halbergman

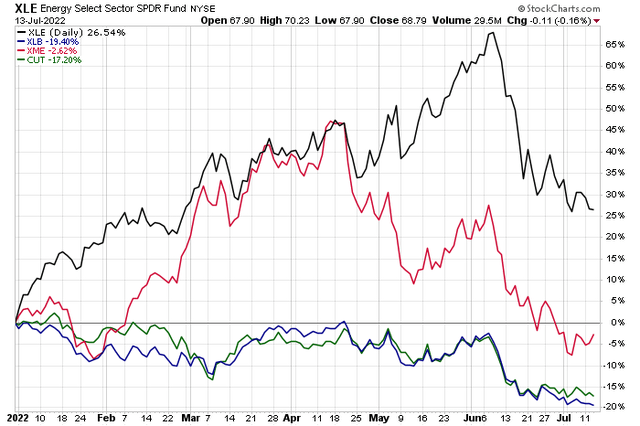

The resource trade was hot to start 2022. From January through early June, the Energy sector was up nearly 70% on the year while some metals and mining stocks in the Materials sector were up more than 40% through mid-April. The CUT lumber ETF and broader Materials sector fund (XLB) did not fare as well, though.

A Topsy-Turvy First Half For Energy & Materials

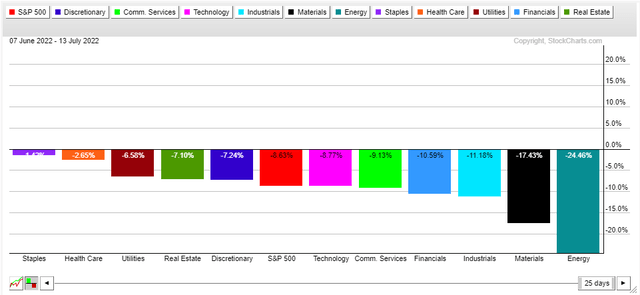

Jump ahead to today, and those two sectors are down big since June 7.

Materials & Energy Sector Weakness Since Early June

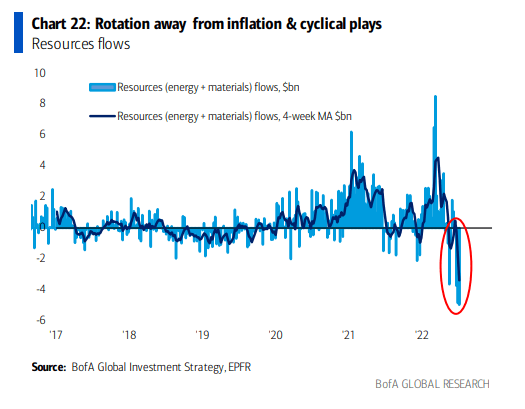

Not surprisingly, Bank of America Global Research, using EPRF data, noted that we have just seen the largest outflow ever from resource plays (and a record 3-week outflow from resources – which is energy & materials stocks) as of early July.

Massive Recent Flows Out of Resource Plays

BofA Global Research

One large-cap materials stock has simply been range-bound during all this volatility. International Paper (NYSE:IP) is a $16 billion market cap firm in the Containers & Packaging industry within the Materials sector. According to BofA, International Paper is one of the largest paper packaging and pulp companies in the world, with sales of more than $19 billion in 2021. IP is the largest containerboard and box producer in North America, with about 32% market share. It is also the largest global producer of fluff pulp.

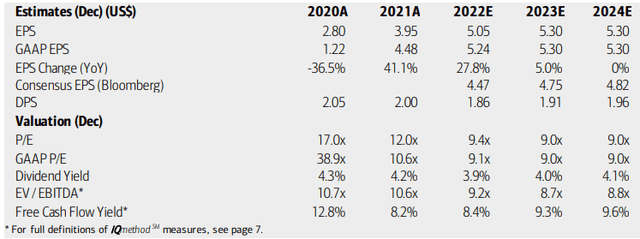

The Memphis-based firm pays a sporty dividend of 4.4%, according to The Wall Street Journal. With a price-to-earnings ratio of just 9.3x last year’s earnings, its valuation appears compelling here for long-term investors. BofA expects EPS to grow handsomely this year but then stall later in 2023 and 2024 as GDP growth remains lackluster. The upshot is that IP’s dividend is forecast to remain stout while its free cash flow yield, a measure of how much cash is available to distribute to shareholders, climbs to near 10%.

International Paper: Earnings, Valuation, Dividend Forecasts

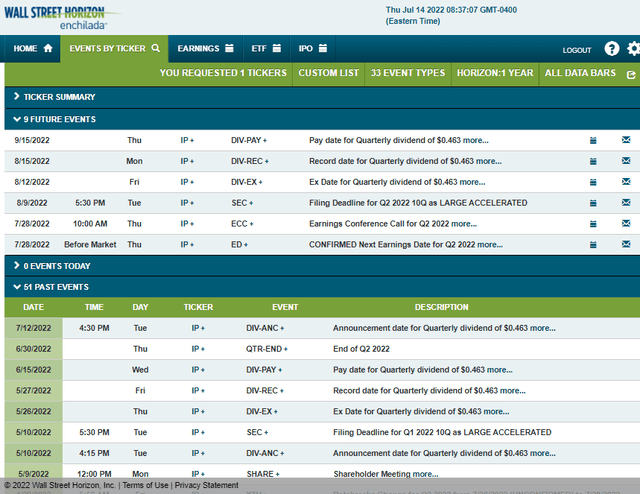

IP recently announced a $0.463 quarterly dividend unchanged from the prior distribution, according to Wall Street Horizon (WSH). WSH also shows a confirmed Q2 earnings date of July 28 BMO with a conference call to follow later that morning.

International Paper’s Q2 Earnings Announcement on the Horizon

The Technical Take

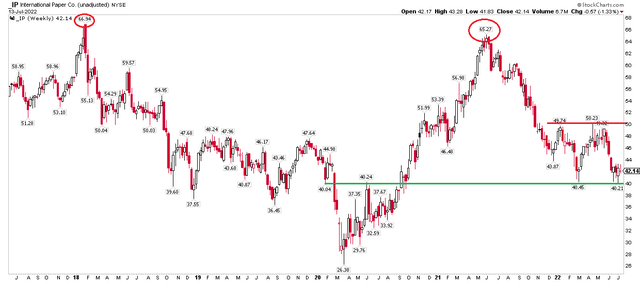

While the valuation, dividend, and free cash flow trends look solid, the charts paint a more depressing picture. Over the last five years, a double top pattern suggests generally bearish price action. Near term, there’s resistance at $50 while support is $40. With shares trading in the low-$40s currently, it sets for a near-term bullish pullback to around $50, but traders are prudent to have a stop below its March, June, and July lows.

IP Stock: Double Top, But Tradeable Range

The Bottom Line

IP shares look good for long-term investors seeking a Materials sector stock with a low valuation and high dividend yield. Short-term traders have defined risk/reward levels to watch right now. I think a near-term bullish thesis, long shares in the low-$40s with a stop under $40, targeting the upper $40s could work.

Be the first to comment