andreswd

Introduction

Intuit Inc. (NASDAQ:INTU) released Q1 FY23 results after markets closed on Tuesday (November 29), and its shares rose 9.6% in the subsequent two days, helped by a broad market rally after dovish comments by Fed chairman Jay Powell.

We initiated our Buy rating on Intuit in September 2019. Shares have since gained 58% (including dividends) in just over three years, though the share price is currently down 40% from its peak last November and 35% year-to-date:

|

Intuit Share Price (Last 5 Years)  Source: Google Finance (01-Dec-22). |

Q1 FY23 results showed our investment case to be on track. Intuit’s core Small Business & Self Employed segment grew revenues by 19% organically year-on-year; its Mailchimp business, acquired in November 2021, saw revenues up low-teens year-on-year though relatively flat sequentially. Credit Karma was negatively affected by macro events and now expects to see a 10-15% revenue decline in FY23. However, the full-year outlook was unchanged for revenues in other segments and for group Non-GAAP EBIT. Intuit stock is at 35.1x FY22 EPS, a 1.6% Free Cash Flow Yield and a 0.7% Dividend Yield. Our forecasts indicate a total return of 85% (19.8% annualized) by July 2026. Buy.

Intuit Buy Case Recap

Intuit is one of the strongest businesses in our coverage, providing mission-critical software and services (with accounting and tax at the core) to small businesses and consumers in the U.S. and selected international markets, on a largely recurring revenue model, including with subscriptions.

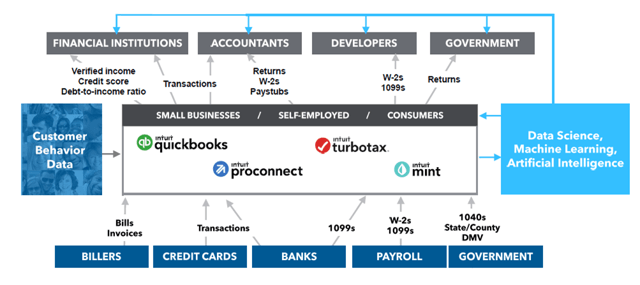

Intuit is also a platform business, enjoying strong economies of scale, operational leverage and the ability to cross-sell. Under the “One Intuit Ecosystem” strategy since 2017, management has enabled the flow of data across its platform as well as opened it to third-party operators, creating a powerful ecosystem of apps, data analytics and referrals:

|

One Intuit Ecosystem (as of 2018)  Source: Intuit investor day presentation (Sep-18). |

Since 2018, Intuit has further expanded its addressable market through acquisitions, including into personal finance products (with Credit Karma) and small business marketing solutions (with Mailchimp).

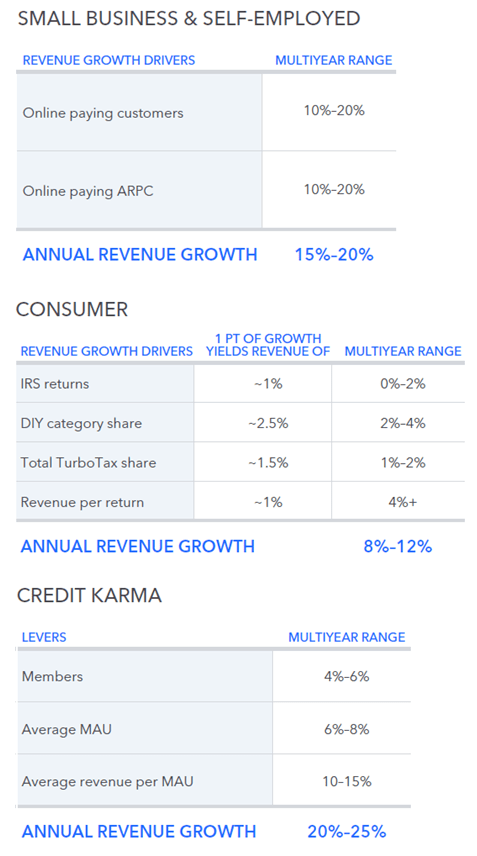

Intuit has historically targeted and delivered double-digit revenue growth as well as an expanding EBIT margin. At its last investor day in September 2022, management reaffirmed these long-term targets, as well as revenue growth targets of 15-20% for Small Business & Self-Employed (“SBSE”), 8-12% for Consumer and 20-25% for Credit Karma:

|

Intuit Long-Term Revenue Growth Expectations By Segment  Source: Intuit investor day presentation (Sep-22). |

Q1 FY23 results show the SBSE segment performing near the top of the expected range, though Credit Karma revenues have started to be affected by short-term macro headwinds.

Intuit Q1 FY23 Results

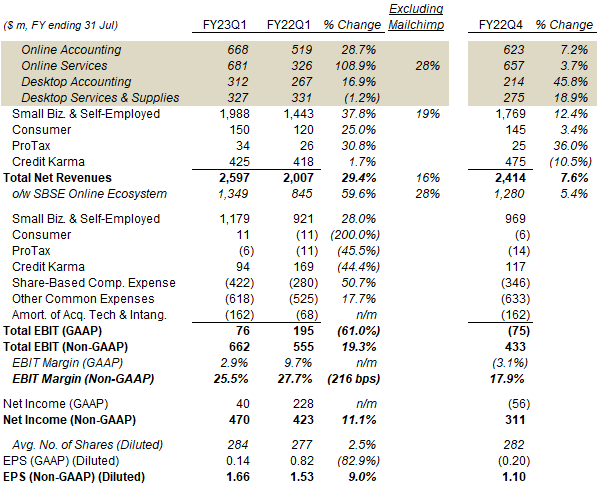

Intuit’s key P&L items for Q1 FY23 (August-October 2022) and their comparison with prior periods are below:

|

Intuit P&L (Q1 FY23 vs. Prior Periods)  Source: Intuit results materials (Q1 FY23). |

The key SBSE segment grew revenues by 37.8% year-on-year, or 19% excluding the acquired Mailchimp business; growth was again led by Online Ecosystem revenues, which grew by 59.8% year-on-year, or 28% excluding Mailchimp. The latter was slightly short of the 30% targeted by management but followed a tough prior-year comparable where it was 36%. SBSE revenue growth continues to benefit from multiple drivers including customer growth, mix shift and higher effective prices; the Payments business in Online Services also benefited from a higher average charge volume per customer.

International SBSE Online Ecosystem revenues grew by 19% organically year-on-year, compared to 39% in Q1 FY22, with management highlighting macro headwinds facing SMBs in the U.K., Australia and France.

The Consumer segment, focused on the TurboTax product for U.S. tax filers, is strongly seasonal with more than 80% of its annual revenues concentrated in Q3 (as of FY22), so its Q1 FY23 performance is not meaningful. The ProTax segment, which serves professional accountants in the U.S. and Canada, is too small to be meaningful.

We discuss the Mailchimp business and the Credit Karma segment separately in more detail below.

Mailchimp Turnaround Continuing

Mailchimp, part of SBSE Online Services, grew revenues by low-teens year-on-year in but was roughly flat sequentially. (Currency is not a factor because Mailchimp sells in dollars even in the 50% of its business that is ex-U.S.)

Intuit acknowledged in Q4 FY22 that Mailchimp was performing “slightly below” expectations, and that marketing had to be reduced while products and processes could be improved first. This quarter, management described the problems as potentially requiring “a couple of years” to fix:

“This was really a business that was run for profitability and it was run for cashflow. And even particularly in COVID times, where you saw a lot of front-office company accelerates, Mailchimp really didn’t … And so we worked very hard in the last year to put a playbook … to accelerate growth … To shift the business from being run for profitability and cashflow to be run for a growth business typically takes a couple of years”

Sasan Goodarzi, Intuit CFO (Q1 FY23 earnings call)

While the need to reaccelerate growth at Mailchimp was also mentioned initially after the acquisition, Intuit management was much less pessimistic in how long this would take back then:

“Their revenue and their new paying user growth were negatively impacted during the pandemic … And they did pullback on some of their marketing spend so they could preserve their profitability … We’re going to be investing aggressively to drive their growth as we go forward. It won’t happen overnight”

Michelle Clatterbuck, Intuit CFO (Q1 FY22 earnings call)

More positively, Intuit highlighted some positive indicators at Mailchimp this quarter, including increases in free-to-pay conversion, customer growth and “expansion revenue” (customers growing and upgrading their SKUs).

While Mailchimp’s recent performance has been disappointing, it contributed just 13% of SBSE revenues (or 10% of group revenues) in Q1 FY23, and things are improving – so this does not change our investment case.

Credit Karma Revenue Decline

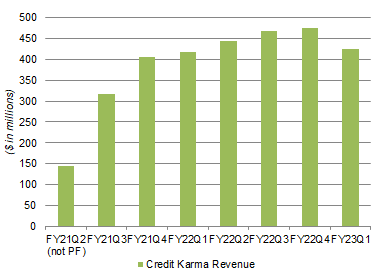

Credit Karma revenues grew just 1.7% year-on-year and fell 10.5% sequentially in Q1 FY23:

|

Credit Karma Revenues By Quarter (Since Q2 FY21)  Source: Intuit company filings. |

Credit Karma had deteriorated significantly and “in all verticals” since Intuit’s investor day in September (when it was expecting a mid-single-digit growth). During the quarter, revenue growth was still strong in credit cards, but faced headwinds in personal loans, home loans, auto insurance and auto loans (consistent with the advertiser pullback in these subcategories that Alphabet (GOOG) observed in its Q3 2022 results); management has seen many financial institutions tighten their lending criteria, including now in credit cards, which reduced volumes at Credit Karma.

As a result, Intuit has revised its FY23 outlook for Credit Karma revenues downwards, from growth of +10% to +15% to a decline of between -15% and -10%. However, management stated “we remain confident in our long-term revenue growth expectations of 20% to 25% for Credit Karma”.

Intuit FY23 Outlook

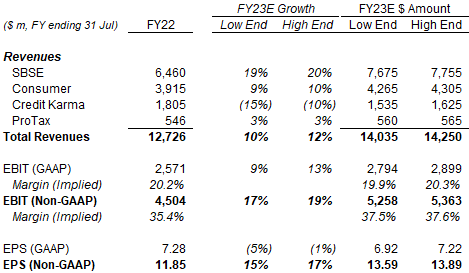

Intuit’s full-year outlook was unchanged for revenues in other segments and for group Non-GAAP EBIT:

|

Intuit FY23 Guidance  Source: Intuit results materials (Q1 FY23). |

SBSE revenues are still expected to grow by 19-20% and Consumer revenues are still expected to grow by 9-10%, driving full-year revenue growth of 10-12% (was 14-16%).

Group Non-GAAP EBIT is still expected to grow 17-19%, with the revenue shortfall in Credit Karma being offset by lower expenses. Intuit’s current approach is to reduce marketing expenses, travel, discretionary spend and other areas that do not generate a near-term return, but to protect R&D expenses.

Group Non-GAAP EPS is still expected to grow 15-17% to $13.59-$13.89 in FY23.

There were plenty of questions from analysts on the earnings call about the likelihood of a recession and its potential impact on Intuit. Management stated their FY23 outlook has taken recent data into account and “intentionally included further conservatism, deterioration just to be prudent”. Most of Intuit’s core businesses (in tax and accounting) provide mission-critical services and have proven resilient in past downturns, and management also emphasized their ability to reduce expenses to offset revenue declines.

In any case, we do not believe temporary downturns change our investment case and, as long-term holders, are not trying to predict their likelihood or short-term impact.

Valuation – Is Intuit Stock Overvalued?

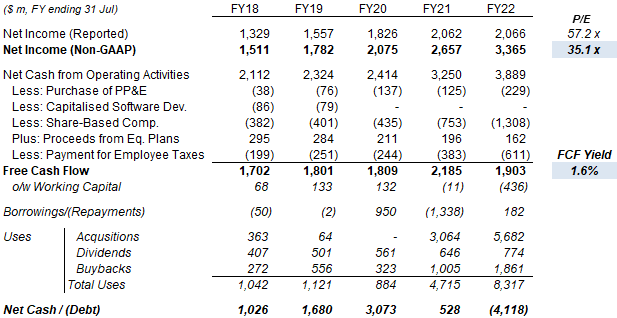

At $416.07, relative to FY22 Non-GAAP EPS, Intuit stock is at a P/E of 35.1x; relative to GAAP EPS, P/E is 57.2x:

|

Intuit Earnings, Cashflows & Valuation (FY18-22)  Source: Intuit company filings. |

Share-based compensation costs of $1.31bn substantially equals the gap between GAAP and Non-GAAP Net Income in FY22. Free Cash Flow (“FCF”) Yield, which we calculate after deducting SBC costs, is just 1.6% on FY22 financials. FCF was reduced by an atypically high working capital cash outflow of $436m, which included a $287m increase in accrued compensation and related liabilities.

Relative to the mid-points of the FY23 outlook, Intuit has a P/E of 30.3x on Non-GAAP EPS and 58.9x on GAAP EPS.

Intuit has a Dividend Yield of 0.7%, from a dividend of $0.78 per quarter ($3.12 annualized), which has been raised by 15% with FY22 results.

Intuit repurchased another $519m of its shares during Q1 FY23. Share buybacks totalled $1.9bn in FY22, equivalent to 1.5% of the current market capitalization, though the average share count was 2.5% (or 7m) higher year-on-year as of Q1 FY23 due to 10.1m shares issued for the Mailchimp acquisition.

$3.0bn of buybacks currently remain in the authorized repurchase program, including $2bn added in August 2022. Management stated their “aim is to be in the market each quarter” and had stated in the past they aimed to use buybacks to, “at a minimum”, offset dilution from share-based compensation over a 3-year period.

Intuit has $4.9bn of net debt (excluding operating leases and restricted cash) on its balance sheet, or 1.5x FY22 EBITDA.

Intuit Stock Forecasts

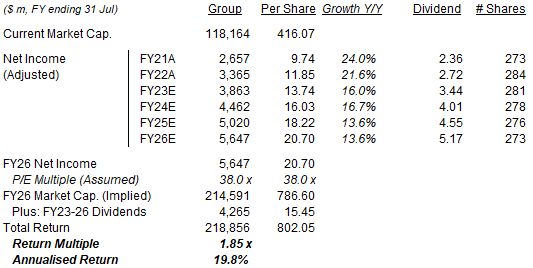

We have kept the assumptions in our forecast unchanged:

- FY23 EPS of $13.74

- In FY24, Net Income growth of 15.5%

- In FY25 and FY26, Net Income growth of 12.5%

- From FY23, share count reduction of 1.0% each year

- From FY23, dividend to be based on a Payout Ratio of 25%

- P/E of 38x at July 2026

Our FY26 EPS forecast is unchanged at $20.70:

|

Illustrative Intuit Return Forecasts  Source: Librarian Capital estimates. |

With shares at $416.07, we expect an exit price of $787 and a total return of 85% (19.8% annualized) by July 2026, in 3.5 years.

Is Intuit Stock a Buy? Conclusion

We reiterate our Buy rating on Intuit stock.

Be the first to comment