Katiekk2/iStock via Getty Images

Mitesco Inc. (MITI) is a first-mover and disruptor in the healthcare industry as it seeks to establish primary healthcare clinics across the nation with services provided by Nurse Practitioners (“NPs”). Mitesco isn’t the only medical provider utilizing NPs, but it is the first to do so exclusively on a grand scale. This article will explain why Mitesco’s plan is a logical step in solving the void in U.S. primary health in anticipation of the stock listing on the Nasdaq in just a few days.

Investment thesis

The Affordable Care Act of 2014 added additional eligible patients to a medical system already overburdened by a shortage of primary care doctors. The shortage is expected to continue to grow. An alternative solution is necessary as our medical system cannot meet the need for personalized care, as cited by 81% of patients surveyed.

Many patients have few options other than to seek care in urgent care centers or emergency rooms. The void in primary care has resulted in an overabundance of avoidable chronic illnesses, representing almost 80% of the total U.S. medical expenditure, costing nearly $4 trillion per year.

Mitesco is in the early stages of filling the void in primary care by being a first mover in accelerating what is occurring naturally. According to this survey, there are 320,000 licensed NPs in the U.S., with almost half of NPs already serving as primary care providers. While there is a shortage of primary care doctors, NPs are graduating at a growing rate that can meet the demand for primary medical care. NPs are the logical solution as they are permitted to perform most of the services performed by a doctor in a growing number of U.S. states.

The Mitesco solution

Mitesco is establishing a nationwide network of clinics named “The Good Clinic,” where NPs provide primary care without the supervision of a doctor. Each Good Clinic provides:

- Complete primary care through in-person or virtual appointments lasting 40 minutes compared to a typical doctor appointment lasting 15 minutes.

- Same-day or next-day appointments compared to the average two-week wait time.

- Conveniently located clinics in multi-family residential buildings in densely populated areas will be a factor in driving same-day appointments and walk-ins.

- On-site products such as books on diet and weight management, vitamins, and oils.

- Individualized treatment plans and coaching.

It is interesting to note how 15 minutes per doctor visit became the norm, although everyone knows this may be insufficient. Years ago, to make doctor visits uniform for billing purposes, Medicare created a reimbursement formula that resulted in 15-minute appointments. Insurance companies followed suit. The formula: (Work RVU x Geographic Index + Practice Expenses RVU x Geographic Index + Liability Insurance RVU x Geographic Index) x Medicare Conversion Factor.

Office and telephonic visits are expected to bring in 70% of total Mitesco revenue, with the majority coming from insurance reimbursement for doctor visits. In-store product sales are payable at the time of purchase and are expected to add 30% to the revenue total.

Individualized treatment

Critical to Mitesco’s business plan is the use of Patient Activation Measurement (“PAM”), a 100 point measurement tool of a patient’s involvement in their healthcare, developed by researchers at the University of Oregon. Studies have demonstrated that a patient’s participation in their healthcare is critical for a successful outcome, and PAM has become an established tool for medical practices.

The Good Clinic develops a personalized treatment and coaching plan for each patient based on PAM results. In the words of The Good Clinic CEO, Michael Howe:

We want the accountability of health care to be in the hands of the patients, but they need the coaches, education, and empathy.

An excellent example of how Mitesco utilizes PAM is a hypothetical plan initiated for a patient diagnosed with diabetes who PAM determines to have a low interest in participating in their healthcare. Typically, diabetes patients are instructed with ten things they need to do immediately. A Good Clinic NP would most likely set up a telemedicine appointment for this patient and introduce just one of the ten items the patient needs to address in order not to overwhelm the patient. After completing the first item, the patient will be more receptive to managing the second item and will receive coaching and follow-up sessions with the Good Clinic NP, completing each of the ten tasks at the patient’s pace.

Why Nurse Practitioners?

Twenty-eight states and the District of Columbia allow NPs to provide complete medical services without a supervising physician. In these states, an NP can establish a treatment plan, prescribe medicine, and order diagnostic tests as recommended by the National Academy of Medicine. NPs also have full practice authority from the U.S. Department of Veterans Affairs.

NPs are graduating at a rate sufficient to serve the need for primary care services, as cited above, and they bring years of experience at a lower cost than doctors. According to the American Association of Nurse Practitioners, a typical NP has been in medical practice on average for 11 years before advancing to become an NP.

Scaling

The company opened six clinics in Minnesota in 2021 and is about to open clinics in Colorado this year, with expansion planned into Florida and Arizona next year. Management plans to add a total of 50 new clinics in the next three years at the cost of $1 million per clinic and purchase existing clinics from retiring doctors that become available in targeted areas.

The average patient appointment should generate about $120 per visit, similar to a visit to a MinuteClinic. Estimating 60 visits per week per NP for the average Good Clinic results in $2M in revenue per clinic. This is an average, with six-room clinics bringing in $2.5M in revenue and four-room clinics $1.5 in revenue from patient appointments, with on-site product sales adding additional revenue. Estimating total operating costs for each clinic at about $600K per year means that each clinic could bring in an average of $1.4 million in gross profits per year. Each existing clinic has the potential to fund creating a new clinic.

Share info

There are about 213 million shares outstanding at the market price of $0.24 per share; the market cap is $51 million. Fully diluted, there are 271 million shares. The Nasdaq uplisting will require a reverse split to raise the share price to a minimum of $3 or $4 per share, depending on how the company meets listing requirements. The company has almost $4 million in debt. According to an S-1 filed in November, Mitesco is seeking to raise up to $17 million as the stock is uplisted to Nasdaq later this month. The company is expected to file an S-1A shortly to provide the details of the cap raise and opening Nasdaq share price.

The capital raise will provide sufficient funds to cover the $3.7 million required to operate the six clinics and overall company operations and the opening of up to ten new clinics this year. Additional funding will be necessary to fund the opening of the remaining 50 clinics planned over the next three years. Future funding is expected to come from revenues from the existing clinics and short-term loans to prevent further shareholder dilution.

Partnerships

The Good Clinic uses PAM to create specialized treatment and coaching programs and technology supplied by AthenaHealth, the largest U.S. health record company. Mitesco’s strategy is validated by in-network agreements with the major health insurance providers and Medicare and Medicaid in each state it operates in.

Insurance providers love the Good Clinic concept. It provides primary care at a lower cost with services that are beneficial in obtaining better patient outcomes and reducing or managing chronic illnesses. Insurers have realized that keeping people healthy is profitable and have modified reimbursement rates to reward keeping patients from recurring illnesses and reducing hospitalization rates.

Mitesco has a working relationship with homebuilder Lennar to establish clinics in newly built communities. The Good Clinic becomes a part of the community by partnering with local companies for employee physicals and drug testing and offers free physicals for kids’ sports and camps.

Management and board

The Good Clinic concept was initially named “MyCare” by its creators, Jim “Woody” Woodburn, Kevin Lee Smith, and Rebecca Hafner-Fogarty. All three have extensive healthcare industry backgrounds, including executive roles at Blue Cross/Blue Shield, United Health, and private medical practices. Each of the founders played a key role at QuickMedic, which was rebranded as MinuteClinic as the business plan switched to a national rollout, placing clinics inside CVS (CVS) pharmacies. CVS bought out MinuteClinic in 2006 for $170 million.

MyCare was acquired by Mitesco in March 2020 and rebranded as The Good Clinic. The first clinic was opened in Minnesota in 2021, similarly in location to the roots of the MinuteClinic. Also, similarly to the MinuteClinic business plan, Good Clinics are placed in areas convenient to large urban populations. The significant differences between the MinuteClinic and the Good Clinic concepts are that the former is geared toward providing urgent care or one-time visits for vaccinations, ear cleaning, etc. At the same time, the latter focuses on complete primary care.

Larry Diamond, the CEO of Mitesco, has 25 years of leadership experience in large healthcare companies such as United Health and startups such as Insignia Health. Insignia Health holds the worldwide patent for PAM and was acquired by Phreesia (PHR) in December.

Michael Howe is the CEO of The Good Clinic. His previous experience includes serving as the CEO of The MinuteClinic. Mitesco management also includes co-founder Kevin Lee Smith as Chief Nurse Practitioner after serving in a similar role at MinuteClinic.

Chairman of the Board of Directors, Tom Brodmerkel is the CEO of Wave Technology Services, a firm involved in medical coding technology. Mr. Brodmerkel serves on other healthcare company boards and has 25 years of management experience at the largest healthcare companies and smaller companies.

Board member Dr. H. Faraz Naqvi is the co-founder and CEO of Crossover Partners, a healthcare investment company. Dr. Naqvi’s vast background includes founding companies involved in elderly healthcare, telemedicine, general primary healthcare, and healthcare investment, as well as holding positions as a healthcare consultant and healthcare analyst. Dr. Naqvi has established an impressive investment record after recording a three-year return of almost 400% managing funds for Allianz Capital.

Attorney Juan Carlos Iturregui brings to the Mitesco board his extensive experience working with governments in the U.S. and internationally in business development.

Sheila Schweitzer has served as a CEO, COO, founder, and consultant in various health companies. She brings to Mitesco expertise in health care analytics, technology, and data processing along with her business acumen.

Reviews

The Good Clinic has received nothing but five-star reviews on Google for all locations, as well as 22 reviews on the Minnesota Chamber of Commerce website and one review on Facebook.

Risks

Mitesco competes with clinics, medical centers, private practices, urgent care centers, and other healthcare provider models while it strives to gain market share utilizing a disruptive market plan. Should the company succeed in its endeavor, its business plan could be copied by competitors.

The company relies on reimbursement by private and government insurance companies and regulations pertaining to healthcare providers. Reimbursement and regulations could potentially change in a manner adverse to Mitesco.

Mitesco was denied a Principle Register federal trademark for The Good Clinic name and instead received a Supplemental Register, which does not provide trademark infringement rights. Until Mitesco can remedy this situation, as management intends to pursue, the company does not have patent infringement rights to protect it from third parties from using The Good Clinic name.

Funding for the six clinics that opened in Minnesota in 2021 has been obtained by issuing preferred shares. In my opinion, this is similar to the growth strategy pursued by CareCloud (MTBC). However, CEO Diamond does not see the strategy being similar, as he related to me:

We on the other hand are always working to minimize the cost of capital for our shareholders. The use of debt is simply a tool to accelerate growth using the financing tool that minimizes cost based on the company’s lifecycle.

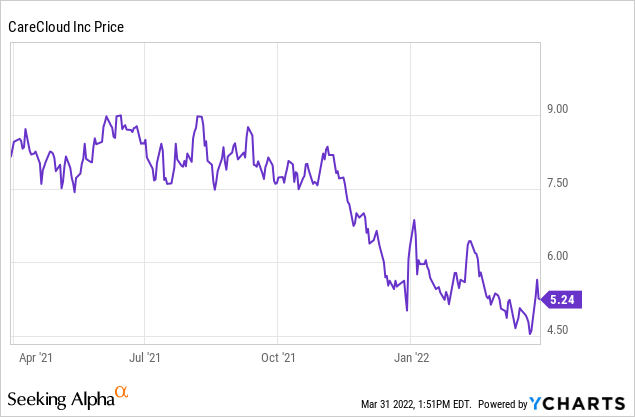

I interviewed CareCloud CEO Mr. Bill Korn in June 2020. Mr. Korn believed that the shares of his company were also undervalued, and doing an equity raise would raise money at a discount to share value. He thought that it would be advantageous to issue equity to retire the preferred when the stock price rose, but unfortunately, MTBC shares haven’t rallied.

Mr. Diamond also believes his company shares are undervalued:

We anticipate using preferred equity or debt at this point in time to accelerate growth in the number of clinics. Since our equity is undervalued we do not view it as the best source of funding due to its current value.

Mitesco does need to raise funds at this time to move quickly and take advantage of being a first-mover before somebody else does. In the future, if the company can establish profitability quickly in a new clinic, management will have the option of financing new clinics via short-term loans. This is something to keep an eye on. Many investors have shied away from investing in MTBC due to its financing growth by issuing preferred shares despite solid revenue growth. Mitesco will have many financing options should the company successfully scale, which requires revenue growth to outpace debt and dilution.

Conclusion

Mitesco is geared to fill a void in our primary healthcare system. Using NPs to provide needed primary care services seems like a natural progression in light of the lack of primary care doctors and the abundant supply of NPs qualified to provide needed services. The Good Clinic concept is a solution to the primary care void, with Mitesco capitalizing on the opportunity with a plan to quickly and profitably scale.

Be the first to comment