Sundry Photography

Intel’s (NASDAQ:INTC) pushed for the approval CHIPS Act, but ironically the bill got Congress approval on the exact day the chip giant reported a horrible quarter. Investors were long warned that results were holding up due to constrained global chip supplies preventing competitors from taking more market share. My investment thesis remains Bearish on the chip giant as cash flows become a major concern as Intel embarks on an expensive foundry building plan.

Massive Cuts

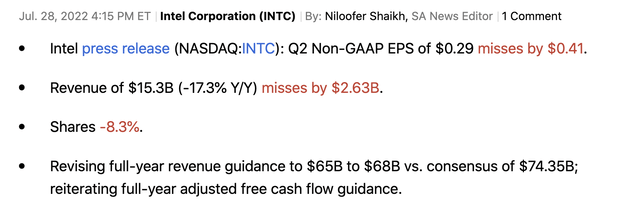

After several semiconductor stocks like NXP Semi. (NXPI) and Texas Instruments (TXN) reported strong results, Intel brought the market back to reality with a horror show for shareholders. The chip giant reported revenues missed estimates by a massive $2.6 billion with numbers down 17% on the year.

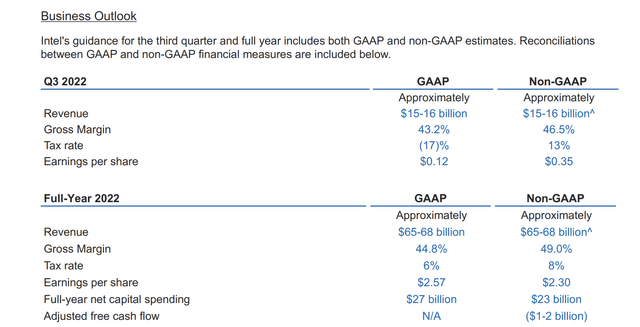

Even worse, Intel predicts ongoing weakness causing the 2022 revenues to be cut ~$7.9 billion from consensus estimates. The revenue guidance on the low end is down $11.0 billion from the guidance following Q1’22 results of $76.0 billion.

Source: Intel Q2’22 earnings release

Naturally, the revenue hit crushed margins and caused a massive hit to EPS. Intel only reported Q2’22 gross margins of 44.8%, down 15 points from last year, leading to an EPS of $0.29 missing estimates by $0.41.

The company once with massive margins and cash flows is now guiding to 2022 adjusted free cash flows of negative $1 to $2 billion. Intel is spending $23 billion on capital spending this year due to the plans to build new foundries. The amount is down from $27 billion likely due to the passage of the CHIPS Act producing a 25% subsidy for building foundries in the US.

Otherwise, Intel would’ve been looking at a $6 billion adjusted free cash flow loss. Now, the company appearing to pivot from building plants in Ohio with or without government funding appears a signal of how bad the financial results were going to be when reporting.

Estimates Continue To Collapse

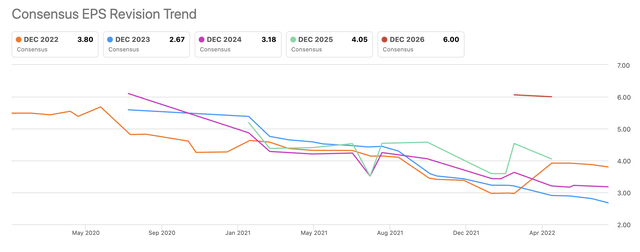

The biggest mistake made by investors over the last couple of years was that Intel wouldn’t fall any further because the stock was cheap. Intel regularly traded at 10x forward EPS estimates, but the forward estimates continue to collapse in a true value trap.

At one point, analysts actually forecast Intel earning $5+ per share in 2023 and now the estimate might be cut to $1. The current EPS targets was already down 50% to the mid $2 range before the company cut 2022 numbers.

The current EPS trend is hardly at a $1 annual rate with the $0.35 EPS estimate in Q3’22. Considering Intel continues to lose market share to Advanced Micro Devices (AMD) and others, one can’t just assume Intel will turn the business around.

Pat Gelsinger has been the CEO of Intel for other a year now and the massive Q2’22 shortfall was partly blamed on internal execution issues per the earnings release statement as follows:

This quarter’s results were below the standards we have set for the company and our shareholders. We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues.

Any investor has to question how Intel is going to spend $27 billion (before subsidies) on capital spending this year and attempt to build out a foundry business and somehow improve execution on the current chip design business. One just can’t assume the chip giant is able to stop the slide considering AMD is only a fraction of the size of Intel.

Intel is guiding to 2022 revenues of $66 billion with Q3’22 revenue estimates dipping to $15.5 billion, or a run rate of only $62 billion. AMD is forecast to only reach 2022 revenues of $26 billion with numbers approaching $29 billion in 2023.

One can easily argue AMD should ultimately close the gap over the years ahead unless something fundamental changes with the business trajectory. In an environment where AMD is chip constrained, one has to wonder where the ultimate bottom in the business for Intel exists. The massive hit to gross margins continues to suggest Intel has to cut prices in order to capture sales in an environment where AMD lacks enough supplies.

The stock is down to $37 in after-hours trading and one has to see this stock price as expensive. The company guided to 2022 EPS of $2.30, but this number includes a large $0.87 EPS in Q1. Based on estimates for a $1 to $2 EPS going forward, the stock remains expensive as the EPS targets collapse.

Takeaway

The key investor takeaway is that Intel remains a horror show for shareholders. The company is headed into an aggressive spending few years with results falling apart. Investors should’ve sold the stock years and ago, and it still isn’t too late to dump Intel.

Be the first to comment