guvendemir/E+ via Getty Images

Well, on Tuesday, March 22, 2022, the stock market rushed back!

Last Wednesday, Thursday, and Friday, following the FOMC meeting that ended around noon on Wednesday, investors felt that the Fed was not really tightening up, as implied in the remarks following Mr. Powell’s comments.

On Monday, Mr. Powell spoke and stated that the Fed would do everything that was necessary to fight and defeat inflation.

Stock prices fell.

But, by Tuesday morning, according to the Wall Street Journal:

“investors were interpreting Mr. Powell’s comments as a vote of confidence in the economy’s outlook.”

“‘The message that came out of the [Fed] meeting last week is that they are going to be tightening [monetary policy] but the [U.S.] is resilient enough to withstand that,’ said Huw Roberts, head of analytics at Quant Insight, a data analytics firm.'”

“The equity market chose to emphasize the economic resilience portion.”

In other words, the monetary policy presented by Mr. Powell was not going to stop the economy from growing. But, would this really stop inflation.

Anyway, on Tuesday stock prices rose again.

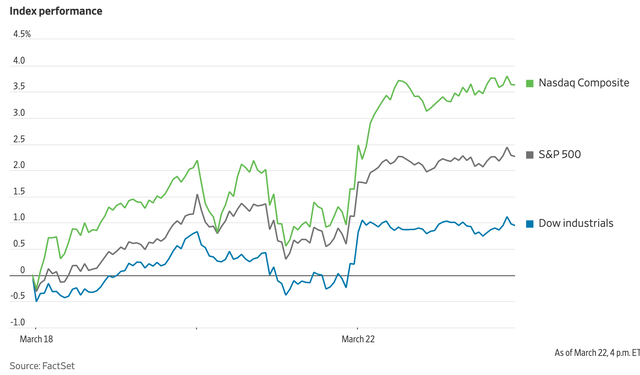

Stock market prices (Wall Street Journal)

The Problem

The problem here is Mr. Powell and the Federal Reserve.

As I have written before, the Federal Reserve should not be dominating the headlines. This means that things are out-of-control.

The Federal Reserve should not be dominating the movement of markets.

The Federal Reserve is causing more problems than it is solving.

The Federal Reserve is really doing its job when no one has anything to say about the Fed.

So, what will be the take on the Fed tomorrow?

What will the newspapers be quoting Mr. Powell on Wednesday?

Will the stock market continue to rise?

And, we still know little or nothing about what the Fed will really be doing in the future.

The Federal Reserve, over the past two years or so, got us into this position.

Right now, it seems clueless about how to get us back to a more productive, stable economy.

The Yield Curve

Just for fun, another factor has come to the attention of analysts.

The yield curve is flattening.

One of the “best” predictors of a recession is a flat or a negative-sloped term structure of the interest rate curve.

Well, investors are starting to observe that the yield curve is getting closer to being flat.

And, if short-term interest rates rise pretty fast over the next month or two as the Fed moves to get its policy rate of interests UP, then there is the real possibility that the yield curve will become flat or even take on a negative slope.

Recession ahead?

Well, it seems as if Mr. Powell does not think this is a possibility.

Remember, on Monday, the Wall Street Journal said that

“investors were interpreting Mr. Powell’s comments as a vote of confidence in the economy’s outlook.”

It seems as if Mr. Powell thinks the economy will go up and up and up.

At least, this is what investors are taking from his remarks.

Is there a problem here?

The Concern

In one respect, Mr. Powell and the Fed are saying too much.

Stock market prices go up and stock market prices go down.

But, on the other hand, Mr. Powell and the Fed are not saying enough.

Just will the stance of monetary policy be in the near future?

Well, we are waiting for new statistics, we hear.

We will do whatever the statistics tell us to do.

And, that is the extent of forward guidance see get.

Is this a sign that in the current environment, the Fed really doesn’t know what to do?

Even with that as a passing thought, the idea that we are even thinking something like that should scare us.

What do you think the stock market is going to do tomorrow?

I know. First, I need to tell you what Mr. Powell is going to be talking about tomorrow, then you can tell me what stock prices are going to do.

Be the first to comment