EvgeniyShkolenko

Very few investment opportunities are, quite literally, out of this world. But one that is that investors should consider for their watch list is satellite operator Iridium Communications (NASDAQ:IRDM). With the continued growth of the space economy, this particular player is positioned well for the future. Growth has been steady for both the top and bottom line of the business and management continues to lock down growth-oriented opportunities. Unfortunately, shares of the firm are no longer as attractive as they were previously because of some significant share price appreciation. This has led me to downgrade the company from a ‘buy’ to a ‘hold’. But for those focused on the very long run, the outlook is still positive and shares don’t need to fall that much to warrant further upside moving forward.

The picture continues to improve

Back in May of this year, I wrote a bullish article about Iridium Communications. At that time, the company had experienced some downside in its share price, likely driven by concerns about the economy. However, the firm was continuing to grow both its top and bottom lines, leading me to call it a great prospect for long-term investors. The robust fundamentals of the company, combined with how shares were priced at that time, led me to rate it a ‘buy’, indicating my belief that it would outperform the broader market for the foreseeable future. Truth be told, the company has significantly outperformed even my own expectations. While the S&P 500 is up by 2.7% since the article’s publication, shares of this satellite business are up a whopping 30.9%.

This move higher for shareholders has not been without cause. For starters, on May 26th, management announced a rather significant development for investors. That development was a contract that was jointly awarded to Iridium Communications and General Dynamics Mission Systems (GD) by the Space Development Agency. The total size of the contract is estimated at $324.5 million, with almost $163 million of it being in the form of base outlays and the remaining $161.6 million attributed to options on that contract. The terms of the contract involve the parties establishing a ground Operations and Integration segment for Tranche 1 of the National Defense Space Architecture initiative that is currently underway. It’s unclear exactly how much of this will go directly to Iridium Communications, but what is certain is that the company can expect a pretty hefty payday from this contract.

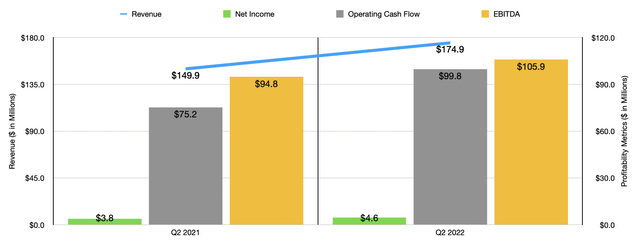

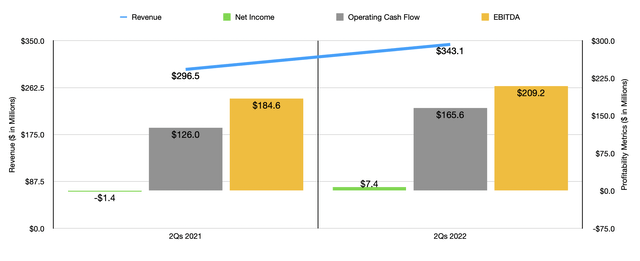

In addition to landing this contract, the enterprise has also reported some rather positive results. In the second quarter of the firm’s 2022 fiscal year, the only quarter for which new data is available that was not available when I last wrote about it, revenue came in at $174.9 million. That represents an increase of 16.7% over the $149.9 million generated the same quarter one year earlier. This increase in sales was driven in large part by an increase in the number of billable subscribers using the company’s platform. This number grew from 1.616 million in the second quarter of 2021 to 1.875 million in the latest quarter. As a result of this, total revenue for the first half of the 2022 fiscal year came in at $343.1 million. That’s 15.7% higher than the $296.5 million generated during the first half of 2021.

As revenue has risen, profitability has also increased. Net income of $4.6 million in the latest quarter was higher than the $3.8 million reported the same time one year earlier. Operating cash flow in the latest quarter came in at $99.8 million. That’s 32.7% above the $75.2 million generated just one year earlier. Meanwhile, EBITDA for the company expanded from $94.8 million in the second quarter of 2021 to $105.9 million the same time this year. Naturally, this strong bottom line performance has had a positive impact on the company’s results for the first half of the year as a whole. This data can be seen in the chart below.

Due to how things are turning out so far this year, the management team at Iridium Communications decided recently to increase their guidance for the current fiscal year. Previously, they anticipated that service revenue, which comprises the bulk of the company’s sales, would rise by between 5% and 7% compared to what the firm achieved in 2021. They now expect growth to be between 7% and 9%. Based on the $492 million in service revenue achieved last year, meeting the midpoint of this range would imply sales of $531.4 million coming from services. The company also expects profitability to come in strong, with EBITDA of between $410 million and $420 million. This is $10 million higher than the prior expected range. The company has not provided any guidance when it comes to other profitability metrics like operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, then we should anticipate operating cash flow of $332.4 million and free cash flow of $270.4 million.

It’s also worth noting the company’s debt position. As of the end of its 2021 fiscal year, its net leverage ratio is 3.4. Management’s long-term goal is to keep this figure between 2.5 and 3.5. This should not be difficult because, using current data combined with year-end profitability, the net leverage ratio should drop to 3.3. It’s worth noting that this is after the company buys back $600 million worth of stock under its share buyback plan, with $267.5 million of it still available by the end of June of this year. In the second quarter alone, the company purchased back 1 million shares for $35 million, so it is actively working on this initiative.

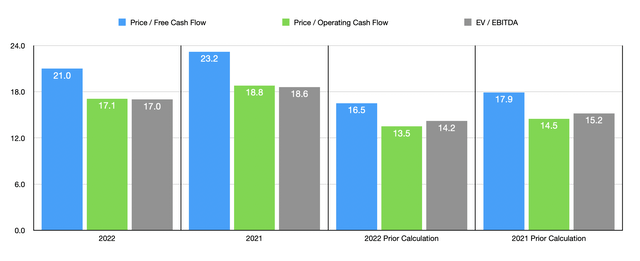

Using the profitability data previously provided, we can see how shares are priced today. The firm is trading at a forward price to free cash flow multiple of 21. That compares to the 23.2 reading that we get if we use 2021 results. The price to operating cash flow multiple should be 17.1, down from the 18.8 reading we get if we use 2021 figures. Over the past year, the EV to EBITDA multiple will have also fallen from 18.6 to 17. As the table below illustrates, the pricing for the company, while definitely not bad for a quality operator, is a bit higher than when I last wrote about the firm.

Takeaway

Based on the data provided, Iridium Communications seems to be doing quite well for itself. The future for the business has never looked brighter and it’s highly probable that fundamental performance will continue to fare well moving forward. Long-term, I have no doubt that the company will create additional value for its investors. But given the recent run-up in pricing we have seen, and in spite of the improved profitability forecast, I do think the stock is more or less fairly valued at this time. Because of that, I’ve decided to reduce my rating on the firm from ‘buy’ to ‘hold’.

Be the first to comment