Solidago/iStock Unreleased via Getty Images

Thesis: Highly Defensive Retail On Discount Again

InvenTrust Properties (NYSE:IVT) is a multi-tenant essential retail real estate investment trust with a portfolio of 62 shopping centers that are primarily grocery-anchored and overwhelmingly concentrated in Sunbelt states.

IVT is a company I’ve written about multiple times before, most recently in a July 2022 Buy-rated article when I pitched it as “A Defensive, Recession-Resistant Dividend Growth Stock.”

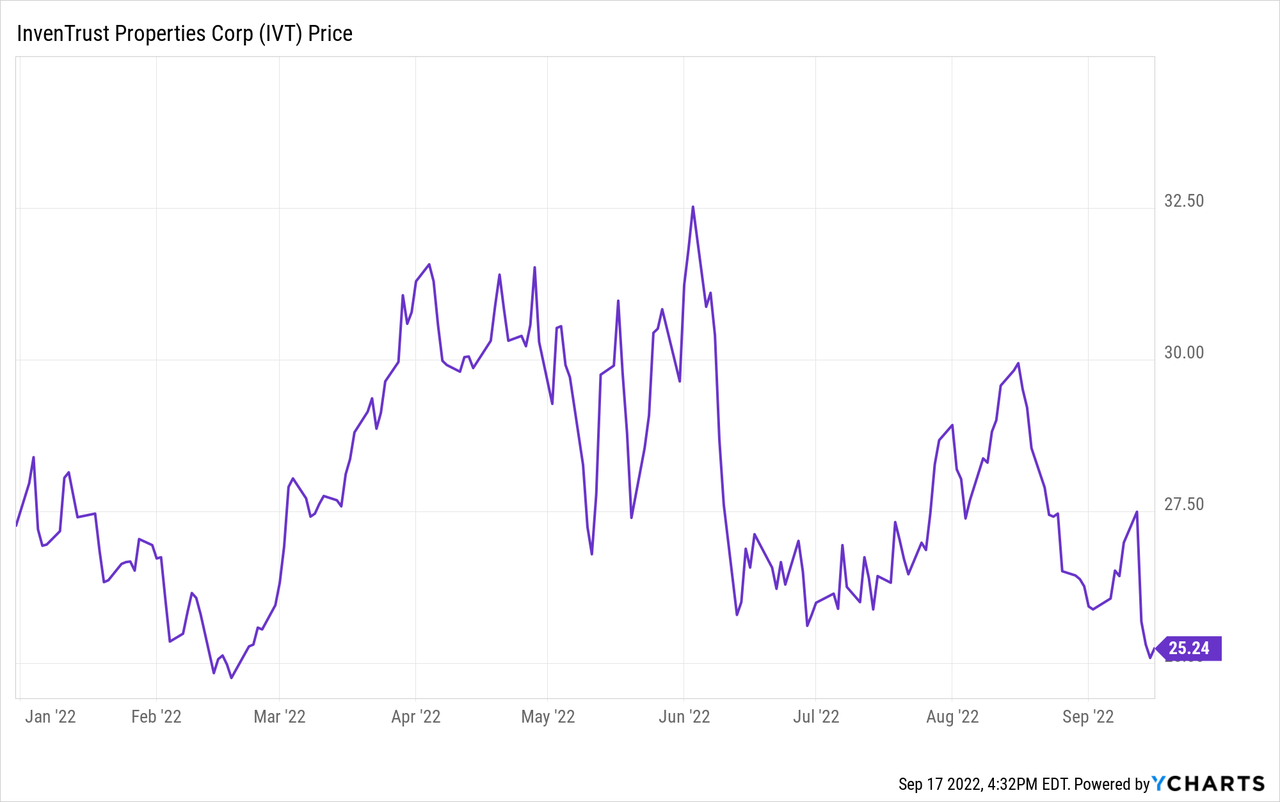

IVT recently suffered a pullback in stock price to around the $25 level, near its lowest point year-to-date.

Based on the midpoint of 2022 core FFO per share guidance of $1.54, IVT is currently trading at a price to FFO multiple of 16.4x.

While by no means dirt cheap (especially for retail REITs), I find this a reasonable price to pay for IVT’s high-quality, defensive, well-located, and recession-resistant property portfolio. For perspective, the current price renders a core FFO yield (the inverse of price-to-FFO) of 6.1%, which is higher than the fair value of IVT’s assets by about 50 basis points.

Let’s get an update on IVT after second-quarter results to see where things stand as of midyear.

Update On IVT

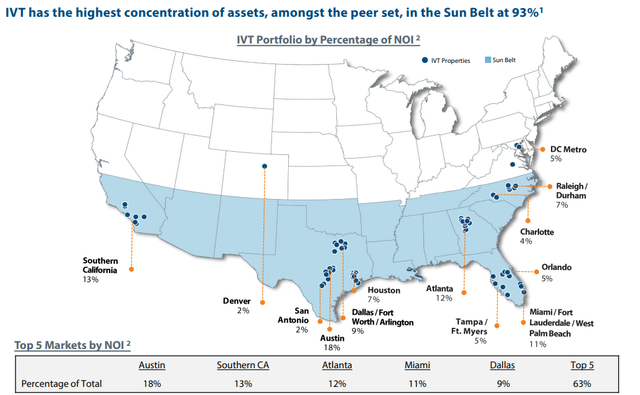

As you may recall from my previous article on IVT (if you haven’t read it, I encourage you to check it out for expanded context and detail about IVT), this relatively newly IPO’d retail REIT primarily owns grocery-anchored shopping centers located in Sunbelt markets.

The portfolio consists of 62 shopping centers with 95.4% average occupancy. About 86% of centers are either anchored or shadow-anchored (wherein the anchor property is owned separately) by a grocer, wholesale club, or superstore that sells groceries. Meanwhile, 93% of the portfolio sits in Sunbelt states.

IVT August Presentation

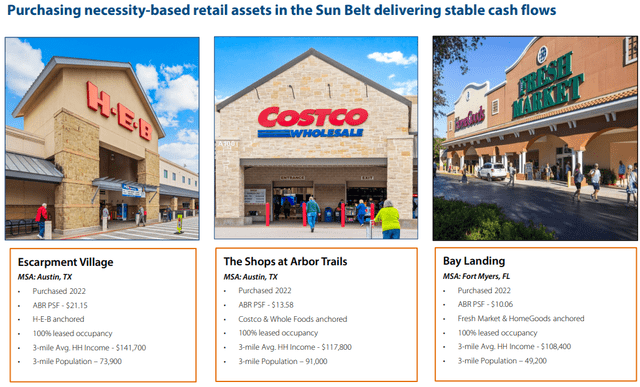

And this Sunbelt exposure is increasing over time. During the second quarter, for instance, IVT acquired two properties, one in Texas and the other in Florida, while disposing of two centers in Colorado. Those two properties in Colorado were sold for $55.5 million, which allowed IVT to book a gain of $36.9 million. That is a massive gain for just two properties!

Meanwhile, I can personally attest to the high-quality locations of the two shopping centers in Austin, TX that were acquired this year, as I’ve visited both of them myself. The Costco (COST) at Arbor Trails is the one I regularly go to.

IVT August Presentation

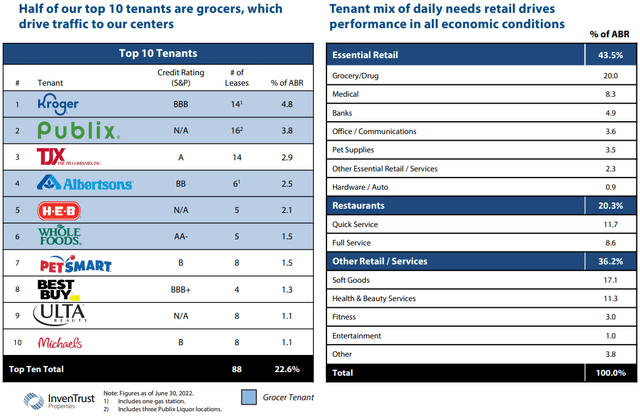

As you might expect, half of IVT’s top ten tenants are grocers, and 20% of annual base rent comes from grocery & drug stores.

IVT August Presentation

Moreover, notice that IVT’s tenant industries are overwhelmingly non-discretionary and recession-resistant. For instance, fitness centers and entertainment venues make up a mere 4% of total rent.

This year is expected to be extraordinarily strong for IVT. Management projects core FFO per share growth of about 10% in 2022, along with 4-5% same-property net operating income growth.

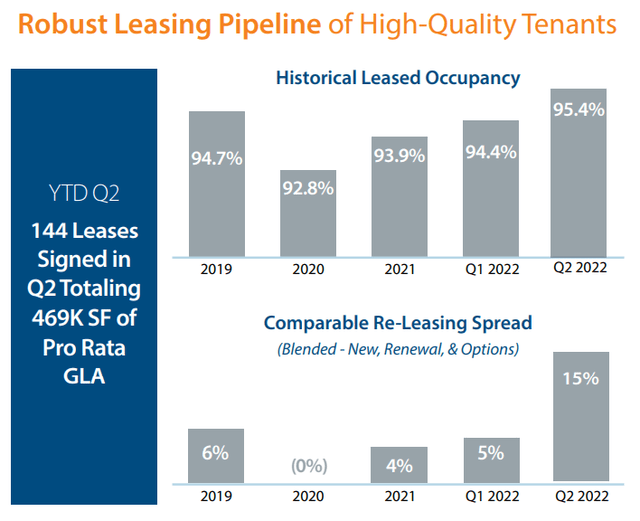

Occupancy has now surpassed its level from 2019, and same-space leasing spreads (lease over lease rent growth) for new and renewal leases shot up to 15% in Q2 after a respective showing of 5% in Q1.

IVT Fact sheet

These factors fueled a 7.7% increase in same-property NOI year-over-year in Q2 as well as a 9.9% YoY increase for the first six months of 2022.

Meanwhile, core FFO growth has been even stronger. In Q2, core FFO per share rose 27% YoY, and in the first half of the year, it jumped 33%. Now, given guidance of about 10% core FFO per share growth this year, management clearly doesn’t expect this pace of growth (mostly against softer comps from last year) to continue. But it is nothing to sneer at!

Balance Sheet

IVT demonstrates its quality and blue-chip nature just as much in its balance sheet as it does in its portfolio.

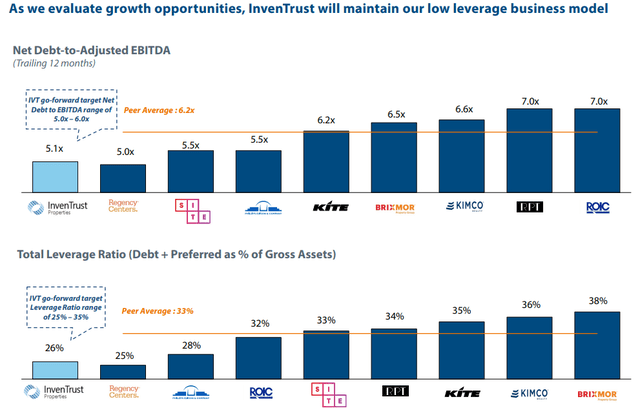

Though IVT’s BBB- credit rating is not quite as high as blue-chip peer Regency Centers’ (REG) BBB+ rating, its debt metrics are very similar.

IVT’s net debt to EBITDA of 5.1x is only a touch higher than REG’s 5.0x, and so is its debt plus preferred equity as a share of total assets of 26% over REG’s 25%.

IVT August Presentation

IVT currently has $103.4 million in cash, which amounts to 6% of IVT’s market cap, available for further acquisitions. Compare that to REG, which has a cash position equal to about 1.2% of its market cap.

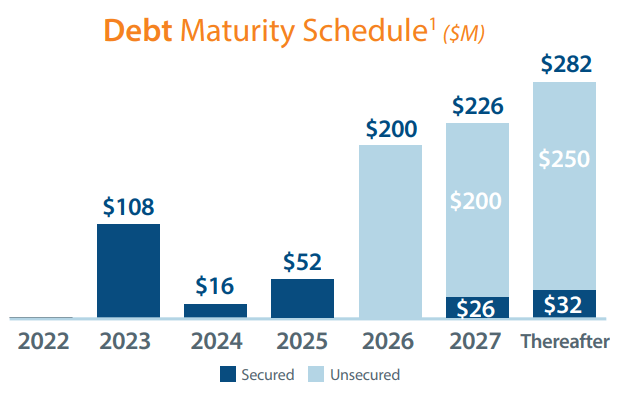

IVT’s weighted average debt maturity of 5.1 years roughly matches the length of its lease terms, which makes sense. And its weighted average interest rate of 3.6% ticked up significantly from the 3.05% average it enjoyed just a quarter ago because of newly issued debt in recent months. (More on that below.)

Now that IVT has an investment grade credit rating, expect the REIT to steadily shift most of its secured debt into unsecured debt over time. Over the next three years, the REIT will have some opportunities to do just that.

IVT Fact Sheet

In August 2022, IVT completed private placement of $250 million of debt, split between $150 million of 7-year notes and $100 million of 10-year notes at a weighted average maturity of 8.2 years and a weighted average interest rate of 5.12%.

While this 5%+ interest rate is higher than the debt IVT raised in previous years, it is not a mark of IVT’s weakness but rather of the dramatic rise in interest rates across the entire economy.

Bottom Line

IVT exudes quality in both the portfolio and the balance sheet. This has led to steady dividend growth averaging 3% over the last five years (with no dividend cut during the pandemic), and a 5% raise this year.

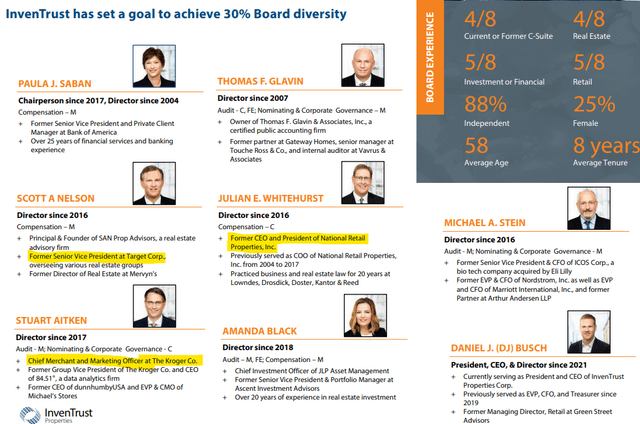

One more area of quality worth mentioning is the composition of the board of directors, several of whom have excellent experience and credentials either on the real estate side or the operating side of retail.

IVT August Presentation

IVT boasts recession-resistance as well as a higher degree of inflation protection than single-tenant net leased retail properties with long leases and little, if any, CPI-based rent escalations. IVT’s leases roll over frequently enough to allow market rate adjustments on a regular basis.

In my view, IVT’s fair value is around a 5.5% core FFO yield, or $28 per share. That gives IVT upside to my estimated fair value of slightly over 10%. Add in IVT’s 3.25% dividend yield and mid-single-digit average annual growth, and I believe buying IVT today will result in total returns of 10-11% annually over the next five years.

IVT is a Buy for conservative dividend growth investors.

Be the first to comment