Investment thesis

Iovance Biotherapeutics (IOVA) stock has jumped 17% this week on news that data from a phase 1 trial evaluating the use of tumor-infiltrating lymphocytes (TIL) in combination with Nivolumab to treat patients with non-small cell lung cancer and other types of solid tumours will be presented at the American Association for Cancer Research on April 28th.

The wording of the announcement has generated a ripple of excitement, since it suggests that some durable Complete Responses (“CR”) have been achieved using the combination that may be an improvement on results that can be obtained using Nivolumab as a mono-therapy. The study is being carried out by the H. Lee Moffitt Cancer Center and Research Institute in collaboration with Bristol Myers Squibb (BMY), Prometheus Laboratories Inc., Stand Up To Cancer and Iovance.

Iovance is pioneering the development of TIL (also known as adoptive T-Cell) therapies, which involves collecting lymphocytes from a patient’s tumor samples, increasing their number and efficacy using proprietary processes carried out at a lab or manufacturing center, and then infusing the supercharged T-cells back into the patient to attack the cancerous tumours.

The company has numerous candidates progressing through clinical trials. Lead candidate Lifileucel targets melanoma and recently entered a pivotal phase 2 trial enrolling 178 patients, whilst a second candidate, LN-145, is also engaged in a pivotal trial targeting cervical cancer, with 138 patients enrolled. Both Lifileucel and LN-145 are also in trials in combination with pembrolizumab (brand name Keytruda, the multi-billion-selling Merck (MRK) drug that is the closest thing to a cancer wonder drug currently on the market) to treat melanoma (lifileucel) and head and neck and non-small cell lung cancers (LN-145), whilst a third candidate, IOV-2001, is in phase 1/2 trials for treatment of chronic lymphotic leukemia (“CLL”) and small lymphotic leukemia (“SLL”).

Although TIL therapy – similar to CAR-T stem cell therapy – is a complex, lengthy and expensive process, Iovance has generated data from its trials that suggest strong treatment efficacy, and as such, the company expects to submit Biologic License Applications (“BLA”) to the FDA this year for both Lifileucel and LN-145 in preparation for eventual commercialisation.

(Iovance 1-year share price performance. Source: TradingView)

As we can see from the chart above, Iovance share price had enjoyed a strong year prior to the coronavirus induced market meltdown, rising from a price of $11 to an all-time high of $39 (a gain of 255%). Having fallen to a price of $19 in mid-March, the stock is now back on an upward trend, thanks to a combination of the company’s strong trial data, the upcoming Nivolumab combination trial data, and rumours that Iovance could soon become an acquisition target for a Big Pharma concern.

Although it can be tricky to assign a fair value to a company that has not yet commercialised a drug or generated any revenues, Iovance candidates’ promise is such that I believe the company’s share price can make further gains this year, continuing its overall upward trend. Since the news of the upcoming phase 1 data was announced trading activity in Iovance stock has increased, and at least one Wall Street analyst has revised their price target to $60 and issued an Outperform rating.

The caveat here is that worse-than-expected data would likely push the stock price back down and dissipate acquisition rumours, but I believe the body of evidence supporting Iovance’s TIR therapies is strong enough to make the stock a decent long-term investment with exciting short-term growth potential owing to numerous catalysts occurring this year.

Company Overview

(Progress of Iovance and TIL therapy. Source: Iovance investor presentation)

TIL therapy originated in 2011 with the pioneering work of Dr. Steven Rosenberg of the National Cancer Institute (“NCI”) (who once treated President Reagen for an intestinal polyp), who is working in collaboration with Iovance. Rosenberg’s early clinical studies of patients with metastatic melanoma using TIL resulted in objective response rates (“ORR”) of 56% and CRs of 24%.

Iovance (headquartered in San Carlos CA with a commercial manufacturing facility in Philadelphia under construction) won an FDA orphan drug designation for Lifileucel back in 2015, for the treatment of melanoma, followed by a fast track designation in 2017, and finally a Regenerative Medicine Advanced Therapy (“RMAT”) designation in 2018 as clinical data from one cohort of the company’s pivotal trial of Lifileucel revealed an ORR of 38% in Melanoma patients with an average 3.3 prior lines of therapy. The data helped Iovance management to raise a further $425 million to fund its ongoing operations in 2018.

Meanwhile, LN-145 was awarded Breakthrough Therapy Designation (“BTD”) by the FDA for treatment of cervical cancer in 2019, and its pivotal phase 2 trial – consisting of 5 cohorts and beginning in April 2017 – is ongoing. IOV-2001 received an Investigational New Drug (“IND”) approval from the FDA in 2019, dosing its first patient in its 3-cohort phase 1 / 2 study in early 2020.

Lifileucel’s cohort 2 data from its melanoma trial was released in November last year at The Society for Immunotherapy of Cancer (SITC) Annual Meeting, showing 35% ORR based on independent review, and as at January 2020, the median Duration Of Response (DoR) had not been reached at 15.5 months. Two Complete Responses were recorded, and 81% of 66 patients had a reduction in tumor burden of greater than 30%.

At the ASCO annual meeting in June 2019, Iovance announced results from its ongoing lN-105 Phase II trial of LN-145, revealing that out of 27 patients with a mean of 2.4 prior therapies, the ORR was 44% with 3 complete responses and 9 partial responses, and the DoR had not been reached after 7.4 months (78% patients experienced some form of tumor reduction >30%). This was sufficient for the FDA to recommend registration in the treatment of patients with metastatic cervical cancer, and subsequently, Iovance widened the scope of the trial to include early-line as well as late-line patients.

A major advantage of TIL therapy is that the technique is able to treat solid tumours which are present in 90% of cancer incidences, with 1.6 million cases per annum. This ought to ensure a large market for Iovance’s TIL treatments, should they be approved, initially in later lines of therapy, before progressing into a larger market still in early-line treatments and eventually across new indications entirely.

Manufacturing and Gen 2 & 3

Iovance says that it is the only company in the US to have a proprietary, scalable, centralised and commercially viable TIL manufacturing process in place.

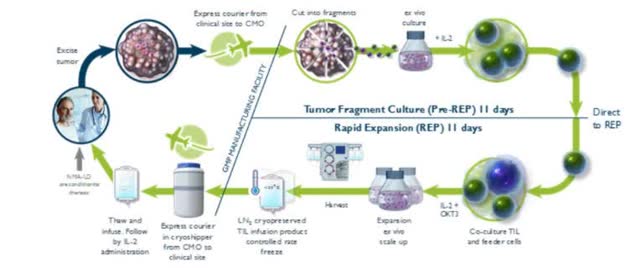

It is an efficient 4 step process which begins with excision of a patient’s lesion to capture the patient’s TIL, then extraction of the TIL by fragmentation of the tumor, followed by expansion of the TIL exponentially ex vivo to yield (Iovance says) 10(9) – 10(11) TIL. Finally, preparation and infusion takes place – first the patient receives a lymphodepletion treatment to suppress the tumor’s microenvironment and maximise the potential potency of the therapy, then the patient receives an infusion of the new cells plus up to 6 doses of IL-2 to stimulate activation and proliferation of the TIL (data taken from company’s 2019 10-K submission).

(Diagram explaining Iovance’s Gen 2 process. Source: Company 10-K 2019)

Iovance began with a process named Gen 1 which took 5-6 weeks and now uses a faster Gen 2 process which takes 22 days in total between receipt of the patient’s tumor sample until shipment of the product back to the institution for infusion. The end product is a cryopreserved TIL, and it has been used on more than 300 patients with a 90+% success rate, Iovance says.

Although the process is efficient, the lengthy wait times caused by extraction and engineering (similarly to CAR-T therapy) is one of the perceived issues with this type of autologous cell therapy treatment. Iovance uses its Gen 2 process for most of its ongoing clinical trials and will include it as part of its BLA submission for Lifileucel. A Gen 3 process (which takes only 16 days) is currently under development and being used in the ongoing LN-145 trials for head and neck cancers, as is a manufacturing process (named LN-145-S1) that identifies and selects TIL that are PD1 positive only and is also being tested in the head and neck cancer studies.

(Iovance manufacturing facility proposed site in Philadelphia. Source: Company presentation)

Iovance is building a 136,000-sq. ft. manufacturing facility in Philadelphia (work is slated to be fully completed in 2022 and will cost $85 million) in order to produce everything in-house and has secured ten patents covering compositions and methods of treatment across numerous cancers using Gen 2, with further patents pending, including for marrow-infiltrating and peripheral blood lymphocyte therapies, novel manufacturing processes and genetically modified TIL therapies.

Approval prospects

It is unlikely that either Lifileucel or LN-145 will be approved in 2020, since the BLAs are not expected to be submitted until the end of the year but the strength of the data from the company’s trial results to date is undeniable, and there is a significant unmet need in the late-stage second- and third-line markets Iovance is targeting (currently melanoma and cervical cancer) that lack a standard-of-care treatment.

The last patient has now been dosed in the pivotal Lifileucel melanoma trial, and Iovance President and CEO Maria Fardis told analysts on the Q419 earnings call that the company plan to follow patients for at least six months before supplying data for the BLA later in the year. Dosing is expected to complete in mid-2020 for the pivotal cervical cancer trial involving LN-145 – the target enrollment figure is 75.

The 44% ORR achieved in the cervical carcinoma trials to date significantly outperforms other treatment types such as antibody drug conjugates (average 22%), anti-PD1 therapies (~11%) and TKIs (27%) – rival treatments being developed by the likes of Seattle Genetics (SGEN, see my note here), Agenus (AGEN), Regeneron (REGN, see my note here) and Puma Biotechnology (PBYI).

As such, I believe that Iovance’s treatments have a reasonable chance of being approved and even targeting best-in-class / standard-of-care status for late-stage treatment, but there is little prospect of the company earning any revenues at least until mid-2021. Should approval occur, the addressable market is large – melanoma is diagnosed in 96,000 patients in the US every year and is responsible for 7,200 deaths, whilst cervical cancer is diagnosed in 13,000 women and causes 4,300 deaths per annum.

With TIL therapy being a new form of treatment, should it prove to be successful in a real-life setting, it would provide significant encouragement for the rest of Iovance’s TIL clinical pipeline, which includes candidates IOV-2001 for CLL and SLL, IOV-3001 – an antibody cytokine engrafted protein that has been in-licensed from Novartis (NVS) – and a further transcription activator-like effector nuclease (“TALEN”) – technology licensed from research partner Cellectis (CLLS) that Iovance will be using to genetically edit TIL.

Cowen analyst Boris Peaker has suggested that the Lifileucel and LN-145 product offerings could be worth as much $6 billion, with the remaining earlier-stage programs worth a further $1-2 billion. The consensus analyst price target for Iovance is $38.

Conclusion

The optimal time (in my view) to have bought Iovance stock would have been in January or February this year, before the stock gained 67% in just a few days to hit $40, or during the recent dip, but at current price of $36, Iovance still represents a reasonable entrance point.

For me, the hype around TIL and Iovance seems justified. Should the data released on 28th April around NSCLC confirm that durable complete responses were achieved in clinical trials, that opens up an exciting new opportunity for Iovance, since it has 2 cohorts in its IOV-COM-202 “basket” study enrolling NSCLC patients for treatment with Lifileucel and LN-145.

This adds to the attractiveness of Iovance as an acquisition target. There is plenty of speculation across social media that Iovance management are not averse to selling the company – with Gilead being linked to a potential acquisition after its $4.9 billion acquisition of Forty Seven – as well as counter-arguments that the NSCLC data may have persuaded Iovance management to take down the for-sale sign. Any acquisition would likely take place at a significant premium to the current price per share and current market cap of $4.5 billion, whilst the price tag will continue to grow so long as Iovance’s candidates continue to progress smoothly towards commercialisation. This a powerful tailwind that gives the stock good potential upside, in my view.

Financially, Iovance appears to be in a stable position. Total current assets were $316 million at the end of 2019 against total liabilities of $45 million, and stockholders’ equity is $299 million. The company made a loss of $197 million in 2019, up from losses of $123 million and $92 million in 2018 and 2017 respectively. It is likely that the company will look to raise further funds to ensure a funding runway that lasts at least until the likely commercialisation of Lifileucel and LN-145 in 2021, and it will be interesting to see what effect this month’s NSCLC data readout will have on the price at which Iovance will issue shares at going forward.

Personally, I believe that Iovance has a relatively unique and advanced product offering, passes the test of having promising data readouts from trials, has a scalable manufacturing strategy in place and maintains good relations with the likes of the NCI and FDA, who are supportive of TIL therapy and so far positive about the effect it can have on the oncology market. As such, it is hard to see a scenario where neither Lifileucel nor LN-145 make it to market (although that can never be ruled out).

Due to the size of the addressable market, I therefore believe that Iovance stock can justify a price above $50 and that any company looking to acquire the company could pay as much as twice this figure based on recent deals within the biotech industry, such as Gilead’s Forty Seven acquisition or Novartis’ purchase of The Medicines Company for $9.7 billion.

Autologous cell therapy does not have a superb track record in a real-life setting to date, with CAR-T therapies such as Yescarta and Kymriah failing to make significant sales in their first years since approval. Perhaps TIL therapy – with its exceptional trial results – has the potential to change that. If it does, it would represent a significant step forward for cancer treatment and shareholders will be rewarded, whether they are investing over the shorter or longer term.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in IOVA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment