gorodenkoff

A Quick Take On Coya Therapeutics

Coya Therapeutics (COYA) intends to raise $15 million from the sale of its common stock and warrants in an IPO, according to an amended registration statement.

The company is advancing a number of drug treatment candidates for neurological and autoimmune diseases.

The firm’s lead candidate may need to wait until at least 2024 to advance in clinical trials, and apparently requires additional grant funding or a collaborator to do that.

Given the additional risks for its clinical trial candidate and the pre-clinical stage of development for its other candidates, I’m on Hold for the COYA IPO.

Overview

Houston, Texas-based Coya Therapeutics was founded to develop Treg-modifying therapeutics for various severe disease conditions.

Management is headed by co-founder, Chairman and CEO Howard Berman, Ph.D, who has been with the firm since inception in 2020 and was previously Medical Science Liaison at AbbVie (ABBV) and held leadership positions at Novartis (NVS) and Eli Lilly and Company (LLY).

The firm’s lead candidate, COYA 101, is in Phase 2a trials for the treatment of amyotrophic lateral sclerosis, or ALS.

Management expects to initiate Phase 2b trials ‘with grant funding or collaborative partnership’ by 2024 at the earliest.

The company’s other candidate programs are in various pre-clinical stages of development.

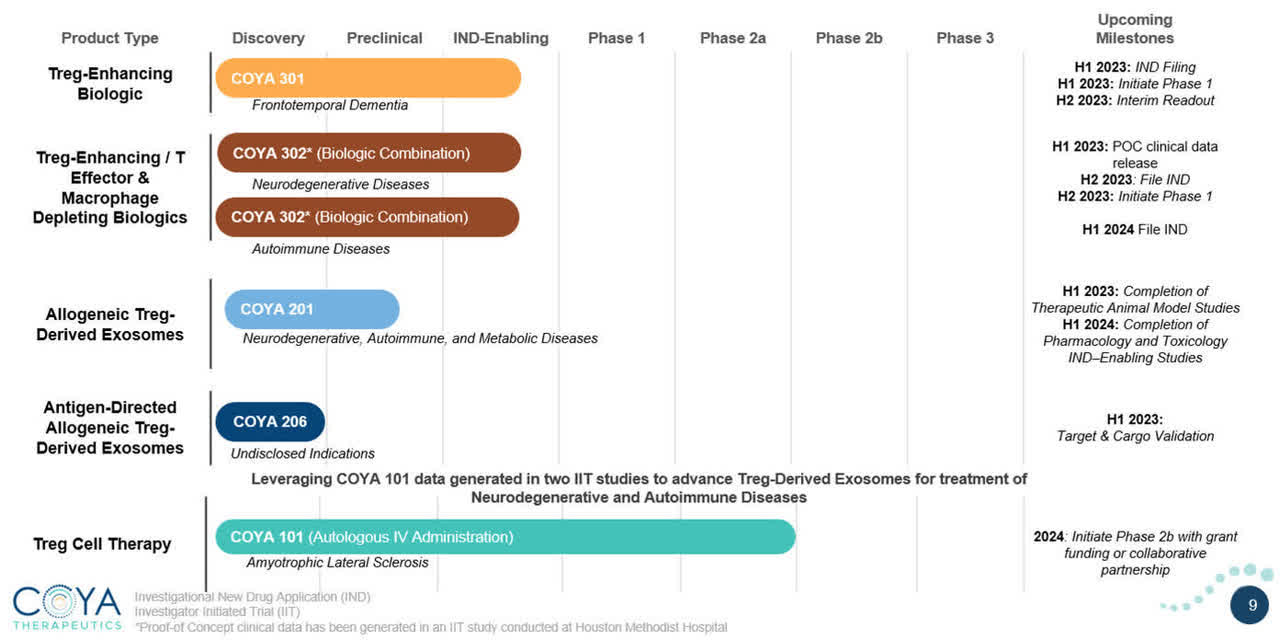

Below is the current status of the company’s drug development pipeline:

Company Pipeline (SEC)

Coya has booked fair market value investment of as of September 30, 2022 from investors including Bertex LLC and individuals.

Market & Competition

Amyotrophic lateral sclerosis [ALS] is a progressive neurological disorder that affects the nerve cells in the brain and the spinal cord. It is sometimes referred to as Lou Gehrig’s disease, after the famous baseball player who was diagnosed with it in 1939.

ALS causes the muscles to deteriorate over time, leading to paralysis and eventually death. Symptoms of ALS can include muscle weakness, slurred speech, difficulty swallowing, and difficulty breathing. As the disease progresses, patients may become unable to move or even speak.

According to a 2019 market research report by Grand View Research, the global market for amyotrophic lateral sclerosis treatment is forecast to reach $886 million by 2026.

North America accounted for the largest market share in 2018 and will likely continue to dominate the ALS demand in the near future.

The Asia Pacific region is expected to grow at the fastest rate in the coming years among all global regions.

Also, there are only two medications approved to treat ALS in the U.S., Rilutek and Radicava. However, another drug, Nuedexta, is also used for ALS conditions.

Major competitive vendors that provide or are developing related treatments include:

-

Mitsubishi Tanabe Pharma

-

Otsuka Pharmaceutical

-

BrainStorm Therapeutics

-

Biogen

-

Corestem

-

AB Science

-

Biohaven Pharmaceutical

-

Sun Pharmaceutical

-

Ionis Pharmaceuticals

-

Others

The company is developing treatments for other serious medical conditions.

Financial Status

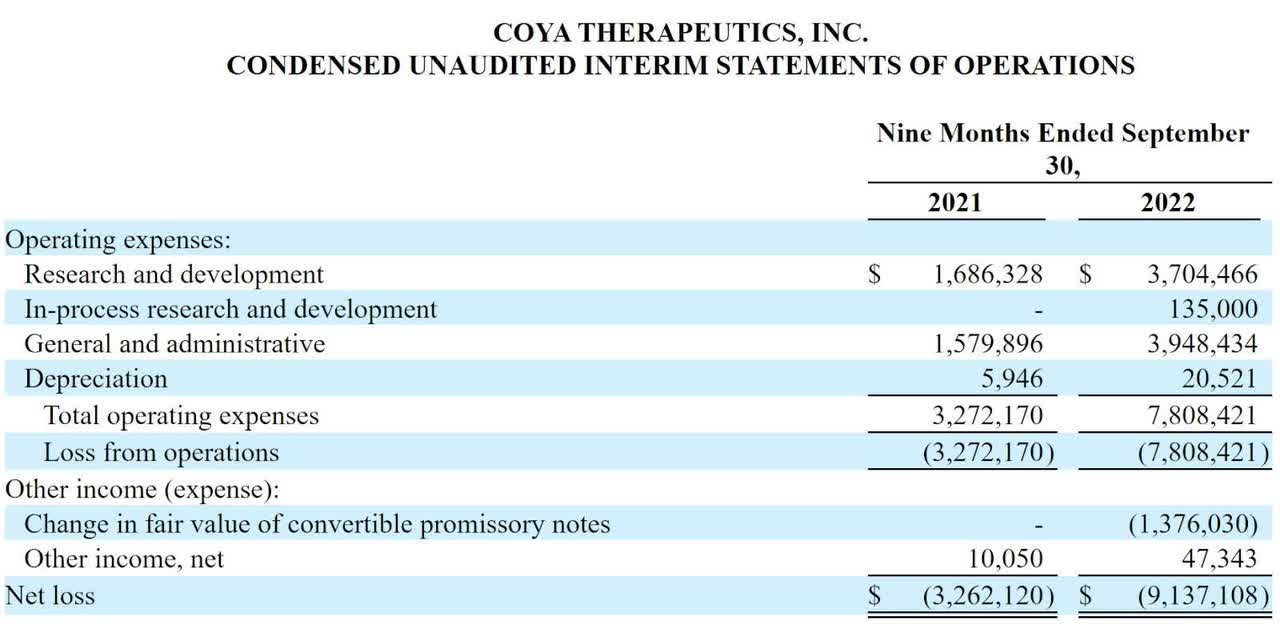

The firm’s recent financial results are typical of a clinical-stage biopharma in that they feature no revenue and significant R&D and G&A expenses associated with its development efforts.

Below are the company’s recent comparative financial results:

Company Statement Of Operations (SEC)

As of September 30, 2022, the company had $8.7 million in cash and $14.4 million in total liabilities.

IPO Details

COYA intends to sell 3 million shares of common stock and one-half of one warrant at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $15.25 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

The warrant will be exercisable at 150% of the share price, or $7.50 and will expire two years after date of issuance.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $26.6 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 31.51%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately between $5.0 million to $5.3 million to advance COYA 301 and COYA 302 through IND-enabling CMC and toxicology studies, and the initiation of a Phase 1 studies;

approximately between $1.0 million to $1.5 million to advance COYA 201 and COYA 206 through or into, respectively, preclinical studies including target validation and animal studies;

approximately between $0.8 million to $1.0 million to advance COYA 101 towards a Phase 2b trial in the event we are successful in receiving non-dilutive funding from government grants or from a strategic partner (we currently anticipate that grant funding, or other non-dilutive funding, in the amount of approximately $3.0 million would be sufficient to begin advancing COYA 101 into a Phase 2b trial; this amount is an estimate and may be subject to change);

approximately between $4.0 million to $4.2 million to fund expenses to advance research and development activities that relate to all our other preclinical activities, including process development activities related to the advancement of our product candidates and the cost of research and development personnel; and

the remainder for planned general and administrative expenses, the costs of operating as a public company, working capital and general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘not currently subject to any material legal proceedings.’

Listed bookrunners of the IPO are Chardan and Newbridge Securities.

Commentary About Coya Therapeutics

COYA is seeking U.S. public capital market investment to advance its drug candidates through and into clinical trials.

The firm’s lead candidate, COYA 101, is in Phase 2a trials for the treatment of amyotrophic lateral sclerosis, or ALS.

Management expects to initiate Phase 2b trials ‘with grant funding or collaborative partnerships’ by 2024 at the earliest.

The market opportunity for treating the various diseases the management is targeting is large and expected to grow as the global population ages and becomes more susceptible to disease over time.

Management hasn’t disclosed any major pharma firm collaboration relationship.

The company’s investor syndicate doesn’t include any well-known life science venture capital firms or strategic investors.

Chardan is the lead underwriter and there is no performance data on its IPO involvement over the last 12-month period.

Coya is operating in the notoriously difficult area of neurodegenerative diseases for its lead candidate, so the IPO is high risk.

As for valuation, management is asking investors to pay an Enterprise Value of approximately $26.6 million at IPO.

This figure is far below the typical range for biopharma firms at IPO.

The firm’s lead candidate apparently requires further grant funding or a collaborator partnership to advance, while the company’s other programs are still in pre-clinical stages of development.

Also, the lead program is not likely to advance into Phase 2b trials until 2024 at the earliest.

Given these additional risks and long time-frame considerations, my outlook on the Coya IPO is Hold.

Expected IPO Pricing Date: To be announced

Be the first to comment