massimo1g/iStock Editorial via Getty Images

One week ago, we published a scenario analysis on the European insurance highlighting AXA (OTCQX:AXAHY) and Zurich Group AG (OTCQX:ZURVY) as Mare Evidence Lab’s top picks. Today, we will provide a top-down analysis scrutinizing and stressing the Italian banks. In our recent publications, we already mentioned that we are forecasting a recession and a consumer crisis during the 2022/2023 period, emphasizing that the worst is yet to come. However, despite the ongoing macroeconomic challenges and the higher interest expenses, the Bank of Italy’s latest data showed a strong resiliency in lending, showing a plus 2.5% year-on-year. So, we believe that Italian banks are at a crossroads and the key question is: will they outperform with central bank rate hikes or will they be dragged down by growing recession risks?

Here at the Lab, we are bullish due to interest rate hikes that create zero-cost revenues while credit losses are expected to remain contained. On the other hand, banks’ stock price performance will suffer due to declining SME indices, lower bond yields and widening credit spreads.

Since February, European banks have given up a third of their market cap due to the deteriorating macroeconomic outlook. However, the sector has the potential to benefit from central banks starting the most aggressive rate hike cycle in decades in response to high inflation.

Scenario analysis

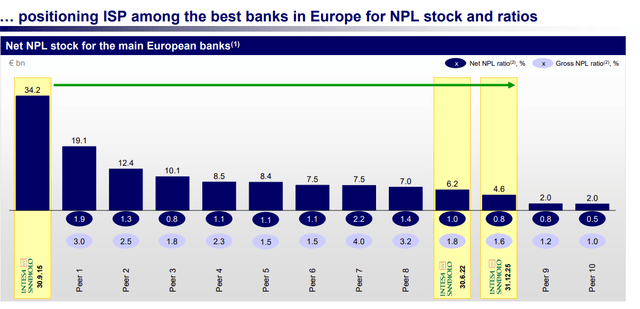

ECB’s deposit rate has moved into positive territory for the first time in a decade and more hikes are likely to follow (it is estimated another 75-basis point increase in October). At the aggregate level, since the financial crisis, banks have tripled their deposits. Thus, without further capital increase, they can deploy billions at zero costs. Furthermore, the credit risks for Italian banks have decreased significantly. We estimate that the peak of write-downs is likely to be two-thirds lower than it was in 2008 or 2011/2012, so while deposit revenues could end up being three times the historical levels, credit losses should be equal to one-third – since 2014, non-performing loans have fallen by 70%. As a result, we see an increase in bank profits over the next three years. In addition, banks are expected to see an interest margin benefit from interest rate hikes. This coupled with valuation including a 10% cash yield including dividends and buybacks, implies a strong outperformance of Italian banks in the future.

Whereas, in the worst-case analysis, growth slowdown, bond yield decline and BTD/Bund spread at 230 basis points will be a brake. Forecasting a recession means that the PMI index will drop, we estimated a decline from 48 to 44, and banks usually underperform PMI declines. As a sector sensitive to interest rates, the relative performance of banks typically also follows the bond yields trend. We expect yields to reverse their recent rally as central bank focus shifts from inflation to growth concerns. Although we believe that, if this were to happen in the context of weakening growth, it would probably be a drag on banks, as was the case in the first half of this year. To sum up, pricing in the worst-case scenario, we project a decline in earnings of more than 15%.

Bottom down approach

After having analyzed the Italian banking sector, Intesa Sanpaolo (OTCPK:ISNPY) is our favorite followed by Unicredit. Why?

- Size matters (especially in a crisis) and ISP is the biggest bank in the Italian peninsula. More importantly, the company’s main activity is located in the North, where GDP is growing and unemployment is low;

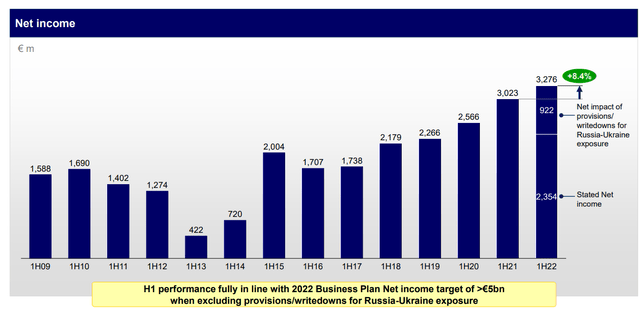

- Despite the ongoing environment, ISP is delivering performance (Fig 1);

- There has an immaterial exposure to Russia with provisions already taken into account in the first half of the year;

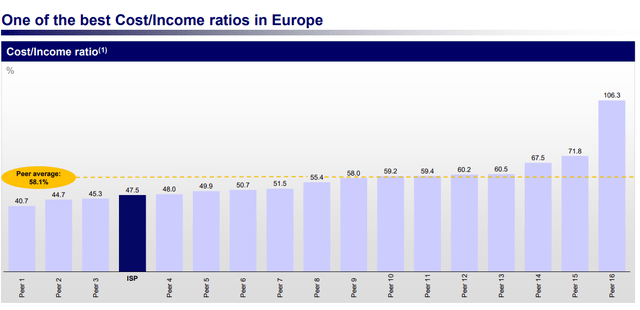

- ISP has one of the best cost/income ratios in Europe (Fig 2). Moreover, thanks to the ongoing company plan to reduce the workforce, this is going to be considerably improved over the short/medium term horizon;

- ISP deleveraged its non-performing loan exposure (Fig 3) and has a very low cost of risks;

- The company is solid at the balance sheet level with substantial capital requirements;

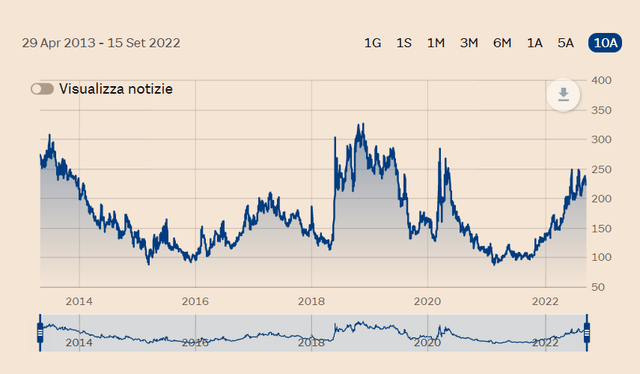

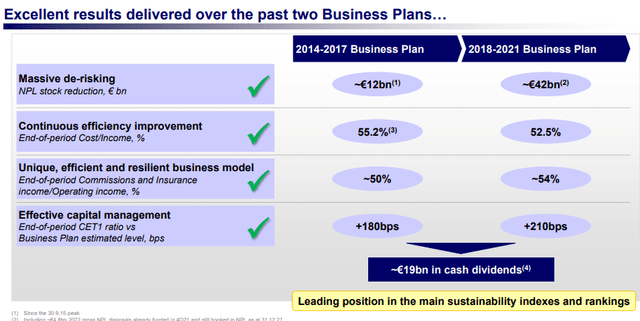

- If this was not enough, you might have a look at the latest business plan and the ISP’s excellent track record (Fig 4).

Intesa Sanpaolo net income evolution Intesa Sanpaolo cost/income ratio Intesa Sanpaolo NPL evolution

Conclusion and Valuation

Bank stocks are benefiting from the rise in interest rates and the revision of the financing rules between the ECB and the credit system. The decline in ROE to 8% in 2022 does not justify a ratio of capitalization to equity equal to 0.5x versus an average of European banks at 0.81x. The analysts’ estimates on the top four Italian banks, currently indicate an average contraction in profits of more than 25% this year compared to 2021. Looking at ISP’s accounts, we are not forecasting such a steep decline. In H1 2022, ISP impaired €1.1 billion in Russian assets, as we mentioned in the analysis of the Q2 results, without the write-off, the company’s net income would have been €3.28 billion a plus + 8.4% against the €3.02 billion delivered in H1 2021. Wall Street analyst consensus was beaten once again and with ISP’s track record, we are confident that the company will navigate this ongoing adverse scenario. Moreover, the leading Italian bank is much more equipped compared to the financial crisis as well as the sovereign debt crisis. Based on a ROTE of 13%, we confirm our €2.4 target price, maintaining our outperforming rate.

- Unicredit Q2 comment: Unlocking UniCredit’s Value

- Intesa Sanpaolo Q2 comment: A Clear Buy

Be the first to comment