With the start of March and with the coronavirus impacting the global economy, I have decided to restart coverage of Irish PMIs – something I did not do for some years now. So here are some of the 1Q 2020 results based on January-February data.

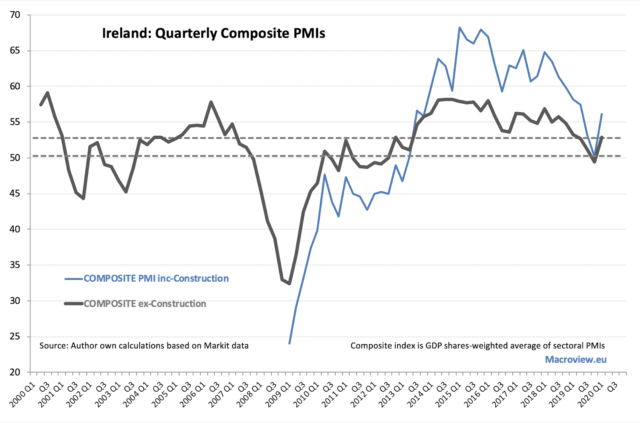

First off, Sector and Composite PMIs on a quarterly average basis. As a reminder, Composite PMIs are computed by me based on Markit and CSO data as GDP share-weighted averages for each sub-component, namely Manufacturing, Services, and Construction:

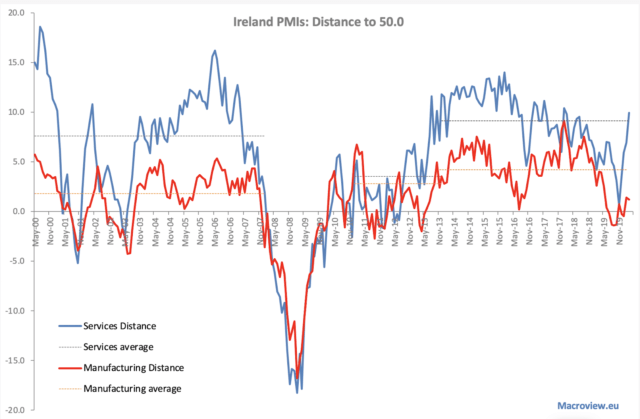

Services clearly lead the recovery from 4Q 2020 weakness, with both Manufacturing and Construction nominally in the expansion territory, but statistically too close to zero growth to be congratulatory.

Composite PMIs ex-Construction is statistically within the long-term average and consistent with subdued growth rates. Composite ex-Construction (based on just Manufacturing and Services) is at 52.86 against the upper bound for the 95% confidence interval around the historical mean of 52.74. Including Construction, the Composite PMI rises to 56.14.

Monthly PMIs against period averages:

None of this data reflects any major concerns with COVID-19 since no cases have been identified in Ireland in the period covered by data. The impact should be felt in March 2020 figures due at the start of April. So, we can look at the above charts as the base for the upcoming COVID-19 impact.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment