Orbon Alija/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Invesco KBW Bank ETF (NASDAQ:KBWB) as an investment option at its current market price. This is a sector-specific fund, with a focus on bank stocks exclusively. Importantly, it is heavily weighted towards the biggest banking names, and it is managed by Invesco. While I often look positively at KBWB, this fund has been a massive disappointment in 2022. It is down by more than the broader market, and has actually hit bear market territory, as seen below:

YTD Performance (Seeking Alpha)

Clearly, this has been a painful market move for investors. Yet, the bright side is I believe this bear market offers an opportunity to be greedy, not fearful. I see a number of positive attributes that lead me to expect gains are on the horizon. As such, I view this 20% drop as a buying opportunity, and will explain why in detail below.

Large Banks Responded Well To Stress Tests

To begin, I want to focus on the results of the 2022 Fed “stress tests” that have become an annual requirement for many large banks. The results were just published last week, so consideration of this development is timely when evaluating KBWB. This year, a total of 34 banks were required to participate, most of which are in KBWB’s portfolio.

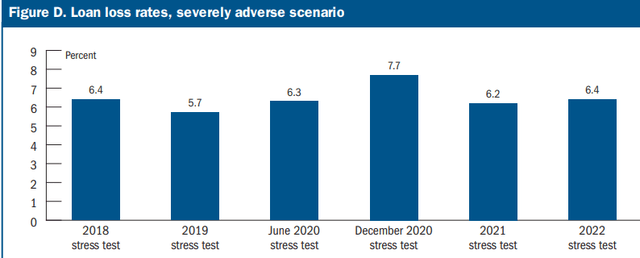

Fortunately, the Fed’s opinion was the large U.S. banks are well-equipped to handle a severe economic scenario. They are balanced and cash-cushioned to continue to operate even with an uptick of losses on their books. Based on the Fed’s projections, under a financially stressful environment, the bulk of the losses would come from bank loans. Fortunately, the expected loss rates are in-line with what they have been for the past few years (and below 2020):

Loan Loss Rates (Federal Reserve)

Of note, these loan loss rates are a combination of all 34 banks, and were calculated as a percent of average loan balances for the nine-quarter projection horizon used for this evaluation. Simply, large-cap U.S. banks are performing similarly as they have in the past few years, and remain in solid financial footing. Given how sharply share prices have fallen, they don’t seem to accurately reflect how the banks will handle a difficult environment and/or recession. To me, this suggests buying here is supported.

Return of Capital On The Horizon

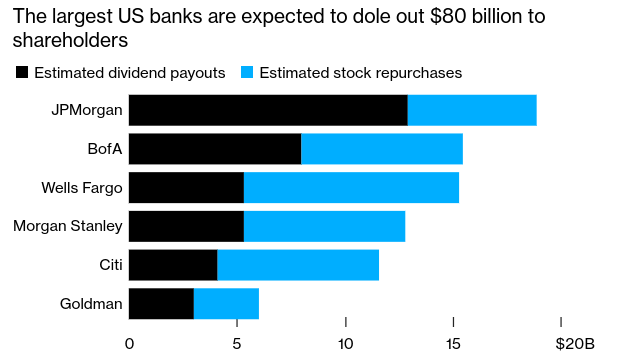

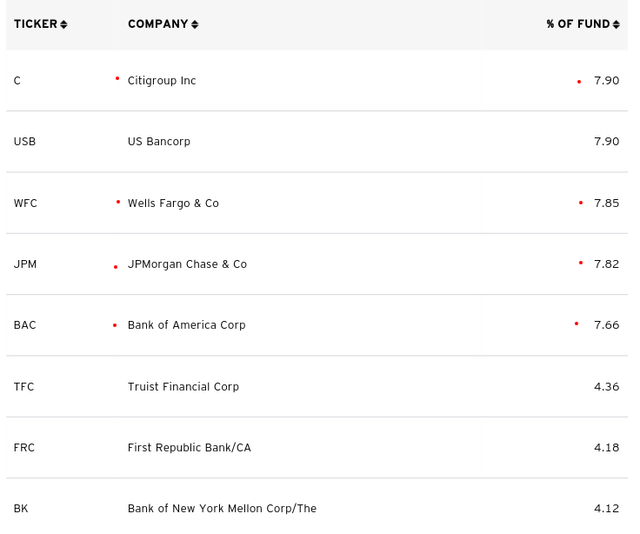

Expanding on the above subject, there is another reason why the results from the stress tests are a tailwind for bank stocks. Specifically, the Fed has cleared the capital plans for a number of the largest U.S. banks. This is important because without a successful stress test evaluation, capital plans could have been suspended or put on hold until the next cycle. This is relevant because four of the top banks whose capital share plans were being evaluated are some of KBWB’s largest holdings:

So, why is this good news? Primarily because some of the largest U.S. banks have generous capital return plans on the horizon. This includes both dividend increases and stock buy-backs, which are quite generous:

Expected Capital Return (Bloomberg)

The takeaway here is that many large-cap banks in KBWB’s portfolio are set to deliver cash to shareholders in a couple of ways. This should keep current shareholders content, and will also be likely to pique the interest of new buyers who want to capture this catalyst. One of the banking sector’s selling points right now is the current yield, relative to the S&P 500. With dividend hikes on the way, this story remains in place.

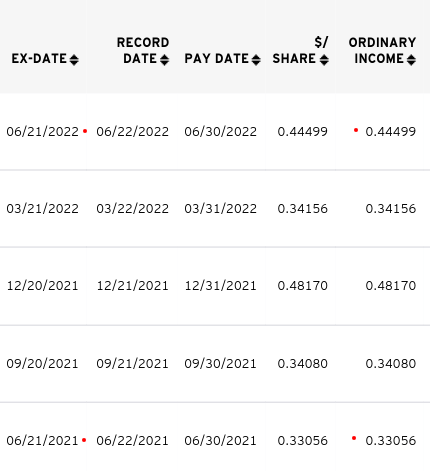

Dividend Income Is Up YOY

Touching further on the income story, there is valid support for suggesting dividend hikes are coming. Aside from the bank’s current capital plans, readers should note that rising dividends has been a theme for this sector over the past few years. In fact, the most recent distribution for KBWB this past month showed a year-over-year increase around 34% compared to what was paid in 2021:

KBWB’s Distributions (Quarterly) (Invesco)

As a “dividend seeker”, this is clearly a great sign for me. The current yield near 3% remains attractive even in a rising rate environment. This is especially true since we can expect distributions to keep rising in the quarters to come (based on the capital return plans discussed above). All told, this is another supporting factor for adding to my position in KBWB.

Large Banks Remain Dominant In The Market

The next attribute to consider is that large U.S. banks continue to play a dominant role in the U.S. banking market. In terms of size, market share, and asset growth, large banks have a considerable advantage over their smaller and regional peers. Through mergers, acquisitions, and organic growth, assets and deposits in the top 10 US banks have grown over the past six years at a compound annual growth rate of 7.2% and 9.5%, respectively, according to a report from Deloitte. This is a faster growth rate than regional and small banking peers, and suggests large banks will remain dominant over the next few years very easily. Of course, longer term large banks face risks from FinTech and other startups, but we are a long way from seeing a rotation in significant in this sector. Simply, I see the holdings in KBWB being extremely relevant for the foreseeable future, so this sector is very investable.

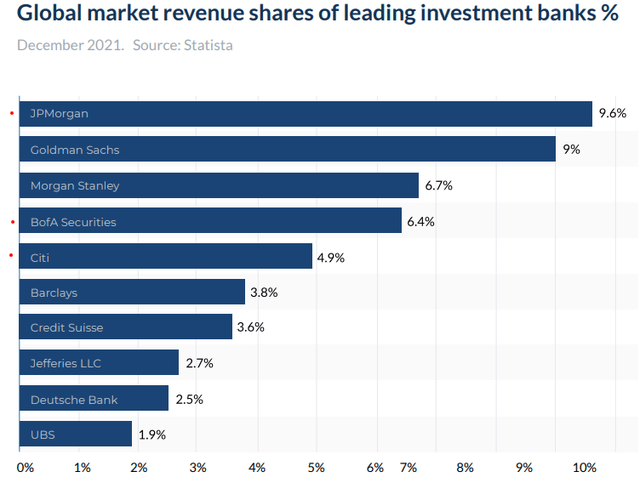

U.S. Names Lead In Investment Banking

Another reason for the increasing size and scale of U.S. banks has to do with their brand recognition and desirability in global markets. While KBWB doesn’t own all top investment banks, it does own the companies with both traditional banking and investment banking (i.e. JPMorgan Chase (JPM), Bank of America (BAC), and Citigroup (C), among others). Fortunately, when it comes to global market share in this space, we see those firms are quite dominating. While names like Goldman Sachs (GS) and Morgan Stanley (MS) are also industry leaders and are absent from KBWB’s holdings list, the other three big names I just listed are capturing a good chunk of global revenue:

Global Market Revenue Share (Investment Banks) (Selby Jennings)

The thought here is that U.S. banks continue to enjoy domestic and international success. They have the brand and history allowing them to draw in foreign money and market share, in a very competitive industry. This leads me to conclude that U.S. banks are where I want to put my investment money, not in foreign ones.

Recession Risk Is Real

Through this review, I have certainly been bullish on KBWB. I believe this outlook will be vindicated, to the point where I am putting more of my own money in the ETF. However, that does not mean there are not risks to buying here. Yes, the fund is down a healthy amount, but it could go down further, especially if we have a recession. While the Fed stress tests suggests the U.S. banking sector is equipped to survive and continue lending during such an event, that does not mean the share price won’t be punished. Shares certainly won’t roar higher, so this is a risk to evaluate before diving in.

This is important because I don’t want investors to get overly confident or aggressive here. Stay within your risk tolerance, and know that banks could have further to fall from these levels. While the stock prices look attractive from where they stood in January this year, they are still up on a multi-year basis, suggesting more downside is possible if macro-conditions deteriorate.

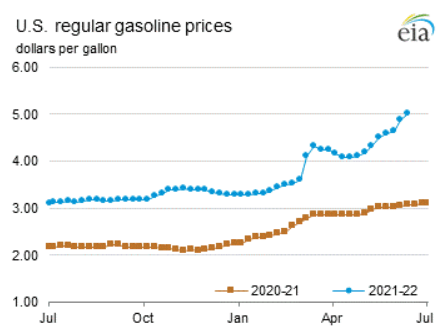

So, why is this the case? As usual, the world has a host of problems right now. There is war in Europe, rampant inflation, and continued pressure on supply-chains. Rising oil prices have sent prices at the retail gas pumps soaring. This is concerning because it dampens consumer sentiment but also diverts household discretionary funds that could be spent elsewhere. The impact on demand in other corners of the market could be hurt enough to help tilt the economy into recession, so monitor oil prices closely:

Retail Gas Prices (U.S. Energy Information Administration)

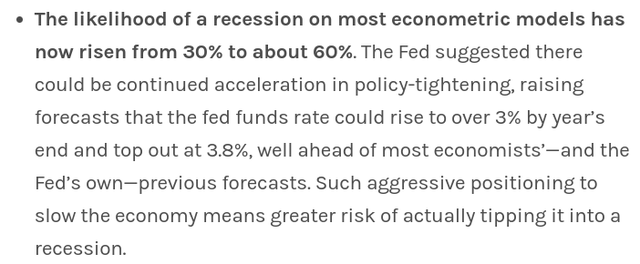

In addition to rising fuel and energy costs, the global economy (including the U.S.) are facing central bank tightening. This includes a reversal of some of the quantitative easing measures and an increase in benchmark interest rates. The impact of these actions so far has been manageable, but the problem is more tightening is on the way. This reality means the risks of a recession have risen dramatically in a short time period:

Recession Outlook (Morgan Stanley)

The fact is that if the U.S. or other global economies do fall into a recession, risk-on sectors are going to feel the brunt of the pain. This would include the more cyclical banking sector, so readers need to evaluate this risk carefully before deciding if a bank-only fund like KBWB is right for them.

Bottom-line

My bank holdings have taken a tumble in 2022, there is no doubt about that. At this juncture though, the drop seems too fast, too fast. When that happens, I view it as a buying opportunity, and that is precisely what I am at these levels. The banking sector had solid stress tests results, have seen dividend increases, and have share repurchase plans as a go-forward tailwind. Beyond this, large-cap U.S. banks continue to enjoy a dominant market share in the U.S., and success in global markets as well. These attributes tell me this is a sector I want more exposure to, not less. Therefore, I will be buying KBWB in the short-term, and suggest readers give this idea consideration at this time.

Be the first to comment