ThitareeSarmkasat

Introduction

In March of this year, I wrote an article titled “Intuit Stock: Why It’s Low Yield Isn’t A Turnoff”. Putting Intuit Inc. (NASDAQ:INTU) on my watchlist was the result of my focus on high-quality dividend growth and low-volatility investments. In this article, I will reiterate that call while highlighting the need for low volatility, dividend growth, and its upcoming earnings in light of ongoing macro developments. The problem is that the company’s main target group, small businesses, is in a terrible spot given economic developments. As bad as that may be for mid-term growth expectations in case of mass bankruptcies, it’s great for investors hoping to buy this high-growth company at a decent price. After all, I believe that INTU is a stock that investors need to buy as soon as a discount opportunity presents itself. Moreover, if economic damage remains limited, it’s even a win for the company as it offers tools for companies to mitigate issues like high inflation.

With that said, let’s dive into it!

Deep Market Penetration & Disruption…

In my portfolio, I own a lot of companies operating in industries with high entry barriers. Almost all of my industrial exposure is invested that way. The same goes for technology and healthcare – among a few others.

I am, however, constantly looking for companies that do well in competitive markets. These markets are often highly fragmented, which means disruption can lead to market share gains and market penetration.

Intuit excels at that like (almost) no other company.

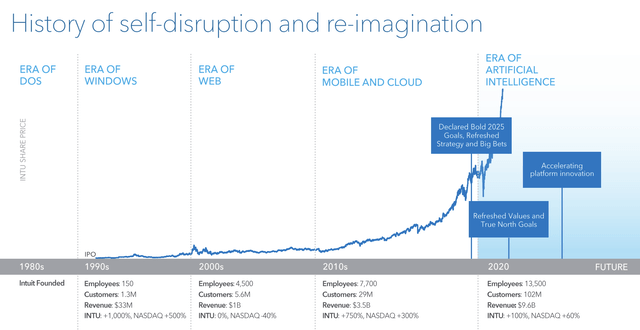

With a market cap of $134 billion, this company has become one of the largest disruptors in its industry. Located in Mountain View, California, Intuit is officially a member of the technology sector that sector is home to the software application industry.

Founded in 1983, Intuit is thriving based on the simple idea that it can make business and related processes much easier. In 1990, the company had 1.3 million customers. That has grown to more than 100 million customers thanks to both organic and acquired growth.

With all of this in mind, Intuit is focused on small businesses and self-employed people. This includes accounting professionals who support them. In this segment, the company operates its well-known product QuickBooks, financial and business management online services and desktop software, payroll solutions, and Mailchimp, which the company bought last year in a $12 billion deal:

Together, Intuit and Mailchimp will work to deliver on the vision of an innovative, end-to-end customer growth platform for small and mid-market businesses, allowing them to get their business online, market their business, manage customer relationships, benefit from insights and analytics, get paid, access capital, pay employees, optimize cash flow, be organized and stay compliant, with experts at their fingertips.

In FY2021, small business and self-employed customers accounted for 49% of total revenues. Consumer accounted for 37% of total revenues. This segment includes do-it-yourself and assisted TurboTax income tax preparation products. The company also has Mint, which helps people track their finances and daily financial behaviors.

Credit Karma and ProConnect accounted for a combined 14% of total sales. According to Intuit, Credit Karma…

[…] serves consumers with a personal finance platform that provides personalized recommendations of credit card, home, auto and personal loan, and insurance products; online savings and checking accounts through our partner, MVB Bank, Inc., member FDIC; and access to their credit scores and reports, credit and identity monitoring, credit report dispute, and data-driven resources.

ProConnect helps professional accountants in the US and Canada through tax offerings including Lacerte, ProSeries, and ProConnect Tax Online. This indirectly is a small-business segment as well, as it is the main target group of the professional accountants the company targets.

The reasons why the company is able to innovate are based on its open platform, AI applications, and the incorporation of experts. What this means is that i.e., QuickBooks is constantly expanded by third-party developers who create new applications and expand the company’s offering. Moreover, because of AI, processes are automated while experts solve one huge issue: confidence from buyers. Even technology is challenging. Experts are needed to guide customers in the right direction.

While most of INTU’s products have a learning curve, reviews are extremely positive and most recognize the company’s advantages that I just mentioned. For example, this one:

Known as the industry standard for small-business accounting software, Intuit’s QuickBooks Online is a solid choice for a variety of businesses, especially those that plan to regularly work with bookkeepers or accountants. Its four plans and add-on services offer a high level of functionality, flexibility and scalability.

The bottom line is that disruption is key here. Or as Intuit puts it:

We aim to disrupt the mid-market with QuickBooks Online Advanced, our online offering designed to address the needs of small business customers with 10 to 100 employees. This offering enables us to increase retention of these larger customers, and attract new mid-market customers who are over-served by available offerings.

… Result In High Shareholder Value

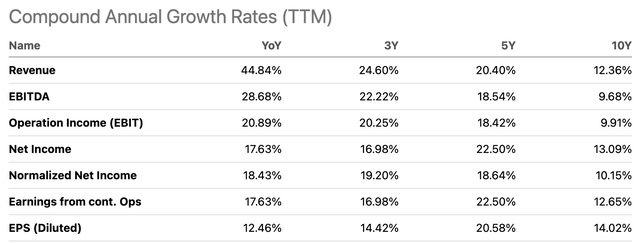

Looking at Seeking Alpha’s table of historic INTU growth rates, we see that these numbers are nothing short of impressive. Over the past 5 years, revenue growth was 20.4% per year, leading to 22.5% annual compounding net income growth thanks to higher margins.

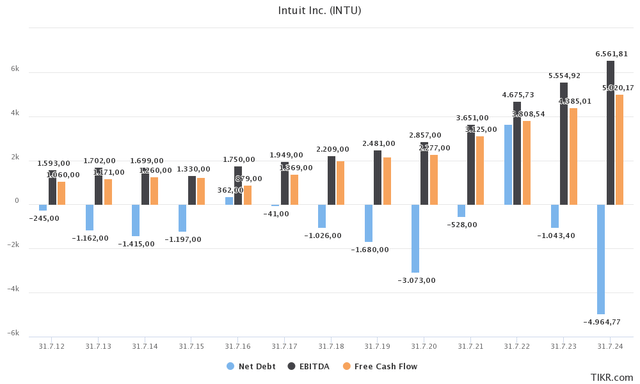

The company’s business model is genius. Margins are high and lead to high free cash flow. The company is now running free cash flow margins of more than 30%. As the graph below shows, the company’s free cash flow is growing by 11.5% per year between 2012-2024E.

As the graph above shows, high free cash flow is leading to negative net debt in most recent years – meaning the company has more cash than gross debt. INTU uses its stellar balance sheet to acquire new growth. For example, the Mailchimp deal in 2021. This temporarily increases net debt again. However, it also boosts free cash flow, which helps to reduce net debt again. Not many companies are able to pull this off because it requires a very successful M&A strategy and the ability to generate value from new companies (successful integration and synergy generation).

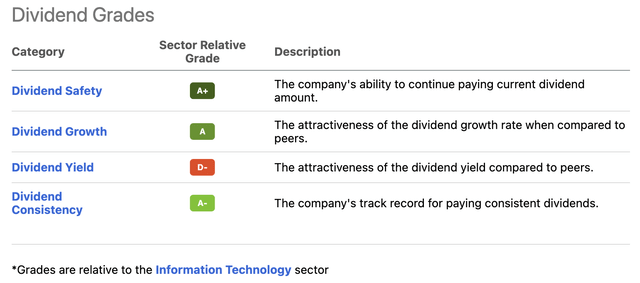

This is also the reason why the company scores high on its Seeking Alpha dividend scorecard.

The dividend yield scores a bit fat D minus, which is even worse considering that these scores are relative to the information technology sector, a sector that is not known for high dividend yields.

In this case, we’re dealing with a $0.68 per share per quarter dividend. That’s $2.72 per year. That’s not a lot given that a share costs roughly $477. This implies a 0.6% yield.

It helps tremendously that dividend growth is strong. The company has hiked its dividend by 19.7% per year over the past 10 years – on average, that is.

The most recent hike was 11.3% on October 7, 2020. Prior to that, the company hiked by 12.8% in October of 2019. In other words, it’s time for another hike.

So far, the company is focused on reducing debt and penetrating the market. That’s fine because the company generates so much value by doing it.

For example, FY2023 expected free cash flow is $4.4 billion, this implies a 3.3% FCF yield based on the $134 billion market cap. This not only paves the road for quick debt reduction, but it also means the company can pay a much higher dividend if it wants to.

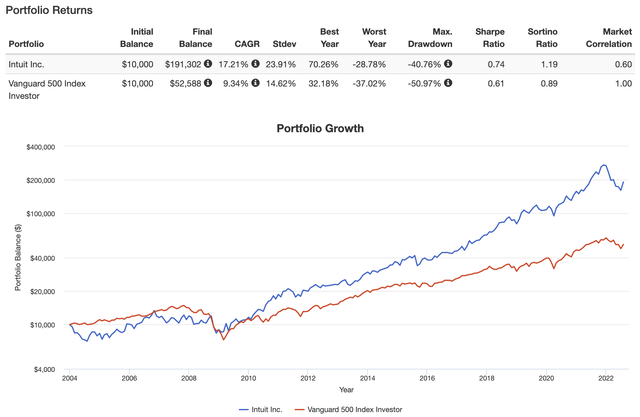

Moreover, while the dividend yield is low, dividend growth and low volatility are paving the way for outperformance. Between 2004 and the day I’m writing this, INTU has returned 17.2% per year. This beats the S&P 500 by more than 700 basis points per year. Meanwhile, the standard deviation was less than 10 percentage points higher. That sounds like a lot, but it’s not given the performance. As a result, the company beats the S&P 500 on a volatility-adjusted basis as well (Sharpe/Sortino ratios).

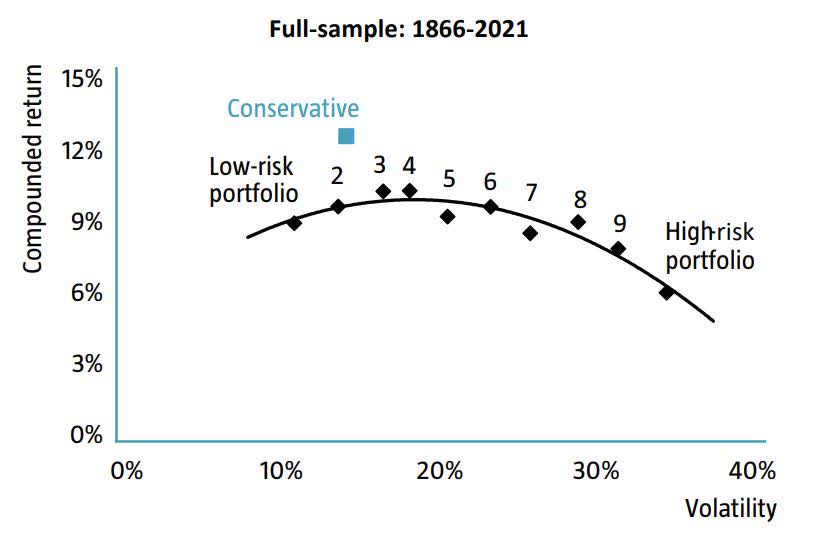

In a recent article, I highlighted why dividend growth (despite a low yield) and low volatility are two related things that provide investors with outperformance.

Essentially, a dividend (growth) is a stamp of approval as it means a company is strong enough to let shareholders benefit from its profits. This sets it apart from so many companies that are unable to do the same. Dividend growth companies are even better as they more often than not protect investor distributions against inflation while proving that they can stand the test of time and headwinds like increasing competition and others.

It often causes downside protection in severe economic times, which lowers volatility and provides long-term outperformance.

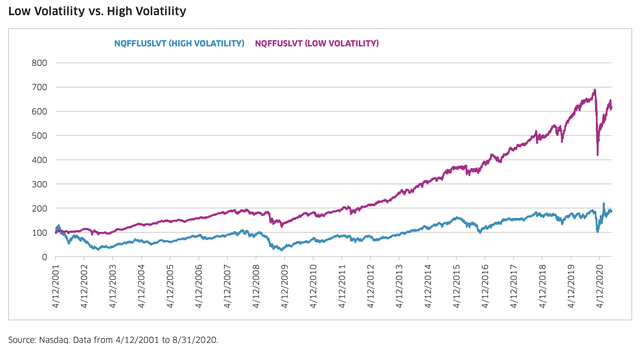

ROBECO

In other words, higher volatility does not mean outperformance, even though one might assume that a higher risk requires a higher return. It’s all about downside protection, which Nasdaq also highlighted in a report:

Aside from the 1-year data, the low volatility strategy has had superior risk-adjusted returns on a 3, 5, 10-year, and since inception basis. This shows that low volatility is better at providing long-term capital appreciation compared to high volatility strategies, which makes low volatility a critical investment factor to consider.

Intuit’s Valuation, Headwinds & Earnings

With all of this in mind, there are developments that could give us better entry prices. While a lot of factors are influencing economic developments, there are two things that I think are important to highlight here:

- Small businesses are in a really bad place.

- INTU is a “tech” trade.

Starting with point one, small businesses are in a very bad spot. In general, it’s fair to say that economic growth is slowing, with indicators pointing at a manufacturing recession (services might follow soon) as I discussed in this article.

High inflation, supply chain problems, and labor issues are problems facing all companies. However, small companies have even more trouble dealing with these headwinds as most lack the tools to improve efficiencies and operations.

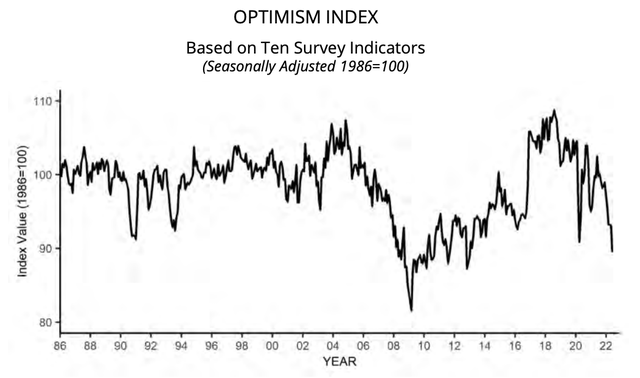

As a result, small business optimism hasn’t been this low since the post-Great Financial Crisis recovery according to NFIB data.

The situation is so bad that almost one in three small businesses cannot survive for more than three months without additional capital. Add to this that rates have gone up, which makes financing much harder.

Moreover, according to the New York Times:

The sector – which the federal government typically defines as businesses below a certain size, ranging from 500 to 1,500 employees depending on the industry – is responsible for two of every three jobs created over the past 25 years, according to the Labor Department. So a weakening of that engine bodes ill for American growth and prosperity.

With that said, there is a risk that the number of small businesses declines due to bankruptcies. However, and this is key, Intuit products are a driving force of digitalization in small businesses. That’s actually good for INTU.

As the company mentioned in its 3Q22 earnings call:

There is an accelerated flight to digitization to manage your cash flow as a small business in these tougher times. And we’re seeing that now. And the example I think I used earlier, but is worth bringing up again is in the month of April, our volume of QuickBooks Capital loans was at an all-time high and 3x higher than the same time last year, where times were much, much better compared to what environment all of us see today. And the other is our payments volume. Just in the last month, in the last week, we are growing north of 30%.

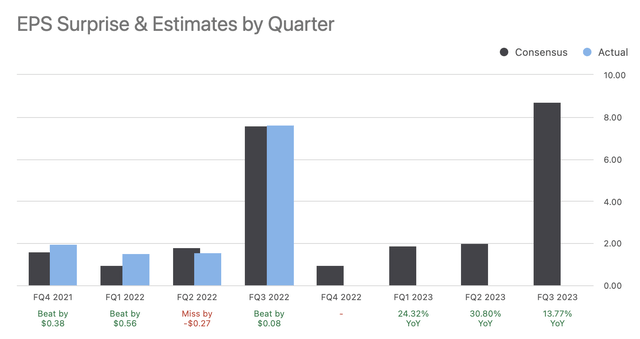

With that said, INTU is reporting earnings on August 23, after the market close. The company is expected to do $0.98 in non-GAAP EPS per share. This is based on 9 analyst estimates. Only one analyst has downgraded his 4Q22 outlook in the past four weeks, which shows that pessimism related to economic development is indeed limited.

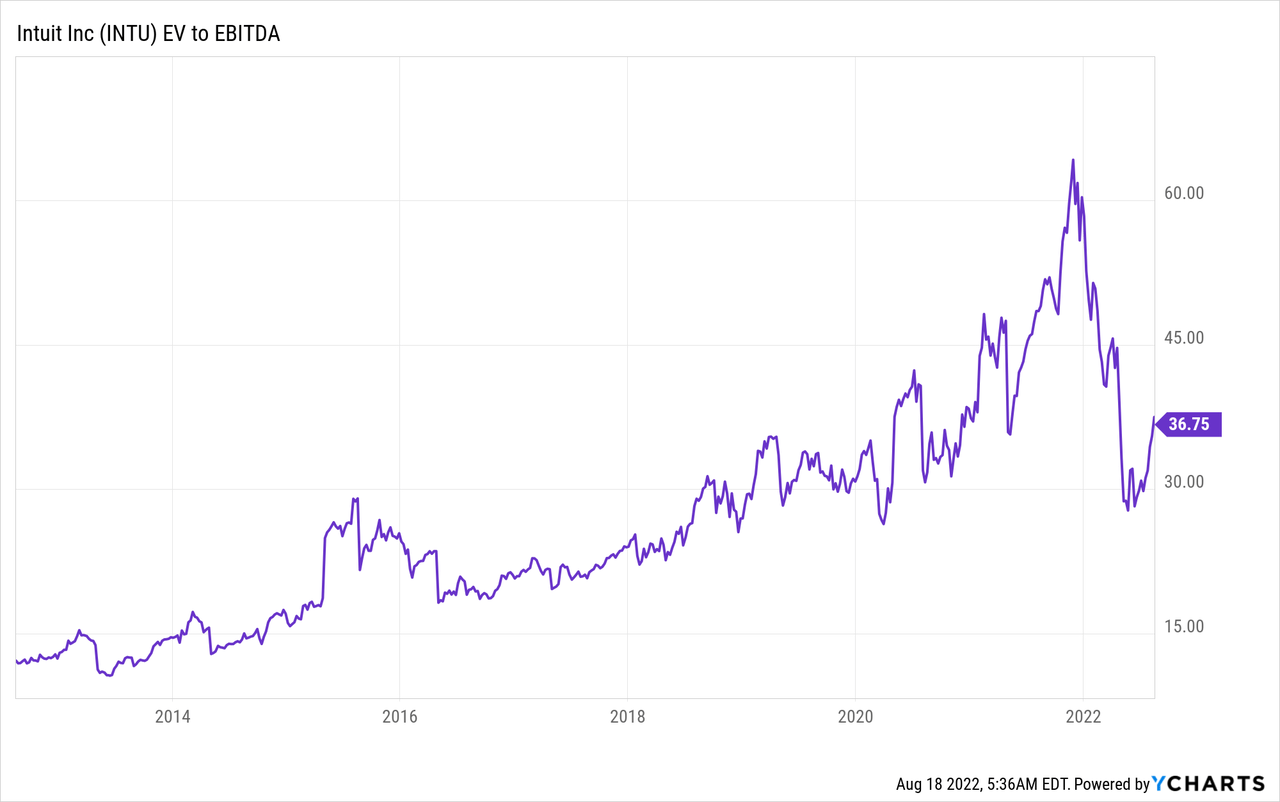

With that in mind, INTU is seen as a tech/growth stock. That’s based on INTU being a tech sector company and the fact that it’s a disruptor with a lofty valuation. The company’s enterprise value is roughly $133 billion based on a $134 billion market cap and $1 billion in expected net cash in the 2023 fiscal year.

This means the company is trading at 23.8x FY2023E EBITDA of $5.6 billion.

While that valuation may seem high, it’s not overvalued for a company expected to grow annual EBITDA by roughly 20% per year going forward.

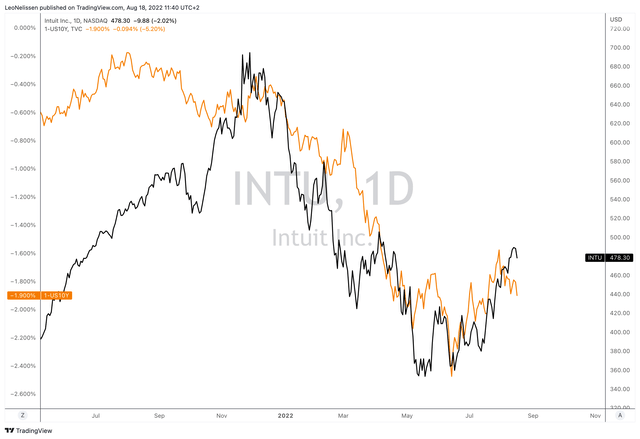

Yet, because of its valuation and characteristics, the company is very prone to higher rates. This year, the stock is following the main trend in rates as the graph below shows. The orange line shows the inverted 10-year government bond yield. This trend is driven by the fact that higher rates make “value” stocks more attractive. Companies with a lower valuation do better when inflation is high as high inflation makes discounting long-term earnings less attractive (which hurts growth stocks).

TradingView (Black = INTU, Orange =1-US10Y Yield)

Hence, while I believe that INTU is a buy on a long-term basis, I do not expect the stock to “fly” again until the Fed is done hiking. That could be next year as inflation is expected to come down. It likely won’t normalize, but as the Fed is expected to hike to 3.5%, it could be enough to signal a pivot.

Takeaway

I remain extremely bullish on Intuit’s long-term outlook. The company is in a terrific position to further penetrate a highly fragmented market thanks to its advanced tools and the increasing need for small businesses to improve operations. The company’s business model is better prepared than ever before for these challenges and its growth outlook remains strong despite the aforementioned economic challenges.

Moreover, I believe that Intuit needs to be approached from a dividend growth point of view despite its low yield. Dividend growth is high and volatility has come down as the company has matured. What investors are dealing with now is a low-volatility stock that is likely to deliver above-average returns in the foreseeable future – especially if the Fed pivots next year, which is what I expect.

So, going forward, we’re getting earnings next week. Look for comments regarding high inflation and small business health as that could determine if the company is indeed able to maintain close to 20% in annual EBITDA growth in the next year.

Other than that, I think INTU is a buy whenever stock price weakness occurs.

(Dis)agree? Let me know in the comments!

Be the first to comment