da-kuk

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”- John D Rockefeller

Introduction

Those who follow developments of my Lead-Lag Live show would note that last week I engaged in a fruitful economic and market-oriented discussion with a noted member of the Economic Cycle Research Institute (ECRI)- Lakshman Achuthan. In keeping with those themes, subscribers of The Lead-Lag Report would also recognize my paywalled macro piece last week, where I examined the characteristics of various market relief rallies over time.

One of the key takeaways from that piece is that you will find a lot of relief rallies that tend to get interspersed within a broad bear market paradigm; novice investors tend to overlook this and assume that things are out of the woods.

To cut a long story short, I suspect that whilst stocks may have looked rather emboldened of late, I still believe the long-term picture looks questionable at best, and one is more likely to see a retest of the June lows.

Under tricky conditions such as this, I believe it would make a great deal of sense to add some defensiveness to your portfolio, and resorting to some dividend-themed portfolios isn’t a bad way to go about this. As noted in the “Leaders-Laggers” section of The Lead-Lag Report, dividend plays have fared reasonably well for the first seven months of 2022, even as most other themes have faltered.

ETF and Canadian Considerations

In light of what I’ve said in the previous section, the iShares S&P/TSX CDN Dividend Aristocrats Index ETF (CLYLF) is something that could work as a suitable defensive play.

Nonetheless, when it comes to CLYLF per se, it deals with 93 Canadian dividend aristocrats; these are essentially stocks that have innately strong balance sheets and cashflow-generating abilities across different cycles; unless you have that foundation in place, you don’t get to a point where you can increase dividends in at least 4 out of the 5 previous years (which is basically the cardinal prerequisite that is demanded by this portfolio’s screeners). Note that these stocks are weighted on the basis of the “indicated dividend yield.” There’s also a very useful income component to consider as exemplified by the monthly dividend income facet of this product.

I’d also bring to your attention that dividend forecasts this year are expected to increase even further from last year and hit $1.54 trillion, representing 5% annual growth, and over a fifth higher than 2020 levels. Don’t be surprised if that number gets beaten by the end of the year. Why so? Well, if we are faced with recessionary or deflationary conditions, which look increasingly likely, you’re essentially staring at a scenario where companies will have limited incentive to invest in CAPEX and the like. I’d like to believe that whatever is curtailed here would likely be distributed to shareholders.

The other thing to note is that this portfolio is dominated by Canadian banks which account for nearly a quarter of the total holdings, and a good 10% higher than the next largest sector- energy. Until a few months back, on account of regulatory requirements, Canadian banks had to keep their dividend distributions in check. This ceiling was recently lifted and it is believed that the banks could increase their dividend outflows from anything ranging from mid-teens to 30%.

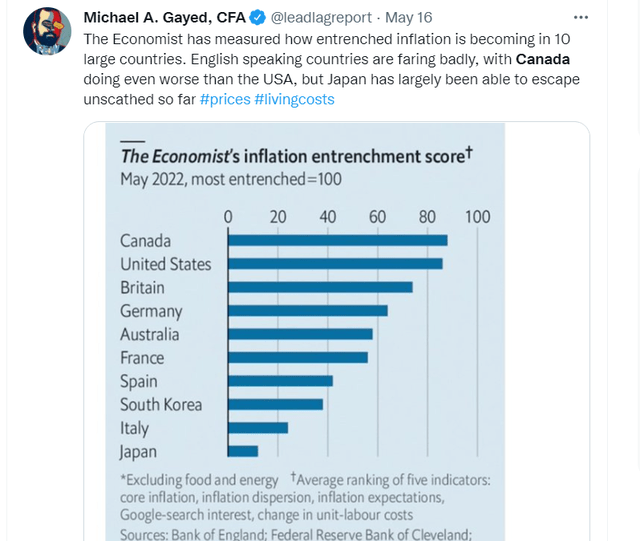

Of course, it’s not all hunky dory for the Canadian banks and the Canadian economy in general. A few months back, I put out a tweet on the timeline of The Lead-Lag Report highlighting how entrenched inflation was in Canada relative to the other large nations.

Well, you’d be interested to know that it is currently over the 8% mark, a level not seen since 1983! A corollary of these steep inflation levels is a front-loading of rate hikes whereby the Canadian central bank caught a lot of people off guard by lifting rates by 100bps even as everyone was only expecting a 75bps hike. More rate hikes are expected this year which would take the policy rate from current levels of 2.5% to 3.75%.

Whilst higher policy rates could do a world of good for the Canadian banks’ net interest margin trajectory, I do worry if there will be ample demand for loans, particularly as the employment situation has turned awry over the last couple of months. As per the most recent report which came out last week, the economy shed over 30000 jobs, a lot worse than the 15000-gain expected by the market. With rates being driven up with such grand fervor, I do worry about debt servicing capabilities, as Canada is innately a highly levered economy with elevated household debt to GDP levels of 102% (just for some perspective, in the U.S. it is at 78%).

Conclusion

Whilst there are a few risks linked to the CLYLF story, note that it can be picked up at a discount to Blackrock’s flagship Canadian focused ETF- The iShares MSCI Canada ETF (EWC). The former is currently trading at a forward P/E of 13.29x, whilst the latter trades at a corresponding multiple of 14.36x. Crucially, the higher yield differential could help mitigate potential drawdowns when sentiment turns weak; CLYLF offers a solid yield of 3.5%, whilst EWC’s yield is only around 2.24%.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment