guvendemir/iStock via Getty Images

Thesis

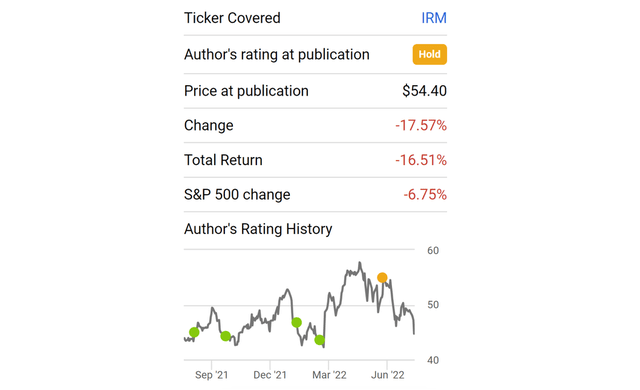

I have been a long-time bull on Iron Mountain (NYSE:IRM) as you can see from my previous articles below. I first published my bull thesis back in July 2021. The stock has delivered a total gain of almost 40% since then when its price hovered above $55. Then recently, I began to see the stock getting ahead of itself and published an article on May 29 entitled “Downgrade To Hold After 33% Gain”.

The price of the stock has declined by about 17% (in contrast to a 7% decline in the overall market) after the downgrade article. And some readers asked if it’s time to revise my recommendation again given such a sizable correction. And unfortunately, my answer is no for a few reasons. On the good side, the business is very conservatively leveraged at this point and well-prepared for what may come next, either higher borrowing costs or even a recession. But on the other side, the valuation is not cheap, growth will likely remain muted, and capital cost is likely to increase. All of these factors would lead to very limited returns in the near future.

As a result, I do not see the potential return justify the risks and uncertainties. And as such, I am reiterating my hold recommendation.

Seeking Alpha

Leverage ratio near record low

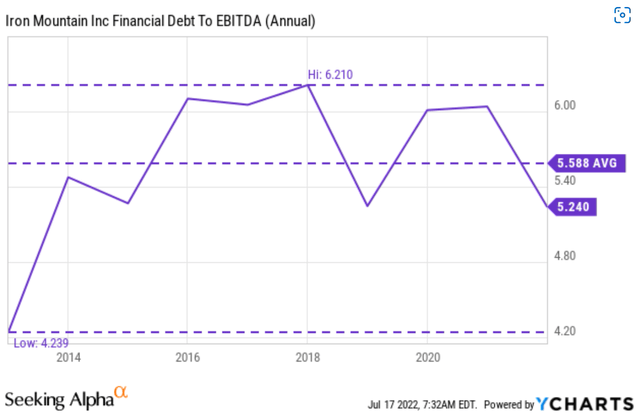

Its long-term debt stands near $9.8B. Its debt has increased by more than $1 billion since the beginning of the year. About $750 million of the increase was used to fund the ITRenew acquisition. To put things under perspective, the good news is that the leverage ratio is near the most conservative end of the spectrum. As you can see from the following chart, the leverage ratio has fluctuated in a relatively stable range between about 4.2x to 6.2x with an average of 5.5x in the past 10 years. Its current leverage ratio of 5.2x is not only below its long-term average, but also close to the lowest level if you exclude the 4.2x ratio in 2013.

The bad news is that management will face some tough capital allocation decisions going forward. On the one hand, they will need to keep spending heavily to drive growth in the data center hosting business. On the other hand, they will also need to deleverage given the macroeconomics uncertainties ahead. As CFO Barry Hytinen commented in early June (abridged and emphases added by me):

In addition, just to build on capital allocation a little bit, we have a long-standing target leverage ratio of 4.5x to 5.5x. As you know, for a lot of good reasons, including building the data center business, the business was outside that range for a period of time showing the really strong cash-generative nature of the business, we’ve been able to de-lever during COVID and get back into our leverage target range while also significantly investing in our growth capital and buying ITRenew as well. So this is, I think, a testament to the really strong cash dynamics that Bill was speaking about.

Seeking Alpha

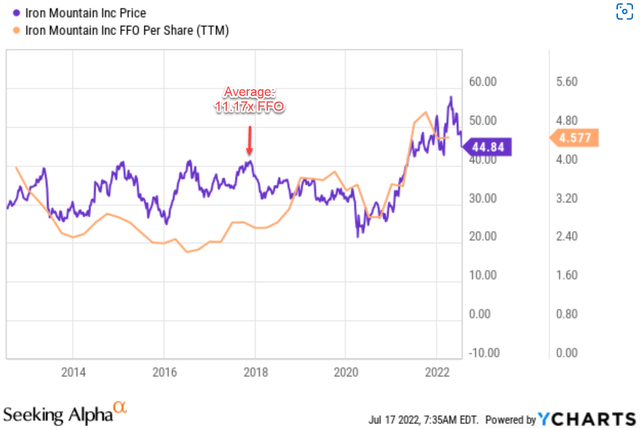

Valuation is not cheap though

Despite the 17% price correction since my last article, the valuation is not cheap though. In terms of FFO multiple, the stock currently trades at about 12.1x FFO. To put things into historical perspective, the stock has been trading in a relatively wide range of FFO multiple in the past, ranging from as low as 6.6x to as high as 18x. The long-term average is 11.2x, and hence the current FFO multiple is at an 8% premium over the historical average.

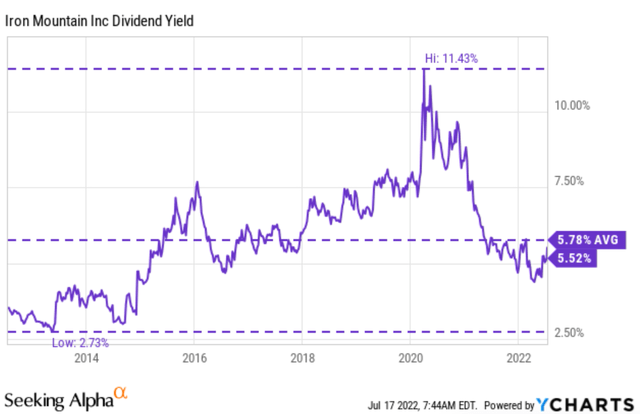

Dividend yield paints the same picture as you can see from the second chart below. Currently, the stock yields 5.5%. Its long-term average yield is 5.78%. So its current yield is about 6% below its long-term average, signaling a similar level of valuation premium as indicated by FFO multiple.

Seeking Alpha

Seeking Alpha

Projected return is limited

Looking ahead, growth potential is limited. For all of 2022, management expects the volume of physical paper storage to be flat to slightly up. My view is a bit more pessimistic, and I expect storage volume to stay flat and the price adjusts for inflation (say 2 to 2.5% on average). The megatrend is that physical paper documents are being replaced by digital documents storage, but paper storage still accounts for the majority of its profits currently (approximately 75% of operating profits last year). And it will take some time (and continued capital investment) for its digital storage to ramp up.

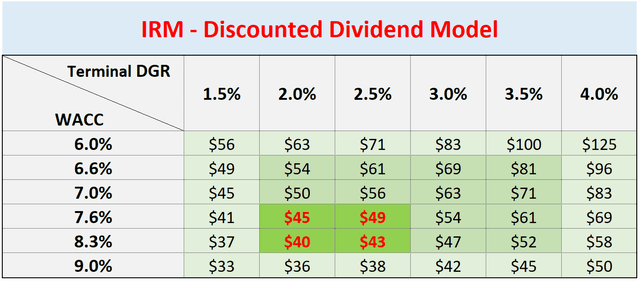

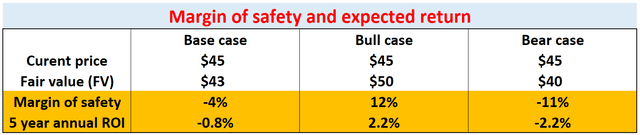

At the same time, borrowing cost is very likely to keep climbing. IRM’s weighted average cost of capital (“WACC”) has been in the range of about 6% to 9% historically, with an average of about 7.6% in the past decade. Looking ahead, I see the cost of capital to inch higher to a 7.6% to 8.3% range. Following a simple discounted dividend model (“DDM”) analysis and assuming the 2% to 2.5% growth mentioned above, the two charts below project its return in the next few years. The key observations are:

- The fair value is around $43 per share. The current price represents a small overvaluation of about 4%, consistent with the FFO and dividend yield assessment above.

- A bull case target price is around $50. In this case, investment at the current price features a decent margin of safety of 12% and a five-year annual return of 2.2%.

- A bear case price is around $40. And in this case, an investment at the current price is projected to suffer an 11% loss or about 2.2% per year in 5 years.

Author

Author

Final thoughts and other risks

Given the above assessment of its growth potential and return projections, I do not see a compelling buy thesis here. The return/risk profile offers too little margin of safety to justify the risks ahead – and this is the gist of the hold thesis.

There are a few other risks to consider. Even though IRM has demonstrated some pricing power in the past, a good part of the price hikes is canceled off by rising costs caused by inflation, especially in the recent inflationary environment. We are also facing the realistic chance of a recession in the near future. Document storage is a lower priority for most individuals and corporations and probably will be among the first line items to cut should a recession hit.

Be the first to comment