Nicholas Smith/iStock Editorial via Getty Images

In this article, I take a closer look at John Deere (NYSE:DE). It is a company I have been watching from the sidelines for many years, but so far not (yet) initiated a position. With all the headlines about potential food shortages as a consequence of supply chain issues from COVID-19 and the Ukraine situation, it seems like a potentially accommodating environment for a company like Deere. Their share price has however dropped 8% YTD at the time of writing and is 25% off its 52-week high. It, therefore, makes sense for me to check it out as a potential investment and share the outcomes of my analysis here on Seeking Alpha.

Deere share price performance YTD (Seeking Alpha)

Recap: My investment strategy and goal

Let me first recap my personal investment strategy and goals, to help you better understand my approach and perspective. My goal is to reach financial independence years before my official retirement age of 67 (or perhaps even 70 or later by then). This independence is achieved when my annual dividend income equals or exceeds my annual cost of living. At that moment I become completely independent from the income from my full-time job. Maybe I am still happily working in a full-time job and continue working, but maybe I decide to quit and find a different meaning for the remainder of my life. Achieving this goal of financial independence seems very realistic and my calculations show I can achieve it within the next 10-15 years.

All my investment decisions are made with this ultimate goal in mind. This means that whenever I have money to invest (my monthly addition to my investment account or re-investing dividend), I assess how it brings me closer to reaching this goal. This means that I look at the dividend that I expect the investment to generate immediately, but also 10 – 15 years into the future. This means that I always try to balance between a reasonable entry yield and expected dividend growth. I also only invest in undervalued or fairly valued high-quality companies and intend to hold them for decades. Safety of principal and foremost reliability of the dividend is extremely important to me.

Please check out this article on a model portfolio to get more insights into my investment style and portfolio, including the update I wrote when the Ukraine crisis unfolded and the portfolio was seriously stress-tested.

Introduction

Deere & Company is a well-known company covered extensively on Seeking Alpha. I, therefore, don’t think a very elaborate introduction of the company is needed, but let me share this with you.

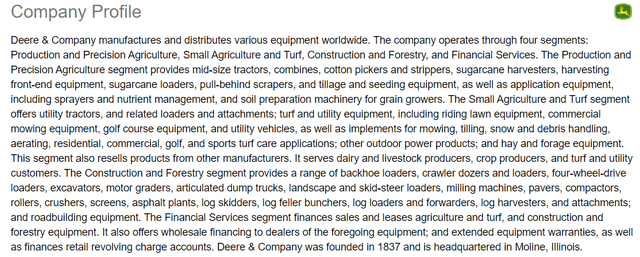

Deere & Company profile (Seeking Alpha)

In 2021, the company had total revenue of USD 44B and 6B in net income. Deere has around 75k employees worldwide and a market capitalization of around USD 100B.

Company profile (Deere & Company annual report 2021)

As you can see the company is a well-diversified global powerhouse in agricultural solutions.

Main competitors are Caterpillar (CAT), CNH Industrial N.V. (CNHI), and Kubota Corp. Japan (OTCPK:KUBTY).

Reasons to like Deere & Company as an investment

Let me now share with you the reasons I found in my analysis that make me like Deere & Company as an investment.

Strong recent financial results

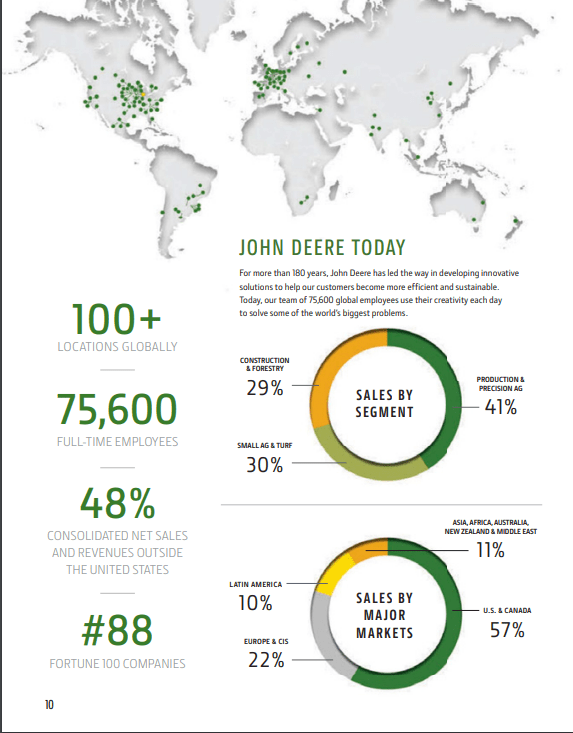

The 2021 financial results were already impressive and discussed in other articles on Seeking Alpha:

Deere & Company 2Q 2022 earnings call update (Seeking Alpha)

Sales increased by 24-27% YoY and net income more than doubled. This is very impressive for such an old company in a quite mature market.

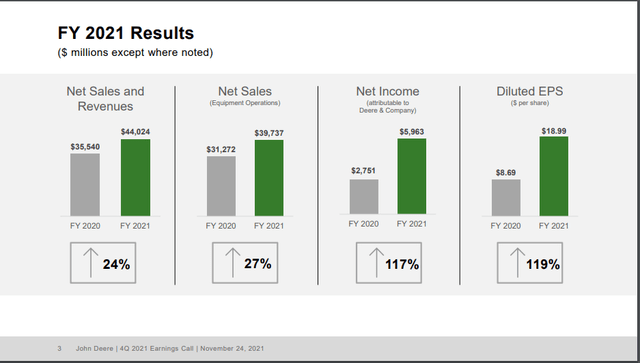

To further add to that, please check out the 2Q 2022 results:

Deere & Company 2Q 2022 earnings call update (Seeking Alpha)

As you can see, on top of the already very impressive 2021 results, the company further grew its top line by 10% and profitability by almost 20%!

For FY2022 they forecast net income to be around USD 7-7.4B compared to USD 6B in 2021. This means they expect the +20% net income growth to be achievable for the full year.

Skyrocketing agricultural commodity prices

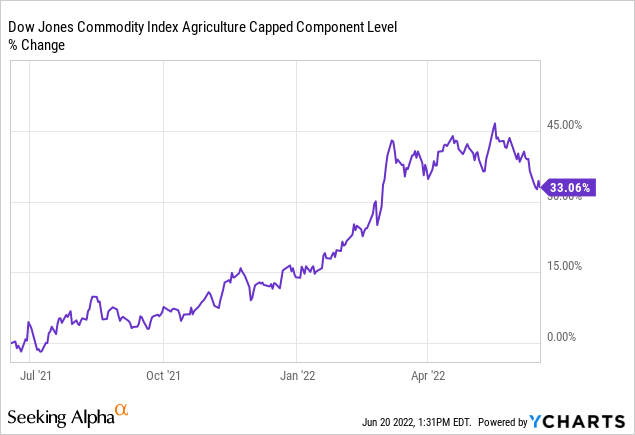

Food scarcity and a potential food crises are regularly in the headlines. The main drivers are extreme weather (causing some bad harvests in recent years), COVID-19-related supply chain issues and (last but not least) the Ukraine war.

As you can see in the graph, agricultural commodity prices increased by 33% over the last 12 months. This is very concerning from a consumer perspective, especially considering a lot of emerging markets where food security is more fragile than in the US or Europe.

From the perspective of Deere & Company, this is a positive development. It means that a lot of their (potential) customers can make more money with their agricultural business, giving them more financial leeway for investments in Deere & Company’s products like state-of-the-art agricultural machinery.

Friendly shareholder policy

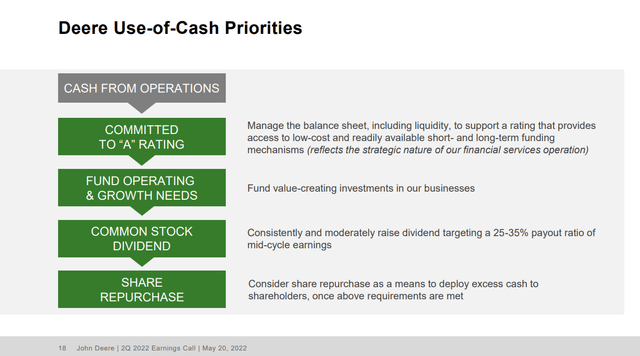

The company also has a friendly shareholder policy, please see below.

Deere & Company 2Q 2022 earnings call update (Seeking Alpha)

They target a consistently and moderately increasing dividend that is sustainable across economic cycles. On top of that, they also deploy excess cash for share repurchases. In 2021 they for example bought back around USD 2.5B in shares or 2.5% of the total market capitalization of the company.

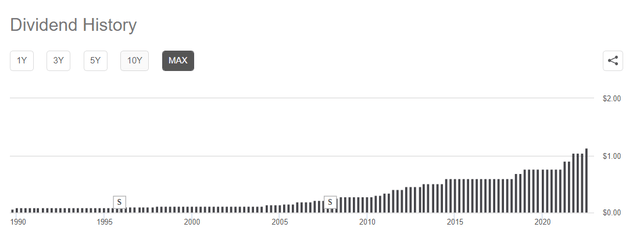

In light of this, it is no surprise Deere has a very long track record of consistently paying a dividend to its shareholders. As you can see below, the company consistently paid out a quarterly dividend since at least 1990.

Deere & Company dividend history (Seeking Alpha)

Yes, the dividend was kept flat during various periods of multiple years. They however did not miss any quarterly dividend payments since 1990 and did not cut the dividend at any moment either. This underlines the robustness of their business and how important they deem their continuous dividend payments. They are also clearly able to right-size the dividend (growth) over a long period, considering the cyclical nature of the wider economy and demand for their products.

Dividend growth over the last 5 years was 11% CAGR. For the next 3-5 years, EPS growth is estimated at 15% CAGR. I expect the dividend to grow in the upcoming years between the historical 11% CAGR dividend growth rate and forward 15% EPS growth, taking the midpoint of 13%.

Innovation

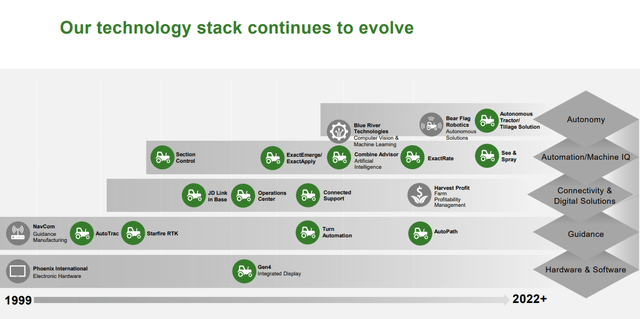

To ensure the relevance of their products in the future and to remain a market leader, Deere & Company invests a lot in innovation. As you can see they actually emphasize cultivating innovation across the whole company. No surprise they have been able to develop a lot of innovations over the years, as for example is shown in the following graphic from their Investor Presentation.

Deer & Company innovations (Investor Presentation)

As you can see they also have a pipeline with further innovation projects. Main focus areas are autonomous tractors and Precision technology.

Such focus on innovation is crucial for a company to remain relevant and (financially) successful, especially in a rather mature market such as in which Deere & Company operates.

Reasons to like Deere & Company less as an investment

To complete the analysis, let me also share what I found to like the least about the company as an investment.

Low entry dividend yield

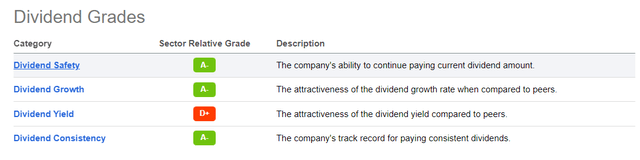

As mentioned earlier in this article, Deere & Company has a very long track-record of consistently paying a dividend and moderately growing it over time. The downside here is that currently the entry yield is only 1.4%. This is also well reflected in the Dividend Grades that Seeking Alpha assigns to the company.

Deere & Company Dividend Grades (Seeking Alpha)

It is a very safe, consistent and growing dividend, the yield is however rather low. For me as a dividend (growth) investor, this is something to be cautious with. Such a low dividend entry yield should be accompanied by sufficient expected dividend growth to enable the dividend yield to grow fast enough to be attractive in the longer term.

Increased costs

Although demand for their products is strong, the company cannot insulate itself from the wider supply chain and chip shortages issues. See for example this article on the topic, where they forecast these issues to remain a challenge throughout the full year. It is not only about increased costs, but also shortages in some of their key components. They are surely not the only company facing these challenges, but it is a factor to consider and that could impact their ability to meet their (financial) objectives and customer demands. It is at least assuring that they updated their FY2022 outlook when releasing the Q2 2022 results and still expect strong results more or less in line with the original outlook.

Economic uncertainties

As several CEOs like Jamie Dimon and Elon Musk have stated recently, we could be heading for turbulent economic times. Unemployment is at record lows, but energy prices and inflation, in general, are spiking, causing central banks to move forward quickly with raising interest rates.

This will likely create downward pressure on the economy, especially slowing down investments because (simply said) the time of ‘free money’ seems to be over. This could also put pressure on demand for many of the products of Deere & Company.

Investment thesis

Deere & Company is a great company with a long successful track record. The company is expected to continue their good performance in the upcoming years. Looking at the stability of their financial performance and dividend (growth) track record, I would be happy to add the company to my investment portfolio.

Let’s take look at the valuation, to assess the current share price.

- The backward-looking TTM PEG ratio is 0.5 and the Forward PEG ratio is 0.97. A PEG ratio at or below 1 indicates the company is attractively valued considering its growth.

- The backward-looking TTM Price Earnings (‘PE’) ratio is 17, the Forward PE ratio is 14. Using Benjamin Graham’s PE ratio formula for growth companies, this implies profitability growth rates of 2.75% – 4.25%. Deere & Company however delivered double-digit growth rates with its net income over the last years and is expecting to keep a similar growth rate for the upcoming years. Considering even a prudent 10% growth rate would justify a PE ratio of 28.5, meaning the share price could double if that was achieved.

My personal criteria for the dividend of any new investment I make is to expect at least a YoC of 7.5% in 15 years.

The entry dividend is relatively low at ‘only’ 1.4% but is expected to grow by 13%. In 15 years, this would bring the YoC to 6.8%. This is a bit below my personal requirement of 7.5% YoC, but should also be accompanied by substantial capital gains. The company has proven itself as a nice compounder with a 325% share price increase over the last 10 years or 15% CAGR. Considering the current undervaluation that the PEG and PE ratio implies, for the next 15 years, substantial capital gains are likely and would generate a nice bonus on top of the fast-growing dividend.

Deere & Company is therefore a BUY, in my opinion, offering a nice combination of longer-term dividend growth and capital gains.

Conclusion

As you have seen, I think Deere & Company is an attractive investment right now, even for dividend-oriented investors that would normally be turned off by the relatively low entry yield. This case underlines the power of compounding high dividend growth, which would still push the dividend yield to an attractive level in 15 years (my time horizon for such investments). On top of that, you have a high probability of enjoying substantial capital gains, the company has proven itself as a long-term compounder.

Hope you enjoyed the article. Happy to read in the comments if you (dis)agree with the analysis and conclusions!

Be the first to comment