Tonpor Kasa/iStock via Getty Images

Investment Summary

Since our last review on Integra LifeSciences Holdings Corporation (NASDAQ:IART) we’ve been satisfied to see the stock push 15% into the green following the release of its Q3 financials. We noticed the stock bounced spectacularly off its 2-year lows and now trades above its 50DMA and 250DMA at the time of writing. We had reinstated our buy thesis for IART in September and took note of the key CereLink overhang along with the corresponding price action. The note included the following points:

- Investors had punished Integra LifeSciences this YTD, more so following the recall of its CereLink monitors.

- At the same time, we opined the market priced in the downside swiftly and with deep effect.

- This resulted in a disconnect in market value to corporate value, thereby originating an alpha opportunity.

- Price objective of $53.

We encourage you to read our previous two publications on IART to immerse yourself in the journey to date [newest to oldest]:

- IART: Wide Dislocation In Fundamentals Vs. Market Value

- IART: Valuation Disconnect, Sell-Side Missing Impact Of Operating Efficiencies

More than 2 months later we’ve got IART up at $56 and trading at 16.8x trailing earnings [non-GAAP] and a trailing FCF yield that’s held the line across FY22. Now following its latest set of numbers, we’re back today to reinstate our buy thesis on IART, re-rating the stock to a price objective of $88.70.

Recent Developments

It’s first worth noting that on December 1st, IART announced it was acquiring Surgical Innovation Associates (“SIA”) on a $50mm valuation. It didn’t mention how it would finance the transaction [cash, external financing, etc] however we’d note the additional $90mm milestone payment that’s embedded into the deal.

SIA develops a product called DuraSorb, a reabsorbable knitted mesh that’s indicated in plastic and reconstructive surgery, to provide support to soft-tissues in the healing process. It integrates and ‘absorbs’ into neocollagenous tissue, meaning the body’s rejection mechanisms will eventually cease.

Speaking of the numbers, IART expects the deal to be dilutive to adjusted EPS in year 1, however sees EPS accretion by year 3, and a return on invested capital (“ROIC”) of >10% by the 5th year post acquisition.

The question is, just how well will the new purchase tuck-in to the existing portfolio? DuraSorb on the other hand is expected to generated FY22 revenues of c.$5mm, and IART hopes to fold it into its tissue technologies segment – specifically, alongside the SurgiMend line, expected to generated turnover of $45mm in FY22.

We’d also note IART’s authorization of a $150mm share buyback, expected to start “in early 2023”. It will do this on a discretionary basis.

The company left the quarter with $511.9mm in cash & equivalents on the balance sheet, $1.78Bn in long-term liabilities, and a current ratio of >3.9x. Therefore, in terms of capital budgeting, we believe the company is well capitalized for both avenues.

Q3 results: CereLink sorted, divisional strengths a highlight

Last time we covered the CereLink overhang for IART and noted it remained a key risk in the investment debate.

As a reminder, the company made a voluntary recall of all its CereLink monitors in August, after it was found some units were displaying pressure readings that were out of range. Investors were quick to price in the downside, as we talked about in the previous publication.

Fast forward to the present day and IART have been actively pushing to resolve the issue with an interim solution, whilst re-engineering its CereLink line.

Per CEO Jan De Witte on the earnings call:

“Over the past two months, we have worked with customers to get loners of the previous generation ICP monitor, the ICP Express out to them. ICP Express is a less feature-rich monitor, but it’s compatible with our CereLink microsensor. And as a result, we’ve been able to provide the large majority of our customers with a solution that secure their continuity of operations and care for their patients.

Our engineering team has been working diligently and we believe we have identified the root cause and the technical fix to rework CereLink product now focused on developing test procedures to validate our remediation plan and meet the regulatory and quality requirements to enable us to start shipping the product again.”

Switching to the numbers, from a high-level view, there were mixed results throughout the P&L.

Revenue of $385mm was flat YoY on adjusted EBITDA margin of 27.3%. The top line result included a $1.5mm CereLink recall provision baked into this result – lower than expected.

As has been customary in FY22, forex (“FX”) headwinds [from USD strength] had an impact on absolute top-line growth, resulting in a 340bps headwind. In constant currency terms, organic growth was 350bps YoY. It pulled this down to operating income of $65mm and basic EPS of $0.60, up 17.6% and adjusted EPS in-line at $0.86.

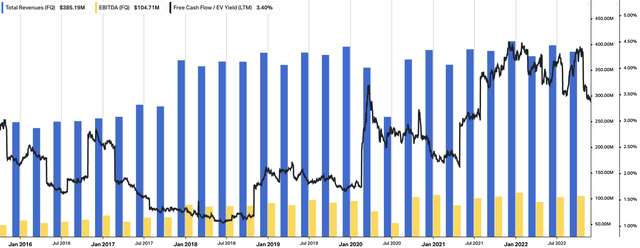

A wider view of IART’s operating performance from FY16-date is noted in Exhibit 1, with particular attention on this year’s revenue prints. We’d like to see IART push back towards its pre-pandemic levels of revenue growth. Nonetheless, it’s held a trailing FCF yield at FY21 levels of 3.4%, with core EBITDA of $104mm. These are tidy numbers that feed into our buy thesis.

Exhibit 1. IART quarterly operating performance, FY16-date.

Data: HBI, Refinitiv Eikon, Koyfin

Turning to the divisional highlights, there were many dotted throughout the P&L. Here we’ve listed a few:

- Codman Specialty Surgical (“CSS”) revenue grew 160bps YoY to $240mm, even factoring in the CereLink adjustment. Without this, it expanded 430bps across the remainder of the CSS portfolio, in line with longer term expectations.

- Leading this segment was global neurosurgery sales, which we saw lifted 230bps from CUSA capital placements. We’d advise this is a positive trend, and serves as good indication that patient turnover/volume trends look to be normalizing in the global market.

- We noted that the tissue technologies segment was a standout, securing 720bps of YoY organic growth to $135mm. The upside was driven by strong momentum in wound construction sales, Integra skin, amniotics and ACell MicoMatrix sales leading the way. This YTD, ACell private label growth is up 11%.

Turning to guidance, management reaffirmed its FY22 numbers that it presented in the last quarter. Recall this was a revenue range of $1.55-$1.56Bn, calling for 50-130bps growth at the top line.

This range also includes ~50bps of FX headwind vs. the previous guidance, totaling 250bps of compression for the entire year.

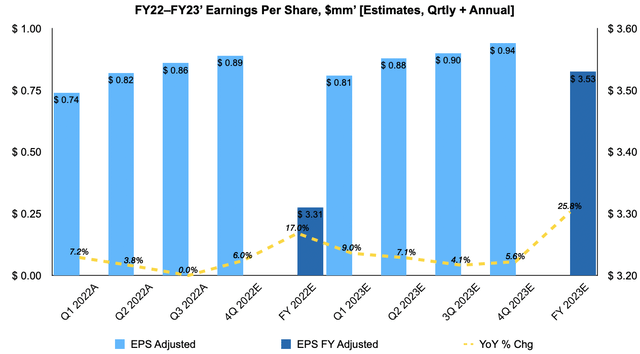

It expects to bring this down to adjusted EPS of $3.29-$3.33, calling for 66% EPS from last year. We’d say this is a fair estimate, as our assumptions [Exhibit 2] call for mid-high single digit growth in quarterly EPS across FY23, stretching up to $3.53 per share by FY23 end.

Exhibit 2. IART FY22-FY24′ EPS growth assumptions [quarterly, annual; internal estimates]

Valuation and conclusion

Consensus currently values the stock at 16.6-23.2x forward earnings, based on non-GAAP-GAAP EPS estimates respectively. The S&P 500’s estimates for FY22 forward P/E is 18.18x, therefore, the market seems to expect IART to outperform the benchmark. We’d agree.

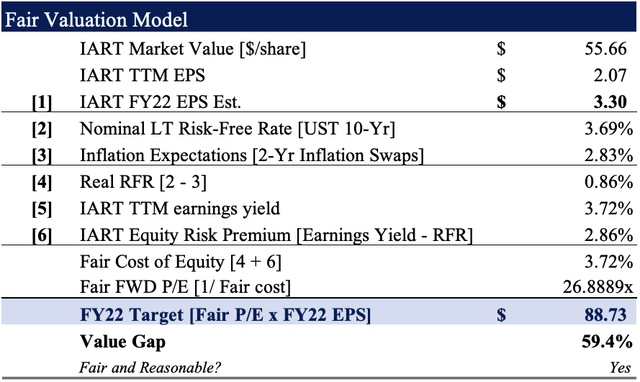

However, we also believe the consensus number underestimates the company’s bottom-line growth numbers. Our EPS growth assumptions indicate IART should be trading at ~26.9x forward P/E [Exhibit 3].

Rolling our FY22 EPS estimates forward and applying the 26.9x multiples derives a price target of $88.73, or ~60% upside potential. Again, this confirms our bullish thesis.

Exhibit 3. FY22 EPS est. $3.30 x 26.88 = $88.73

Note: Fair forward price-earnings multiple calculated as 1/fair cost of equity. This is known as the ‘steady state’ P/E. For more and literature see: [M. Mauboussin, D. Callahan, (2014): What Does a Price-Earnings Multiple Mean?; An Analytical Bridge between P/Es and Solid Economics, Credit Suisse Global Financial Strategies, January 29 2014] (Data: HBI Estimates)

Net-net, we reaffirm our buy thesis on IART seeking an $88.70 price target. This is built on the company’s bottom-line growth numbers, in addition to the removal of the CereLink overhang.

Be the first to comment