Andreas Rentz

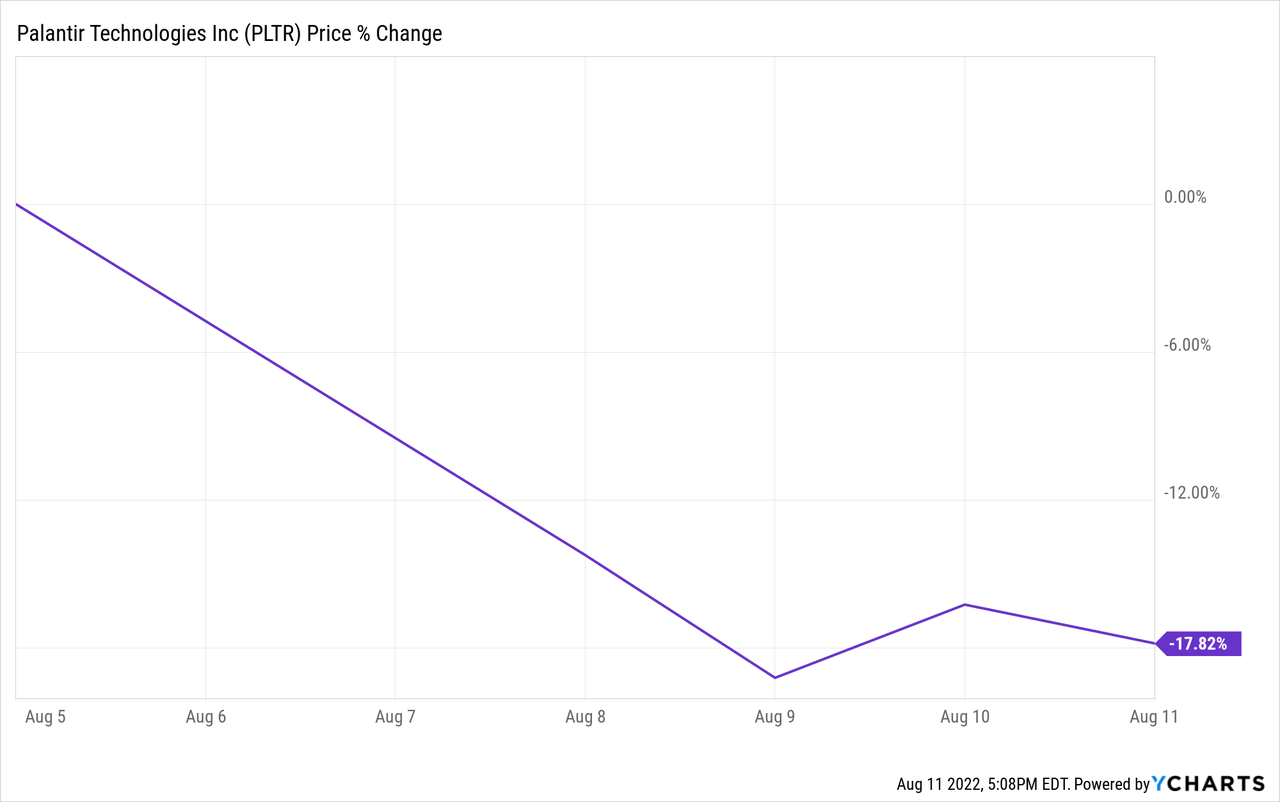

Palantir Technologies (NYSE:PLTR) recently reported disappointing Q2 results and forward guidance, sending shares plunging on the news:

However, we believe that the long-term outlook for the stock remains bullish and, therefore, view the dip as a great opportunity to buy shares. In this article, we share our thoughts on the specifics of PLTR’s Q2 and our outlook for the stock moving forward.

PLTR Stock Q2: The Bad

The bad news for PLTR from its Q2 report and forward guidance was very straight forward:

- Its -$0.01 adjusted earnings per share and its $437 million revenue numbers both missed Wall Street estimates.

- The U.S. Government business saw its growth decelerate to a 27% revenue growth rate in Q2 and overall revenue growth was 26%, also disappointing relative to expectations.

- Guidance for Q3 and the full year also fell well below analyst estimates.

Given that the U.S. Government growth story is supposed to be the main driver of the long-term bull thesis, a deceleration of its growth rate here is concerning and obviously drove a bunch of investors away.

On top of that, the same old negatives persisted for PLTR. Sky-high stock-based compensation continued, leading to a wide gap between the company’s positive free cash flow and its GAAP earnings results. When factoring in the massive stock-based compensation to employees, PLTR continues to run up steep losses and dilute its shareholders.

Given the slowing growth in its top business segment and the continued profitability destruction and shareholder dilution from the stock-based compensation, it is fair to ask whether the company is worth paying 10x trailing twelve-month revenues.

PLTR Stock Q2: The Good

On the flip side, there were also some positives to take away from the quarter, as well as some valuable context for some of the disappointing results that should encourage shareholders who choose to patiently wait for the long-term thesis to play out.

First and foremost, the overall U.S. business showed strong 42% year-over-year growth on a TTM basis and 45% year-over-year growth on a Q2 basis alone. Furthermore, its U.S. commercial revenue grew at a rapid 120% year-over-year rate. One of its biggest growth accelerators was its healthcare subsegment, which generated $153 million in the first half of 2022, representing a 91% CAGR over the past two years.

On top of that, the growth runway only keeps getting larger as the total addressable market continues to grow, boosted by numerous new innovative products released since PLTR has gone public. These include Edge AI, MetaConstellation, Apollo for SaaS, Cosmos, and others.

When factoring in its international business, total government revenue growth remained disappointing at just 13%, but total commercial revenue growth was a much more impressive 46%. On top of that, the net customer count grew by 80% year-over-year and 10% sequentially in Q2. 70% of this growth was commercial. Even more importantly, the average revenue from its top 20 customers grew by 17% year-over-year, reflecting strong customer satisfaction that is delivering robust organic growth at a rate double that of inflation over the same time span.

With $2.4 billion in cash, no debt on the balance sheet, and a total undrawn credit facility of $950 million as of the end of Q2, PLTR remains in exceptional position to continue investing and hiring aggressively to drive continued long-term growth. Management also notably reaffirmed its 2025 revenue guidance of at least $4.5 billion in revenue and also said for the first time that it expects to be profitable in 2025 as well.

Investor Takeaway

While the headline results and guidance were obviously disappointing – as was the stock price plunge following the release of the quarterly report – investors should think twice before jumping ship here. PLTR has always emphasized that its vision is about the long-term and one quarter of disappointing performance and half a year of weaker than expected guidance should not be decisive in determining its long-term fate.

In fact, the key elements of the PLTR investment thesis remained in place during the quarter and CEO Alex Karp provided some helpful context and color on the earnings call that helps to validate the thesis:

- PLTR’s Foundry business continues to boom, particularly in the United States. Its triple-digit growth rate is extremely impressive, its customer count continues to grow rapidly, and top customers continue to increase their revenue contribution to PLTR at a rate that is rapidly outpacing inflation. If this can continue – especially if its growth rate can pick up internationally – PLTR could see high levels of growth for many years to come.

- There is no indication that PLTR’s Gotham business is on the decline or even that its long-term growth trajectory has been seriously altered. While the government growth rate has declined in each of its past four quarters, it nevertheless continues to grow at a double-digit rate. Furthermore, PLTR has a near two-decade track record of successful contract winning and relationship building with the U.S. Government and – with geopolitical threats only increasing – is likely to see that relationship even more highly prized by the U.S. Government in the coming quarters.

- Alex Karp stated on the earnings call that he views the current deceleration in the U.S. Government business as a short-term bump in the road and not a signal for a long-term trend of declining growth:

I think we shared in one of our earnings calls was that our government U.S. business has a CAGR over a decade or more of 35%. During that time, we’ve had a number of years that were flat, and this is frustrating. Believe me, it’s more frustrating for us than anyone else because we would prefer an even lower CAGR, but having more certainty.

And so nevertheless, you can ask yourself the question, does it appear that the last 10 years were less dangerous or the next 10 years are going to be more or less dangerous than the last 10 years? So, it’s just a very basic view that we have. The next 10 years, the next 2 years are clearly more dangerous. America’s engaged on multiple fronts. And then there’s a question, does Palantir have the product market fit and access to the market?

Our product, we’re looking at the U.S. business that’s going to cross the $1 billion mark next year as well. This is like so you have a $1 billion software business as of next year with positioning that has never been as good. So both our micro positioning and obviously, the macro position, it’s so sublime. It’s hard to talk about without sounding like we’re kind of warmongering.

And that’s why I am positing internally and externally the growth in U.S. government over a multiyear period will be at least as good in the future as it was in the past. However, that 35% CAGR included a number of years where it was flat or even negative, and that’s just the frustrating part about contracting at our level. The contracts are so big and meaty that you got to kind of wait.

- Last, but not least, Mr. Karp emphasized that PLTR has a durable competitive advantage:

one of the most important things driving our software, but especially in commercial is, is that people have tried and tried and tried to build our product. We have a number of customers that we’ve been able to bring on board this year that, quite frankly, didn’t like us. And it’s like — but the product brought them back.

And why did the product bring them back? Because the product is actually delivering value that is otherwise not available. And you could imagine 2 years ago, you could spend $1 billion instead of spending $20 million on Palantir. A lot of those people have spent $1 billion. And lo and behold, they are bringing — being brought back to this product often with people that do not inherently want to hang out with us, but the product has brought them back.

And in the U.S. government especially, the U.S. government has tried everything not to buy our product. We had to sue the U.S. government twice. Just imagine how popular I am. They still are buying the product. It’s not a love relationship always. It’s — we bring you back. Our products bring you back.

Once you’ve used Foundry for whatever, all the use cases we talked about, you use Nexus Peering, powering — by powering GAIA and Foundry to bring yourself home alive, you’re not eager to not come home alive. And you will buy the product that actually delivers that even if the person who’s nominally or is actually in charge is unlikable to you.

In essence, thanks to nearly two decades of being refined through aggressive investments in research and development and performance improvements as a result of executing countless missions and corporate enhancements, PLTR’s products are extremely difficult to replicate. As a result, of being best-in-class for a number of mission-critical uses, even if it isn’t the cheapest option, many organizations – particularly the U.S. Government – have no choice but to purchase it. This durable competitive advantage should enable it to continue generating impressive growth rates that keep up with and likely exceed the strong growth tailwinds driving the broader data analytics and artificial intelligence sector.

As a result, we remain very bullish on the stock and view the sell-off after the earnings report as an excellent opportunity to buy shares.

Be the first to comment