JasonDoiy

Intel (NASDAQ:INTC) shares just keep dropping and now yield nearly 6%. It’s been a disastrous year for shareholders, and it seems like there is always another shoe to drop. The most recent one being the warning from Advanced Micro Devices (AMD) in which it guided for a much bigger than expected drop in revenues. It is getting to the point whereby the shares of chip stocks are dropping over and over again on even the same news and news that was not at all unexpected. It should not surprise anyone that the chip industry has a glut of inventory and that revenues and margins are declining. So the AMD news was expected by many investors and yet it led to a big drop in the share price of many chip makers. Of course, the recent big drop in the market over a better-than-expected jobs report, has only made matters worse.

We know that markets tend to overshoot to the upside and also to the downside. Based on the extremely negative sentiment from investors and the industry news from the chip sector, I think we are possibly at or near the overshoot to the downside moment for Intel and chip stocks in general. The overshoot to the downside can be seen when sentiment is very negative, and stocks are at oversold levels, the combination of which could be a signal of capitulation. Another sign we could be at or near the bottom for some chip stocks, is the recent price action in Micron (MU). This company recently announced earnings and guidance which were weak; however, the stock is trading a bit higher now, than it was just before this news was released.

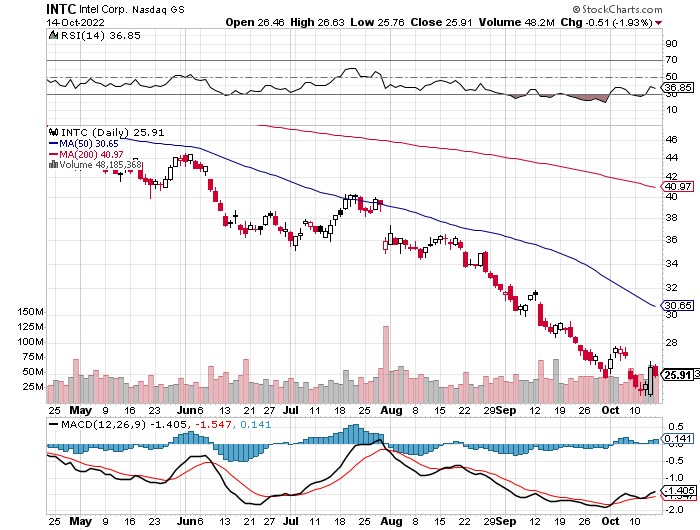

The Chart

There is really nothing good to say about the chart below, except for the fact that it shows this stock is oversold. Intel shares have plunged below the 200-day moving average of around $41, and even below the 50-day moving average which is about $31 per share. Since mid-August, this stock just seems to drop nearly every day and there has been no meaningful rebound. The combination of bad news from the chip industry and the downtrend in the stock market has pushed this stock down to levels it has not seen for years.

Anyone following the chip industry knows that there is a glut of chips and PC sales are weak now, and yet it seems like every time a company confirms this industry weakness, the shares take another plunge, as if it is some new revelation. This leads to the possibility that the chip glut and weak PC sales has already been more than priced into this stock. If that is the case, Intel shares could gap up at some point and trade back over the $30 level. However, I would not count on that because markets and stocks tend to overshoot to the downside and that means it could drop to $20, or even less. That’s why it makes sense to slowly build a position in this stock. I try to balance how many shares I buy so that if the stock goes up, I am happy, and yet (because I don’t own too many shares) I will also be happy if the shares go down because I can buy more and average down.

StockCharts.com

Insider Buying

I have not seen any significant insider buying at any semiconductor companies lately, except for Intel. In August, 2022, the CEO of Intel, Pat Gelsinger bought nearly 15,000 shares in a transaction valued at over $500k. This follows other significant buys that Mr. Gelsinger made earlier in 2022. Furthermore, David Zinsner, the CFO, purchased nearly $250k worth of Intel shares in May, 2022. These purchases are underwater as the stock has been dropping along with the market in general, but longer term, these insider buys could pay off and it suggests confidence by insiders in the future of Intel.

Intel Could Be A Huge “De-Globalization” Beneficiary

In the past several months, it has become increasingly clear that relying too much on other countries to produce semiconductors or healthcare or other products could be a huge national security risk. The invasion of Ukraine and discussions by China about the “peaceful reunification” of Taiwan has brought this issue to the forefront. The new “CHIPS Act” is designed to encourage the manufacturing of semiconductors in the United States since it is clearly a matter of national security in terms of both the military and the economy. Intel is likely a big beneficiary of the CHIPS Act, mostly because it is one of the only chip companies that actually manufactures them as well. It is not just countries that have now realized the massive risks that are taken when the supply chain is too dependent on a single country, but companies are seeing it as well. Just imagine what would happen to a company like Apple (AAPL), if China tensions with Taiwan resulted in a lack of supply from that country. It is estimated that Taiwan makes about 65% of the World’s semiconductors and 90% of the World’s advanced chips. Most of this comes from Taiwan Semiconductor (TSM) which is a major supplier to Apple. That is an untenable situation and it is clear that companies like Apple need to quickly diversify and domesticate its supply chain.

It was recently announced that Apple would start manufacturing the iPhone 14 in India, as well as other products. This move diversifies their manufacturing base away from China. I expect that they are looking to also diversify their chip supplies away from Taiwan due to the risks of relying too much on a single country, and especially one that has major tensions over a takeover by China. Intel is now building new manufacturing facilities in the U.S. which will position it to manufacture chips, including ones designed by other companies. I expect that in the future, Apple and other big tech companies will be making deals with Intel. The new $20 billion facility in Ohio is expected to allow Intel to start manufacturing chips in 2025. This could be a gamechanger for Intel and the global semiconductor industry.

The Long-Term Outlook For Semiconductors Is Extremely Bullish

It makes sense to buy stocks in this sector during downturns like the one we are seeing now. The negative sentiment and big drop in chip stocks is sowing the seeds of the next upcycle. The future for this industry is obviously very bright, especially since so many products increasingly have chips in them. This industry will also see future growth fueled by cloud computing, autonomous/electric vehicles and A.I. According to a McKinsey study, the chip industry will grow from about $600 billion in 2021, to around $1 trillion by the end of this decade alone. Many semiconductor companies are now trying to work through excess inventory issues, weaker demand due to a slowing economy, and new restrictions on chip sales to China. These challenges have created an ideal buying opportunity because valuations for Intel and other chip stocks have not been this low in years, and most of these issues can be worked off in the 2 to 3 quarters.

The Dividend

Intel pays a quarterly dividend which totals $1.46 annually. This provides a yield of nearly 6%. At this rate, an investor could collect almost $7.50 in dividend over the next 5 years. That means an investor who buys now at around $25 per share, could have a cost basis of just about $17.50 per share after factoring in the estimated dividend payment over the next 5 years. Another option to increase potential returns would be to sell call options on your position. The combination of collecting a dividend of nearly 6%, and additional income through the sale of options could provide significant gains and help to buffer potential downside risks. Victor Dergunov recently wrote an article titled “Intel: The Potential Turnaround Of The Decade”. He sees Intel producing $8.80 in earnings per share in 2028, and the share price at $150. I am not as bullish, but even $100 per share in 2028, would be great. Especially if you have collected nearly $7.50 per share in dividends over that time frame.

The Potential Downside Risks

There are many potential downside risks which include everything from management executing poorly, to recessions, and competition from other chip makers. These potential downside risks seem heightened right now, especially because the share price has plunged. All of these concerns are real and should they play out in a severe way, I would not be surprised to see this stock trading for $12 to $15 per share. However, all of these risks have existed throughout Intel’s history, and historically, this company has pulled through. So, it could already be at or close to the bottom.

It is too easy and it is human nature to extrapolate too much from a recent downtrend and assume that it will continue indefinitely. That might already be the case in terms of how many investors view Intel. It’s also worth noting that investors have a history of being overly negative when it comes to semiconductor companies. Back in 2014, Advanced Micro Devices was trading in the $4 range and I wrote a bullish article on it, even though many investors clearly thought this company was never going to have much success again. That turned out to be a generational buying opportunity, just as it could be for Intel shares today. Since then, the shares have had a huge run from the $4 level and this just goes to show that excessive pessimism can provide great buying opportunities. It also shows that major turnarounds do happen in this industry.

In Conclusion

Intel has been a very disappointing stock and management has not proven itself yet. However, the potential upside reward now appears to greatly outweigh the downside. At just about $25 per share, the worst-case scenario is that the stock goes to zero, but in a not even best-case scenario of $100 per share in 2028, the upside is four times greater than the downside. I would not bet the farm on this or any stock, but as Victor Dergunov said, this could be the turnaround of the decade. No one really knows where the bottom is until after it happens. Based on how weak the stock market is trading and how aggressively the Fed is raising rates, it makes sense to buy small amounts of this stock and only do so in stages.

Be the first to comment