ismagilov

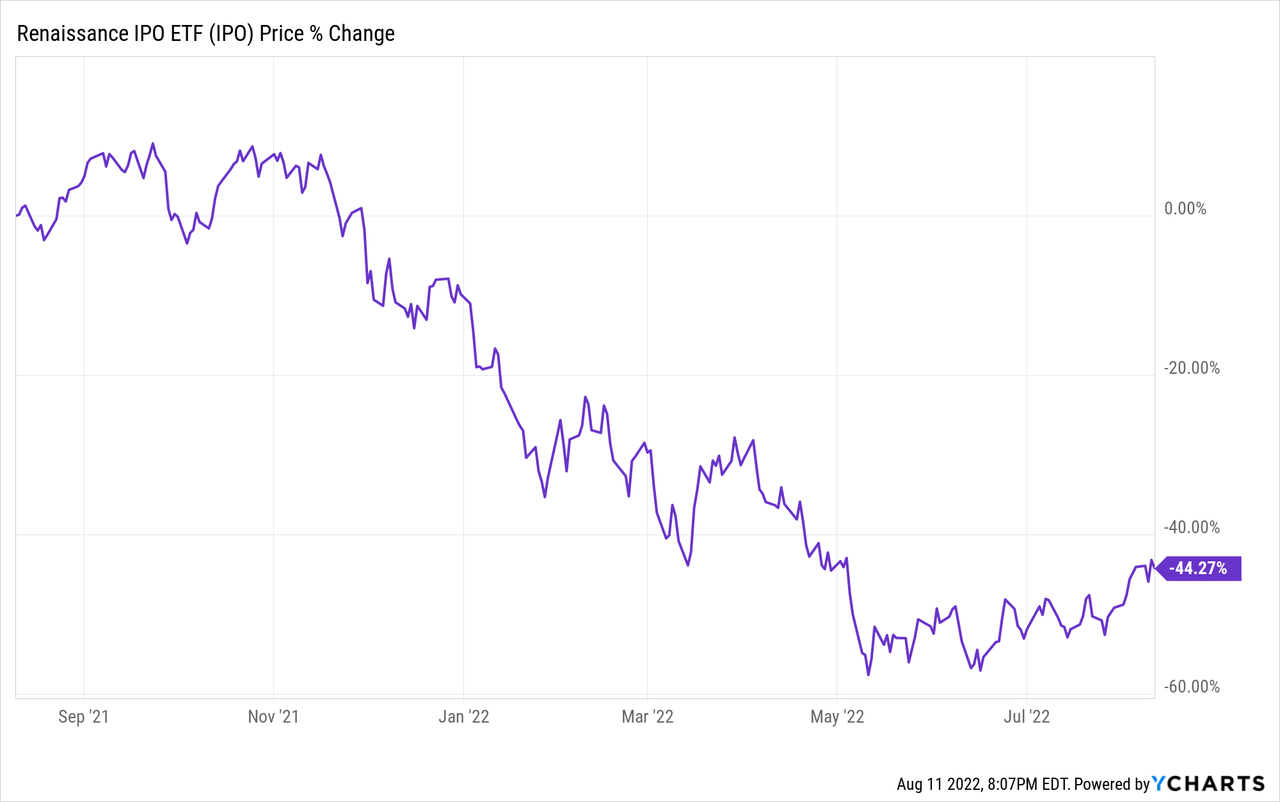

The Renaissance IPO ETF (NYSEARCA:IPO) is an equity index ETF investing in recently IPOed companies. Although there are many important factors to consider when analyzing IPO, including the growth prospects and valuations of the fund’s underlying holdings, I want to focus on one specific issue in this article: recent losses and implications thereof. IPO is down more than 40% during the past twelve months, which has important implications for shareholders.

IPO’s underlying holdings fund a significant portion of their CAPEX and payroll through issuing shares, which dilutes existing shareholders. When share prices are high companies can issue shares at favorable prices and conditions, minimizing dilution, benefitting existing shareholders. When share prices are low the opposite is true, and issuing shares results in excessive, destructive shareholder dilution. Share prices have plummeted 55% during the past twelve months, increasing expected shareholder dilution from share issuance, a significant negative for the fund and its shareholders. Under these conditions, I would not be investing in these companies, or in IPO.

IPO – Quick Overview

IPO is an equity index ETF investing in recently IPOed U.S. companies, defined as those with IPOs in the past three years. It tracks the Renaissance IPO Index, an index of these same securities. It is a market-cap weighted index, with a 10% security cap meant to ensure diversification.

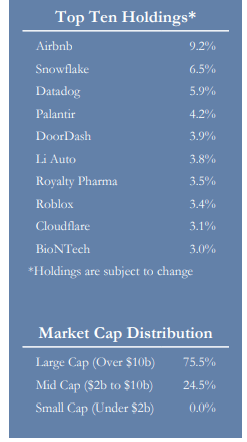

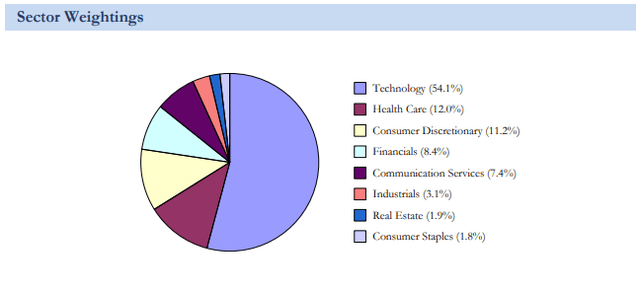

IPO currently invests in exactly 100 companies, focusing on the tech industry. The fund’s largest holdings include well-known tech companies which have recently gone public, including Airbnb (ABNB), Snowflake (SNOW), and BioNTech (BNTX) IPO’s largest holdings and industry weights are as follows.

IPO

IPO

In my opinion, and considering the above, IPO faithfully tracks the U.S. IPO market. Doing so has many positives and negatives, but for this article I wanted to focus on the impact that lower share prices has on the long-term prospects of these companies. Let’s have a look.

IPO – Share Issuance and Dilution Analysis

Tech has significantly underperformed these past few months, with smaller, higher-growth tech companies seeing above-average losses. IPO itself is down by more than 40% these past twelve months, very significant losses.

In most cases, higher share prices have the opposite effect, leading to lower dividend, earnings, and free cash-flow yields, ultimately resulting in lower total shareholder returns, all else being equal. Higher share prices also mean frothy valuations which could, potentially, lead to capital losses, assuming valuations normalize.

The above is, I think, the basic story about how share prices and valuations affect investors. Low share prices and cheap valuations are generally good, and vice versa. There are, however, other important, but sometimes overlooked, considerations. Some context first.

Companies of all stripes invest in capital goods, property, plant and equipment, R&D, and other CAPEX. These expenses are necessary for growth, so tend to be particularly high for high-growth tech companies, including most of IPO’s underlying holdings. These same expenses can be financed in many ways, including through equity, debt, or self-funding from company profits. High-growth tech companies tend to lean towards equity financing, as they rarely generate sufficient cash-flow to self-finance their growth investments, and as young, unproven companies have higher financing costs.

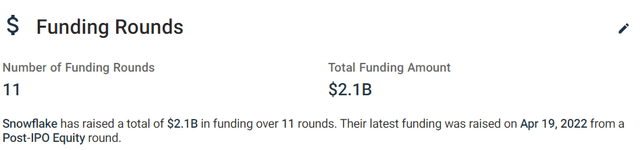

As an example, Snowflake, the fund’s second largest holding, has raised more than $2.1B in equity funding since inception. Last round was in April 2022, just four months ago, for $0.6B, so funding needs are quite large, and ongoing.

Crunchbase

Equity funding means issuing shares, which means diluting existing shareholders, a negative for these. When share prices are high, a company might need to issue a relatively small number of shares, minimizing dilution, and so ensuring minimum harm to existing shareholders. When share prices are low, the opposite is true, and equity financing is a significant negative for existing shareholders.

As an example, let’s go back to the Snowflake example above. Snowflake issued around $600 million worth of shares in April 19, 2022. At the time, Snowflake was trading at a $197 share price, with 300 million shares outstanding. Assuming shares were issued at said price, the company would have had to issue around 3.0 million shares, diluting existing shareholders by around 1.0%, or very little. Snowflake’s share price has tumbled since April, with the company currently trading at $167 per share. If shares were issued at today’s prices, the company would have to 3.6 million shares instead, diluting existing shareholders by around 1.4%, a bit more than before. If Snowflake’s share price continues to decrease, dilution would increase as well. For companies that rely on equity funding to fund their CAPEX, low share prices increase shareholder dilution when raising funds, a negative for existing shareholders.

Valuations themselves also matter, although less so for most high-growth companies, including most of IPO’s underlying holdings. Cheap valuations increase the hurdle rate on accretive equity-funded investments, while frothy valuations have the opposite effect. Issuing shares for a company like Petrobras (PBR), with a P/E ratio of 2.8x and a forward dividend yield of +20%, would almost certainly be a terrible idea, as you are diluting a 20% dividend yield and a 35% earnings yield, which are both very significant figures. Better to simply receive the earnings and dividends as they are. Issuing shares for a company like Snowflake, with a P/E ratio of 1200x and no dividends, is a much better idea, as you are diluting an extremely meager earnings yield, and there are no dividends to speak of. Better to invest to try to boost earnings.

In any case, low share prices and cheap valuations are a negative when issuing shares, which is quite common for IPO’s underlying holdings. Said companies have seen plummeting prices and valuations these past few months, down by more than 40% in the past year, which significantly imperils their ability to raise equity funding at favorable terms. At best, the companies will still be able to raise funds, but at less favorable terms, increasing shareholder dilution, a significant negative for existing shareholders. At worst, the companies will not be able to raise equity funding at reasonable terms, CAPEX will have to be cut, and growth will slow down. VCs have already warned startups and similar that this will very likely be the case, and to prepare accordingly.

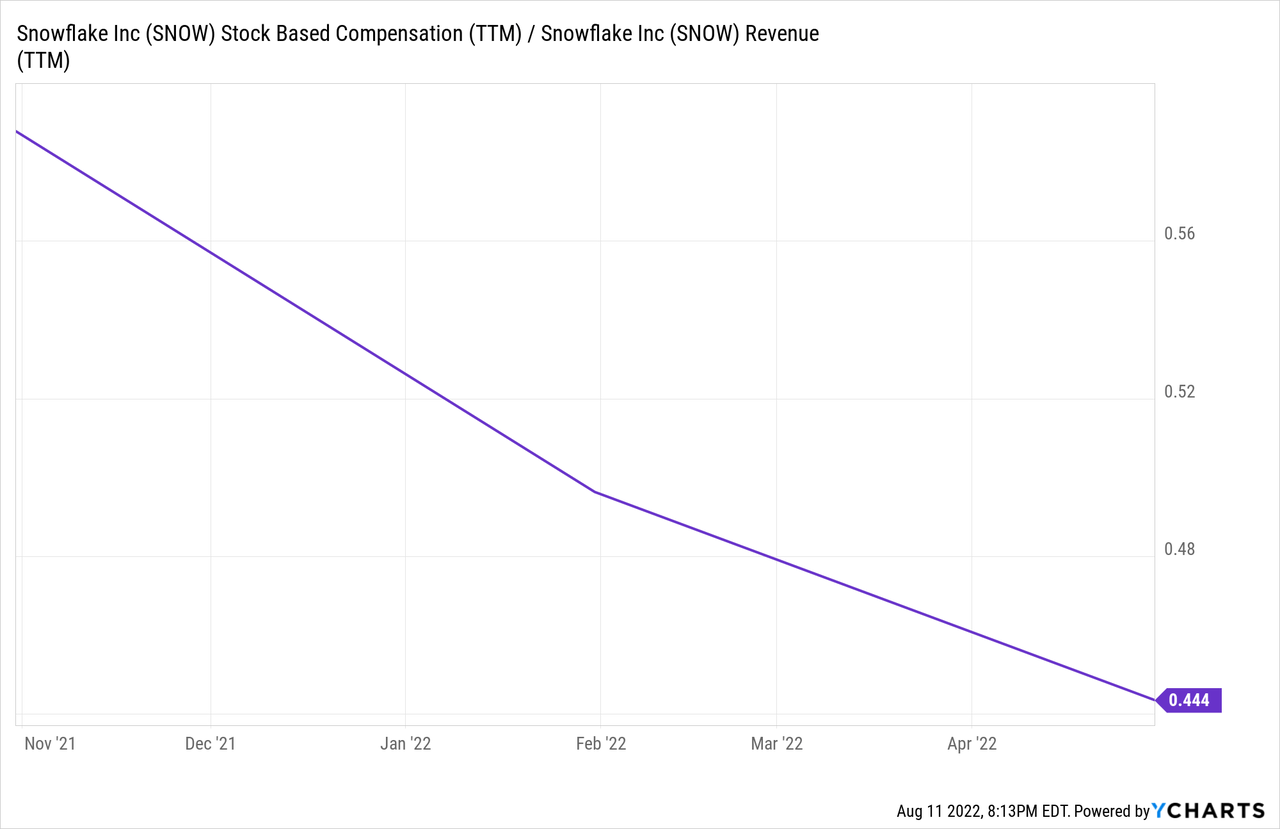

High-growth tech companies also sometimes issue shares to compensate employees (SBC). Doing so serves to conserve precious company cash, and aligns employee incentives, benefitting the company and its shareholders. Doing so also dilutes existing shareholders, a negative for the same. The net effect of these policies is mostly dependent on share prices and valuations. Share-based compensation tends to be a positive when share prices and valuations are high, as shareholder dilution is minimized when this is the case, and vice versa. High-growth tech companies tend to have significant SBC plans. Snowflake, for instance, spends more than $600 million in SBC, equivalent to around 45% of the company’s revenues, a massive amount.

As an aside, considering excessive SBC plans, it is unclear to me if many of these companies have a clear path to profitability or cash-flow generation. Snowflake only looks profitable as it pays a significant portion of their payroll costs, equivalent to 45% of revenue, through issuing shares. This is not a sustainable business without constant infusions of shareholder capital, which means it is not a sustainable business period, in my opinion at least.

For high-growth tech companies and shareholders, declining share prices and valuations are both significant negatives, as these make it more difficult to fund CAPEX and make payroll without incurring in significant shareholder dilution. These issues are already having a significant negative impact on the industry, with many tech companies paring back CAPEX, and boosting payroll. These are significant negatives, but sometimes overlooked by investors, as most companies simply do not face these issues. High-growth tech companies do, and so investors must consider these issues before investing.

In my opinion, the days of easy money, sky-high tech industry valuations, and equity-funded growth, and consistent growth outperformance are over, for now at least. IPO won’t fare well under current conditions, so I would not be investing in the fund at the present time.

Conclusion – No Reason to Buy

IPO’s underlying holdings were dependent on high share prices to fund their CAPEX and payroll. Lower share prices have harmed their business models, and put into question their long-term prospects, very significant negatives. Under these conditions, I would not be investing in these holdings, or in IPO.

Be the first to comment