SimonSkafar

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 26th 2022.

I recently wrote about the performance of inflation-hedge ETFs, including those focused on TIPs, commodities, energy, and the like. While looking through energy ETF performance, the Invesco Dynamic Energy Exploration & Production ETF (NYSEARCA:PXE) caught my eye.

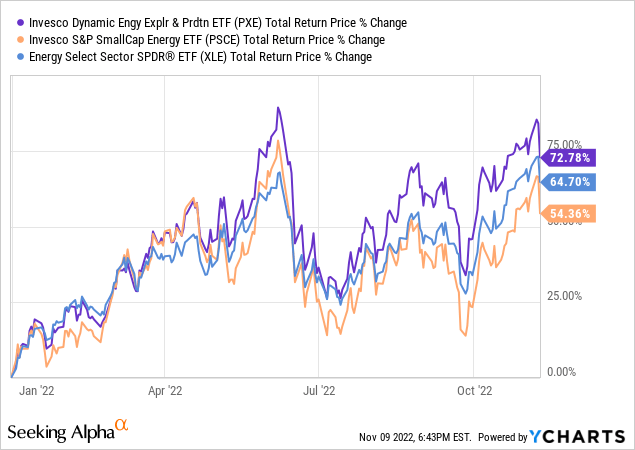

PXE has been the best-performing energy industry ETF YTD, excluding leveraged funds and the like, with returns of over 73%. For reference, the Energy Select Sector SPDR ETF (XLE), the industry benchmark, is up by a bit less than 65% for the year. Considering PXE’s outstanding performance and strong energy industry fundamentals, thought the fund merited a closer look.

PXE is a smart-beta U.S. energy industry ETF. It invests in the 30 U.S. energy equities with the strongest fundamentals across momentum, growth, quality, value, and management metrics. PXE’s methodology is proprietary, so evaluating it in any real depth is impossible. PXE has outperformed relative to its peers YTD, but has effectively matched, technically slightly underperformed, since inception. PXE is a reasonable investment, although I see few reasons to expect further outperformance moving forward.

PXE – Basics

- Sponsor: PIMCO

- Underlying Index: The BofA Merrill Lynch Long Treasury Principal STRIPS IndexSM

- Dividend Yield: 2.14%

- Expense Ratio: 0.15%

- Total Returns CAGR 10Y: 5.43%

PXE – Overview

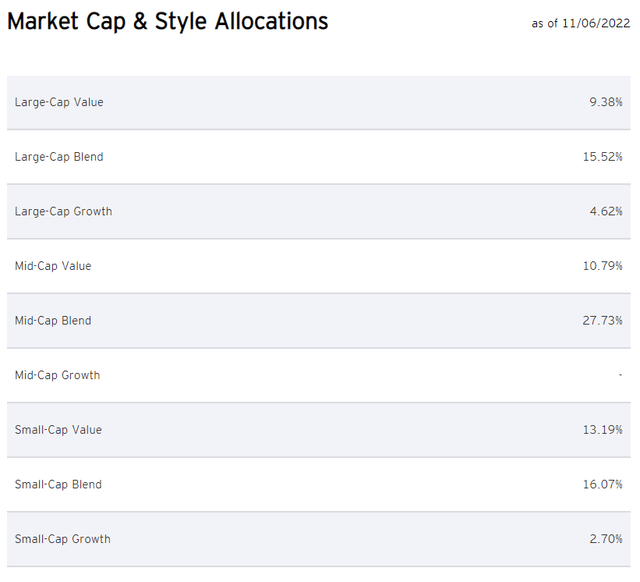

PXE is a U.S. equity energy index ETF, tracking the Dynamic Energy Exploration & Production Intellidex index. Said index is proprietary, so details are scarce, but the general gist of it seems clear enough. The index includes in the 30 U.S. energy equities with the strongest fundamentals across momentum, growth, quality, value, and management metrics. Weights are based on market-cap and these same fundamental criteria. There are caps and floors meant to ensure diversification across sizes, with the index including large-caps, mid-caps, and small-caps in very roughly equal proportions.

PXE’s underlying index seems reasonable enough. It is perhaps a bit more complicated than usual, in some cases perhaps needlessly so, but the broad strokes are fine.

PXE itself invests in 30 different U.S. energy companies, of all market-caps.

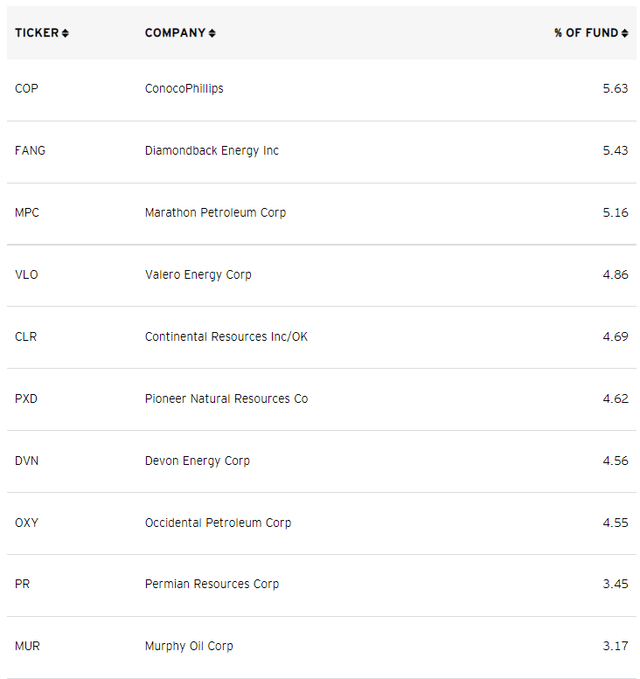

Largest holdings are as follows.

PXE’s holdings include many well-known energy companies, including ConocoPhillips (COP) and Marathon Petroleum (MPC). PXE’s exclusions are noteworthy, with the fund excluding both Exxon (XOM) and Chevron (CVX), the two largest U.S. energy companies, from its holdings. Exclusions are almost certainly due to the fund focusing on stocks with strong fundamentals. Presumably Exxon and Chevron lack or compare unfavorably in some of these, perhaps those related to value. Exxon and Chevron are mainstays in most energy funds, so their exclusion is notable.

PXE exclusively invests in U.S. energy stocks, and so shares their characteristics and investment thesis, centered on their strong fundamentals.

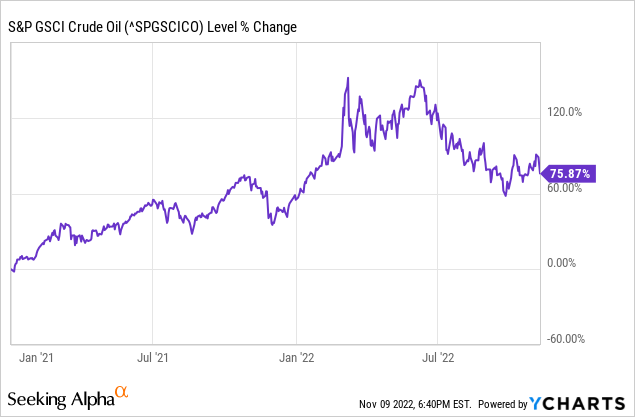

Energy prices have skyrocketed for more than a year, almost doubling since early 2021. Prices have softened these past few months, but remain elevated, at over $85 a barrel.

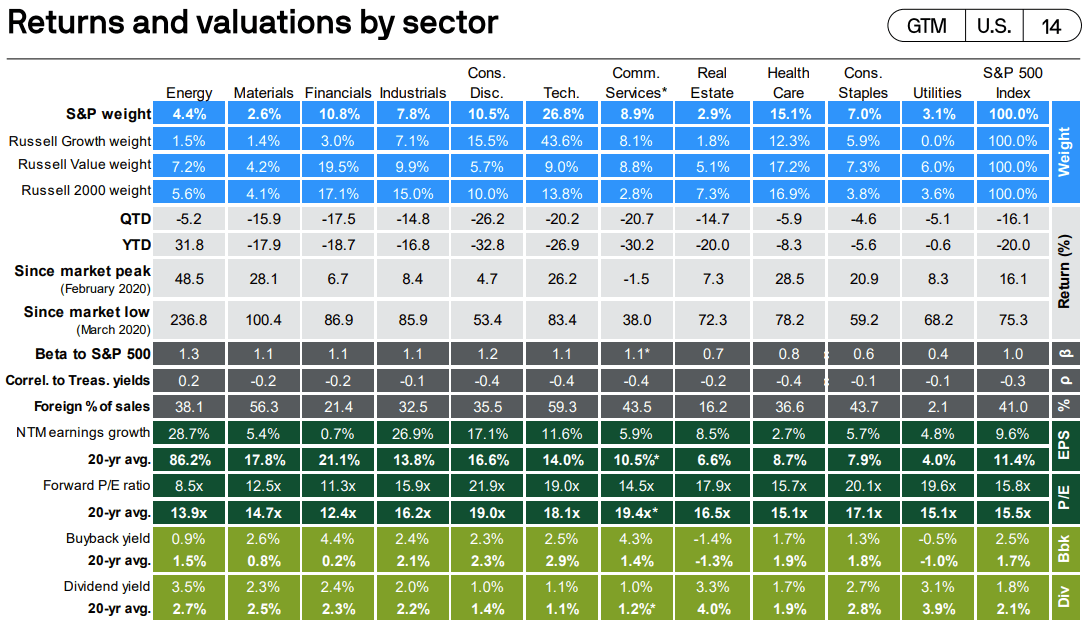

Skyrocketing energy prices have led to significantly increased revenues and earnings for most energy companies. Growth expectations remain quite strong, with most analysts expecting energy industry earnings growth of 28.7% for the next twelve months, versus 9.6% for the S&P 500. Both figures would undoubtedly soften if economic conditions continue to worsen, however.

J.P. Morgan Guide to the Markets

Energy stocks remain very cheaply valued, with PXE sporting a PE ratio of 5.3x, and a PB ratio of 2.1x, significantly lower than average, and lower than all relevant equity industry segments.

PXE offers investors exposure to the cheaply valued, high-growth U.S. energy industry, and has significantly outperformed YTD. Although this is a strong investment thesis, it is also a relatively common one, with several funds offering comparable value propositions. Chief among these is XLE, the industry benchmark. As such, thought a quick look at the differences between these funds might be of use and interest to readers and investors.

PXE versus XLE

Different Indexes and Strategy

PXE’s key differentiator is the fund’s investment strategy.

PXE only invests in energy companies which score well on a slew of fundamental metrics, including quality, valuation, growth, etc. Companies with low scores get excluded, like Exxon and Chevron.

XLE, and most other energy index funds, have much laxer inclusion and exclusion criteria, and tend to invest in almost all energy companies of a given size. XLE currently invests in Exxon and Chevron, and it will almost certainly continue to invest in both companies for the foreseeable future.

In my opinion and experience, PXE’s investment strategy is fine, but not materially stronger than XLE / average. Outperforming the market is a bit more difficult than a couple of fundamental screens. I’ve seen dozens of multi-factor ETFs with similar investment strategies, and most don’t consistently outperform the market. At the same time, as the strategy is proprietary, we can’t analyze it in any real depth.

Due to these issues, I see no reason to believe that PXE’s investment strategy is stronger than that of XLE, or than that of its peers. I have no reason to believe the opposite either, so the strategy is neither a negative nor a positive, in my opinion at least.

Greater Mid-Cap and Small-Cap Exposure

PXE invests in U.S. energy equities of all sizes, including mid-caps and small-caps.

XLE focuses much more heavily on large-caps, as do most other energy funds.

Smaller companies tend to be riskier than larger ones, and this is particularly true in the energy industry. Small-cap energy companies are famous for their (sometimes) dysfunctional management teams, reckless capital allocation decisions, weak balance sheets, and over-exposure to energy prices. Small-cap energy stocks tend to be significantly riskier than average. Investors know this, and so tend to flee small-caps when times as tough, leading to significant losses and underperformance during the same.

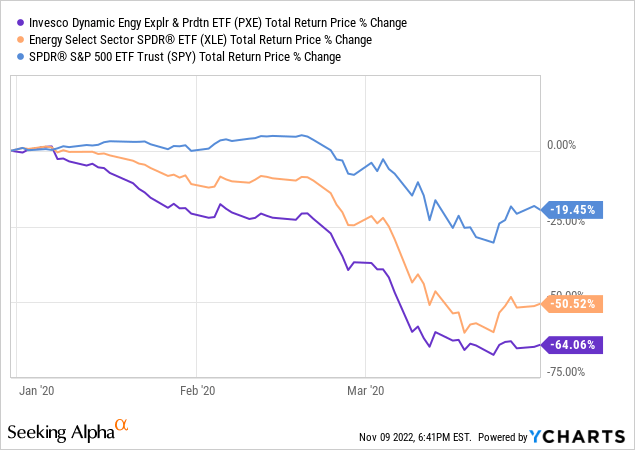

PXE has sizable small-cap investments, but does not exclusively invest in these stocks. As such, the fund should moderately underperform relative to XLE during downturns, recessions, and periods when oil prices decline. This was the case during 1Q2020, the onset of the coronavirus pandemic, as expected.

PXE’s small-cap energy investments make it a moderately riskier fund relative to XLE. Still, both are energy funds, and have significant exposure to energy prices. PXE underperformed relative to XLE during the above scenario, but both funds underperformed relative to the S&P 500, and XLE also experienced significant losses. PXE is definitely riskier than XLE, but both have broadly similar risk profiles.

Performance Track-Record

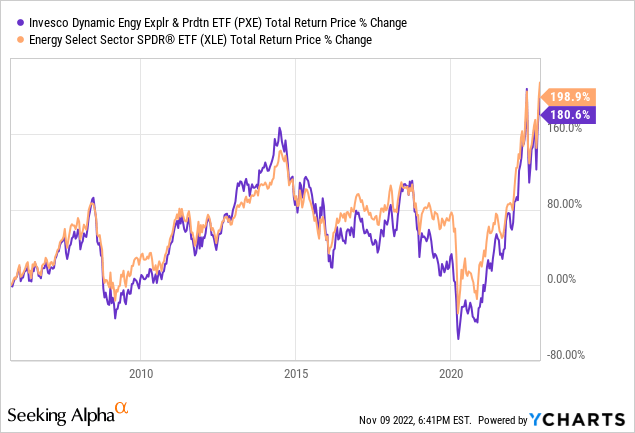

PXE and XLE have broadly similar long-term performance track records. PXE has very slightly underperformed since inception, but the difference is small, and somewhat volatile and short-lived.

PXE tends to be somewhat more volatile than XLE. As mentioned previously, PXE underperformed in early 2020, when energy stocks crashed as oil prices cratered. On the other hand, PXE has outperformed YTD, during which oil prices have boomed, and investor sentiment has improved. Importantly, PXE’s outperformance was due to security selection and weights: small-cap energy exposure detracted from the fund’s performance, as these stocks underperformed relative to the benchmark.

From the above, it seems quite clear that PXE’s investment strategy has worked remarkably well this year, but the track-record since inception is much more mixed.

In my opinion, PXE’s performance track-record is slightly inferior to that of XLE, due to greater realized volatility and losses during downturns. Although these are definitely negatives, I don’t think they are significant enough to be deal-breakers.

Conclusion

PXE is a smart-beta U.S. energy industry ETF. The fund is a reasonable investment opportunity, but provides few benefits relative to XLE, the industry benchmark.

Be the first to comment