assuming deceleration due to the law of large numbers; (3) competitor growth rates at a larger scale; and (4) possible expansion into other verticals, such as e-commerce, dating, or social apps. In all scenarios, I have assumed that ironSource meets the midpoint of their 2022 revenue guidance (46% YOY growth), but have changed the forecasted revenue CAGRs from 2023-2026. These calculations were completed on the 10th April 2022.

Under a base case scenario where ironSource grows at a 25% revenue CAGR from 2023-2026 and trades on a 5x LTM EV/sales multiple (30% contraction in multiple from the current price), investors would be rewarded with a 2.5x multiple of invested capital or a 20% IRR.

Under a more aggressive forecast of 30% revenue CAGR from 2023-2026 and a 6.5x LTM EV/sales multiple (8% contraction in multiple from the current price), investors would earn a 31% IRR.

Under a conservative scenario where ironSource grows at a 15% CAGR from 2023-2026 and trades on a 3.5x LTM EV/sales multiple (51% contraction in multiple from the current price), investors would earn a 5% IRR.

Under all scenarios, I would expect ironSource to continue to post 30%+ adjusted EBITDA margins and up to 40% margins in the aggressive scenario, resulting in exit EV/EBITDA multiples of less than 20x.

Future Return Scenarios (Author Generated using Microsoft Excel)

10) Risks

However, there are several risks to ironSource’s business, none of which are fatal, but could have a material impact on ironSource’s future growth rates. These include:

-

ironSource loses their dominant market position in the US mobile gaming market due to increased traction from other competitors, such as AppLovin or Digital Turbine;

-

Consumer demand for mobile games does not grow as much as expected over the coming half-decade and/or consumer preferences shift to alternative console-based forms of gaming;

-

ironSource is unable to gain traction and find product-market fit in other verticals (e.g., social or dating apps); or

-

ironSource struggles to integrate recent acquisitions into their larger business, resulting in degradation in corporate culture and/or loss of staff.

11) Conclusion

ironSource is an impressive business with all the hallmarks of a secular compounder capable of earning a 15%+ IRR for investors through to 2026. The business has a founder-led management team with solid inside ownership and a long-term vision to expand into adjacent markets, such as social and dating apps.

ironSource has a demonstrated track-record of profitable growth with a 70% revenue CAGR since Q1 2019 and consistent 30%+ adjusted EBITDA margins over this period. As such, ironSource is not dependent on the capital markets to fuel further growth, which is an attractive proposition in the current environment with rising interest rates and waning investor enthusiasm for tech stocks. ironSource’s unit economics also appear strong, with net revenue retention rates averaging 158% for the past 10 quarters, and consistent growth across customer cohorts dating back to 2016.

While the business faces some competitive pressures, the backing of billionaire investor Orlando Bravo at a $11.1b valuation should comfort investors who are underwater with their investment. I will be purchasing shares in the coming weeks and will average into the position over time if ironSource continues to exceed their revenue/EBITDA forecasts throughout 2022.

Be the first to comment