Eoneren/E+ via Getty Images

Accenture (NYSE:ACN) is a global professional services firm providing technology and strategy transformation solutions.

We think the company’s business description could soon change towards becoming a B2B software player in the digital transformation and strategic consulting space, leading to massive earnings and multiple expansions.

Accenture’s current business model

We serve clients in three geographic markets: North America, Europe and Growth Markets (Asia Pacific, Latin America, Africa and the Middle East). Our geographic markets bring together capabilities from across the organization in Strategy & Consulting, Interactive, Technology and Operations-infusing digital skills and industry and functional expertise throughout-to deliver value to our clients.

We manage our business through the three geographic markets and go to market by industry, leveraging our deep expertise across our five industry groups-Communications, Media & Technology, Financial Services, Health & Public Service, Products and Resources. Our integrated service teams meet client needs rapidly and at scale, leveraging our network of more than 100 innovation hubs, our technology expertise and ecosystem relationships, and our global delivery capabilities.

Source: Accenture 10K

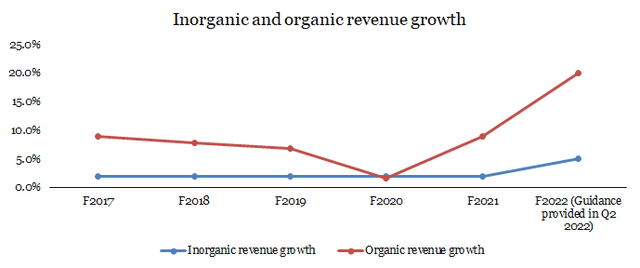

In short, Accenture’s presence pervades industries, geographies, and domains. To stay competitive, the company has been acquisitive and has been adding many solution capabilities to its repertoire. As a result, almost 2% of Accenture’s revenue comes from inorganic growth.

Revenue

Accenture is a $50 billion machine. So first, we unpack the revenue to understand how it has been growing.

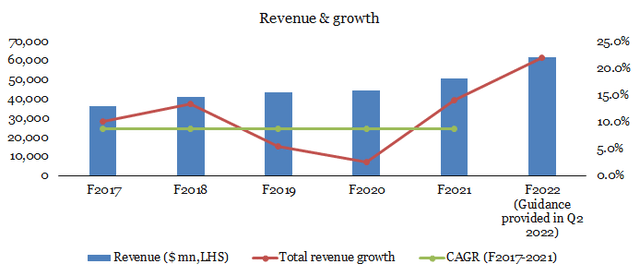

10K, Management Commentary, Author’s analysis

Over F2017-2021, Accenture has grown at a CAGR of 8.7% ($ basis), with F2021 revenues coming in at $50.5 billion. For F2022, the pull forward in demand for digital transformation and clients’ need to adapt in a pandemic-altered world has led to the management upping its growth expectation to around 22%, which implies F2022 revenue of $61.7 billion.

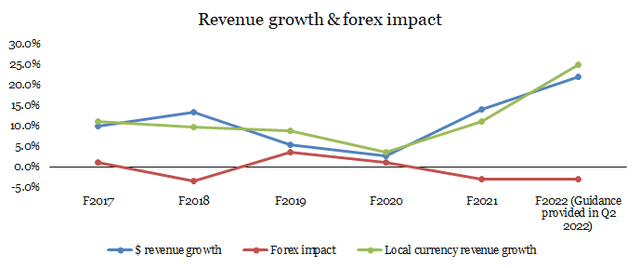

Notably, the management guided to 24-26% on a local currency basis, but due to Accenture’s global operations, there is always a forex component involved. For F2022, the management has indicated a 3% forex hit, which would reduce the mid-point of the local currency revenue growth (25%) to a $ growth rate of 22%.

10Ks, Management commentary, Earnings report

Stripping out the forex impact, the CAGR of local currency revenue growth over F0217-2021 is 8.29%.

We break the local currency growth into organic and inorganic growth.

Inorganic growth

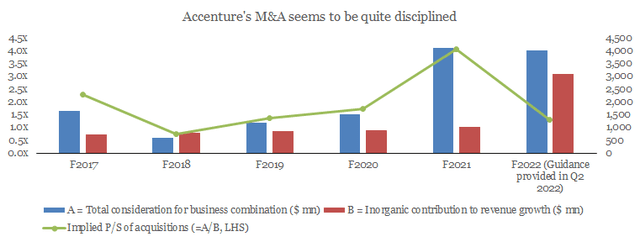

Accenture has always been a vocal proponent of M&A. As a result, the company has an established framework to address the buy vs build conundrum.

For many years, Accenture has managed to keep the contribution from inorganic growth to around 2% of the total.

For F2022, the expectation is for this number to shoot up to 5% to reflect the more incredible benefits that the management expects owing to compressed demand in the system. In addition, corresponding to the inorganic growth, Accenture’s appetite for M&A has also been growing.

On average, the company has paid less than two times the revenue of the target companies, making Accenture one of the most disciplined acquirers. The 4x in 2021 was a clear outlier but was much better than the madness in the market.

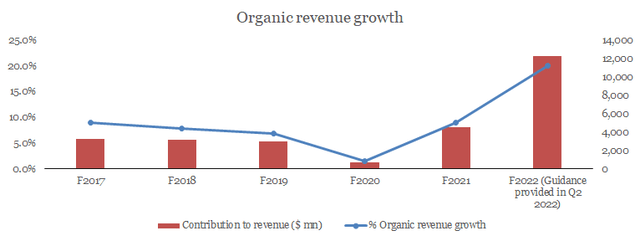

Organic growth

During F2017-2021, organic growth averaged 6.3%.

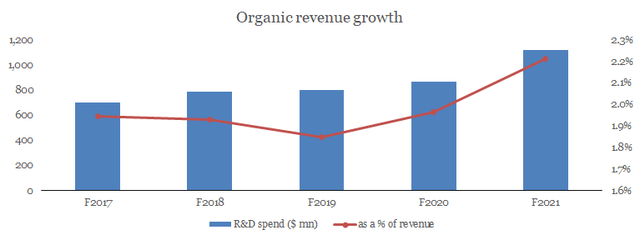

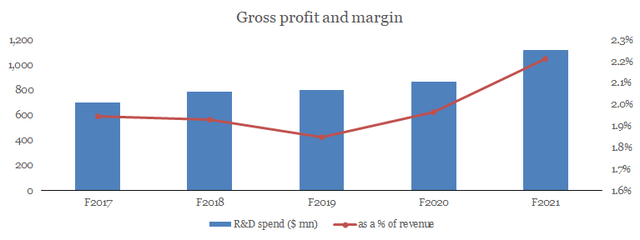

The company has also been spending considerably on its R&D.

The combination of investments across M&A, R&D, and focus on building solutions capabilities has had a direct impact on the gross margins.

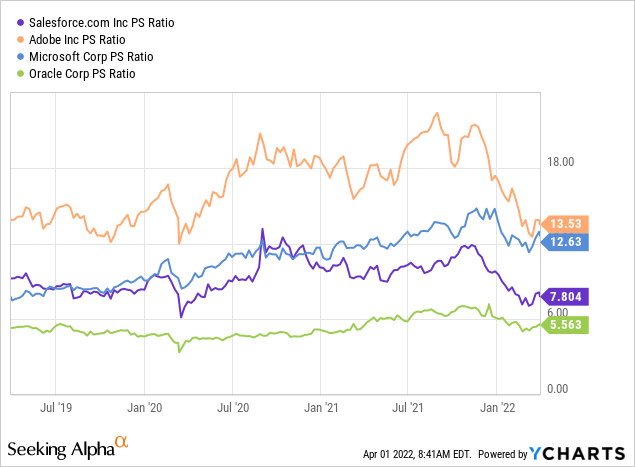

Software companies, especially SaaS companies, have more than 80% gross margin. However, the 30% margin profile is typically that of service companies. Thus, the improvement in gross margins is an indicator of pricing power and the transition towards a more software-like business.

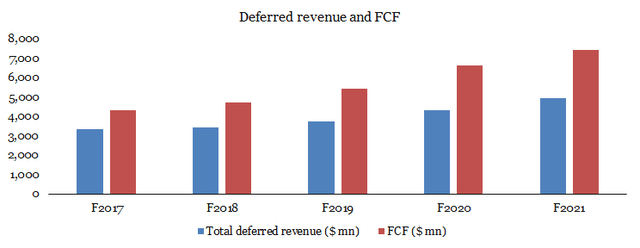

To contextualize further, it is worth looking at Accenture’s deferred revenue or advanced revenues, another indicator of SaaSification.

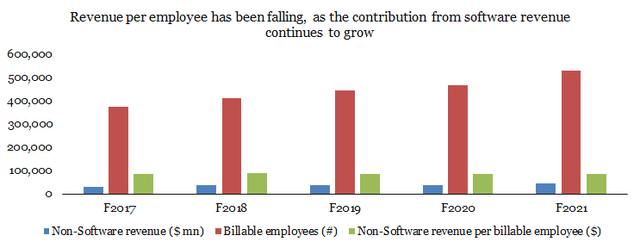

While some readers may contest that Accenture’s FCF has a lot more drivers other than just the change in deferred revenue, it is worth noting that assuming a billing of close to 100% for the software business (making software revenues nearly equal to the deferred revenue), nearly 90% of the business is services. To illustrate, consider how the revenue (ex-software revenue) per employee has moved.

As the company’s focus moves toward software, the non-software revenue per employee has declined at 34 bps per year.

Accenture has an efficient model where 6% growth comes organically and 2% from M&A (the 6/2 model). The investments have improved the revenue margin profile and are moving in the right direction.

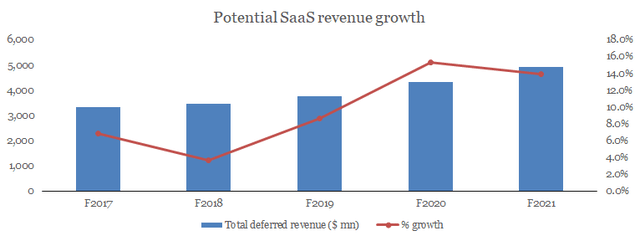

Based on the deferred revenue, we estimate that Accenture’s software revenue contribution is growing at around ten bps per year. Considering the expectation of inorganic growth for this year, we expect the trajectory of contribution to increase this year significantly.

The hiatus in this year’s M&A activity also signals that Accenture is digesting and potentially separating the more service-intensive businesses (somewhat like what IBM did a while ago). With a headcount close to 700k, the company’s persistent wage inflation is an acknowledged headache. While Accenture has been able to pass on the costs, the environment of hardening yields will soon make discussions of price hikes quite tricky. Coupled with the already falling revenue per employee, the company should soon look to bifurcate its businesses. The benefits of this process will be hugely valued accretive.

Valuation

Assuming deferred revenue to represent the company’s SaaS revenue, we estimate that Accenture’s software revenue is growing in the mid-teens and is expected to accelerate as the software revenue contribution grows.

Consensus estimates F2023 (the next fiscal) revenues to be around $68 billion. We estimate that approximately 15% or $10 billion of this revenue will be software-driven, leaving $58 billion from services.

We apply a conservative P/S of 10x on the software revenue to arrive at $100 billion.

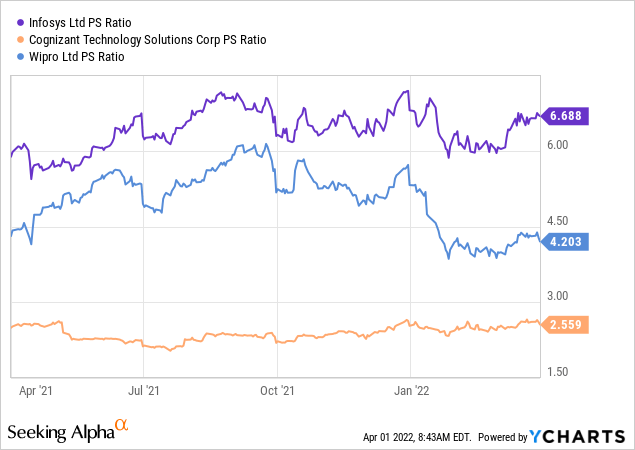

To the remaining services revenue, we apply a P/S of 3x to arrive at $174 billion.

We arrive at a total market cap of $274 billion vs the current $214 billion, or a potential upside of 28%.

Risks

- As clear from the graphs above, any follow-on from the pandemic is likely to adversely impact the company due to the large, fixed cost base.

- We don’t see any execution challenges. The company seems to have a playbook for executing complex M&A. Of course, the Ukraine – Russia situation could present an exception, and we do not wish to speculate on it.

- The explosive F2022 guidance leaves little room to sprout theories of a slowdown in the move towards software and thus is another risk taken off our list.

- The one potential challenge we see is wage inflation, which has been causing pain across the globe, and we think the company will soon take some significant steps toward alleviating the margin pressures it has been facing.

Conclusion

Accenture has reached a stage with the 6/2 model is almost a given. However, Accenture will be compelled to respond, considering its aspirations to become a higher margin (software-driven) solutions provider and growing wage pressures. Thus, a very plausible bifurcation and potential re-rating are on the cards, and we are looking to capitalize on the opportunity.

Be the first to comment