HUNG CHIN LIU/iStock via Getty Images

Overview

The Invesco Golden Dragon China Portfolio ETF (NASDAQ:PGJ) (“the fund”) provides exposure to a broad range of U.S. exchange-listed companies that derive most of their revenues from the People’s Republic of China.

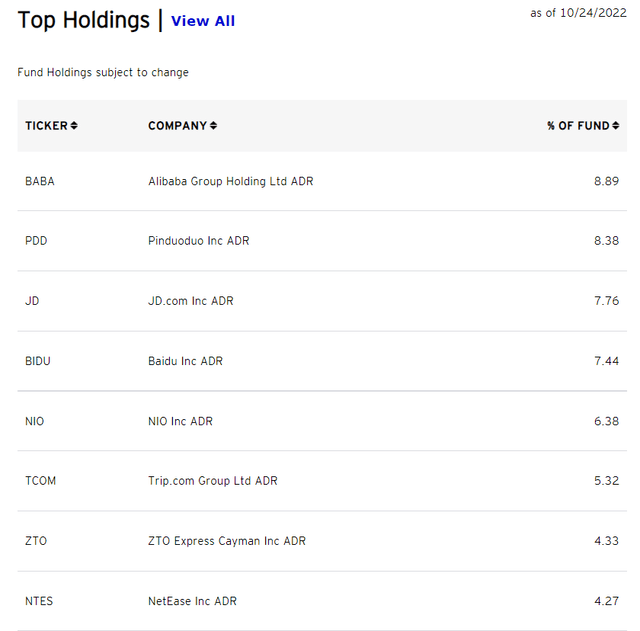

The fund has 68 holdings, with at least 90% of its total assets in equity securities that comprise the NASDAQ Golden Dragon China Index (“the Index”).

The fund has a total expense ratio of 0.70% per annum (37th cheapest among similar ETFs). Franklin Templeton and iShares provide similar ETFs with cheaper expense ratios.

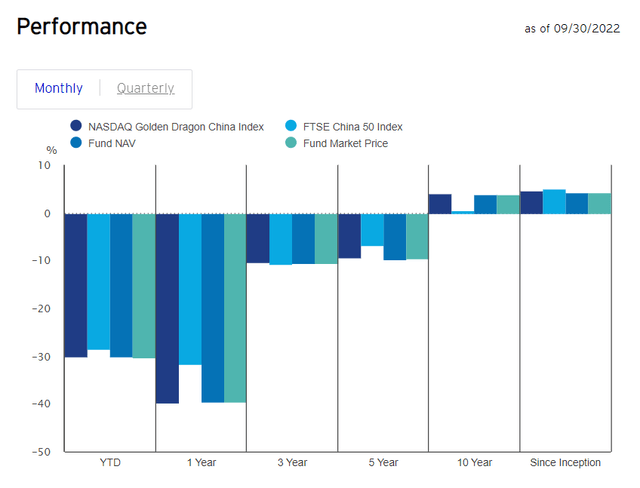

Performance

The fund has been able to track its index relatively closely, however it has not been able to outperform it.

The fund’s NAV has grown 4.20% per annum since its inception, compared with its index at 4.63% per annum.

The fund, which was created in 2004, has failed to deliver meaningful NAV growth for its shareholders.

Portfolio

The fund provides exposure to the unique economic opportunities taking place in China while still providing the transparency offered with U.S. listed securities.

China has been wildly successful after liberalizing foreign trade and investment at the end of the 1970s. The GDP annual growth rate in China average 9.05% percent from 1989 until 2022.

The fund is heavily weighted towards Internet stocks with the largest holdings including Alibaba (BABA, OTCPK:BABAF), Pinduoduo (PDD), and JD.com (JD).

Is China still investable?

The NASDAQ Golden Dragon index shed 14.4 percent on Monday in its largest one-day fall on record following confirmation of President Xi Jinping’s third term in power, bringing its decline to about 50 per cent this year.

As Xi embarks on a new term in power, ending China’s two-term limits for its leaders, China is getting closer to an autocracy.

China’s relation with the U.S. under Xi’s tenure has been very complicated. Now that Xi has tightened his grip over the Politburo Standing Committee, the most powerful political body in China, Taiwan is back on the agenda.

Talks about a possible invasion of Taiwan by China has been rumored for years. The head of the U.S. Navy has recently warned that the American military must be prepared for a Chinese invasion of Taiwan before 2024.

President Biden has vowed to aid Taiwan militarily if such a scenario happens. The risk of war is very real, as Putin has reminded us all this year.

I believe that the geo-political risks as a U.S. investor are starting to outweigh the rewards of investing in China.

U.S. asset managers have gambled on China for a very long time, making the emerging country a key pillar of their assets under management (“AUM”) strategies. Due to the conflict of interest, it will take time for views to change on China.

The divide between the U.S. and China is getting bigger every day and shows no sign of stopping. The direction of travel is clear and makes investing in China not a viable long-term strategy.

Conclusion

I believe that the risk of war between the U.S. and China is becoming very real. China is still a great growth story, but the geopolitical risks as a U.S. investor investing China outweighs the rewards. In my point of view, China is no longer investable for U.S. investors.

If you enjoyed the article, please like and subscribe to receive the latest articles!

Be the first to comment