Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 1.

As investors are well aware, most income sectors are sitting on sizable losses this year as a result of higher interest rates, wider credit spreads and lower equity prices. This price action can make it difficult for investors to maintain their exposure, much less commit new capital in a volatile market environment. However, what’s important to highlight is that many income sectors now boast significant margins of safety, providing a sizable cushion to compensate for future potential volatility and drawdowns. In this article, we highlight a number of sectors that have a sizable margin of safety and highlight attractive income opportunities.

Before moving into individual sectors, it’s important to highlight that the Fed, which has been a key driver of income market performance this year, is quickly approaching a limit to how long it can keep hiking at the present pace. In fact, recently we have seen Neel Kashkari and James Bullard of all people – previously the most hawkish Fed regional presidents – declare that they will be looking to stop raising rates in 2023. Mary Daly also chimed in on the need to step down the pace of hikes after earlier disparaging market pricing for expecting this exact thing.

The consensus now expects the Fed to near the peak of its hiking cycle in 2-3 meetings with the policy rate ending up around 5%. The reasons are many. First, purely mathematically the Fed has to slow down or stop unless it wants to end up with a double-digit Fed Funds rate – a rate that would be way out of line with the level of inflation (at least the one that it pays most attention to, i.e. Core PCE).

Two, other central banks are starting to pivot – the Canadian and Australian central banks have delivered smaller than expected hikes and it’s unusual to see divergence between Western central banks.

Three, the old chestnut of “long and variable lags” suggests the Fed knows there is a lot of tightening in store already which needs to play out in order to avoid overtightening.

Four, the front-loading of the hiking cycle has provided some ammo to forestall the wage-price spiral or the resetting of inflation expectations to a higher level – two things that the Fed really worries about.

Five, the global coordinated hiking cycle is doing some of the Fed’s work for it as global demand is already cooling, allowing supply chain issues to improve.

Let’s now take a look at a number of sectors which boast decent cushions against further drawdowns.

The high-yield corporate bond market is trading not far from previous yield peaks. The sector has delivered an -11% return this year, however, the pace of losses is very likely going to slow down, if not reverse. This is for four basic reasons. First, bond yields have jumped sharply from ultra-low levels by rising over 5%. Historically, we have not seen yields spend much time above 10% in the last two decades – a matter of days during the COVID shock and about 15 months during the GFC.

Second, high yields provide a larger cushion against rising yields. A yield of 9% which is on offer these days in the sector at an average duration of 4 means that yields need to keep rising more than 2.25% each year (including defaults) in order to keep returns from being positive.

Three, bond prices (the reverse side of yields) are very low with a weighted-average price of 86% in the sector. This means that if we do see defaults, the loss is much smaller than if we were starting at a price of $105 which was the case in 2021.

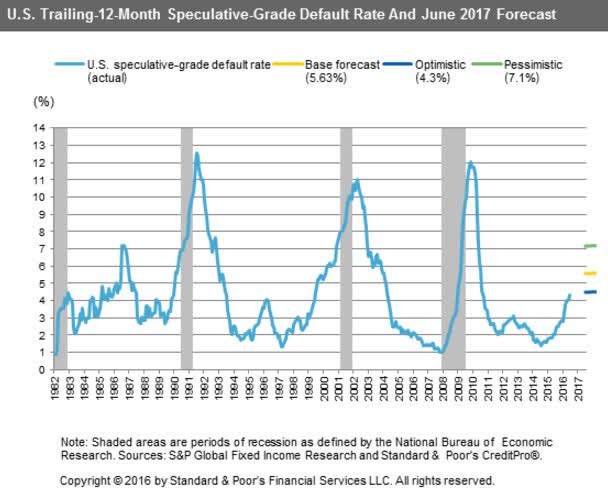

Four, defaults will very likely increase over time, however, defaults tend to peak sharply and subside quickly. Let’s make a conservative assumption that defaults will move above the previous peaks of about 12% to 15% and stay there for several years. In that case we would expect the sector to deliver a loss of 9% per year or about where the current yield is. In other words, we need to see a historically unusual level of defaults combined with a historically unusual length of elevated defaults for returns to be negative. Clearly this assumption is very onerous since a 15% annualized default rate means there will be not much of a sector left after a few years.

S&P

Overall, this shows that the margin of safety is fairly elevated in the High Yield corporate bond sector and that the kind of losses we have seen this year are unlikely to keep going at the same pace.

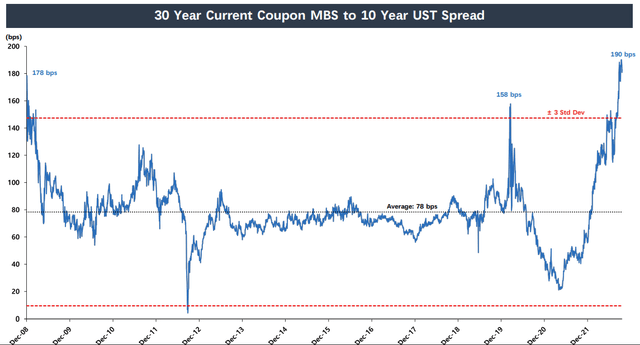

Let’s turn to the Agency MBS space which has really struggled this year. The yield differential between 30Y agencies and 10Y Treasuries (roughly comparable on a duration basis) has blown out to a historic record. Broader gauges of the Agency market are not as extreme but are still historically elevated.

Many investors automatically think back to the GFC and worry that this blow-out is either a reflection or a precursor to households not paying their mortgages and/or that house prices are set up for a crash. The reality is a little more prosaic and more interesting.

As many investors know, when interest rates rise, the duration of Agencies increases. This happens because the higher rates go the less likely households are to refinance mortgages, in effect, locking them in for longer and increasing the likely final maturity of individual mortgages.

It’s also important to know that many institutional investors allocate to Agencies on a duration, rather than notional basis. For instance, just like many retail investors who keep 60/40 (or some other ratio) portfolios have to rebalance their equity and fixed-income allocation to keep the ratios in line, institutional investors need to rebalance their fixed-income portfolios in order to keep the duration of the Agency allocation in line with its target within the broader portfolio.

These two facts (rising rates increase the duration of Agencies + institutional investors allocating to Agencies on the basis of duration) means that when rates rise, many institutional investors have to sell Agencies in order to avoid a mechanical increase in their Agency allocation. As a side note, it is, of course, possible to hedge the duration of Agencies via instruments like interest rate swaps but you cannot hedge the so-called Agency basis / spread exposure which increases along with duration.

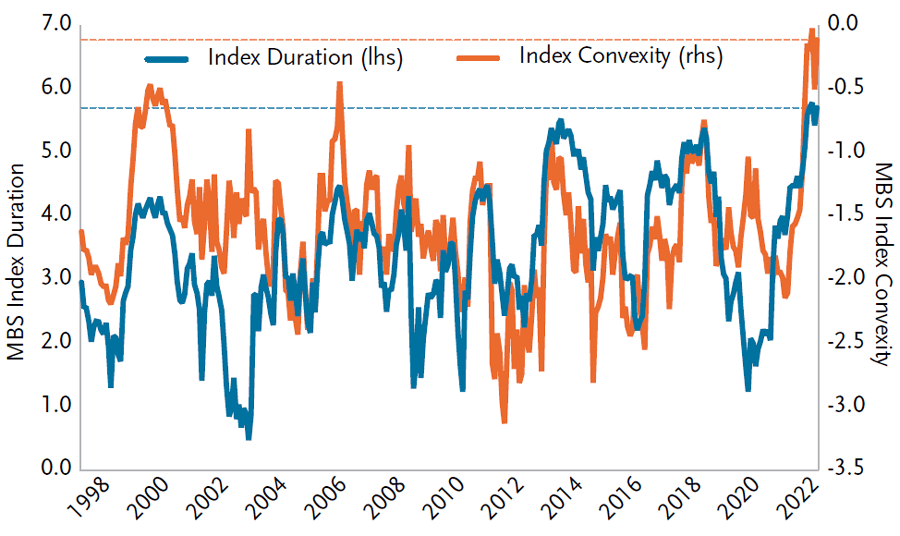

This selling pressure is likely what’s behind the terrible performance of Agency MBS. The good news here is that the convexity of the Agency market is very close to zero as the chart below shows. What this means is that Agencies are pretty much as long duration as they are ever going to get. The intuition here is that we can think of households as holding a refinancing option on their mortgage but this option is very out-of-the-money since no one is going to refinance a 4% mortgage into a 7% mortgage. In short, the selling pressure due to the increase in duration is likely to subside significantly. Obviously, there are other drivers of Agencies, among them the Fed balance sheet roll-off of both Treasuries and Agencies. That said, we are very unlikely to see the continued weakness trend in Agencies that we have this year.

TCW

Finally, let’s quickly turn to the Preferreds sector to illustrate the broader point. Most actively-managed funds like CEFs tend to focus on institutional securities over retail / exchange-traded / $25-“par” securities. This is because the pool of institutional securities is larger, they are easier to trade (i.e. they trade in larger blocks OTC) and they are typically better value than retail preferreds.

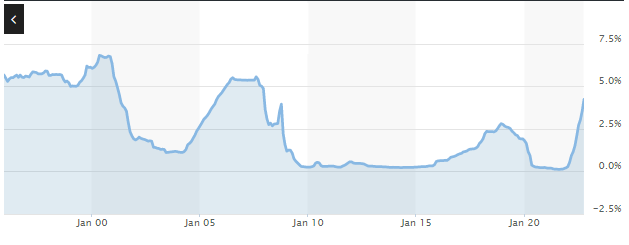

What’s important to know is that the institutional preferreds sector is nearly all Fix/Float, i.e. there is an initial fixed-coupon period of around 5 years. After this period, the security switches to a variable rate, unless redeemed. The variable rate is set so that the variable coupon at the time of issuance is the same as the fixed coupon. However, because interest rates are high relative to the previous 5 years, it means that variable-rate coupons will jump sharply in nearly all cases.

Marketwatch

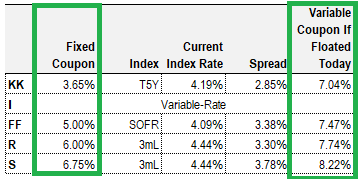

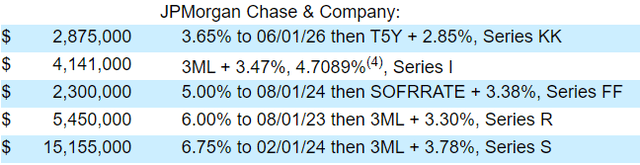

For example, let’s take a look at the JPM preferreds held by (FFC). All four of these are Fix/Float – Series I was redeemed on October 31.

If we look at the remaining series and compare their current fixed coupons to their variable-rate coupons if they switched today, we see that there is an enormous yield pickup. What this means is that if rates stay anywhere near current levels, then these preferreds will either see a bump in their yield (see the two highlighted columns below) or they will be redeemed (as Series I just was).

In either case, the prices of these preferreds will be supported (either mechanically via a redemption since most preferreds are now trading below “par” or through its jump in yield). This is particularly the case that most preferreds are so-called crossover credits, i.e. primarily rated BB/BBB which historically have had an extremely low default rate. In other words, there is not much concern for a sharp jump in defaults in the institutional preferreds sector due to the rise in interest expense.

It is true that most of the sector is in Financials which worries some investors, however, the sector has become very boring in a good way since the GFC due to a large increase in the level of capital and restrictions on assets banks can hold easily.

Systematic Income

Ideas And Takeaways

As highlighted above, we continue to see attractive opportunities across a number of income sectors that boast a strong margin of safety. Our favored income areas continue to be floating-rate or modest duration sectors with a decent-quality profile. This is not only to cut down on duration exposure but also take advantage of a flat/inverted yield curve as well as take into account the fact that lower-quality credit spreads are still trading at fairly expensive levels, leaving less margin of safety for investors.

Specifically, we see value in Agency MBS and intermediate-quality preferreds, crossover-credit (i.e. BBB/BB) floating-rate bonds as well as residential credit.

In the sector, we like NLY preferreds due to their stronger fundamental profile (lower leverage and higher equity/preferred coverage). Within the 3 series suite we like NLY Series G (NLY.PG) which currently has a stripped yield of 8.06% but is expected to rise to a yield of 11.4% once it switches to a variable-rate coupon at the end of Mar-2023.

We continue to like the Angel Oak Financial Strategies Income Term Trust (FINS) which holds mostly floating-rate investment-grade bonds. It trades at an 8.9% yield and a 14.2% discount.

Finally, we would again highlight the Tax-Advantaged Preferred Securities and Income Fund (PTA) which trades at a 8.87% yield and a 12.3% discount.

Be the first to comment