JasonDoiy

Intel Corporation (NASDAQ:INTC) has been a manufacturer of computer hardware chips but had flat growth over the years, as most production was overseas. However, as domestic demand becomes a priority for Intel, they have decided to make significant investments in fabrication plants which should come online in 2025. Based on guidance from the company, this could be the long-term payoff to bring back its renaissance of the internet boom days.

Strong Fundamental Outlooks for 2026

Ratios

All the significant ratios, including quick and cash ratios, were most robust in the last two years. This is likely due to Intel bringing back chip production into the USA.

|

Unnamed: 0 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Current ratio |

1.693 |

1.731 |

1.400 |

1.909 |

2.102 |

|

Quick ratio |

1.126 |

1.105 |

0.932 |

1.239 |

1.379 |

|

Cash ratio |

0.197 |

0.182 |

0.188 |

0.237 |

0.176 |

Source: Financial Modelling Prep.

Growth

As Intel had outsourced much of its chip production to Asia, this revenue growth and gross profit growth have been weak over the last five years.

|

Unnamed: 0 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Revenue growth |

0.057 |

0.129 |

0.016 |

0.082 |

0.015 |

|

Gross profit growth |

0.080 |

0.119 |

-0.037 |

0.035 |

0.005 |

|

Ebitgrowth |

0.393 |

0.300 |

-0.055 |

0.075 |

-0.178 |

Source: Financial Modelling Prep.

Data

A simple moving average of the last 200 working days showcases the strength of a stock as compared to others, including those in the same sector. Unfortunately, this year has been challenging for many blue-chip companies, including Intel. As one can see, over the last 200 days, the stock returns have been steeply negative. Furthermore, it has been only in the previous 50 working days that the stock has turned positive, with relative weakness in the last 20 working days.

|

Unnamed: 0 |

Values |

|

SMA20 |

1.22% |

|

SMA50 |

4.10% |

|

SMA200 |

-24.83% |

Source: FinViz

Enterprise

Intel’s stock price has suffered over the last five years, with its highest peak in 2019. Also, the market capitalization has shrunk over the years as well. This is due to all outsourcing production in Asia, where Intel lost a competitive edge against other companies, including direct competitor AMD.

|

Unnamed: 0 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Symbol |

INTC |

INTC |

INTC |

INTC |

INTC |

|

Stock price |

49.980 |

46.710 |

65.690 |

55.440 |

51.940 |

|

Number of shares |

4.701 B |

4.611 B |

4.417 B |

4.199 B |

4.059 B |

|

Market capitalization |

234.956 B |

215.380 B |

290.153 B |

232.793 B |

210.824 B |

Source: Financial Modelling Prep.

Estimate

Intel is readying production for its new fabrication plants in Ohio. They should be ready by 2025, according to this article.

As one can see, Intel hopes to boost its revenue by 2026 as its new plants go into total production by that time. That should help increase the EPS by three times and the net profit by a relative magnitude of 3x. This is the time to invest in Intel, but if you’re willing to tie up capital for the next four years, that is something you could also do to reap the significant long-term benefit, as Intel should lead up to higher stock prices over the years.

|

Yearly Estimates |

2022 |

2023 |

2024 |

2025 |

2026 |

|

Revenue |

63,736 |

61,908 |

65,271 |

62,560 |

105,699 |

|

Dividend |

– |

– |

1.52 |

1.75 |

– |

|

Dividend Yield (in %) |

4.78 % |

4.85 % |

5.11 % |

5.89 % |

– |

|

EPS |

1.97 |

1.98 |

2.46 |

2.06 |

6.85 |

|

P/E Ratio |

15.12 |

15.01 |

12.07 |

14.43 |

4.34 |

|

EBITDA |

18,794 |

20,853 |

24,771 |

18,202 |

– |

|

Net Profit |

8,228 |

7,557 |

9,690 |

– |

26,698 |

|

Pre-Tax Profit |

8,406 |

9,635 |

12,262 |

12,478 |

31,410 |

|

Net Profit (Adjusted) |

9,228 |

6,473 |

9,871 |

4,080 |

– |

Source: BusinessInsider

Technical Analysis Shows Optimal Time for Market Entries

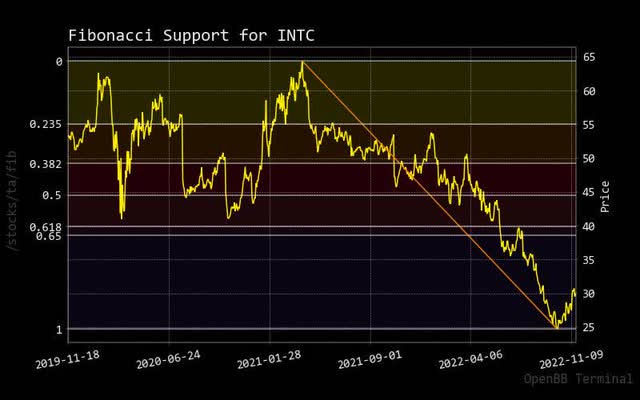

Fibonacci

As one can see, this Fibonacci trendline has reached its bottom, while Intel stock price appears to bounce back. As the price rises from $30 to $50 at the 0,382 Fibonacci level, one might consider market-taking entries here as it will measure roughly a 50% recovery from the high of $65 set last year in 2021.

Fibonacci INTC (custom platform)

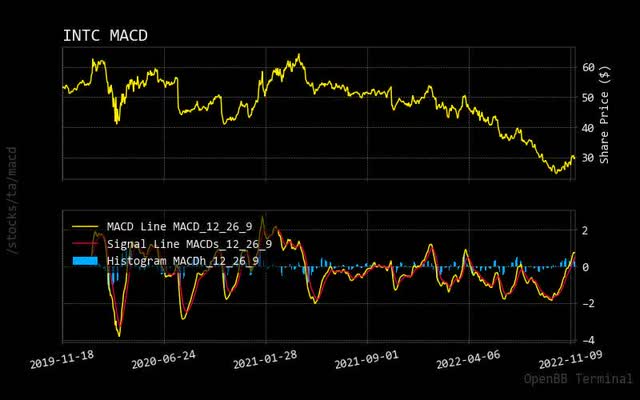

MACD

Another way to confirm market entry for Intel is when the stock price crosses over the zero line with the MACD line of the lower chart panel. One can already see this has taken place, so entries might be wise to get early returns on this newest price action for Intel.

RSI

As the latest stock price action does take place with Intel, it appears it has nearly reached the overbought RSI market condition. As with previous similar events, the stock price has yet to be thoroughly tested to see if a pullback will occur. To confirm this momentum, one must understand that the fear of missing out has yet to be reached for Intel. Acceleration can easily be determined by overlaying other analytical types, including fundamental over the long term and even artificial intelligence analysis for short-term growth.

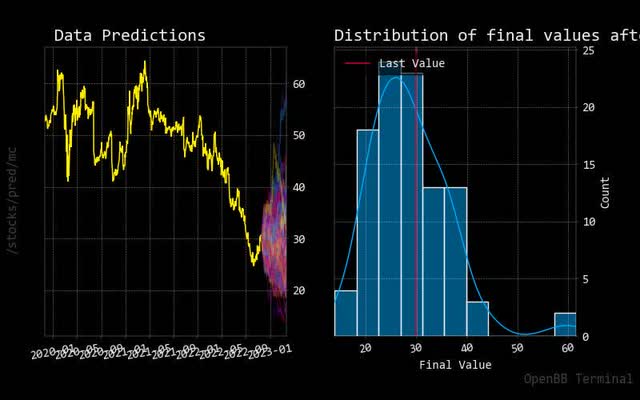

Prediction via AI

Monte Carlo

As one can see with the Monte Carlo simulation of data prediction, prediction paths are pointing higher, reflecting the expected Intel stock price increase probability. Moreover, the accompanying normalized distribution chart confirms higher stock price with even some extremely suitable fat tail risk.

Monte Carlo INTC (custom platform)

Regression

The red forecasted 30-day regression line shows price action for Intel will be reasonably flat. This might not necessarily be true, but it would help to subdue any potential excitement with this stock as strength builds in an upswing.

Regression INTC (custom platform)

Risk Positive With CEO Purchasing Stock

Sustainability

It is hard to assess if a future stock price will be affected by underperforming ratings of a company’s sustainability ranking. As one can see here, for Intel, this is the case. It might hinder Intel’s future stock price growth if action is not taken to improve this. Many institutional investment firms are becoming very active in this as many significant activist pension funds expect investments in only ESG-rated firms with outperformance.

|

Unnamed: 0 |

Value |

|

Social score |

5.94 |

|

Peer count |

28 |

|

Governance score |

6.96 |

|

Total esg |

17.26 |

|

Highest controversy |

3 |

|

ESG performance |

UNDER_PERF |

|

Percentile |

16.44 |

|

Peer group |

Semiconductors |

|

Environment score |

4.36 |

Source: Yahoo Finance

Price Target

During the steep decline in the Intel stock price over the last year, many market analysts set higher, unrealistic price targets that Intel could not meet. However, after the current bottom has been reached with the latest upswing, market analysts have set more realistic price targets, which Intel seems to satisfy. As a result, this can impact Intel’s stock rating to an outperformer as Intel’s stock price meets these targets.

Source: BusinessInsider

Insiders

Insider Stats

It is exciting to see how executives at Intel are purchasing their stock to show confidence to get a return on their stock options. This also seems to be confirmed, as CEO Patrick Gelsinger repurchased many shares in August.

|

Unnamed: 0 |

X |

Filing Date |

Trading Date |

Ticker |

Insider |

Title |

Trade Type |

Price |

Quantity |

Owned |

Delta Own |

Value |

|

0 |

nan |

2022-11-18 16:14:23 |

2022-11-16 |

INTC |

Tan Lip Bu |

Dir |

P – Purchase |

$29.49 |

+50,000 |

100,500 |

+99% |

+$1,474,365 |

|

1 |

nan |

2022-11-09 16:40:02 |

2022-11-08 |

INTC |

Tan Lip Bu |

Dir |

P – Purchase |

$27.98 |

+48,146 |

50,500 |

>999% |

+$1,346,966 |

|

2 |

nan |

2022-11-08 16:55:15 |

2022-11-04 |

INTC |

Tan Lip Bu |

Dir |

P – Purchase |

$27.49 |

+1,854 |

2,354 |

+371% |

+$50,975 |

|

4 |

nan |

2022-08-25 16:53:36 |

2022-08-24 |

INTC |

Gelsinger Patrick P |

CEO |

P – Purchase |

$33.86 |

+14,800 |

343,746 |

+4% |

+$501,153 |

Source: Open Insider

Conclusion

Over the last few weeks, Intel has reached a bottom with a bounce to an accelerating uptrend with the stock price. Using various techniques to measure the magnitude of this upswing, it appears short term, but profit could still be made. The fundamentals show moderate growth, with a doubling of revenue by 2027. This is due to investments in fabrication plants in Ohio, as described. This is the time to invest in Intel, but in the short term, it is still a definite buy with long-term returns.

Be the first to comment