4kodiak

It was another earnings season in 2022, which means Intel (NASDAQ:INTC) had another disappointing quarter to provide. Inline results were overshadowed by further cuts to guidance as Q4 will miss analysts’ estimates for the second quarter in a row. I hope no one’s looked at the full-year picture of expected negative cash flow and $2.00 in GAAP EPS (2021 was $4.86 and 2020 was $4.94). I mean, there’s a dividend to cover, gang! One that costs $1.48 per share yearly (and should it want to keep a seven-year streak alive, even more). It doesn’t look good for Intel on any front. But is the market already there? Has it priced in this historic record low growth? Initial signs show the market may have had enough as valuation metrics are at gut-wrenching lows not seen before with Intel’s stock. But the 2023 picture doesn’t provide any tangible reasons the market will keep Friday’s gains.

It’s Stormy Out There

There’s nothing I like about Intel’s current situation. Its technology roadmap has a lot to prove as it plays the catch-up of a lifetime to Taiwan Semiconductor (TSM) and Samsung (OTCPK:SSNLF)(OTCPK:SSNNF) in terms of chip fabrication technology leadership. After many delays, will it get the next one right? In my view, one isn’t enough – the company needs a string of technological successes to prove it didn’t happen upon a nut in the winter.

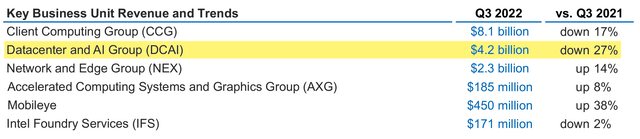

Financially, it’s burning cash and seeing the lowest growth in the industry, which is now hitting the lucrative data center division. And this is what surprised me the most – either Intel is in real trouble in the data center – on top of the client division – or the other shoe is about to drop for other companies like AMD (AMD) and Nvidia (NVDA) as they get ready to report in the next week and three weeks, respectively.

But, the thing I’ve been focusing on in this semiconductor decline, and even the broader tech industry downturn, is looking if the market has had enough “bad news” to indicate estimates have bottomed. Because this is how you invest; you look ahead like the market and find which companies are best set to recover first.

But to do that, one must find where the downward earnings revisions slow and ultimately stop. Physics dictates to reverse direction, an object must come to a complete stop before velocity increases in the other direction. Micron (MU), for example, is already seeing this, which makes sense since it’s usually the canary in the semiconductor coal mine, leading both up and down.

The question, then, is Intel at the point where the earnings revisions have reached a terminal point in their downward trajectory?

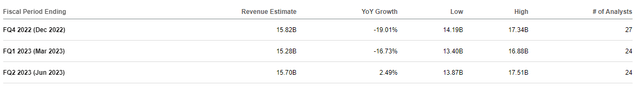

At first glance, the initial market reaction after hours on Thursday and trading on Friday would lead you to believe so. But then you look at the earnings estimates and see they’re still much higher than the company’s guidance (and were higher still on Thursday before the report).

But is Intel one quarter away from providing inline guidance? Two quarters? A year? That’s the fundamental question to determine if Intel is worthy of investment now while the market reacts to bad news by bidding up the stock.

The Outlook Isn’t Supporting Better Estimates

One needs to see how management views the next several months to get a read on this. Over the last two years, Intel has had the worst end of any market weakness. If management sees an inkling of light at the end of the negative growth tunnel, it’s worth noting.

But the read-in I got from the earnings call was not positive. There was plenty of talk about the 2025 plan and even into 2026, but it was about all the things the company still had to execute on. Bringing things more into the relative near-term, using 2023 as the footing for market expectations, it was more of the same, if not a worse outlook.

We are adjusting our Q4 outlook, and we are planning for the economic uncertainty to persist into 2023.

– Pat Gelsinger, CEO

We expect these headwinds to persist and as a result, we’re lowering our expectations for the fourth quarter.

– David Zinsner, CFO

DCAI revenue was $4.2 billion, down 27% year-over-year on TAM reductions and continued competitive pressures even as market share continues to track in line with our expectations.

– David Zinsner

Beyond Q4, there’s a high degree of macroeconomic uncertainty, and it appears that the current challenging market environment will extend well into 2023 with the potential for a global recession.

– David Zinsner

And inside of that, it’s just hard to see any points of good news on the horizon, inflation in the U.S., the situation in Europe with energy and the war and in Asia. So against that backdrop, we’re still looking to have economic headwinds as we go into next year. And with that in mind, obviously, lowering our guide for Q4.

– Pat Gelsinger

What I found telling was the reliance on other semiconductor industries to benefit its business. For example, lower DDR5 costs should help Sapphire Rapids, which utilizes the new DRAM standard.

…and some of that will help our business like lowering of DDR memory costs will decrease the premiums on DDR5 that makes Sapphire Rapids a more compelling platform.

– Pat Gelsinger, Earnings Call Q&A

But the memory industry is not looking at a long bottom, as expectations are for things to flatten out in the next quarter and begin becoming constructive again before the end of the first half of 2023. So relying on other semiconductor sectors to buoy its product is not a reasonable strategy, especially when it’s the memory industry.

And to put a finer point on my concern about the data center business unit and the company’s bellwether status (which I stated it lost mid-last year), it admits to doing worse than the overall market.

And in data center, we grew slower than the market. And as the product line gets stronger, we will be in a position to regain share, regain ASP, obviously, ramp the Sapphire Rapids. But we still see ourselves not in a position that we’re gaining share yet and expect that will be the case for a couple of more quarters.

– Pat, Q&A

Intel is operating from a position of weakness. The continuing narrative is “make up ground” or “regain share.” This is a difficult position for any company to be in. It means the company cannot, under any circumstances, misstep its execution; otherwise, it means falling further behind. And not only must it execute flawlessly, but it must do so with a better strategy and better product than its competitors.

While I think Intel does have competitive products, some better than the likes of AMD, it’s trying to not only architect and design these products but produce them at scale – something it has struggled to do for the better part of the last decade.

But this is nothing new for Intel. And to return to my point of market expectations, it’s hard to see how the market is willing to raise earnings estimates when the current outlook is for all of 2023 to be challenging to forecast and without any inkling of upside catalysts.

Some Backstops, Sorta

On the other hand, management may have used this report as a kitchen sink quarter to lower expectations to the absolute bottom, allowing for a lowered bar to be easily cleared in 2023. However, based on history, Intel is slow to recover from any macroeconomic situation due to the anchor it calls foundries.

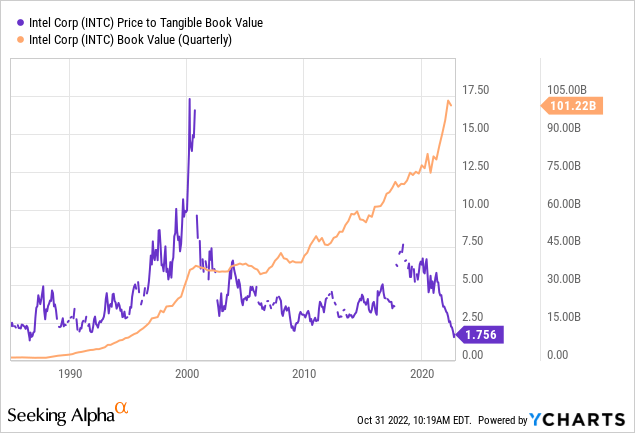

The difficulty I have with seeing more downside revisions is the relative valuation is at historic lows. For example, price-to-tangible-book is at 30-year lows. This is while book value has increased quite a bit in the last few years.

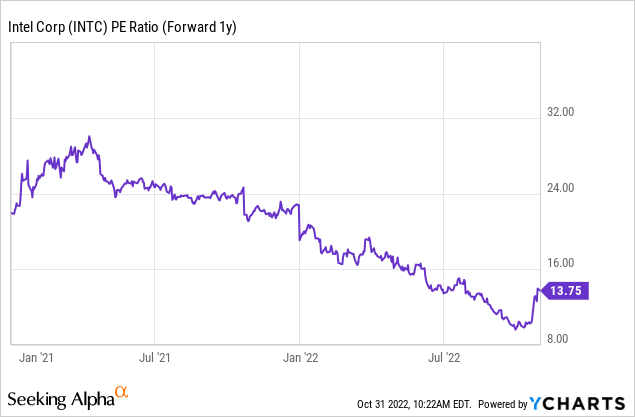

However, Intel’s forward PE ratio is heading higher as estimates head lower. So, what appears to be a very low valuation gets bumped up as earnings estimates get cut. This is similar to what Micron experiences as the cycles ebb and flow. In Micron’s case, you buy when the forward P/E is high and sell when the forward P/E is low. While Intel isn’t classified as a cyclical semiconductor, it is experiencing a macroeconomic cycle.

The Future Isn’t Supportive Of The (Initial) Market Bullishness

To put a bow on this, the market still has more adjustments on earnings estimates before it starts to look constructive again. I don’t expect any improvement in the next three quarters (including the current quarter). In addition, Intel’s logic market will lag behind the memory market, which is only expected to recover mid-next year. While the market rewarded bulls on Friday, the upside from here is very limited, and the stock may float back down into the mid-$20s before year-end.

Be the first to comment