amanalang/iStock via Getty Images

By Rob Isbitts

Summary

Invesco Ultra Short Duration ETF (NYSEARCA:GSY) has provided its investors with essentially nothing, despite approaching its 15-year anniversary. This ETF has a total return including dividends of just 17% over those nearly-15 years. It’s a wonder it still exists. Yet there is something happening that has not occurred in a long time, and might just play into GSY’s hands. That something is a combination of rising US T-Bill rates and an end to the total dominance of the US Dollar on world currency markets. We rate GSY a Hold, but encourage fans of short-term bond ETFs to keep this one on the radar.

Strategy

This ETF owns a variety of very short-term bonds. Its objective is to beat the return on US T-Bills and similar instruments that mature in a year or less. GSY tries to this in several ways, including owning very short-term issues from US and non-US corporations as well as non-US equivalents of T-bills, i.e. the shortest foreign government debt instruments.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds

-

Sub-Segment: Short-Term

-

Correlation (vs. S&P 500): Very Low

-

Expected Volatility (vs. S&P 500): Very Low

Holding Analysis

GSY holds over 200 securities, with no position occupying more than 3% of the fund, and only 3 positions accounting for more than 2% of the ETF’s assets. This spreads risk well, and only adds to the defensive nature of this security, the vast majority of whose holdings mature in 2023. US holdings make up about 60% of the fund, and BBB-rated holdings make up nearly 40%. 20% of the holdings are unrated.

Strengths

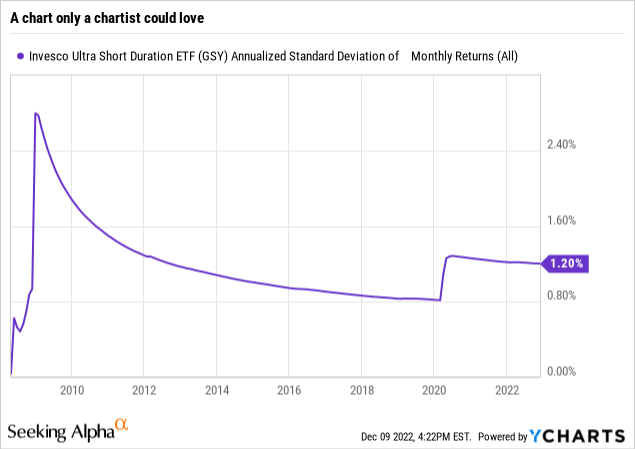

GSY has one of the lowest historical standard deviations we’ve ever seen in an ETF. In English, that means that its returns from one period to the next don’t vary much at all. In generic terms, if a fund averages a 1% annualized return (which this one has, historically), and has a 1% annualized standard deviation, that means that its 1-year return has ranged from 0% and 2% about 2/3 of the time, and between 3% and -1% in a year about 95% of the time. As you can see, the annualized standard deviation of GSY “popped” up to about 3% during the Global Financial Crisis, has stayed around the 1% range over the past decade, and only recently popped its head above that 1% area. Is that a strength? If you are more concerned with return of your capital than return on your capital, yes.

Weaknesses

If you ever find an ETF with a much higher return (say, 5-10% a year) with a 1% standard deviation, let us know…because if it exists, its either a very, very rare bird, or its Madoff-ian. But we digress. And who can blame us, talking about an ETF that has basically goes at the same speed all the time for more than a decade. That speed is standing still. In fact, if an investor bought this in a professionally-managed account, they’d probably have a negative return since inception, since GSY can’t even cover the advisory fee. So, if GSY continues to do what it has done in the past, there’s no need to give it a thought.

Opportunities

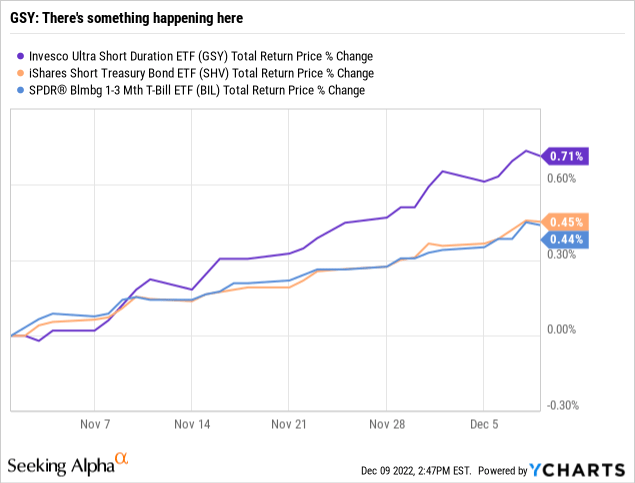

So, there must be something that got the contrarian in us to notice this ETF, and notice it now. The above chart shows that to you. Now, we are not going to make a big deal about the fact that GSY gained 0.7% in about 5 weeks, handily beating US T-Bills. The question is why, and will it turn into a stronger trend. After all, investors are starved for anything resembling a reliable return that doesn’t come with massive market risk, and isn’t close to zero. They’ve been looking for that for a long time.

The key here is the US Dollar. Because nearly 40% of GSY is invested in very short-term bonds that are not denominated in US Dollars. The Dollar has been on a historic run, and income/risk-management types like us have been searching for unique ETFs that might offer a way to capitalize on this very unique investment climate. If the US Dollar were to continue its recent hint of topping out, the T-Bill holdings from places like Canada, Japan, German and the UK might add some value to a plain vanilla T-bill ETF.

If you have read some of our other ETF profiles on bond funds, you know that we are very bearish on credit markets, i.e. corporate bonds. However, when that corporate bond exposure is predominantly in items that mature in under a year, we cool our jets a bit on the “credit market crisis” talk.

Threats

If 2008-2009 was the worst-case scenario for GSY, it is within the range of what we’d consider reasonable. In the heat of that crisis, GSY gained 12% in a single day, then gave it all back the next day. That’s why it has a 12% “Max Drawdown” statistic. Other than that 2-day net-zero-return situation, it has been a smooth, boring, uninspired ride. For nearly 15 years.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

GSY’s history could be confused with a money market fund, or worse. But it is solidly-built, has Invesco, an ETF leader behind it, and doesn’t take single-security risk. It is one we’d consider buying at the right price, and if it fit the rest of our portfolio mix.

ETF Investment Opinion

The wildcard here is whether that US Dollar and credit market flight to safety (of very short-term bonds) ends up being something to capitalize on. This is such a strange yet opportunistic time in market history, especially for bond investing. Frankly, we can’t believe we are even a bit excited about this ETF. But like the old saying goes, GSY might continue to go nowhere. But we’re “saying there’s a chance” that it could be a rare opportunity at some point during 2023. Thus, we rate it a Hold, not an “ignore” which is what we’d normally do with an ETF with a 17% cumulative return over 15 years.

Be the first to comment