Tippapatt

A Quick Take On Inuvo

Inuvo (NYSE:INUV) reported its Q3 2022 financial results on November 14, 2022, missing expected revenue and EPS estimates.

The company provides an alternative advertising method to online users without using third-party cookies.

Given the increasing risks of a recession and its effects on the firm’s revenue growth trajectory combined with its increasing operating losses, I’m on Hold for INUV for the near term.

Inuvo Overview

Inuvo is a technology company that develops and sells online-centric information technology solutions.

The firm’s services include ValidClick, which provides marketing and advertising services, data collection, analytics, software, and publishing, and IntentKey, an artificial intelligence-based consumer intent recognition system designed to reach targeted mobile and desktop in-market audiences.

The firm is headed by Chairman and CEO Richard Howe, who was previously Chief Marketing / Strategy Officer at Acxiom and prior to that, VP / General Manager Marketing Services at Fair Isaac Corporation.

Inuvo’s Market & Competition

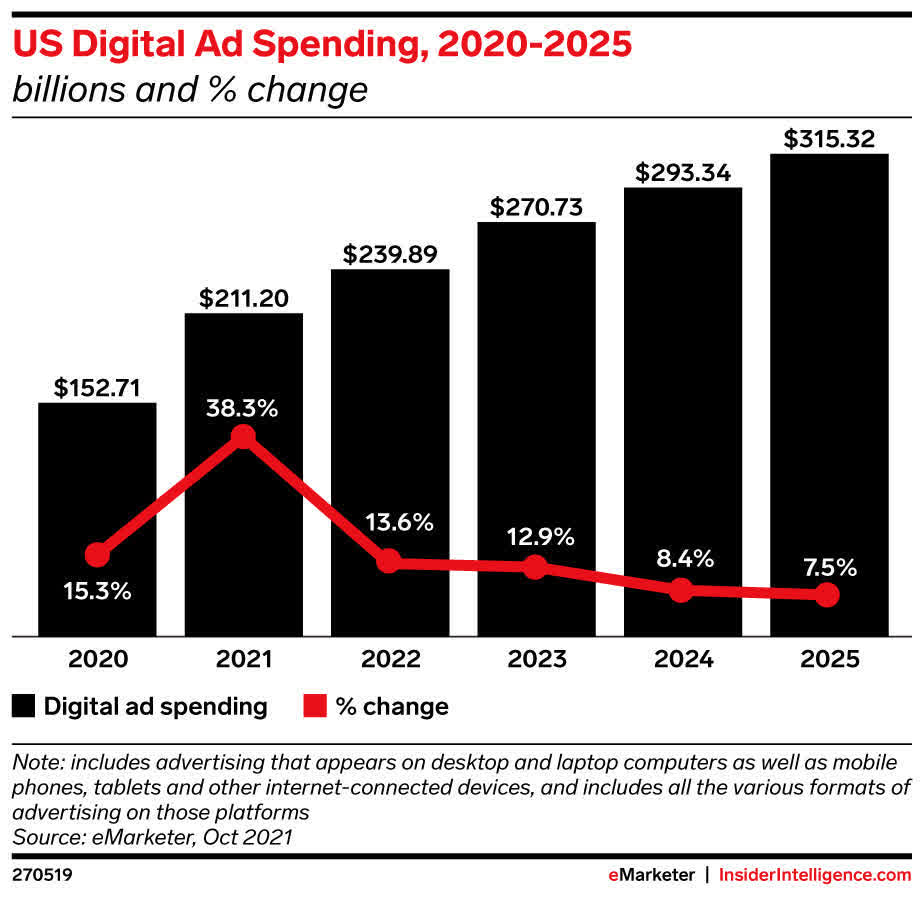

According to a market research note by eMarketer, the market for digital ad spending was an estimated $153 billion in 2020 and is forecast to reach $315 billion by 2025.

In 2020, despite the global pandemic, digital ad spending grew by 15.3%.

The note asserts that 2021 saw significantly increased digital advertising growth after a slower-than-expected 2020, but that future growth rates will decline through 2025.

The chart below shows the report’s forecasted growth trajectory and digital ad spend percentage of total from 2020 to 2025:

U.S. Digital Ad Spending (eMarketer)

Potential competitors include:

-

Zeta Global

-

Google

-

Adobe

-

Yahoo

-

Meta

-

Oracle

-

Skai

-

Amazon

-

Criteo

-

Salesforce

Inuvo’s Recent Financial Performance

-

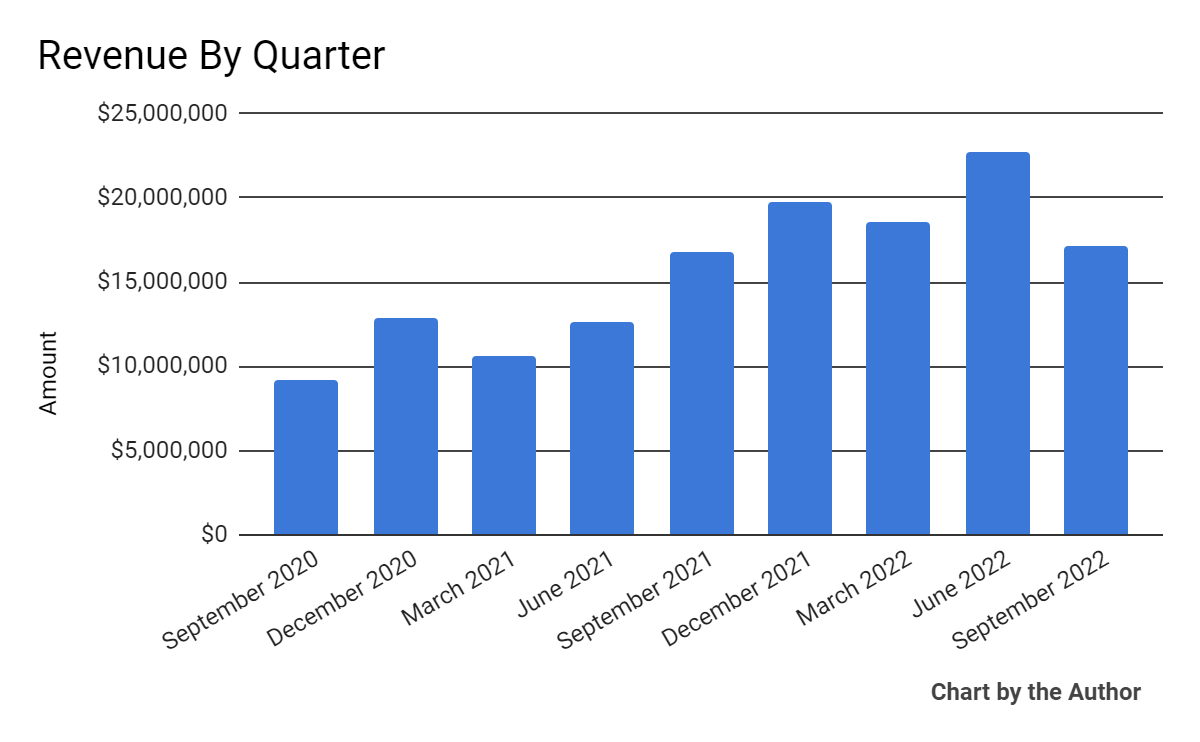

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

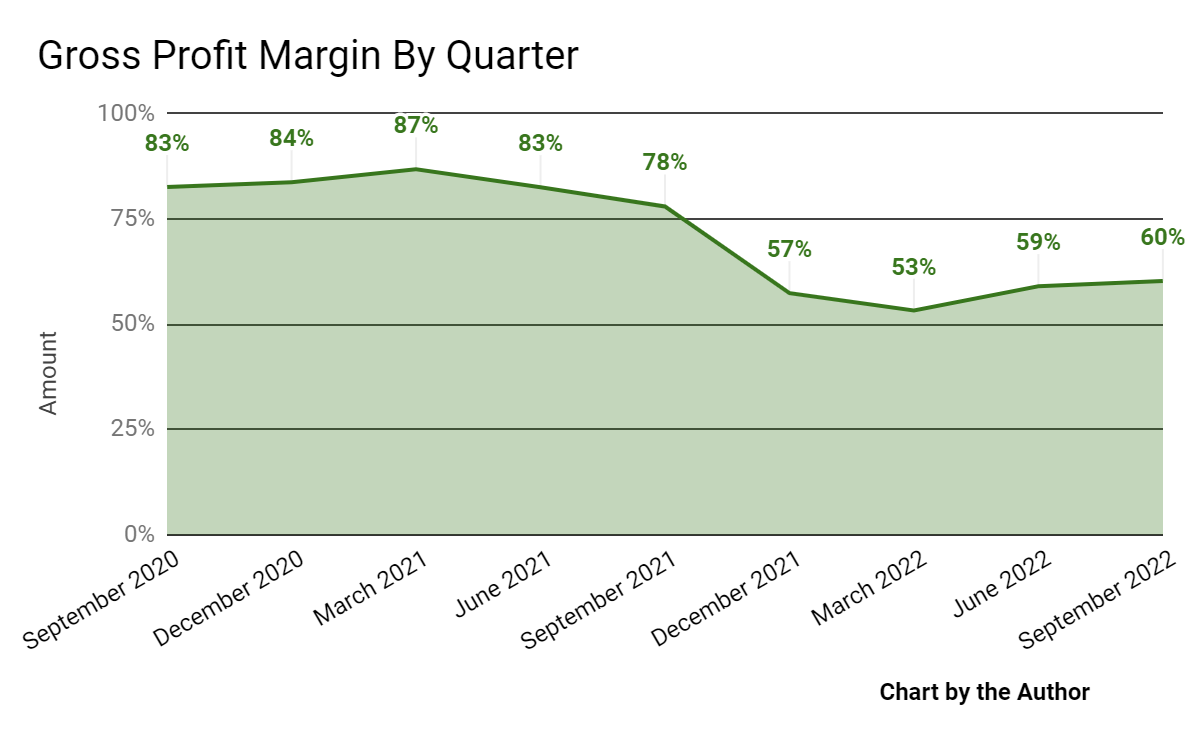

Gross profit margin by quarter has dropped substantially in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

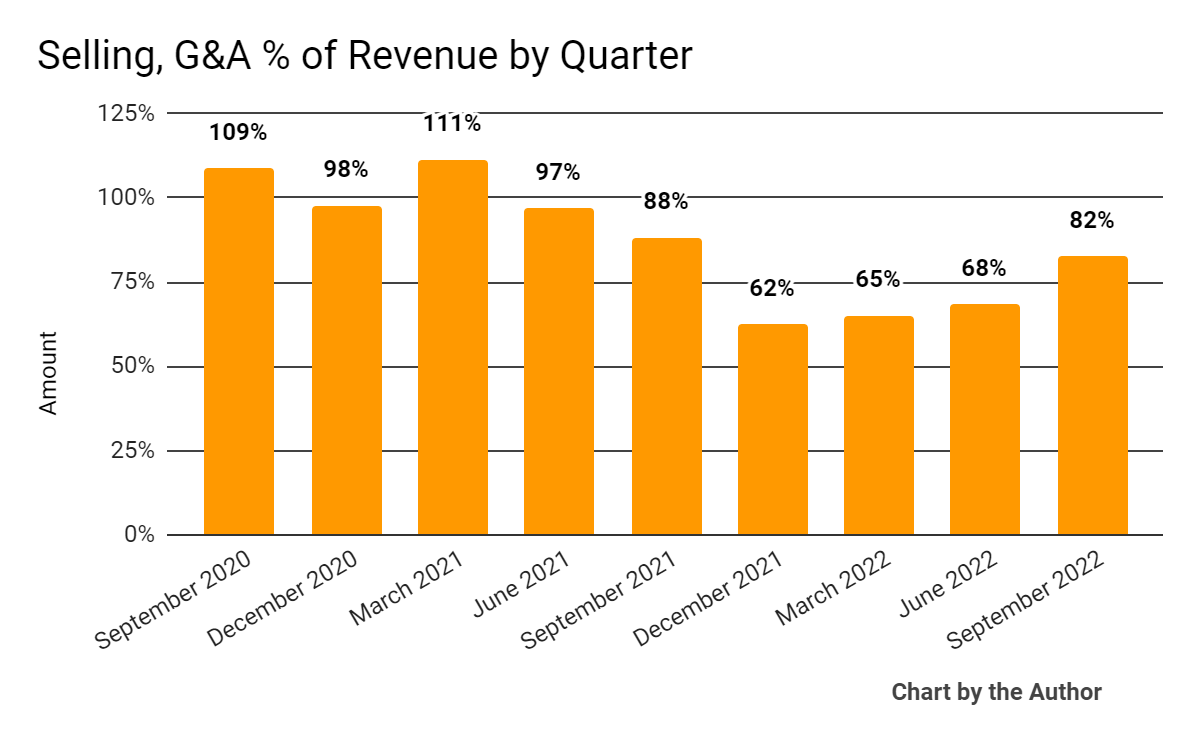

Selling, G&A expenses as a percentage of total revenue by quarter have also dropped materially recently:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

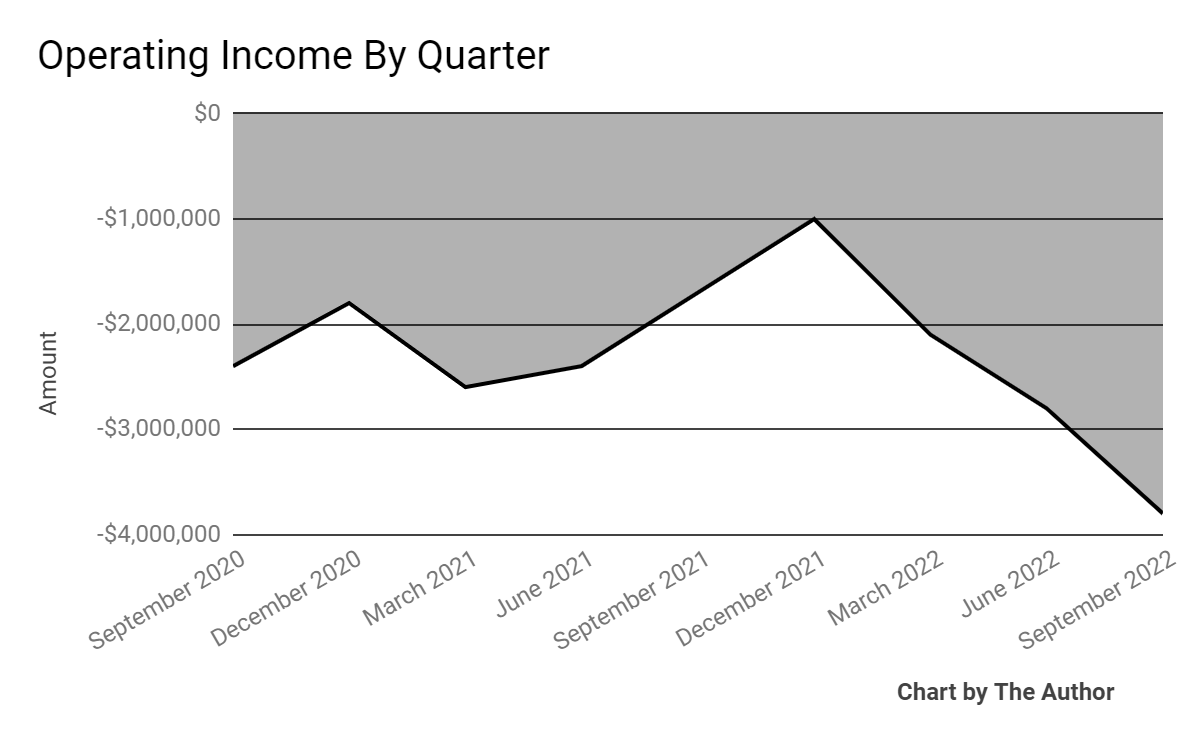

Operating losses by quarter have worsened markedly more recently:

9 Quarter Operating Income (Seeking Alpha)

-

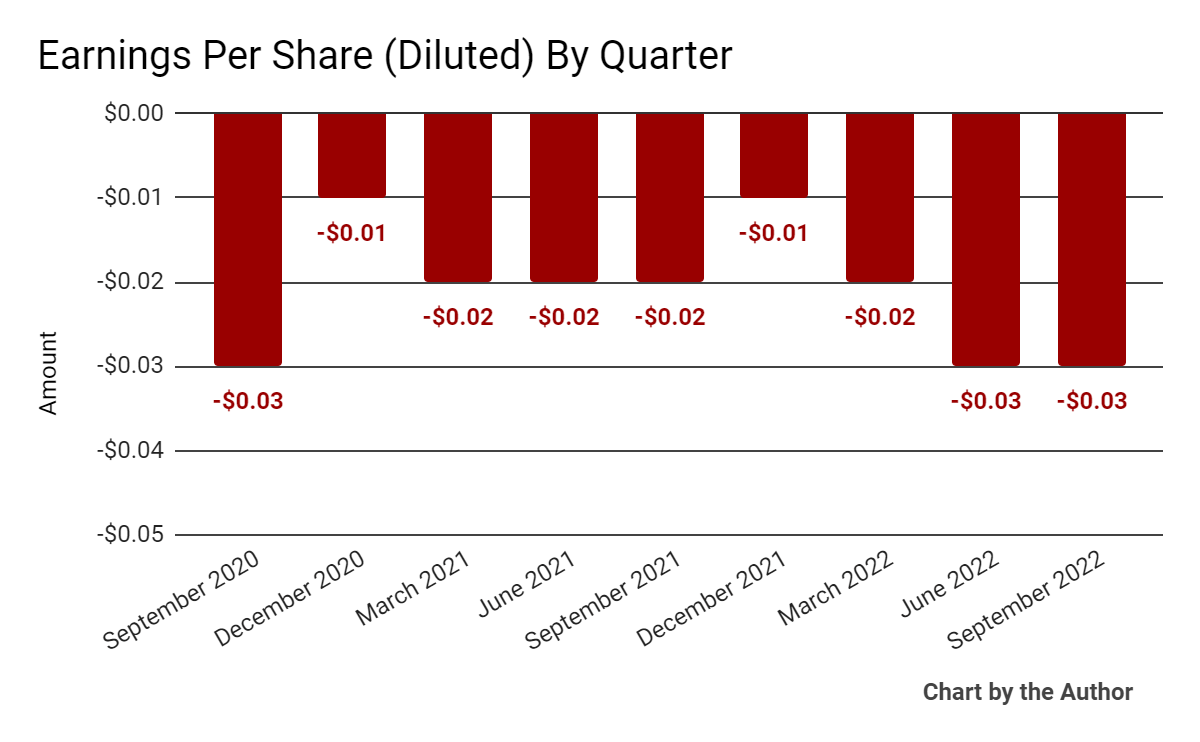

Earnings per share (Diluted) have deteriorated as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

In the past 12 months, INUV’s stock price has fallen 50.6% vs. the U.S. S&P 500 index’ drop of around 10.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Inuvo

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.4 |

|

Revenue Growth Rate |

47.3% |

|

Net Income Margin |

-13.3% |

|

GAAP EBITDA % |

-10.2% |

|

Market Capitalization |

$36,400,000 |

|

Enterprise Value |

$28,660,000 |

|

Operating Cash Flow |

-$3,420,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.09 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Inuvo’s most recent GAAP Rule of 40 calculation was 37.1% as of Q3 2022, so the firm has performed fairly well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

47.3% |

|

GAAP EBITDA % |

-10.2% |

|

Total |

37.1% |

(Source – Seeking Alpha)

Commentary On Inuvo

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management noted a ‘deceleration in consumer spending…and the loss of an agency client.’

Also, a ‘well-known platform’ purchased invalid advertising (disclosed in the 2nd quarter) and management is seeking ‘full reimbursement.’

In response to the dispute, which is now in arbitration, the ‘well-known platform’ has suspended the firm’s accounts resulting in $1 million in lost revenue in Q3.

Management believes its IntentKey system is performing much better than client KPI requirements and has ‘yet to lose a client due to performance.’

As to its financial results, topline revenue rose by 45% year-over-year for the first 9 months of 2022, although Q3 revenue barely grew over the same period in 2021.

Management did not disclose any company retention rate metrics. Its Rule of 40 results have been reasonably good.

INUV’s operating losses worsened during the quarter, producing its worst operating loss of the last nine quarters.

For the balance sheet, the firm finished the quarter with cash, equivalents and short-term investments of $7.7 million and no debt.

Over the trailing twelve months, free cash use totaled $5.1 million, of which capital expenditures accounted for $1.7 million in cash used.

Looking ahead, the effects of a shift to its IntentKey platform, with its lower gross margin but higher potential profit due to a lower cost of traffic acquisition will be unknown for some time.

However, management asserted that its gross margins should return to previous levels.

Regarding valuation, the market is valuing INUV at an EV/Revenue multiple of only 0.4x.

The primary risk to the company’s outlook is increasing pressure on advertising budgets as the macroeconomic business environment slows down or has already entered into recession territory.

Given the increasing risks of a recession and its effects on the firm’s revenue growth trajectory combined with its increasing operating losses, I’m on Hold for INUV for the near term.

Be the first to comment