BalkansCat/iStock Editorial via Getty Images

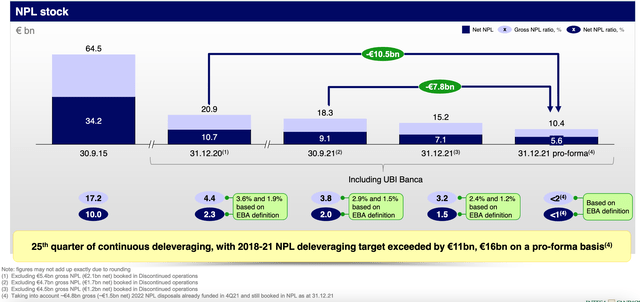

Intesa Sanpaolo (OTCPK:ISNPY), hereafter referred to as ISP, is the largest Italian bank and enjoys an intriguing preeminence in some of the most promising non-banking businesses, such as insurance and asset management. Following its acquisition of UBI Banca in 2020, which at the time was Italy’s third largest bank, ISP has reported some of the best quarters in its history and in early February presented a very encouraging three-year business plan. Among other things, ISP’s plan included a €3.2 billion buyback program in 2022. This is in addition to the bank’s already generous dividend policy and was possible given the remarkable progress ISP has made in recent years in deleveraging its balance sheet and securing its NPL exposure.

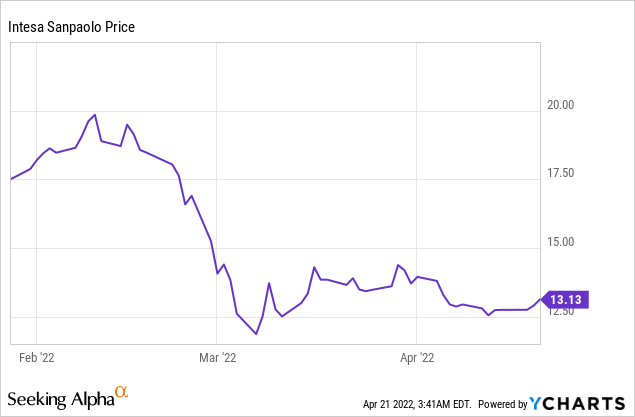

The share buyback comes at a very opportune time, as all Italian banks (including ISP) have been hit hard by the global crisis in recent months.

Impending risks ahead

Although the recent price correction clearly represents an opportunity for the company’s buyback plans, investors should be aware of the significant risks associated with the current situation. First, there is the bank’s involvement in Ukraine and Russia. This led to a sharp drop in the share price at the beginning of the military operations. However, as the bank later communicated, the total loss in the worst case would be around €5 billion, which is by no means a big problem for this Italian bank. In fact, this sum represents less than ISP’s annual operating profit and less than 10% of the company’s net assets. Nevertheless, the current international crisis represents another problem of (great) concern for the Italian banking system in general. It is the risk that the entire Italian economy (and a significant part of the European economy) will go under as a direct consequence of abnormal inflation and modest nominal growth: in a word, stagflation! We can already see the first signs of a slowdown in the Italian economy: and inflation is already roaring all over Europe. To be precise, banking and insurance (and ISP is a combination of both business sectors) should do quite well in an inflationary environment if central banks are willing to raise interest rates. After all, the banking sector did very well during the last cycle of (relatively) high interest rates in the years leading up to the 2008 financial crisis.

However, the times ahead are not easy to decipher: Inflation is currently caused by the energy crisis, rising commodity prices and bottlenecks in various supply chains around the world. These factors are not going away anytime soon, and in fact, a food crisis is already looming on the horizon. Demand for basic commodities is quite inelastic, so it is not clear how raising interest rates could eventually solve the problem. On the other hand, European countries, and Italy in particular, have high budget deficits and public debts: it is not clear how they will manage to service the debt with much higher interest rates. Moreover, it is no secret that Italy is highly dependent on energy imports, especially from Russia. If Russian supplies were to drop significantly, this would have serious consequences for the Italian economy, as the search for alternative energy sources would (possibly) be long and expensive. Needless to say, all this uncertainty could lead to a suspension (or more likely a reduction) of the bank’s planned share buyback and dividend payout. If hyperinflation scenarios continue, the ISP may suddenly need reserves to cover the growing influx of nonperforming loans in coming quarters and shrinking deposits. On the other hand, ISP operates a well-established asset management and insurance business that is likely to be less affected by such a development. Moreover, the leading position the bank occupies in Italy could help it gain more market share at the expense of its competitors, which might be in a much worse position due to their smaller size: indeed, it was no coincidence that ISP managed to acquire UBI banca, one of its main competitors, in the middle of the pandemic crisis. So, some positive outcomes are possible as well, but all in all, European banks are moving towards a dangerous pattern at the moment, and ISP is no exception.

Your Takeaway

Intesa Sanpaolo has managed to effectively turn around its business over the past five-ten years and has started this quarter with a strong tailwind: accordingly, management has decided to implement a share buyback program until 2022, which could eventually be extended in the coming years. This is despite the fact that the same management has stated in the past that it is not so supportive of share buybacks as a means of compensating shareholders! Now, with the share price down about 30% since the plan was announced in response to the bank’s involvement in Ukraine and Russia, it looks like the buyback could be a bargain for ISP shareholders. However, the stock plunged for good reasons: even though the specific exposure to countries in direct conflict is somehow negligible, the Italian economy could be hit hard by the impact and possible escalation of the current crisis. Even if the situation would be somehow defused in the coming months, it is likely that the entire European economy will have to go through a period of stagflation, the duration of which no one can currently predict.

While it is true that banks could thrive in an inflationary environment, stagflation is something completely different. Therefore, Intesa Sanpaolo is not a buy now, while existing shareholders should wait for more clarity before taking action.

Be the first to comment