onurdongel/E+ via Getty Images

A Quick Take On Junee Limited

Junee Limited (JUNE) has filed to raise $25 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company provides interior design and fitting-out services for homes and businesses in Hong Kong.

Junee generates fairly low and dropping gross margin, indicating that its business is a highly competitive, low-margin business.

I’m therefore on Hold for JUNE’s IPO, although day traders seeking a low nominal price may be attracted to the stock.

Junee Limited Overview

Hong Kong, China-based Junee was founded to provide a range of interior design services in the residential and commercial markets in Hong Kong.

Management is headed by co-founder Executive Director, Yuk Ki (Francis) Chan, who has been with the firm since inception in 2011 and has over 30 years’ experience in the interior design and fit-out industry in Hong Kong.

The company’s primary offerings include:

-

Interior design

-

Fit-out (construction & renovation)

-

Maintenance

Junee has booked fair market value investment of $1.34 million as of December 31, 2021 from investors including senior management and other individual-directed entities.

Junee – Client Acquisition

The firm bids on new projects in both residential and commercial sectors in the greater Hong Kong region.

Junee focuses on project management and typically hires subcontractors to perform fit-out and maintenance services.

Selling & Marketing expenses as a percentage of total revenue have varied as revenues have fluctuated, as the figures below indicate:

|

Selling and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended December 31, 2021 |

0.4% |

|

FYE June 30, 2021 |

0.2% |

|

FYE June 30, 2020 |

0.5% |

(Source – SEC)

The Selling & Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling & Marketing spend, was 152.1x in the most recent reporting period, as shown in the table below:

|

Selling and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended December 31, 2021 |

152.1 |

|

FYE June 30, 2021 |

-14.1 |

(Source – SEC)

Junee’s Market

According to a 2021 market research report by HKTDC Research, the Hong Kong market for design and related services is extremely fragmented.

As of the end of 2020, the market counted over 6,900 firms providing services, with more than 18,000 employees in total. The number of firms grew by 161% from the approximately 2,660 firms operating in 2000.

These figures were inclusive of various design disciplines outside of interior design.

However, due to recent social turmoil, property prices in Hong Kong have essentially plateaued at a record high value in aggregate, leaving questions as to the future demand growth for interior design services.

Junee Limited’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Variable topline revenue

-

Growing gross profit and gross margin

-

Uneven operating profit/loss

-

Fluctuating cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$5,948,435 |

136.6% |

|

FYE June 30, 2021 |

$6,299,004 |

-3.3% |

|

FYE June 30, 2020 |

$6,511,771 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$941,457 |

155.8% |

|

FYE June 30, 2021 |

$1,186,004 |

52.1% |

|

FYE June 30, 2020 |

$779,585 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended December 31, 2021 |

15.83% |

|

|

FYE June 30, 2021 |

18.83% |

|

|

FYE June 30, 2020 |

11.97% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended December 31, 2021 |

$(56,927) |

-1.0% |

|

FYE June 30, 2021 |

$273,552 |

4.3% |

|

FYE June 30, 2020 |

$(221,285) |

-3.4% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended December 31, 2021 |

$(21,029) |

-0.4% |

|

FYE June 30, 2021 |

$421,830 |

7.1% |

|

FYE June 30, 2020 |

$(182,865) |

-3.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended December 31, 2021 |

$(482,821) |

|

|

FYE June 30, 2021 |

$607,657 |

|

|

FYE June 30, 2020 |

$(326,784) |

|

(Source – SEC)

As of December 31, 2021, Junee had $895,280 in cash and $2.6 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021 was negative ($66,925).

Junee Limited’s IPO Details

JUNE intends to sell 3.6 million shares of common stock, and selling shareholders will offer 1.4 million shares at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $25.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $56 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 35%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

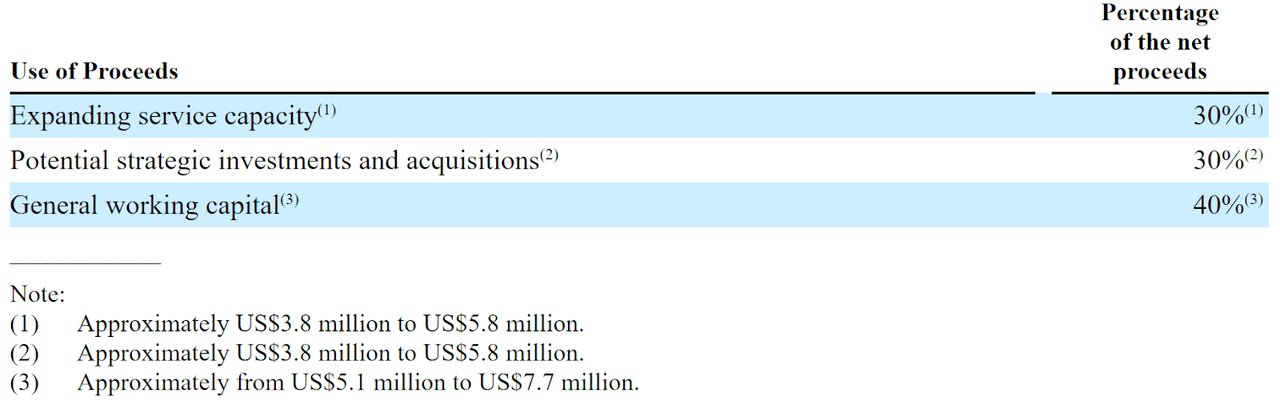

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Use Of IPO Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company was not a party to any material legal or administrative proceedings, as of June 30, 2021.

The bookrunners of the IPO are Univest Securities and Pacific Century Securities.

Valuation Metrics For Junee Limited

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure (TTM) |

Amount |

|

Market Capitalization at IPO |

$71,428,575 |

|

Enterprise Value |

$55,997,666 |

|

Price/Sales |

7.34 |

|

EV/Revenue |

5.75 |

|

EV/EBITDA |

191.67 |

|

Earnings Per Share |

$0.02 |

|

Operating Margin |

3.00% |

|

Net Margin |

3.85% |

|

Float To Outstanding Shares Ratio |

35.00% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

-$66,925 |

|

Free Cash Flow Yield Per Share |

-0.09% |

|

Debt/EBITDA Multiple |

1.59 |

|

CapEx Ratio |

-18.07 |

|

Revenue Growth Rate |

136.56% |

(Source – SEC)

Commentary About Junee Limited

JUNE is seeking U.S. public capital market investment to build out its in-house capabilities and for general working capital.

The firm’s financials have reported uneven topline revenue, increasing gross profit and gross margin, variable operating profit/loss and fluctuating cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021 was negative ($66,925).

Selling & Marketing expenses as a percentage of total revenue have varied as revenue has fluctuated; its Selling & Marketing efficiency multiple rose sharply to 142.1x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future earnings for investment back into the company’s growth initiatives and operating requirements.

The market opportunity for interior design and fit-out work in Hong Kong is difficult to determine. The region has experienced social unrest in recent years and a crackdown by authorities on various activities, so businesses face uncertain prospects for growth.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Univest Securities is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (6.5%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the uncertain economic environment that Hong Kong is facing, with the potential for higher interest rates causing a drop in demand going forward.

Junee also is operating at a fairly low and dropping gross margin, indicating that its business is a highly competitive, low-margin business.

I’m therefore on Hold for JUNE’s IPO, although it may attract day traders seeking a low nominal price for volatility opportunities.

Expected IPO Pricing Date: To be announced

Be the first to comment